Consumer staple stocks tend to show less volatility, as customers must purchase them regardless of economic conditions. While you can buy and sell individual stocks in the consumer staples sector to invest in these assets, you also have the option to invest in a "basket" of these stocks using a consumer staple index fund.

A consumer staple index fund provides instant diversification within your portfolio and protection if any of these companies has a rough year or quarter. Read on to learn more about how a consumer index fund works, why you might want to invest in consumer staples and more about the pros and cons of these funds.

Overview of consumer staples index funds

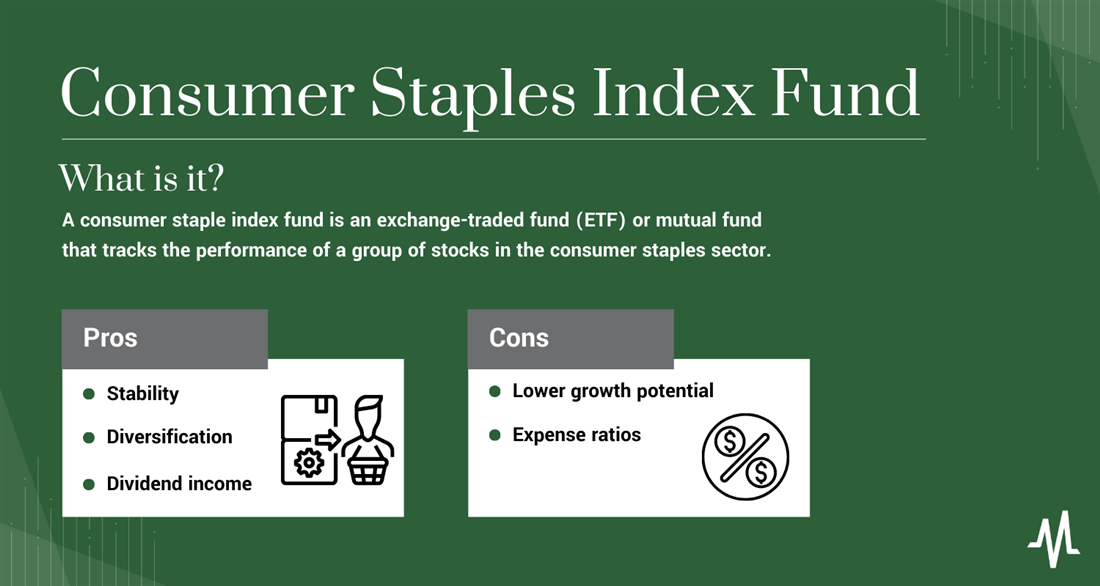

A consumer staple index fund is an exchange-traded fund (ETF) or mutual fund that tracks the performance of a group of stocks in the consumer staples sector. These funds comprise consumer staples stocks, typically tracking a major consumer index. Some common examples of stock market indexes that track the performance of consumer goods are the Dow Jones U.S. Consumer Goods Index and the MSCI U.S. Investable Market Index.

Investing in a consumer staples index fund is an easy way for investors interested in the general sector of the market to gain instant, diverse exposure. Instead of hand-selecting a few stocks that you think will perform well, consumer index ETFs and mutual funds allow you to invest in all the sector's top performers quickly.

Consumer staples

The consumer staples industry is a large and diverse sector that includes companies ranging from small, niche producers to large multinational corporations. Consumer staples are products such as food, beverages, household items and other everyday goods that people buy and replace regularly. These products tend to be less sensitive to economic changes than other sectors, as people will continue to purchase them regardless of economic conditions.

Consumer staples companies have stable and predictable revenue streams, which makes them attractive investments for investors seeking steady returns. However, the consumer staples industry is highly competitive, with many companies competing for market share. Overall, the consumer staples sector is steady compared to others, providing essential products and services needed for years to come.

Index funds

A stock market index is a measure that tracks the performance of a group of stocks or other securities, using a weighted measure to adjust performance. An index fund is a group of stocks that trade together as a single unit under the theme of a specific index. Index funds may be structured as ETFs or mutual funds.

Index funds seek to replicate the performance of a specific market index by holding a portfolio of securities that closely mirror the composition of the index. For example, an S&P 500 index fund would hold the same 500 stocks that make up the S&P 500 index in the same proportion represented in the index. This allows them to act as passive investments, offering lower management fees because it's a rarely rebalanced fund.

How consumer staples index funds work

Consumer staples funds work the same way as other index funds except that they track indexes based on consumer staples. Some common examples include the MSCI US Investable Market Consumer Staples 25/50 Index and the S&P 500 Consumer Staples Index. As these indexes perform, the underlying index funds tied to the performance provide the same returns to investors.

Consumer staples index funds can be a great addition to your portfolio, especially if you seek strong returns and stability. Over the past decade, consumer staples ETFs have offered an average annual return of around 5% and a standard deviation of around 12%, lower than the S&P 500 Index. These ETFs are more stable investments, providing slightly better returns than other sectors.

