Quantitative investing is infinitely easier to implement on an individual level than it’s trading counterpart. It simply comes down to identifying factors that outperform and setting appropriate position balancing, risk management, and rebalancing criteria.

Investing quantitatively protects us from the behavioral biases that creep into our portfolio when analyzing securities in a discretionary matter. It also takes significantly less time, as coming to a reasonable investment thesis for just one company that will take up a sizable concentration in your portfolio can take several dozen hours.

Today we’re talking about a few popular quantitative value investing strategies. Although we’ve seen value fall out of favor in the last decade or so, value as a standalone factor significantly outperforms the indexes over the long-term.

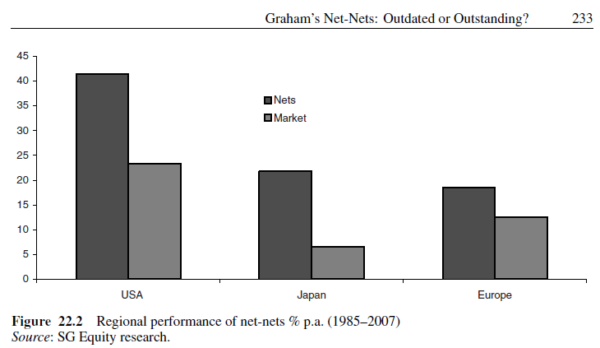

Chart from Quantitative Value Investing

The Magic Formula

The Magic Formula is a quantitative investment strategy outlined by hedge fund manager Joel Greenblatt in his book The Little Book That Beats The Market. The formula is constructed with two fundamental filters, one taken from the philosophy of Ben Graham, the other taken from the philosophy of Warren Buffett.

The first is a value filter, inspired by Graham, which looks for companies with very high earnings yields relative to their enterprise value. Greenblatt used EBIT / enterprise value to determine this. He prefers the use of EBIT (operating earnings) to eliminate the different tax structures of companies, and the use of enterprise value, which takes the debt obligations of a company into account.

The second filters for quality, inspired by Buffett, looking for companies with high returns on capital. Greenblatt used EBIT / (net fixed assets + working capital) to determine this. The metric screens for companies that use their capital efficiently, a favorite of Buffett. To demonstrate the importance of ROIC, Greenblatt often refers to the example he used to teach his young son about the concept of return on capital:

“Imagine your friend Jason opens a gum store, Jason’s Gum Store. It costs him $400,000 to open the store, and the store makes $200,000 per year. That’s a 50% return on capital. Now imagine another store, called Broccoli, that only sells Broccoli. It costs the same $400,000 to open the store, but they only make $10,000 a year, a 2.5% return on capital. It’s clear which is the better business.”

You take these two filters and run a screen on a universe of stocks, ranking them by the best combination between quality and value.

The strategy has destroyed the S&P over the long-term, as you can see from this chart from the book:

With that said, The Magic Formula’s performance, like most value strategies, has lagged post-global financial crisis. Take a look at InvestorsEdge’s analysis of the strategy’s recent performance:

The Acquirer’s Multiple

The Acquirer’s Multiple is a quantitative investment strategy developed by Tobias Carlisle, and coined in his book of the same name. Carlisle aimed to improve upon the already simple Magic Formula by reducing it even further.

In his testing, Carlisle found that the value factor (EBIT/EV) within the Magic Formula on its own, outperforms both the quality factor isolated and the Magic Formula itself. This lead to him penning The Acquirer’s Multiple book and founding an ETF based on the strategy.

Here’s a chart from Carlisle’s presentation to Quantopian, called How To Beat the Little Book. The chart displays different portfolio weightings of the two Magic Formula factors, coming to the conclusion that the value factor alone outperforms in both risk-adjusted, and absolute returns.

Implementation of the strategy is as simple as buying a weighted basket of stocks with the highest operating earnings yield.

Final Thoughts

I’ve introduced you to two very simple quantitative investment strategies to give you a jumping-off point in your research. You may like the return profile of one of these, and choose to set it and forget it, or choose to do more research using a platform like Quantopian.

For those seeking more information, stay tuned for our future piece on factor investing.

With the wide availability of data and cheap backtesting platforms, interested investors can have a field day testing out their ideas, possibly developing a robust strategy in the process.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report