Data storage solutions company Western Digital NYSE: WDC stock collapsed on lowered guidance and the sell-off in the benchmark indexes. The sequential lowered guidance is troubling for investors despite having beaten earnings estimates by $0.18 per share. Investors are questioning whether the Company is purposely lowballing estimates to make it easier to beat again. It’s especially disheartening when competitor Seagate Technology NYSE: STX shares exploded higher on a smaller earnings beat but guided in-line rather than lower. The flash storage and hard drive giant sees strong demand due to the increasing need for storage, but transitory headwinds from supply chain disruptions are cutting into margins and top-line growth. Mobile shipments of its BiCS5 products into leading smartphones rose 60% sequentially representing 40% of total revenues. While client SSD business fell due to the supply chain disruption, the Company is starting to see pricing stabilize in more transactional markets. The punishment in its stock is becoming more appealing especially if the guidance shortfall is truly transitory in nature. Prudent investors can look for opportunistic pullback levels to pick up shares trading at just 6X forward earnings.

Q2 Fiscal 2022 Earnings Release

On Jan.2 22, 2021, Western Digital released its fiscal second-quarter 2022 results for the quarter ending December 2021. The Company reported a non-GAAP earnings-per-share (EPS) profit of $2.30 excluding non-recurring items versus consensus analyst estimates for a profit of $2.12, an $0.18 beat. Revenues grew 22.6% year-over-year (YoY) to $4.83 billion beating analyst estimates for $4.82 billion. Western Digital CEO David Goeckeler commented, “While we continue to experience strong demand across our end markets, these challenges continue to present a headwind to near-term results. We’ve executed well in building a solid foundation for future profitable growth driven by innovative products within our flash and hard drive businesses. As these transitory headwinds subside, we expect to emerge in a stronger position to drive better through-cycle results, creating value for our shareholders, employees and customers”

Lowered Guidance

Western Digital lowered its guidance for fiscal Q3 2022 with revenues estimated to come in between $4.45 billion to $4.65 billion compared to $4.73 billion consensus analyst estimates. The Company expected EPS between $1.50 to $1.80 versus $1.93 consensus analyst estimates.

Conference Call Takeaways

CEO Goeckeler highlighted some key takeaways from the quarter including strengthening its portfolio of products, qualifying the Company’s enterprise SSD products with 3 major cloud players and 2 OEMs. They began shipments of its OptiNAND technologies 20-terabyte hard drives and commercialized its energy-assisted hard drives. He discussed the disruption of its supply chain which has impacted its ability to build its products and in turn impacted its customer’s ability to ship those products. CEO Goeckeler insists the problems are temporary, “These issues are transitory in nature, affecting both revenue and gross margin and we expect them to subside as the supply chain normalizes. We remain confident that the long-term growth and profitability opportunity in front of us has not changed.” The silver lining is the 50% YoY top-line increase in their HDD and Flash business. The momentum should continue as component headwinds subside. It appears that management has lowered expectations for a worst-case scenario so that investors can brace for near-term pain, but be pleasantly surprised if the Company jumps over the lower bar in the next quarter.

