But what are consumer staples stocks, and why should you consider adding them to your investment portfolio? We will teach you how and why consumer staples stocks are essential. Plus, we will explain how to use these stocks to create a defensive position in your portfolio that will help you minimize the impacts caused by stock loss or economic downturn. Learning about consumer staples stocks will help you build a more solid investment strategy and a more robust investment portfolio.

Overview of consumer staples

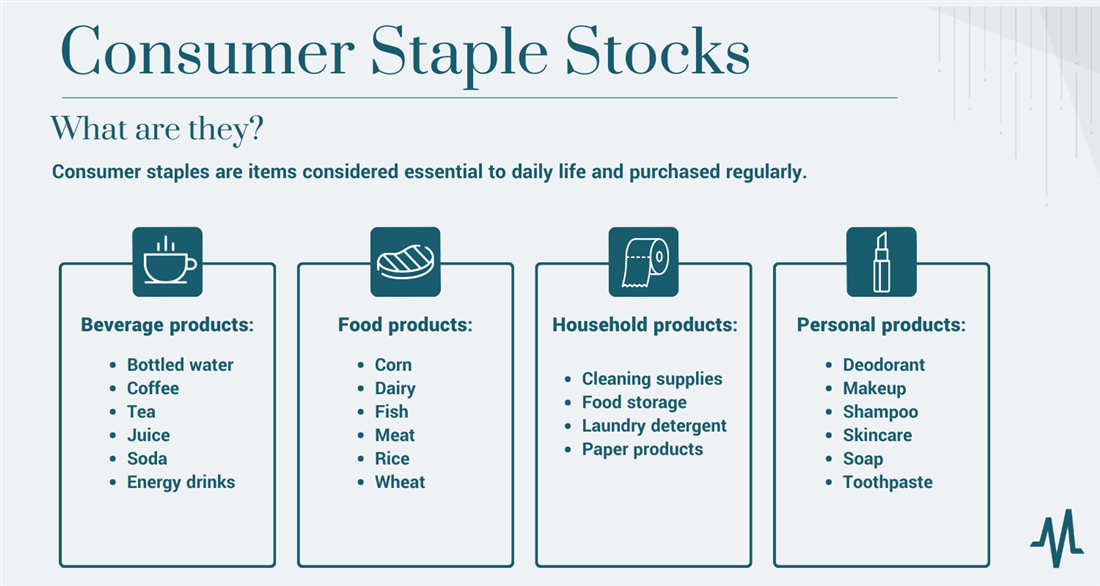

To begin your understanding of consumer staples, let's briefly answer the question: "What are consumer stocks?" Consumer stocks represent companies that produce goods that you need or want regularly. These companies typically divide up into consumer staples and consumer discretionary stocks. Staple items are things you cannot (or won't) live without, while discretionary items are things you want but aren't necessary to your daily life. When times get tough, consumers will seek out staple items and avoid spending on discretionary items, and that is what gives consumer staples their stability.

Consumer staples, like food, water and personal items, are necessary for daily living. These are considered staple products because people will continue purchasing them, even during economic downturns. The consumer staples sector has a long history of steady and consistent growth. This stable consistency makes consumer staples stocks an attractive option for investors who are looking for reliable returns over the long term. As a result, consumer staples stocks are considered defensive investments that can help balance a portfolio and provide a source of stability and income. When you talk about consumer staple stocks, you refer to the consumer staples sector, which groups all the consumer staple stocks.

Understanding consumer staples stocks

What is consumer staples? Consumer staples stocks represent companies that produce or sell essential goods that consumers consider necessary for their daily lives. These goods include food, beverages, personal care products, household items and other everyday essentials. Unlike consumer discretionary stocks, which involve products or services that consumers may cut back on during economic downturns. When comparing consumer discretionary versus consumer staples, you find that staples are products people continue to buy regardless of the economic climate. The demand for these items remains relatively stable, making consumer staples stocks the resilient investment option.

Consumer staples stocks play a crucial role in the stock market, providing stability and consistency to investment portfolios. These stocks are often considered defensive investments, meaning they can act as a reliable anchor during periods of market volatility. Investors turn to consumer staples stocks to mitigate risks associated with economic downturns, stock market fluctuations, or other uncertainties.

Key characteristics of consumer staples stocks

Consumer staples stocks possess distinct characteristics that set them apart in the stock market landscape. These traits contribute to their reputation as stable and reliable investments. Let's dig into the key features that define consumer staples stocks and make them attractive to investors.

