Weight management company

Weight Watchers International NYSE: WW shares have been on a

rollercoaster ride since the beginning of 2020 as it collapsed nearly (-80%) off its $47.19 pre-COVID highs to $9.75 lows bottoming out in late March with the benchmark

S&P 500 index NYSEARCA: SPY. While the SPY has rallied to within 5% off it’s all-time-highs, Weight Watchers has only recovered just over half it’s losses. The Company is emerging as part of the new normal post-COVID-19 lifestyle trend as consumers migrate to contactless and nutritious meal planning and delivery. The stifled price rally and potential for further rollbacks in coronavirus hotspots set up buying opportunities ahead of its upcoming earnings release in early August. Prudent investors should pay attention to opportunistic pullback levels as wider time frames signal upside trajectories.

Weight Watchers - Q1 FY 2020 Earnings Release

On April 28, 2020, Weight Watchers released its fiscal year Q1 2020 earnings for the quarter ending March 2020. The Company reported a loss of (-$0.09) per share versus consensus analyst estimates for a loss of (-$021) per share, beating by $0.12 per share. Revenues grew to $400.4 million versus $402.72 analyst estimates. Service revenues grew to $324.7 million increasing 6.9% year-over-year (YoY) driven by the increase in digital subscribers. Subscriber growth was 9.2% YoY, and digital subscriber growth was 15.9% YoY, which is the real growth driver during the pandemic.

Weight Watchers - Jeffries 36% Upside Upgrade

On May 13, 2020, Jeffries analyst Stephanie Wissink started coverage of Weight Watchers with a $32 price target representing a 36% upside from the $23.38 price it was trading at. She noted that COVID-19 is presenting, “… a durable trend; wellness is being prioritized, supporting superior growth potential. WW’s digital shift is margin-enhancing, drivers superior capital returns and justifies a higher multiple.”

Weight Watchers - June 2020 Business Update

Weight Watchers provided an optimistic business update on June 15, 2020. The Company noted as of June 6, 2020, total subscribers grew to 4.9 million up 7% YoY consisting of 3.8 million digital subscribers and 1.1 million Studio+ digital subscribers. Digital member sign-ups accelerated since mid-April driving digital subscribers to “all-time highs”. The company also anticipated 400 studios will be open by June 30, 2020. Weight Watchers fully repaid its outstanding revolver balance on June 5, 2020 and had a $127 million cash balance. They also increased credit revolver to $175 million from $150 million.

Weight Watchers - Digital Engagements Driving Growth

The Company is seeing 97% satisfaction rates on virtual coaching workshops and plans to continue rollout of Virtual Group Coaching product. The COVID-19 pandemic has enabled members to maintain stronger connections virtually as average member retention is currently above 10-months. The reality is that people digital enables people to stay connected without the hassle of traffic and travel. That has been the by-product unveiled by the pandemic and a sustainable trend as the digital migration not only has legs but is sticky too. The surge of COVID-19 hotspots will only improve the migration to digital as many economies are contemplating restart rollbacks and the potential for reinstituting stay-at-home mandates again. On July 14, 2020, the White House Coronavirus Task Force is recommending 18 states in the “red zone” rollback re-openings due to the surge in coronavirus cases. A red zone is defined as a core-based statistical area (CBSA) where new cases surge above 100 per 100,000 population and positive COVID-19 test positivity above 10%. These states include Alabama, Arkansas, Arizona, Florida, Georgia, Idaho, Iowa, Kansas, Louisiana, Mississippi, North Carolina, Nevada, Oklahoma, South Carolina, Tennessee, Texas and Utah.