WDC Opportunistic Pullback Levels

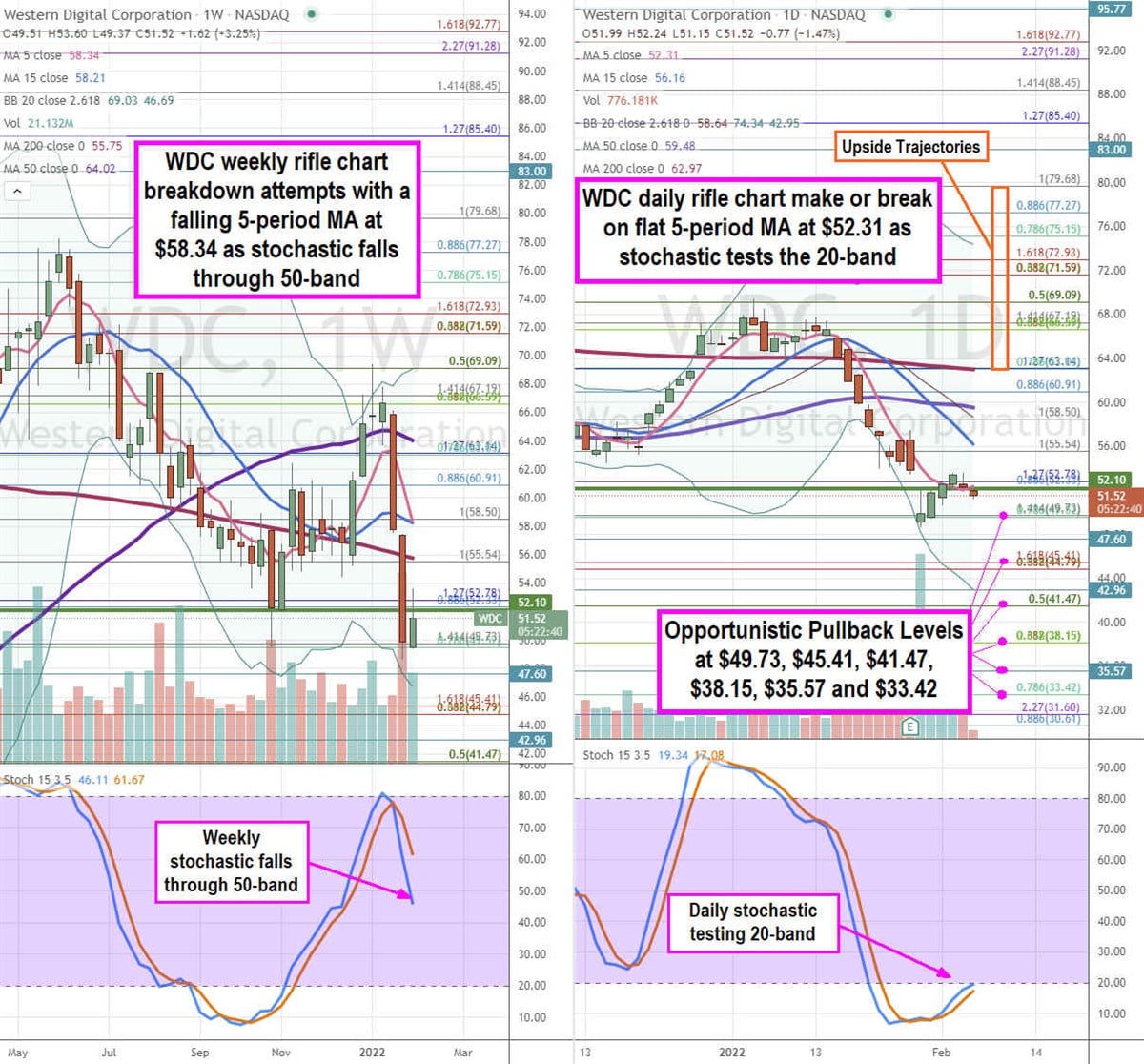

Using

the rifle charts on the weekly and daily time frames provides a precision view of the price action playing field for WDC shares. The weekly rifle chart peaked near the $69.09

Fibonacci (fib) level before plunging to a low of $48.62 on its earnings miss. The weekly rifle chart collapsed through the 200-period moving average (MA) as its attempts a breakdown with the falling 5-period MA attempting to crossover down through the 15-period MA at $58.19. The weekly stochastic rejected off the 80-band as it falls through the 50-band. The weekly lower Bollinger Bands (BBs) at $46.64. The daily rifle chart is stalling for a make or break as the 5-period MA flattens at $52.26 while the 15-period MA continues to close the channel falling at $56.14. The daily stochastic is attempting to coil at the 20-band. The daily

market structure low (MSL) buy triggers above $52.10. If the daily inverse pup breakdown forms, then watch the lower BBs at $42.96.

Prudent investors can monitor for opportunistic pullback levels at the $49.73 fib, $45.41 fib, $41.47 fib, $38.15 fib, $35.57 fib, and the $33.42 fib level. Upside trajectories range from the $63.14 fib up towards the $79.

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.