Low volatility and steady returns

Consumer staples stocks are known for their low volatility and the ability to deliver steady returns over time. The demand for essential products like food, beverages and personal care items tends to remain consistent regardless of broader economic conditions. This stability in demand contributes to a more predictable revenue stream for consumer staples companies.

Factors contributing to low volatility and steady returns

- Non-cyclical nature: Consumer staples are non-cyclical products, meaning their demand remains relatively constant regardless of economic cycles. People continue to purchase these items even during economic downturns, providing a buffer against market volatility.

- Defensive nature: The defensive characteristics of consumer staples make them less sensitive to market fluctuations. Investors often turn to these stocks for stability during economic uncertainty, contributing to their lower volatility.

- Resilience in tough times: Consumers prioritize spending on essential items during economic challenges, creating a reliable market for consumer staples. This resilience in demand enhances the stability of these stocks.

- Steady cash flow: Companies in the consumer staples sector often experience steady and predictable cash flows. This financial stability contributes to consistent returns for investors.

Inelastic demand

One defining characteristic of consumer staples is their inelastic demand. Inelasticity means that the quantity demanded for these essential goods does not change significantly due to price changes. Consumers view these items as necessities, and fluctuations do not influence their purchasing decisions in prices.

Factors contributing to inelastic demand

- Essential nature: Consumer staples encompass products people consider fundamental for daily living. Whether the prices rise or fall, consumers are less likely to cut back on items like food, beverages and personal care products.

- Limited substitutability: In many cases, there are limited substitutes for certain consumer staples. For example, specific brands or types of food and personal care products may have unique qualities that consumers prefer, reducing the likelihood of switching to alternatives.

- Routine consumption: Consumption of regular and recurring consumer staples further reinforces their inelastic demand. These items are part of daily life, leading to a consistent and stable market for these products.

Dividend yields

Consumer staples stocks are often valued for their consistent dividend payments, making them appealing to income-seeking investors. Many companies in this sector have a history of distributing dividends, providing a reliable income stream in addition to potential capital appreciation.

Factors contributing to attractive dividend yields

- Stable earnings: Consumer staples companies typically generate stable and predictable earnings, allowing them to sustain regular dividend payments.

- Cash flow generation: The demand for essential products contributes to steady cash flow, enabling companies to allocate funds for dividend distributions.

- Investor appeal: The reliability of dividends from consumer staples stocks appeals to investors seeking a dependable income source. This aspect aligns well with the long-term, income-oriented investment strategies.

The low volatility, inelastic demand and attractive dividend yields make consumer staples stocks stand out as a resilient and income-generating investment option despite market conditions.

Types of companies in the consumer staples sector

The consumer staples sector refers to the list of consumer staples stocks, including companies that produce or sell products that consumers regularly purchase, regardless of economic conditions. This sector includes companies that manufacture and sell items considered daily or weekly consumer necessities. As you might have already guessed, the consumer staples stocks list is relatively lengthy, so to help, we have divided it into categories to make it easier to understand.

Food and beverage companies

A beverage company considered part of the consumer staples sector produces or sells essential items deemed daily necessities for consumers. Consumer staples beverage companies are known for generating steady revenue and profits because these products are in constant demand regardless of economic fluctuations. Types of beverages typically considered to be staples include:

- Bottled water

- Coffee

- Tea

- Juice

- Soda

- Energy drinks

These products are further insulated from loss because they are typically established brand names with fierce customer loyalty. Nasdaq provides examples of excellent consumer staples stocks, including beverage manufacturers like PepsiCo Inc. NASDAQ: PEP.

Food product companies

Food is typically considered a general necessity. However, you can only consider some food a staple during recessions or economic downturns — not everything. Food staples refer to foods that comprise the dominant part of a population's diet. Staple food products are items such as:

- Corn

- Dairy

- Fish

- Meat

- Rice

- Tubers (potatoes, yams, cassava)

- Wheat

Food companies that produce items such as cereal, instant potatoes and meats are great staple investments. These are great investments because when times get tough and families scale back, they typically return to inexpensive staple foods. Society's natural tendency to return to its roots during tough times puts companies like General Mills Inc. NYSE: GIS and Tyson Foods Inc. NYSE: TSN on MarketBeat's list of top consumer staples stocks.

