Wave Life Sciences Today

WVE

Wave Life Sciences

$6.28 +0.28 (+4.67%) As of 04:00 PM Eastern

- 52-Week Range

- $4.25

▼

$16.74 - Price Target

- $22.18

Wave Life Sciences Ltd. NASDAQ: WVE is a clinical-stage biotechnology company focused on unlocking the broad potential of RNA medicines to transform human health. The company is generating significant interest from investors due to its dedication to RNA editing, a novel approach to treating a range of genetic diseases. Wave Life Sciences is one of the pioneers in this biopharmaceutical sector, and its dedication to innovation has attracted the attention of investors and the scientific community.

RNA Editing Breakthrough Fuels Wave Life Sciences' Growth

Wave Life Sciences' stock recently surged by as much as 82%, pushing the stock over 185% year to date, after the company achieved the first-ever therapeutic RNA editing in humans. This groundbreaking achievement was demonstrated in the ongoing Phase 1b/2a RestorAATion-2 trial of WVE-006, an RNA editing oligonucleotide designed to address alpha-1 antitrypsin deficiency (AATD), a rare genetic disorder affecting the lungs and liver. This milestone has solidified Wave Life Sciences' position as a pioneer in RNA editing, a revolutionary technology that has the potential to transform the treatment of genetic diseases.

The RestorAATion-2 trial enrolled individuals with AATD who are homozygous for the SERPINA1 Z mutation, meaning they cannot produce functional alpha-1 antitrypsin (AAT) protein. This deficiency can lead to a range of severe health complications, including emphysema, cirrhosis, and liver failure.

Remarkably, a single subcutaneous dose of WVE-006 in the first two Pi*ZZ AATD patients resulted in mean plasma total AAT levels of approximately 11 micromolar, with mean wild-type M-AAT representing over 60% of total AAT. This data indicated that durable editing with M-AAT protein was observed over 57 days. This level of success is particularly notable, as restoring 50% M-AAT would be consistent with the heterozygous “MZ” genotype, associated with a lower risk of AATD lung and liver disease.

The RestorAATion-2 trial is ongoing, and Wave Life Sciences is expected to share multidose data in 2025. If the multidose data continues to demonstrate the efficacy and safety of WVE-006, it could revolutionize the treatment of AATD, a disease with limited treatment options.

Focusing on Long-Term Potential

While Wave Life Sciences is still in the clinical stage of development, its recent breakthroughs have generated significant market buzz. It’s important to understand the company’s current financial performance, though most investors are focused on the company’s long-term potential. Wave Life Science’s earnings report for the second quarter of 2024 reflected this stage of development, with some key metrics falling short of expectations.

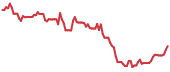

Wave Life Sciences Ltd. (WVE) Price Chart for Tuesday, April, 15, 2025

For the most recent quarter, Wave Life Sciences reported -$0.25 earnings per share (EPS), missing the consensus estimate of -$0.16 by -$0.09. The business had revenue of $19.69 million for the quarter, compared to the consensus estimate of $24.80 million. Notably, Wave Life Sciences had a negative return on equity and a negative net margin, reflecting the significant investment in research and development.

The company’s long-term strategy hinges on the success of its robust pipeline of clinical programs, and investors are betting on the potential for revenue and profitability to improve as these programs progress. As a group, sell-side analysts expect that Wave Life Sciences will post -$1.02 EPS for the current year, reflecting this stage of development.

Wave Life Sciences Gets a Wave of Upgrades

The interest in Wave Life Sciences’ breakthroughs and the potential for RNA editing to revolutionize the treatment of genetic diseases has also generated interest from the Wave Life Science analyst community. Several investment firms have recently upgraded their ratings on Wave Life Sciences stock.

Wave Life Sciences Stock Forecast Today

12-Month Stock Price Forecast:$22.18253.21% UpsideBuyBased on 11 Analyst Ratings | Current Price | $6.28 |

|---|

| High Forecast | $36.00 |

|---|

| Average Forecast | $22.18 |

|---|

| Low Forecast | $15.00 |

|---|

Wave Life Sciences Stock Forecast DetailsRaymond James NYSE: RJF raised its rating from Outperform to Strong Buy and increased its price target from $13.00 to $22.00. HC Wainwright followed suit, increasing its price target from $15.00 to $22.00 and assigning a Buy rating. Wells Fargo & Company NYSE: WFC lifted its price target from $11.00 to $22.00 and gave the stock an "overweight" rating.

No recent analyst downgrades have been reported, further reflecting the prevailing positive sentiment among investors. The consensus among analysts suggests that Wave Life Sciences is well-positioned for continued success in the near term as it continues to capitalize on the potential of RNA editing to transform the treatment of genetic diseases. Wave's current high-side target stands at $22.00, while the consensus sits at $18.56. This situation offers investors the potential for an upside of 20% to 30%.

A Potential Leader, But Proceed With Caution

Given the positive developments in Wave Life Sciences' RNA editing research, the company is well-positioned for continued growth in the near term. This positive outlook is reinforced by the consensus among analysts, who have recently upgraded their ratings on Wave Life Sciences stock, with no recent downgrades.

However, it’s important to remember that Wave Life Sciences is still in the clinical stage of development, and there is no guarantee that its products will be successful. While Wave Life Science’s financial performance shows signs of investment in its pipeline of clinical programs, it has also reflected the significant costs of research and development.

While investors should proceed with caution, Wave Life Sciences' innovative approach to developing RNA editing therapies positions the company as a potential leader in the evolving RNA editing space. With the potential to revolutionize the treatment of genetic diseases, Wave Life Sciences is a company worth monitoring closely.

Before you consider Wave Life Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wave Life Sciences wasn't on the list.

While Wave Life Sciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.