Wood products manufacturer

Weyerhaeuser Company NYSE: WY stock has been on a tear rising and falling with spot lumber prices. The Company owns nearly 11 million acres of timberland and is one of the largest lumber providers in the worlds, operating as a real estate investment trust (REIT). The Company is a major benefactor of the

housing boom and home

renovation trend. The

pandemic spawned migration out of the cities and into the suburbs has resulted in the

work-from-home transformation being a key cornerstone in the “new normal” despite the

re-opening. While lumber prices have retreated from its highs, supply shortage coupled,

construction growth and

low-interest rates are still keeping demand levels elevated in the

residential real estate market. Weyerhaeuser derives nearly 85% of its revenues from the residential housing market which helped fuel 45% top-line growth in the most recent quarter. Prudent investors looking for a value play on lumber and residential housing can watch for opportunistic pullbacks to consider scaling into Weyerhaeuser shares.

Q1 2021 Earnings Release

On April 30, 2021, Weyerhaeuser released Q1 Fiscal 2021 results for the quarter ending in March 2021. The Company reported earnings per share (EPS) of $0.91 excluding non-recurring items, beating consensus analyst estimates of $0.84, by $0.07. Revenues grew 45% year-over-year (YoY) to $2.51 billion, beating analyst estimates for $2.45 billion. Weyerhaeuser achieved its highest ever quarterly adjusted EBITDA at $1.1 billion, up 68% sequentially. CEO Devin Stockfish stated, “I am extremely pleased with our first quarter results, as our business delivered Weyerhaeuser’s higher quarterly adjusted EBITDA on record despite severe winter weather and supply chain disruptions. We also surpassed out previous record for Wood Products adjusted EBITDA by more than 50%... As 2021 progresses, new residential construction activity is exhibiting remarkable momentum and repair remodel demand remains very favorable.” The Company completed the acquisition of 69,200 acres of high-quality Alabama timberlands for $149 million. The Company also agreed to sell 145,000 acres of timberland in Washington for $266 million to Hampton Resources, which it expects no tax liability on the sale.

Q2 2021 Outlook

The Company expects Q2 2021 Timberlands adjusted EBITDA to be comparable to Q1. However, it expects Wood Products adjusted EBITDA to be significantly higher than Q1. The Company expects higher sales volumes from lumber and increased sales realization for engineered wood products will be partially offset by higher raw materials costs specifically for oriented strand board web stock.

Conference Call Takeaways

Weyerhaeuser CEO Devin Stockfish set the tone, “With these encouraging tailwinds, our housing market outlook is very favorable and furthered supported by macroeconomic fundamentals that will continue to drive strong U.S. housing activity, including record low supply of new and existing homes for sale, strong homebuilder sentiment, favorable demographic trends, flexible work arrangements driving increased mobility and migration to the suburbs, higher savings rates and continued post-COVID improvements in GDP and unemployment.” He expected repair and remodel demand to “remain strong” through 2021 as evidenced by expanding backlogs.

Valuation

One remarkable fundamental metric is the relative forward low P/E of 11.25 on the shares. The Company has also reinstated the dividend in October 2020 adding an additional 1.5% annual yield. The average lumber composite prices rose 41% sequentially bolstering sales by 42%. While shares are mostly correlated with lumber prices, the Company realizes most of its revenues from its Wood products division, which saw 68% sequential growth to $889 million of adjusted EBITDA. Prudent investors should be patient in watching for opportunistic pullback entries as elevated lumber prices continue to recede.