Household product companies

Household staple products are products used regularly and considered essential to the consumer. Products consumed to maintain a clean home and live a healthy lifestyle are consumer staple household products, including items you probably reach for every day:

- Cleaning supplies

- Food storage bags and containers

- Laundry detergent

- Paper products (paper plates, paper towels, toilet paper)

These products are essential for maintaining a clean and healthy home, and people consume them regularly. Keeping the demand for these products steady and making these products less susceptible to market fluctuations. Many companies that produce these products have established brand names, solid reputations and loyal customers, which make them further resistant to economic instability and sector competition.

Personal product companies

Personal product staple companies produce or sell essential personal care products considered daily necessities for consumers. These companies are typically categorized under the consumer staples sector and produce or sell items such as:

- Deodorant

- Makeup products

- Shampoo

- Skincare products

- Soap

- Toothpaste

These products maintain personal hygiene. Consumers buy them regularly, making them less susceptible to the economy's fluctuations. These companies often provide reliable dividend income and are considered a defensive investment due to their ability to withstand economic downturns.

Staple retailer companies

A staple retailer company is a company that operates retail stores that sell consumer staple products. These companies "live" under the consumer staples sector. When reviewing staple retail companies, you want to look at companies that primarily sell staple products:

- Discount grocery stores

- Grocery stores

- Hypermarkets

- Neighborhood markets

- Supermarkets

The products sold in these markets are often in constant demand and are consumed and purchased regularly. Staple retailers have a significant presence in the retail industry and provide consumers access to a wide range of essential staple products at competitive prices. Some examples of staple retailer companies include Walmart Inc. NYSE: WMT, Costco Wholesale Co. NASDAQ: COST, Target Co. NYSE: TGT and The Kroger Co. NYSE: KR.

Tobacco companies

Tobacco is considered a staple due to its addictive nature. A consumer staple tobacco company is a company that produces and sells tobacco and tobacco-related products. These companies "live" under the consumer staples sector and include tobacco products such as:

- Cigarettes

- Cigars

- Nicotine infused vapor

- Snuff and snus

Consumer staple tobacco companies often have long-established brand names and fiercely loyal customer bases, making them more resistant to competition and economic instability. However, investing in tobacco companies is often controversial due to the health risks associated with tobacco products and many socially responsible investors may choose to avoid them.

Key players in the consumer staples sector

The consumer staples sector is home to major companies offering essential daily living products. Let's take a look at the different parts of the consumer staples sector and examine some of the key players and their notable brands:

Food and beverage companies

- Nestlé: Nestlé S.A. OTCMKTS: NSRGY stands as the world's largest food and beverage company, boasting a diverse range, including coffee (Nescafé), infant formula (Gerber) and confectionery (Kit Kat).

- PepsiCo: A multinational giant, PepsiCo NASDAQ: PEP is renowned for beverages (Pepsi, Mountain Dew) and snacks (Doritos, Lay's).

- The Coca-Cola Company: Headquartered in Atlanta, Coca-Cola NYSE: KO is the leading producer of non-alcoholic beverages globally, with brands like Coca-Cola, Sprite and Fanta.

- Unilever: Unilever LON: ULVR is a British multinational that produces a variety of consumer goods, including Lipton tea and Ben & Jerry's ice cream.

Household products companies

- Colgate-Palmolive: Offering a range of consumer products, Colgate-Palmolive NYSE: CL is known for Colgate toothpaste and Palmolive dish soap.

- Kimberly-Clark: Known for personal care products, Kimberly-Clark NYSE: KMB produces brands like Kleenex, Kotex and Huggies.

- Church & Dwight: Church & Dwight NYSE: CHD manufactures household products such as Arm & Hammer baking soda, Nair hair removal products and OxiClean laundry detergent.

- Henkel: A German multinational Henkel FRA: HEN3 owns brands including Persil laundry detergent, Schwarzkopf hair care products and Fa body care products.

- Reckitt Benckiser: Headquartered in the UK, Reckitt Benckiser LON: RB produces consumer goods like Lysol disinfectant, Durex condoms and Air Wick air fresheners.

Personal care product companies

- L'Oréal: A French cosmetics giant, L'Oréal EPA: OR offers a diverse range of beauty products, including Lancôme, Maybelline and The Body Shop.

