After reaching an impressive all-time high closing price of $345.46, at the height of the pandemic in 2021, shares of Wayfair NYSE: W have fallen over 83% to their current prices. The company had close to a $38 billion market cap at its peak. As of yesterday's closing price, the market cap of W was just over $6 billion.

However, after consolidating near $35 from March to June, shares broke higher and have since soared 62% over the last month. YTD, shares of the company are up almost 74%. With a reversal seemingly confirmed by the recent surge higher, is now the time to consider an investment in W?

A Closer Look at The Chart

Shares of the online home furnishing giant have discovered price stability in recent months. The price stability, by way of consolidation over critical support, comes after the stock broke the downtrend mid to late last year. Since breaking the downtrend, $30 has consistently been supported, indicating buyers have an appetite for the stock and positions have been accumulated.

With the stock up almost 74% YTD, the chart signals that there could be further upside as shares are yet to test or break over critical resistance, which stands around $70 - $75.

In the short term, however, with shares up 62% over the last month, a positive sign of continuation and what traders might look for is a pullback and a higher low, which would indicate buyers are willing to pay higher prices. The RSI is 76.26, meaning W shares are overbought in the short term. With a Beta of 3.06 and ATR of 3.17, volatility is no stranger to the stock, and a pullback can be expected. Whether the stock finds support or further supply on a pullback will be the all-important tell.

Wayfair Business Update

Wayfair recently announced that the company's Chief Commercial Officer will retire in Q1 2024 after 14 years at the company. Jon Blotner has been appointed the new CCO and will begin the role in October 2023. Jon Blotner brings almost two decades of retail and technology experience with him.

The company also stated that quarter-to-date revenue trends are improving despite challenging market conditions. Gross revenue is trending in the negative mid-single-digit percentage range YoY. Still, the company has seen positive YoY growth in total orders, offsetting lower average order values and deflationary impacts.

The company is experiencing momentum in its core commercial offering and aims to achieve adjusted EBITDA profitability in Q2.

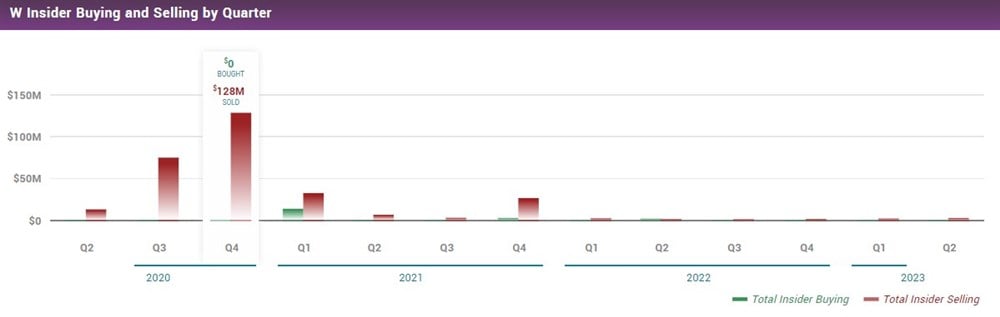

Insider Transactions

Investors will not like the trend that has developed with insider transactions. Over the last year, only one quarter saw insiders purchase stock, amounting to $1.75 million. In the same period, insiders have sold close to $8 million worth of stock. Since Q2 2020, insiders have sold close to $293 million worth of stock compared to $18.34 million worth of buying.

Consensus Rating and Price Target

Based on 25 analyst ratings, W has a Hold rating and a consensus price target of $48.68, predicting a 14.76% downside in the name. For the first time in almost two years, the consensus price target is below the share price.

Time to invest?

Wayfair's stock has shown significant volatility, with a large decline followed by a recent surge higher. The chart suggests a potential upside as the stock hasn't tested critical resistance levels yet. However, it is currently overbought, indicating a pullback is likely. If the stock can base near resistance and signal that buyers have stepped up in the name, a move towards $70 could be on the table.

Before you consider Wayfair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wayfair wasn't on the list.

While Wayfair currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.