It's good for you, the lifeblood of our planet, and we’re all probably not drinking enough of it — it's water, and it's one of the most crucial resources on Earth. With a worldwide demand and essential utility functions ranging from energy creation to healthcare, it’s easy to see why investors are turning their eyes toward water stocks and companies.

Suppose you’re looking to add stocks of companies that offer bottled water, water asset management stock options or other hydro-assets to your portfolio. In that case, it’s important to know the risks and benefits of investing in water. Read on to learn more about the importance of water to our global economy and some of the best water companies to invest in.

Introduction to Water Stocks

A water stock is a share of stock issued by a company primarily involved in the water supply, treatment, distribution or conservation industry. These stocks offer opportunities for investors to participate in the growth and sustainability of the global water sector and to invest in water utility stocks that ensure safe and clean drinking water. While adding exposure to water stocks can come with the benefits of utility stocks (including consistent demand), regulatory requirements and rules should be considered before you invest.

Importance of Water as an Asset

Water, the lifeblood of our planet, is not just a fundamental necessity for human survival but also a crucial driver of the global economy. As the world grapples with increasing water scarcity and environmental concerns, the investment landscape increasingly turns to water shares as a valuable and sustainable investment. Every day, individuals and industrial operations consume millions of gallons of water globally — and the demand should continue increasing over time.

With this growing demand is growing water scarcity. For the next two decades, the National Intelligence Council of the United States predicts that civil society will face a shortage of potable water. Poor governance and resource management in some parts of the world may contribute to growing strains on the current water infrastructure. Nine countries hold about 60% of the world’s water supply, with about 2.3 billion people living in areas where water insecurity is a recurring problem.

According to the United Nations, integrated water resources management (IWRM) manages the world’s water supply under a growing global population. IWRM is a dynamic approach to water treatment and supply management that controls water stress while considering the local environment. Corporate participation is a crucial component of responsible IWRM, including companies that provide the actual treatment and delivery of services and data and tracking companies that manage and monitor water usage and loss. These water treatment companies and data operations can offer a unique range of opportunities for future water investors.

The Water Industry Landscape

The water industry comprises a diverse landscape of company types, with every kind of water stock offering a different service. These segments cover the entire water cycle, from sourcing and treatment to distribution and wastewater management. The most common company segments in the water industry include the following:

- Local utilities: Utility stocks are the water-related stocks most investors consider when investing in water. These are typically government-owned or regulated entities supplying drinking water to households and businesses. In some areas, local utilities are managed by publicly traded water companies with stock on major exchanges.

- Water treatment technologies: Water treatment companies specialize in treating raw water to make it safe for consumption or industrial use. These companies develop and operate treatment processes and technologies and may also have a branch of research and development responsible for creating and selling water treatment equipment.

- Water infrastructure: As anyone who owns a home knows, various components keep water flowing safely and at the right temperature. Water infrastructure companies design and produce pumps and valves for various water-related applications, from water supply to wastewater management. Some companies involved in the maintenance and development of water infrastructure are also publicly traded.

- Bottled water and beverages: Some of the most well-known water stocks source, purify and package water for commercial sale. Some other beverage companies may rely heavily on water as a primary ingredient and implement water-saving measures in their production processes.

Why Invest in Water Stocks?

Investing in water stocks can offer unique advantages as part of a fully diversified investment portfolio.

Growth Potential

The demand for clean and safe drinking water is rising as the global population grows. This demand is particularly pronounced in emerging economies where access to clean water remains challenging, presenting an opportunity to invest in water as a growth stock. In particular, researching water stocks involved in supplying water to developing countries and areas may offer more pronounced growth potential, as demand for clean water is most pressing in these areas.

ESG (Environmental, Social, and Governance) Considerations

Environmental, social and governance (ESG) principles are guidelines that encourage responsible investment practices worldwide. Investing in the best water companies can align closely with ESG principles, as some of the largest companies involved in water purification are also closely aligned with government efforts to distribute safe water internationally.

Water companies must adhere to strict environmental regulations, subject them to governance standards prioritizing legal and ethical practices. Ethical water management practices, such as responsible water sourcing, efficient water use and pollution prevention, are fundamental to the sector's operations. As an investor, you may want to prioritize water investments that align with the United Nations’ ESG goal list. Most relevant are Goal 6 (Clean Water and Sanitation) and Goal 13 (Climate Action), which emphasize access to clean water, sustainable water management and climate resilience.

Water Stocks Investment Strategies

The best water stocks to buy might vary depending on your goals and investment timeline.

Identifying Promising Water Stocks

Unfortunately, not every water stock is equally viable as a long-term investment option. Some factors to consider as you evaluate each investment option include the following:

- Market share: Companies with a significant market share may have a competitive advantage in an arena like utilities. When investing in water stocks, you may want to prioritize companies with longer histories or higher total market capitalizations, especially when investing long-term.

- Geographic reach: If you’re looking for emerging water stocks, consider options in areas with water insecurity. These markets may provide more opportunities as infrastructure for clean and safe water is still developing.

- Profitability: Before investing in any individual corporate stock, analyze the company's profit margins, return on equity (ROE) and earnings growth. You can find these data points and information on outstanding debt on the company’s balance sheet.

If you’ve never invested before, you may want to create a watchlist of water stocks you’re considering adding to your portfolio before investing. This allows you to monitor and analyze price trends, entering your position at a most advantageous time to your strategy.

