Fast food restaurant franchise

Wendy’s NYSE: WEN stock has been consolidating ahead of a breakout for the most of 2021. The iconic burger chain is expected to grow its footprint to 7,000 stores by the end of 2021 with another 200 potential franchisees in the pipeline despite navigating

supply chain challenges. The Company hopes to achieve 8,500 to 9,000 restaurants worldwide by the end of 2025.

Digital sales rose mix rose 8% and its loyalty program grew 10% reaching 19 million in 2021, up from seven million at the start of the year. The number two U.S.

hamburger chain continues to bolster its breakfast menu as a growth driver as it looks for a channel breakout in the new year. Prudent investors seeking exposure in this

durable burger chain can watch for opportunistic pullback levels to gain exposure.

Q3 FY 2021 Earnings Release

On Nov. 10, 2021, Wendy’s released its third-quarter fiscal 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) profit of $0.19 excluding non-recurring items versus consensus analyst estimates for a profit of $0.18, beating estimates by $0.01. Revenues rose 4% year-over-year (YoY) to $470.26 million falling short of $471.49 million consensus analyst estimates. U.S. same store comparable sales grew 2.1% YoY, global comps grew 3.3%, and international comps grew 14.7%. The Company increased its share buyback authorization to $300 million from $80 million including an accelerated $125 million Q4 2021 accelerated share purchase program. Wendy’s CEO Todd Penegor commented, "We continued to grow our breakfast business, digital sales accelerated, and we meaningfully expanded our global footprint in the third quarter. Global Same-Restaurant sales grew in the high-single digits on a 2-year basis, reinforcing the strength of our brand in a challenging environment. Our focus on executing against our key priorities and our continued partnership with the best franchisees in the business give me confidence that we will achieve our vision of becoming the world's most thriving and beloved restaurant brand."

Downside Guidance

Wendy’s issued downside full-year 2021 EPS coming in between $0.79 to $0.80 versus $0.82 consensus analyst estimates. The Company expects systemwide sales growth to come in between 11% to 12% with adjusted EBITDA between $465 million to $470 million.

Conference Call Takeaways

CEO Penegor set the tone, “ We achieved a strong two-year global same-restaurant sales result of 9.4% driven by growth across the globe, which included an acceleration in our breakfast and digital sales mix throughout the quarter. Our strong performance helped us lengthen our streak of growing or maintaining our QSR burger dollars share to an outstanding nine consecutive quarters and further strengthen our position as the number 2 hamburger chain in the U.S. Our expansion into Europe through the UK continue to accelerate as we've opened several restaurants since the second quarter. We're seeing extremely strong sales across all of our UK restaurants as customers are thrilled to have Wendy's in the market, making us even more excited about our growth opportunity. We also announced a new strategic partnership with Google, which we believe will allow us to tap into the capabilities of a world-class technology Company to drive growth for us now and into the future. I will also share some results from a recent franchisee survey that highlights the strength of our relationship with our franchisees, which we continue to believe is a differentiator for us as a brand. We remain fully committed to our 3 long-term growth initiatives to build our breakfast day-part, accelerate our digital sales, and expand our global footprint. Our goal remains the same, which is to invest in driving efficient accelerated growth. We are delivering on that commitment with strong year-to-date adjusted EBITDA and free cash flow growth and overall results that are pacing well ahead of our initial 2021 plan.”

He concluded, “Our playbook of investing to drive accelerated growth behind our 3 long-term pillars, to build our breakfast stay part, driver digital business, and expand our footprint across the globe remains the same, and we continue to make meaningful progress. Our continued growth and success would not be possible without the partnership we have with our franchisees, who we believe are the best in the business. We recently received the 2021 Franchise Business Review survey, resulting in another year of Wendy's exceeding industry benchmarks and also paced ahead of our results from 2019.”