WY Opportunistic Pullback Levels

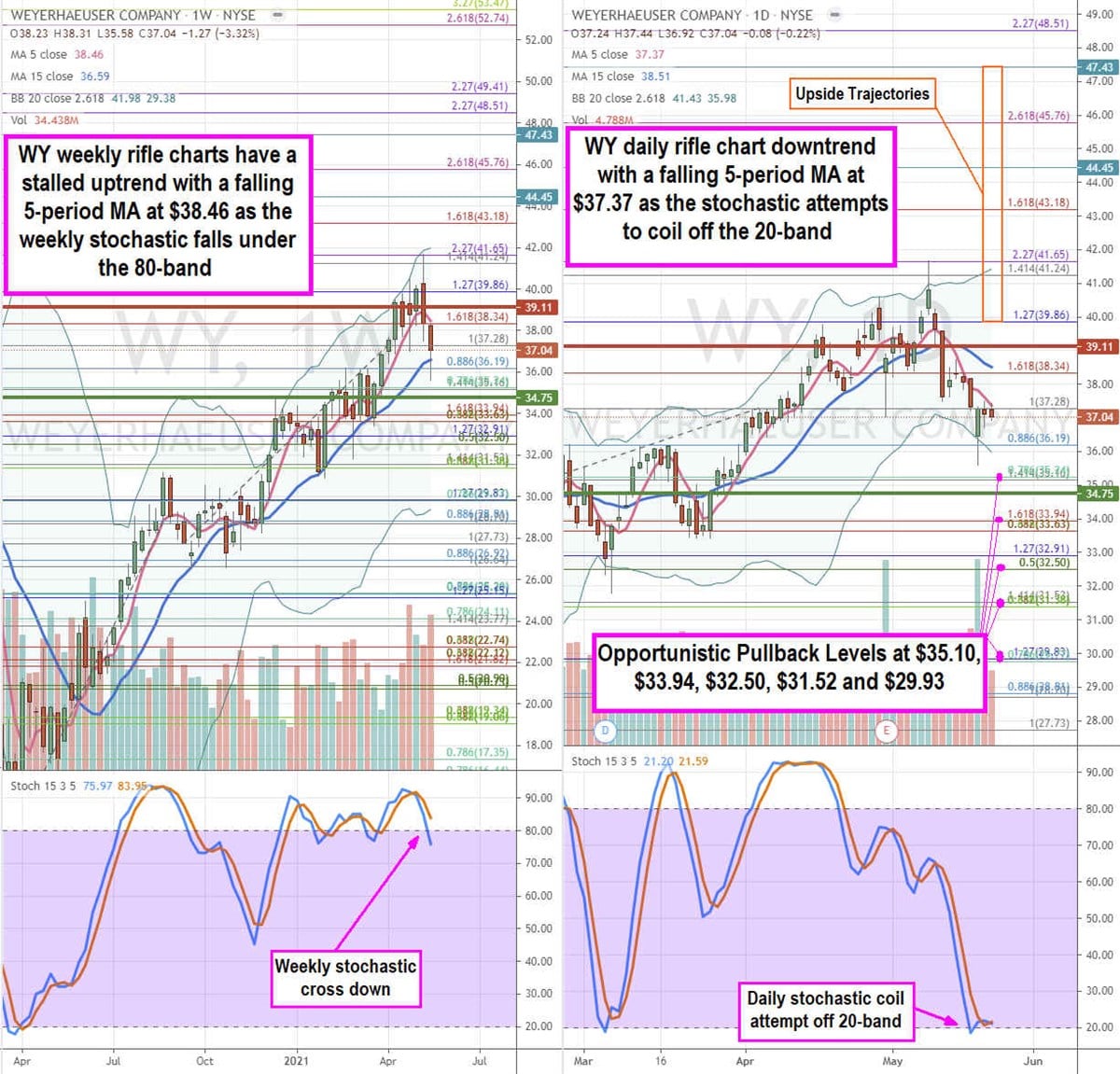

Using the rifle charts on the weekly and daily time frames provides a precision view of the near-term playing field for WY shares. The weekly rifle chart is losing steam as the uptrend stalls with a falling 5-period moving average (MA) near the $38.34 fib Fibonacci (fib) level. The weekly 15-period MA is at $36.59 as the weekly stochastic falls under the 80-band. The daily rifle chart downtrend formed as the daily market structure high (MSH) that triggered on the $39.11 breakdown. The daily 5-period MA is falling at the $37.28 fib with lower daily Bollinger Bands (BBs) at $35.98. The daily market structure low (MSL) triggered above $34.75 acting as a key support line in the sand. Prudent investors can watch for opportunistic pullback levels at the $35.10 fib, $33.94 fib, $32.50 fib, $31.52 fib, and the $29.93 fib. The upside trajectories range from the $39.86 fib up towards the $47.43 level.

Before you consider Weyerhaeuser, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weyerhaeuser wasn't on the list.

While Weyerhaeuser currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 best stocks to own in Spring 2025, carefully selected for their growth potential amid market volatility. This exclusive report highlights top companies poised to thrive in uncertain economic conditions—download now to gain an investing edge.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.