In 2020, as stock markets plunged due to COVID-19 fears, consumer staple index funds remained relatively steady with returns in line with prior years. Still, they underperformed relative to U.S stocks overall by about 2%.

Pros and cons of consumer staples index funds

Investing in consumer staples has benefits and drawbacks, both as index funds and as individual stocks. Think about both potential outcomes before choosing to invest in these funds.

Pros

The benefits include:

- Stability: Companies included in indexes that track consumer staple indexes are usually products people buy regardless of whether the economy is doing well or poorly. Investors get a level of stability for their portfolio, which can be comforting during times when the overall market is down.

- Diversification: Consumer staple stocks purchased through an index fund benefit from adding a wide level of market exposure to the investor's portfolio. This makes a consumer index fund less risky when purchasing individual stocks.

- Dividend income: Many stocks in major consumer staple indexes pay dividends, allowing them to act as a stream of passive income for reinvestment made available to investors.

Cons

The downsides include the following:

- Lower growth potential: Consumer staples companies often have slower growth rates than other sectors, leading to lower returns than companies in more dynamic sectors. While this makes them stronger choices for long-term investments, it may not be ideal for investors looking for value stock options.

- Expense ratios: Mutual funds and ETFs have expense ratios paid to the company managing the fund. Expense ratios are absent when purchasing individual stocks, which may impact your overall return, especially when investing in building a steady stream of dividend income.

Example of a consumer staples index fund

To help you understand how a consumer staples index ETF or index fund works, we'll look at the Vanguard Consumer Staples Fund NYSE: VDC. The Vanguard Consumer Staples Fund is an exchange-traded fund (ETF) made up of consumer staples stocks, with each holding weighted to best match the performance of the underlying index. The Vanguard Consumer Staples Fund aims to track the performance of the MSCI U.S. Investable Market Consumer Staples 25/50 Index, which is composed of domestic stocks in the consumer market sector.

The Vanguard Consumer Staples Fund is one of the largest consumer staple index ETFs, with more than $6.5 billion in assets under management. Some of the fund's largest holdings are in the following companies, which produce products you may use daily.

- Procter & Gamble Company: A quintessential example of a consumer staple stock, Procter & Gamble NYSE: PG is one of the world's largest manufacturers and marketers of household products, with a market share in over 180 countries. The company's portfolio includes brands like Olay, Vicks, Head & Shoulders, Gillette, Mr. Clean, Downy and countless others. P&G is the largest holding in VDC, making up over 12% of the fund's total holdings as of March 2023.

- Altria Group: The Altria Group NYSE: MO is one of the world's largest producers and marketers of cigars, cigarettes and related tobacco products. The company is also researching, developing and selling smokeless tobacco products, including chewing tobacco and vaporizers.

- PepsiCo: PepsiCo Inc. NYSE: PEP is one of the world's largest food and beverage companies. While Pepsi is best known for its namesake soda brand, a merger with the Frito-Lay corporation has exposed Pepsi to various food production opportunities. Some brands under the PepsiCo umbrella include Lay's, Doritos, Cheetos, Mountain Dew, Sierra Mist and Gatorade.

These three companies are just a few examples of the dozens of corporations issuing stocks in the VDC. The fund's makeup may change as companies fall into or out of qualification to go in the underlying index. As the VDC aims to track the MSCI U.S. Investable Market Consumer Staples 25/50 Index, you'll notice that many of the top companies included in the index also make up the fund.

How to invest in consumer staples index funds

Investing in consumer staples index funds is relatively straightforward compared to other types of investments. When selecting a consumer staples stocks ETF or mutual fund, look at the expense ratios charged by the fund’s managers and compare them with similar funds to find a low-cost investment option. Pay attention to the underlying assets that comprise each index, as some may be more timely than others.

Choose the right fund

When selecting a consumer staples index fund, consider the fund's expense ratio, diversification strategy and management style. Some funds may have higher expenses due to their active management approach, while others may be more passive and have lower expenses. Also, consider the size and liquidity of the fund. Larger funds typically offer better liquidity and lower trading costs.

Another factor to consider is the underlying assets that make up the index. For example, the MSCI U.S. Investable Market Consumer Staples 25/50 Index comprises a diverse mix of consumer staple stocks, including household and personal care products, tobacco, beverages, food and more.

You get broad exposure to the consumer market sector since it includes large-cap, mid-cap and small-cap companies. However, some funds may focus on specific sub-sectors or regions, so understand the fund's investment objective and strategy before deciding.

Open an account

Once you've chosen your ideal ETF or mutual fund, you have to inform your broker of how many shares you'd like to purchase and then move forward with trading those shares on whichever stock exchange you prefer. You can open an account with a broker, typically from online brokers or traditional brick-and-mortar firms.

