Big Lots Raises Guidance, Shares Surge

Big Lots (NYSE:BIG) is and has always been an underappreciated name in the retail space. The company operates as a big-box/consumer discounter and comes with a very strong following. Over the past few years, long before the COVID pandemic or even the Trade War (remember that?), this company was working hard to revamp its image, improve its stores, and drive traffic. Those efforts were paying off before the COVID struck, now, with folks spending their money on home and home products, Big Lots efforts are paying off in spades.

Today’s news more than underscores this company’s success. Big Lots upped its guidance for the year to a range above the consensus. When I say above the consensus I mean above the consensus, like more than 225% above consensus. The new guidance calls for comps in the mid-to-high-20% range with EPS of $2.50 to $2.75 versus the $0.84 predicted by Wall Street’s sell-side community.

What I find most surprising about the news is that it’s taken so long for the market to understand this. Not only have we seen other retailers with a focus on staples and home do well, but the jump in May Retail Sales data is very telling. In company-specific news, Big Lots updated the market about curbside delivery early in June and we all know how well that has been working. Target (NYSE:TGT), Home Depot (NYSE:HD), and Dicks Sporting Goods (NYSE:DKS) (among many others) report strong eCommerce sales underpinned by curbside-pickup and delivery options. Later in the month, more than a week ago, Big Lots told us Q2 comps “continue to be up strongly and well ahead of expectations”.

A Fortress Balance Sheet And Dividend Too

There is more to like about Big Lots than a growth story. The growth story is good, fabulous even, don’t get me wrong, but the balance sheet and dividend make it all the better. Regarding the balance sheet, total debt is very low and what there is, is more than well-managed. One reason is the recent move to sell-leaseback four company-owned distribution centers. The deal provided the company with an additional $550 million net allowing them to pay the revolving credit facility to zero (0) and increase the cash balance to nearly $900 million.

Regarding the dividend, Big Lots isn’t what I would call a consistent dividend grower but there are some caveats. The history shows a tendency for distribution increases and no decreases, the payout ratio is very low and the yield relatively high. Taking today’s pop into account, the stock is yielding close to 3.25% which blows the average S&P payout right out of the water.

Another Catlyst In The Wings: The Analysts

The analysts were not feeling much love for this stock ahead of today’s news but I think that will begin to change. How could it not? Big Lots has proven its strategy is working. Anyway, the average rating is neutral with 6 of the 10 ratings a hold/neutral. Considering today’s news puts the entire outlook for calendar 2020 and 2021 in the waste bin, I expect to see a flurry of analysts activity over the coming weeks and months.

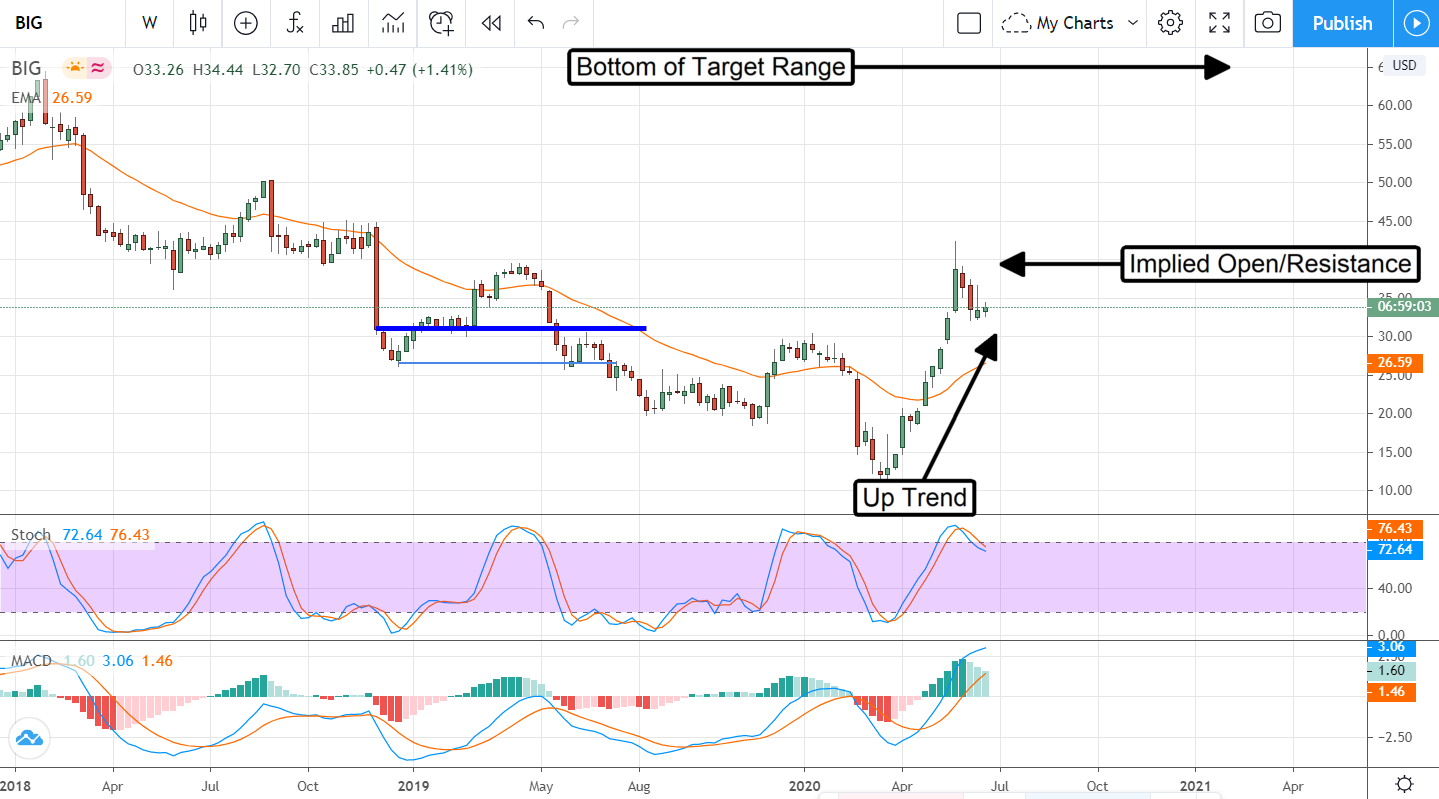

Looking at the charts, today’s pre-market pop has share prices trading near the consensus target of $38.89. This is also just below the recent high and possibly resistance. Looking at the indicators, based on an Extreme Peak in MACD and an implied bullish crossover in stochastic, I have to say I don’t think resistance is going to hold prices back very long. The chart is showing a clear uptrend that is confirmed by today’s news and price action so I see a continuation unfolding once the $40 is broken.

My target for Big Lots, assuming a clean break of resistance, is close to the all-time high near $70 or about 75% upside from today’s implied open.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.