WEN Opportunistic Pullback Levels

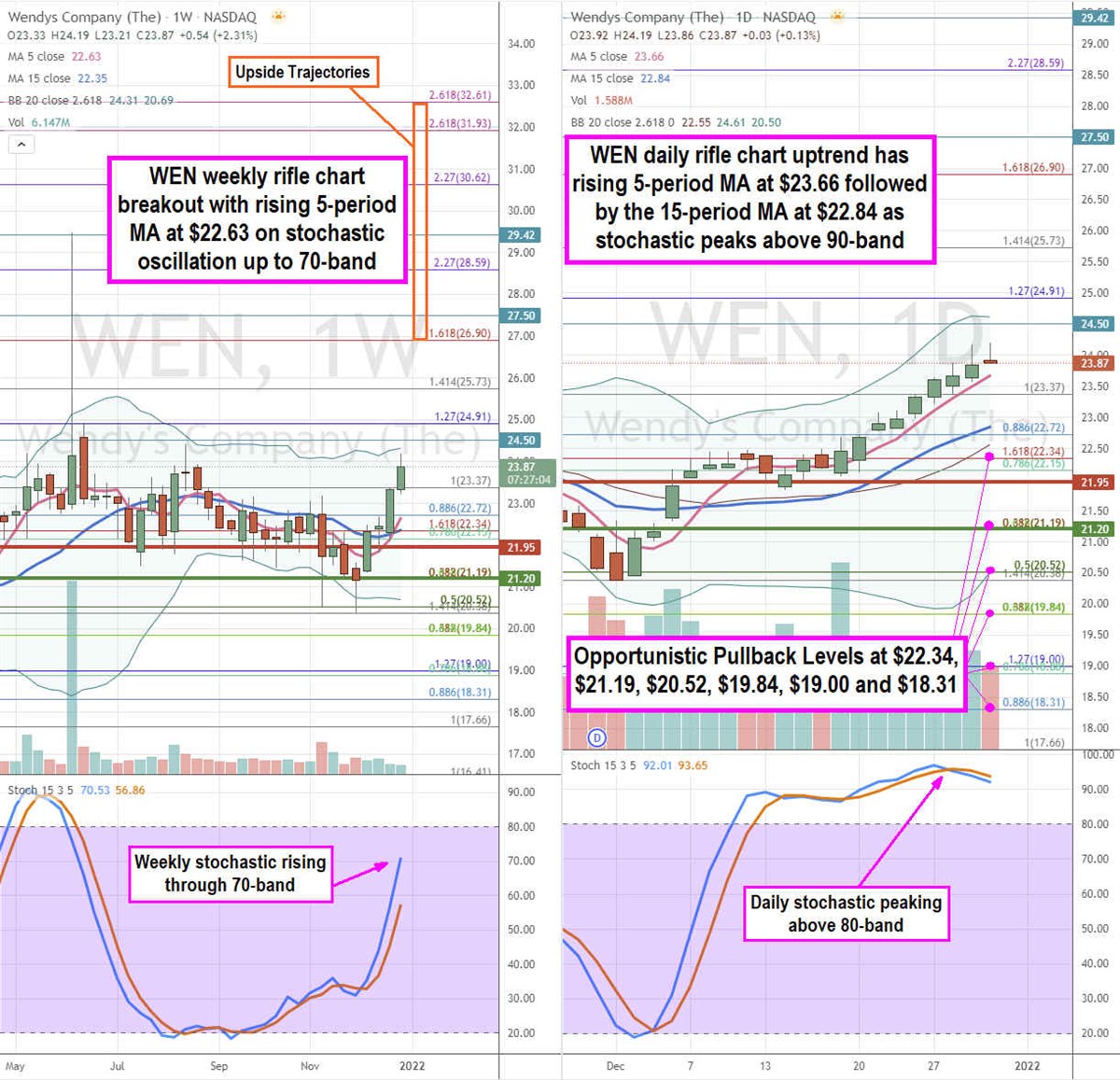

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for WEN stock. The weekly rifle chart recently peaked at the $24.91 Fibonacci (fib) level before slipping to a low at the $20.38 fib before coiling. The weekly rifle chart is back in an uptrend with a rising 5-period moving average (MA) at $22.63 followed by the 15-period MA at the $22.34 fib as the stochastic rises through the 70-band. The weekly upper Bollinger Bands (BBs) sit at $24.31. The daily rifle chart has been in a steady uptrend grind with a rising 5-period MA at $23.66 followed by the 15-period MA at $22.84 The stochastic has peaked and is starting to slip down at the 90-band. The daily market structure high (MSH) sell triggers at $21.95. The daily market structure low (MSL) buy triggered on a breakout through $21.20. Prudent investors can watch for opportunistic pullback levels at the $22.34 fib, $21.19 fib, $20.52 fib, $19.84 fib, $19.00 fib, and the $18.31 fib level. Upside trajectories range from the $26.90 fib up towards the $32.61 fib level.

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.