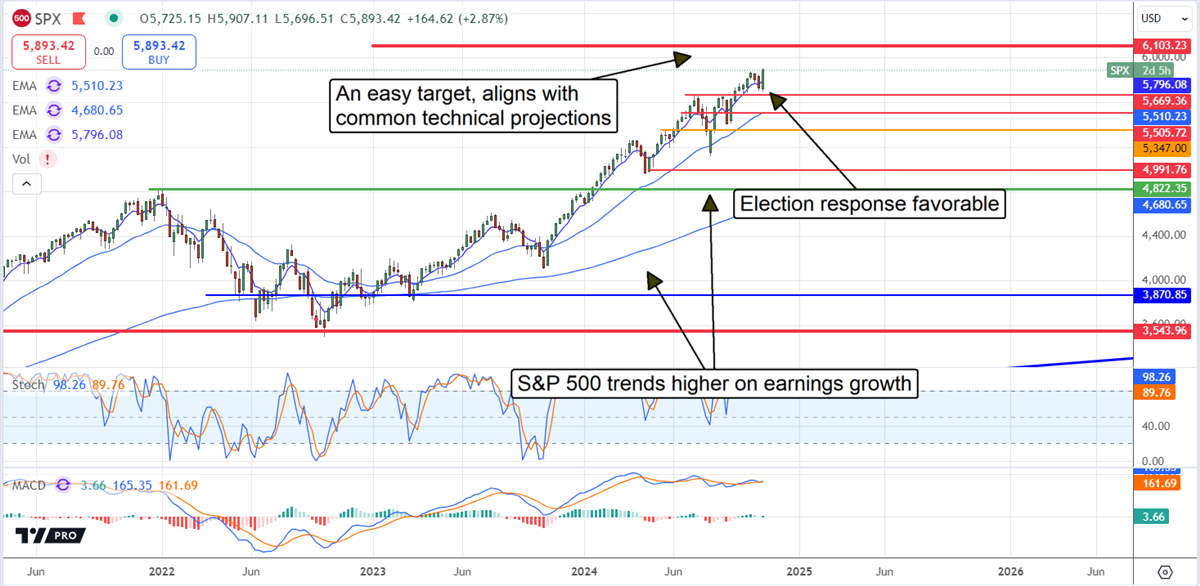

As surprising as it may be, Donald Trump won a second term in office. One of few to do so non-consecutively, his 2nd term has long-lasting repercussions for the market. If history is to be used as a guide, those repercussions will be good for stocks. Looking at the S&P 500 NYSEARCA: SPY starting the week of November 16th, 2016, just after his first victory, through the results of elections in 2020, investors stand to win big. The S&P 500 gained roughly 70% then and was tracking toward new highs in Q1 2020, just before COVID-19 hit the proverbial fan.

The S&P 500 Advanced 70% After Trump’s First Win

Trump’s first term brought market gains, but also volatility; it did not move higher in a straight line. Drivers of volatility included his trade war with China, which is still technically underway. Many but not all of the restrictions put in place by the Trump administration are gone, and some new ones exist. Trump will likely hammer down on this and other policies, aiding the reshoring of industries ranging from consumer goods to semiconductors.

Another driver for the market is Trump’s business-friendly policies. In the first term, he lowered taxes, easing headwinds for businesses, and he will do the same this term. Extending the cuts enacted by the 2017 Tax Cuts and Jobs Act is a priority on the agenda. Some of those will expire at the end of the year, and the president-elect wants to build on them. Additionally, he plans to cut taxes at all levels, including taxes on tips, social security, and overtime, which will significantly boost consumer spending power.

Trump Was Good for Labor Markets

Healthy labor markets and improving consumer conditions are hallmarks of the first administration. The labor data trended favorably going into the term, and those trends strengthened as the term progressed. Unemployment hit the lowest levels since the housing crisis, job creation was trending near historical highs, and job openings were rising, leading to a high quit rate. Quit rates are important because they indicate high employee confidence and reflect healthy consumer spending power.

Today's labor data is down significantly from 2022 to 2023, but the decline is relative. The peaks in 2022 and 2023 were driven by the COVID-rebound and stimulus spending, normalizing to align with the healthy levels in late 2019 and early 2020. The new Trump administration will likely support labor market health and help it to sustain growth for the next four years.

Trump and the Fed: Inflation May Be Sticky

There is FOMC and inflation risk, but it is out of his control. However, the Fed is on track to lower rates periodically in 2025, easing the headwinds put in place since 2022, which is favorable to the Trump agenda. The consensus is for the base rate to fall to 4% or lower by the end of 2025, ultimately creating tailwinds in the housing and consumer markets.

Strong labor markets and spending should sustain the outlook for S&P 500 revenue and earnings growth, potentially leading to an analyst upgrade cycle and an upwardly trending index. The risk is that improving economics will sustain inflation and keep rates well above the 2% target and interest rates above historical norms if less restrictive than now.

Earnings Growth and Capital Returns Sustains the S&P 500 Uptrend

The outlook for S&P 500 earnings has diminished from highs set earlier in 2024 but remains robust. The index earnings grew in Q3 2024, and the consensus forecasts growth will accelerate to the low-double-digit range in Q4 and sustain at those levels in 2025. Trump’s election will likely create a dual tailwind for those figures, making it easier for businesses to operate and consumers to spend. In that world, the stock market rally will likely broaden and include more than a few sectors.

The outlook for the S&P 500 is to reach 6,000 by the end of the year. The market is trending higher on momentum, earnings growth, and the expectation for easing interest rate pressure, and the uptrend can be sustained indefinitely in this scenario because of capital returns. The S&P 500 is on track to pay over $600 billion in dividends next year, up roughly 5% from 2024, and is expected to sustain the pace of growth, if not accelerate it, each year under Trump.

Before you consider SPDR S&P 500 ETF Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SPDR S&P 500 ETF Trust wasn't on the list.

While SPDR S&P 500 ETF Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.