- Estée Lauder Companies: This American manufacturer Estée Lauder Companies NYSE: EL distributes cosmetics and fragrances under brands like Estée Lauder, Clinique and MAC Cosmetics.

- Coty, Inc.: Based in New York City, Coty Inc. NYSE: COTY produces fragrances, cosmetics and hair care products under brands like CoverGirl and Rimmel.

- Shiseido Company, Ltd.: A Japanese multinational Shiseido Company Ltd. OTCMKTS: SSDOY product line includes skincare, makeup and hair care products with brands like Shiseido and NARS Cosmetics.

- Beiersdorf AG: Headquartered in Germany, Beiersdorf AG ETR: BEI focuses on personal care products, including Nivea, Eucerin and Hansaplast.

Tobacco companies

- Philip Morris International: A Swiss-based company, Philip Morris International NYSE: PM, is a major player in the cigarette and tobacco industry, with brands like Marlboro.

- Altria Group, Inc.: Based in the United States, Altria Group NYSE: MO is a multinational tobacco and cigarette company known for brands like Black and Mild and Skoal.

- British American Tobacco plc: A British multinational British American Tobacco LSE: BATS produces various tobacco brands, including Dunhill and Kent.

- Japan Tobacco Inc.: Headquartered in Japan, Japan Tobacco OTCMKTS: JAPAY is a major player in the tobacco industry with brands like Winston and Camel.

- Imperial Tobacco Group plc: A British multinational, Imperial Tobacco Group OTCMKTS: IMBBY manufactures brands including Gauloises and West.

These companies are major contributors to the consumer staples sector, providing indispensable products and establishing a strong presence in the global market.

Why invest in consumer staples companies?

You can invest in consumer staple stocks for several reasons. One of the primary reasons is that consumer staples are considered essential products that people need regardless of economic conditions. Consumer staple companies are less likely to be affected by economic downturns than companies that produce nonessential products. As a result, these companies may provide more stable and reliable earnings even during challenging economic times. Consumer staple stocks create a "defensive position" in your stock portfolio, which helps to stabilize your entire portfolio during market volatility.

Another reason you may invest in consumer staple stocks is that you often provide consistent dividend income, an attraction to income-seeking investors. These companies typically have a history of paying dividends, often considered reliable and sustainable.

In addition, consumer staples companies often have established brand names and loyal customer bases, which can provide a degree of protection against competition. Security can make them more attractive to investors looking for companies with long-term growth potential and stability.

Investing in consumer staple stocks may provide diversification benefits to your portfolio. Investing in various consumer staple companies can diversify your portfolio and potentially reduce risk.

Pros and cons of investing in consumer staples companies

Investing in consumer staples stocks has several pros and cons. Consumer staples are products people need to buy regardless of economic conditions, making the sector relatively stable. Additionally, companies producing these products often have established brand names and loyal customer bases, protecting against the competition. On the other hand, the growth potential of consumer staple companies may slow down and be vulnerable to changes in consumer preferences or regulatory changes.

Pros

If you're considering investing in the stock market, consumer staples stocks can offer a range of benefits that make them an appealing option for many investors. Let's take a closer look at some of the pros of investing in consumer staples stocks.

- Stability: Consumer staples products are considered essential items, which means that the companies that produce them are less likely to be affected by economic downturns.

- Consistent dividends: Many consumer staples companies pay consistent dividends, making them attractive to income-seeking investors.

- Brand loyalty: Established brand names and loyal customer bases can make consumer staples companies more resistant to competition.

- Defensive investment: Consumer staples stocks are considered defensive investments, which can protect individuals during market downturns.

Cons

While consumer staples stocks have many advantages, there are also some potential drawbacks. Here are some of the cons of investing in these types of stocks.

- Limited growth potential: The growth potential of consumer staples companies may be limited compared to other sectors, as the demand for their products is relatively stable.

- Vulnerable to regulatory changes: Consumer staples products are subject to regulations that can impact the industry, making them vulnerable to regulatory changes.

- Changes in consumer preferences: The demand for consumer staples products can change based on consumer preferences, impacting companies' profitability.

- Valuation: Consumer staples companies are often considered less attractive during periods of high valuations due to their lower growth potential.

Analyzing consumer staples stocks

When dissecting a consumer staples stock, it is important to complete a thorough examination incorporating financial ratios, fundamentals and technical analysis. Financial ratios, such as the Price-to-Earnings (P/E) ratio, serve as a lens into a stock's valuation, with a higher P/E potentially indicating optimistic growth expectations. Likewise, the Price-to-Sales (P/S) ratio gauges a stock's value relative to its sales revenue, offering insights into potential undervaluation.