Discount brokerage accounts are ideal for low-budget investors or if you execute a few trades frequently; commission fee structures and minimum balance requirements vary across providers. On the other hand, full-service brokerages provide more personalized advice — including tax planning — but usually come with higher annual fees.

Portfolio diversification

As with any investment, manage your risk when investing in consumer staples index funds. While these funds are usually less volatile than other sectors, they are still subject to market risks and economic fluctuations. Diversification across multiple sectors and asset classes can help mitigate these risks and stabilize your portfolio. You could also consider adding bonds, real estate, or international investments to diversify your holdings further.

Consumer staples index funds vs. other investment options

Should you consider an index fund for your consumer staple investment? The answer to this question might vary depending on your goals and risk tolerance. Index funds provide a wide range of benefits to long-term investors, including an instant layer of diversification without hand-selecting individual stocks. This can be a critical consideration in the consumer staple industry, when individual stocks may be more volatile. While a consumer staple index might show less volatility than individual stocks, this also translates to lower general investment returns.

Index funds offer a passive approach to investing, while actively managed funds allow you more control over your investment decisions. With actively managed funds, the fund manager monitors and changes up the selection of stocks to maximize gains.

This means active trading fees can eat away at your returns compared with an index fund that requires minimal maintenance or effort from investors. However, choose an active consumer staples fund carefully crafted by experienced analysts rather than a generic index-copying product. This could add extra value if you're willing to pay for it.

The other major difference between an index fund for consumer staples and the broader market is their performance. Since consumers tend to purchase staples regardless of economic conditions or industry trends, they stay relatively stable during tumultuous times. Cyclical stocks, meanwhile, such as in the consumer discretionary sector, will often fail to perform well.

This could be attractive if you're looking for total returns with less risk, especially compared to many stock investments in volatile industries like technology or finance, which could tank at any given moment due to a macroeconomic event.

Tips for successful investment

Ultimately, deciding whether to invest in consumer staples index funds boils down to your investment goals. Regardless of your route, making sure your portfolio is diversified will help reduce potential risks while allowing growth opportunities across different sectors.

Long-term investing

For many investors, the best approach to investing in a consumer index fund is long-term.

Over time, these funds tend to benefit from the inflation protection they provide due to their consistent returns. Long-term investment also helps average out short-term price changes. It can reduce your overall portfolio risk, since you're not exposed to as much market volatility over longer periods. Adopting a buy-and-hold strategy for at least five years allows you to get more growth while allowing any significant dips or rises in prices to affect your returns less significantly, meaning there's no need for active management.

Dollar-cost averaging

Dollar-cost averaging is a great way to spread out your investment risk over time and reduce the chances of buying at too high a price. The idea here is that you purchase shares regularly, usually monthly or quarterly, regardless of whether prices have risen or fallen.

This helps buffer any moves up by avoiding lump sum purchases, which could be costly if it turns out stocks have already hit their peak. Besides helping manage initial volatility when you invest in an index fund, this strategy will also help average out fluctuations over time.

Rebalancing strategies

Re-evaluate your portfolio periodically to ensure it accurately reflects your original goals and risk tolerance. This means you need to regularly rebalance any investment holdings, selling off stocks or funds that have become too large of a percentage of the overall portfolio, while buying back other investments that might be underweighted. This helps protect against market volatility.

Rebalancing also forces you to sell high and buy low by taking profits when stock prices increase but adding more shares at times when they decrease, allowing for greater potential returns when the market recovers.

A staple of any investor's portfolio

The consumer staples sector may be just the ticket if you're seeking safe harbors while navigating today's tumultuous markets. With its familiar, everyday brands and products, reliable returns and minimal risk, this sector offers a secure entry point for new and seasoned investors alike.

FAQs

No matter if you decide to invest in a consumer staples index ETF or mutual fund, it’s a good idea to answer any lingering questions you may have. The following are some of the most common questions that investors have about consumer staples funds.

How does a consumer staples index fund work?

A consumer staples index fund is a type of ETF or actively managed mutual fund that primarily invests in assets within the consumer staples index. These companies usually produce products that consumers need to buy regardless of how the economy is moving — you can view a list of examples of top consumer staples stocks to get an idea of common companies included.

Are consumer staples index funds a good investment?

Consumer staples index funds may be a good choice for investors looking for long-term investments that are likely to show lower levels of volatility. However, no investment is ideal for everyone, so be sure to consult with a financial professional before making any major investing decisions.

Is it better to buy consumer staples stocks or index funds?

In most cases, it’s more advantageous to invest in an index fund for consumer staples rather than buying individual stocks in the consumer sector. While index funds have the drawbacks of management fees and expense ratios, they provide investors with an instant level of diversification for their portfolios. This is likely to result in less overall loss if the consumer staple market takes a turn.

Before you consider Altria Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altria Group wasn't on the list.

While Altria Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.