Passive vs. Active Investment

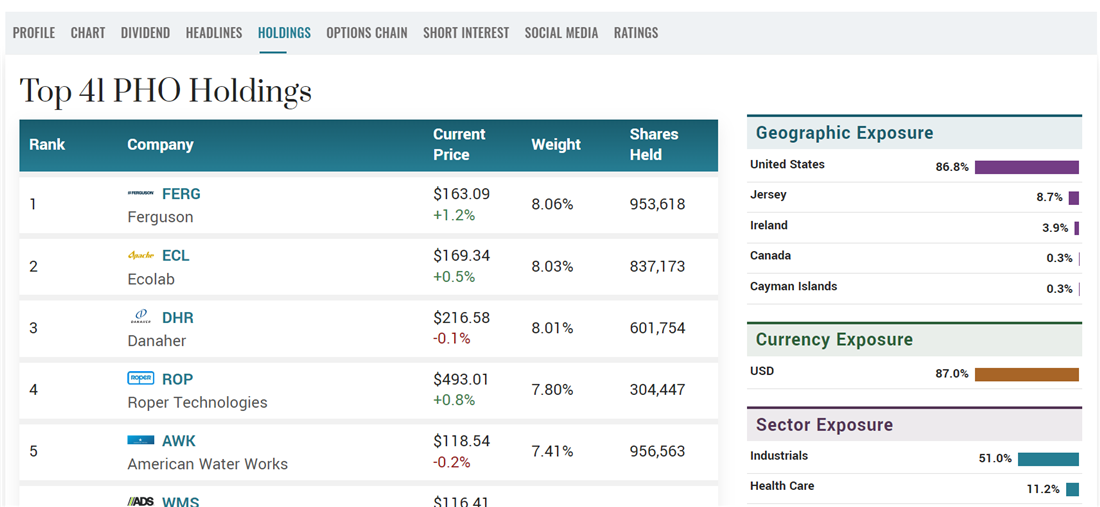

If you want wider exposure to the water market, consider investing in a water ETF. Water ETFs like the Invesco Water Resources ETF NASDAQ: PHO invest in water-related stocks and assets. When you purchase a share of the fund, you gain exposure to all of the underlying assets in the fund’s holdings. While this strategy gives you less direct control over each investment, it offers beginner investors an easy route to instant diversification in the water sector.

Image: PHO invests in 41 water-related stocks and assets.

Notable Water Stocks

Now that you understand the basics of the global water economy, you can start comparing water companies to invest in. The following are some notable water company stocks already making headlines and smaller, emerging options suitable for lower-value investments.

Established Industry Leaders

American Water Works NYSE: AWK is one of the largest and most successful waterworks companies and the largest option when investing in water stocks based in the United States. American Water Works boasts a total market capitalization of more than $22 billion, making it the largest water-related stock in the country. With over 14 million active customers, American Water Works offers wastewater management and clean water services in 14 states.

If you’re looking to add a more international option to your portfolio, you might want to consider Veolia Environnement EPA: VIE. Founded in the 1800s in France, it has evolved and expanded its operations to become one of the world's largest environmental services companies. In addition to providing water treatment and distribution across Western Europe and North America, the company also maintains a significant waste management and energy services infrastructure. Its shares are trading at less than 30 euros per share in October of 2023, which may leave room for growth potential.

Emerging Players

In addition to major choices like regulated utility providers, a variety of emerging water investments can add additional depth to your portfolio. One such option is Pentair NYSE: PNR, a leader in water filtration systems. The company designs, manufactures and sells filtration equipment for residential and industrial uses and showcases a total market capitalization of $10.5 billion in 2023.

With about 70% of the world’s water going towards agricultural development, Valmont Industries NYSE: VMI is another top emerging choice for investors. Involved in developing irrigation systems, Valmont Industries isn’t a top water stock in the same way as American Water Works, but it provides a similarly crucial service. Irrigation systems are seeing a rise in demand, especially in areas affected by climate change. This may position Valmont as a growth stock as continued demand for irrigation systems spreads.

Risks and Challenges in Water Stocks

Risk management is an important part of investing in any asset class. The following are some important risks and challenges investors must consider before investing in water.

Regulatory and Environmental Risks

Water is an everyday necessity — and as such, laws and regulations must protect the purity of our water supply. Governments worldwide impose strict regulations to ensure the safety and quality of drinking water, with some costly compliance requirements falling solely on the shoulders of some of the top water stocks. Failure to meet water quality standards may lead to fines, lawsuits, reputational damage and the inevitable dip in share prices.

Considering the shrinking water supply before investing in water is important. Companies involved in water-intensive industries may face supply challenges, leading to increased operational costs or the need to implement water-efficient practices. Managing wastewater is a significant additional concern for all industrial operations and can be particularly sensitive for water treatment companies.

Market Volatility

Market volatility can impact water stocks directly, especially those in international markets dealing with more water scarcity. While market volatility may not be a major concern for investors taking a buy-and-hold approach, short-term investors must understand the average daily movement of the stock you've actively traded. Research both average daily trading volumes (which can predict daily price movements) and the average bid-ask spread before using an asset for short-term trading.

Long-Term Water Investing

With a consistent and universal demand, most investors use a long-term buy-and-hold strategy when evaluating the best water stocks for their portfolio. If you’re inexperienced in evaluating corporate debt levels or reading a balance sheet, it can be a good idea to invest in a water ETF over individual shares of stock. Regularly re-evaluate your holdings and ETF expense ratios to ensure they continue to serve your current long-term financial goals.

Before you consider American Water Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Water Works wasn't on the list.

While American Water Works currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report