Examining dividend payout ratios unveils a company's commitment to shareholder value. Examining the payout ratio provides insight into how much of a company’s earnings will return to shareholders.

While ratios provide a good starting place, it is also important to dig into the fundamentals of a stock. The strength of a brand significantly impacts sales within the consumer staples sector. Consider any major brand and how its robust image contributes to market presence. Assessing market share provides a glimpse into a company's dominance and revenue-generating potential.

The concept of a "moat," a sustainable competitive advantage protecting a company from rivals, becomes essential when evaluating a corporation's commitment to sustainability. This commitment can be viewed as a unique moat, safeguarding its market position.

Technical analysis, with tools like moving averages, Relative Strength Index (RSI) and support and resistance levels, further enriches the evaluation process. Moving averages identify trends, with an upward trend indicating a positive trajectory. The RSI measures the speed and magnitude of price movements, providing insights into potential overbought or oversold conditions.

Integrating financial ratios, fundamentals and technical analysis offers a nuanced understanding of consumer staples stocks. This holistic approach empowers investors to make well-informed decisions aligned with their financial objectives and risk tolerance, recognizing the dynamic interplay of factors shaping the consumer staples sector.

Tax considerations

When investing in consumer staples stocks, it's vital to consider the tax implications and adopt tax-efficient strategies to optimize returns and minimize tax liabilities. Two primary tax considerations for these investments are capital gains taxes and dividend taxes.

Capital gains taxes come into play when you sell consumer staples stocks at a profit. The tax rate is contingent on the duration of your ownership. Short-term capital gains (held for less than a year) are taxed at your standard income tax rate, which can be considerably higher. In contrast, long-term capital gains (held for a year or more) are taxed more favorably.

Consumer staples stocks often pay dividends, which are taxed as ordinary income. The rate of dividend taxation is determined by your income tax bracket, with rates spanning from 0% to 20%.

To navigate these tax implications efficiently, several strategies can be employed:

- Holding consumer staples stocks for the long term is advantageous, as it not only capitalizes on lower long-term capital gains tax rates but also aligns with these investments' typically stable and enduring nature.

- Tax-loss harvesting can be used strategically to offset capital gains from consumer staples stocks by selling other investments with capital losses, effectively reducing your overall taxable gains.

- Tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans, offer the option to invest in consumer staples stocks. Traditional IRAs and 401(k)s provide tax-deferred growth, allowing taxes to be deferred until funds are withdrawn in retirement. Roth IRAs offer tax-free growth and withdrawals under specific conditions, providing substantial tax efficiency.

- Tax-efficient asset location involves placing tax-inefficient investments, like high-dividend consumer staples stocks, in tax-advantaged accounts while keeping tax-efficient investments in taxable accounts. This helps to lower your tax liability.

- The qualified dividend income deduction can reduce tax rates on qualified dividends, potentially resulting in substantial tax savings depending on your income and filing status.

- Tax credits, such as the foreign tax credit, can be explored to offset your tax liability and bolster overall tax efficiency.

- Estate planning strategies can be considered when passing on consumer staples stock investments to heirs to minimize or eliminate estate taxes.

When it comes to tax-efficient withdrawal strategies, it's crucial to plan your withdrawals to minimize tax impact when selling consumer staples stocks, preserving more of your investment gains.

Reinvesting dividends can also be tax-efficient, enabling you to increase your investment without incurring immediate tax liabilities.

Lastly, staying informed about evolving tax laws and regulations is essential, as changes can impact your investments and tax strategies. Consulting with a tax advisor or financial planner can help you tailor a tax-efficient investment plan aligned with your financial objectives and tax reduction goals.

Navigating consumer staples for long-term success

Consumer staple stocks stand out as pillars of stability, offering low volatility, inelastic demand and attractive dividend yields. From household names like Nestlé and Procter & Gamble to stalwarts like Colgate-Palmolive, these companies provide enduring value and brand loyalty. While acknowledging limited growth potential and susceptibility to regulatory changes, strategic investors can leverage comprehensive analysis and tax-efficient strategies to fortify their portfolios. With their resilience in market fluctuations and consistent returns, consumer staples are essential assets for long-term investing success.