Weight Watchers Price Trajectories

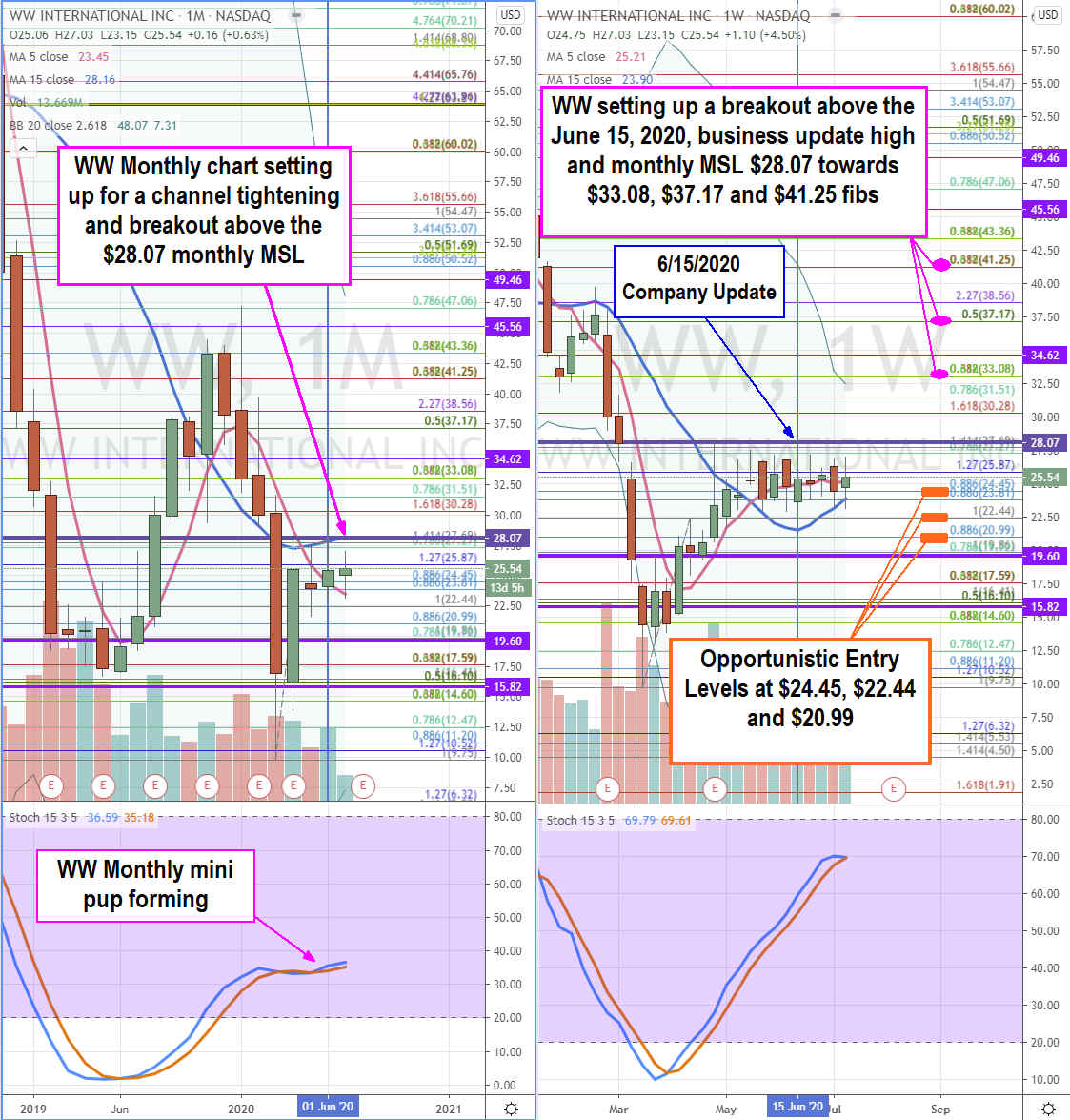

Using

the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for WW stock. The monthly rifle chart triggers a

market structure low (MSL) buy above $28.07. The monthly stochastic is trying to form a bullish stochastic mini pup which sets the channel tightening target back up to the 15-period moving average (MA) at $28.07 as it bases above the 5-period MA at $23.45. It is worth noting the weekly MSL triggered above $19.60 and daily MSL triggered above $15.82. The weekly stochastic is “kissing” and ready to either form a mini pup sloping up to trigger a daily bullish pup breakout or cross down to provide

opportunistic pullback entry levels at $24.45Fibonacci (fib) level , $22.44 fib and the $20.99 fib. One more level (likely not before earnings) is the $19.50 weekly MSL trigger area in case shares dump on the earnings release. The Company is scheduled to report Q2 2020 results in the first week of August 2020. Share prices below June 15, 2020, Company update highs would set the bar low and above sets the bar high. Use this to determine potentially trimming into earnings run up momentum in case a sell the news reaction forms.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.