A Correction Is Long Overdue

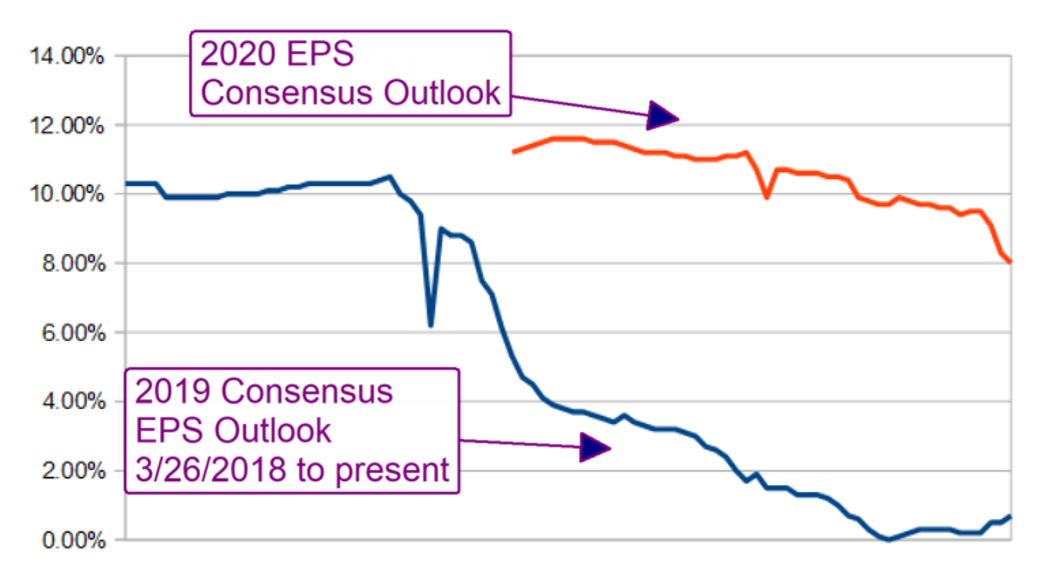

I have been calling for, anticipating, and preparing for a stock market correction for quite some time. I found it, find it, hard to believe the stock market can continue to climb higher while the outlook for earnings is deteriorating. Sure, the S&P 500 (SPY) eeked out a small measure of EPS growth in 2019 but, compared to the +10% analysts had been expecting at the start of the year, it’s nothing.

The best bull case I can make about earnings growth and stock market prices is the trajectory for EPS growth is positive. The pace of S&P 500 EPS growth is expected to accelerate on a quarter-to-quarter basis for the next 6 to 8 quarters and from this year to next year. That fact is offset though by consensus estimates, estimates that continue to fall, which leaves the market on shaky footing.

The outlook for 2020 EPS was in decline before the coronavirus outbreak, with the outbreak that decline is accelerating. Companies from Apple to Walmart and Proctor & Gamble have warned about the potential impact the virus will have on earnings. Apple says it could affect them by $billion or more, a minimum impact of 6.25%, and others will be hurt worse. At the current pace of decline, we can expect Q1 earnings for the S&P 500 to be negative, the risk now is how the virus will impact the rest of the year.  So, back to the idea a correction is brewing; there might not be one in the cards but it sure looks like it to me. The S&P 500 was trading nearly 19X its forward earnings at the end of Friday’s session. That’s well above the five and ten-year averages and based on nothing but hope. Let’s not forget much of last year’s rally can be attributed to the trade war outlook and the promise of the Phase 1 Deal.

So, back to the idea a correction is brewing; there might not be one in the cards but it sure looks like it to me. The S&P 500 was trading nearly 19X its forward earnings at the end of Friday’s session. That’s well above the five and ten-year averages and based on nothing but hope. Let’s not forget much of last year’s rally can be attributed to the trade war outlook and the promise of the Phase 1 Deal.

Where To Invest For A Market Downturn

The obvious answer to the question, where to invest your money for a market downturn, is with safe-haven stocks. For me, that means real assets. Real assets are a broad category of investments that have a few characteristics in common that add up to better performance in times of market downturn. It is not uncommon for these assets to not only outperform the broad market but to rally while other equity assets are in decline.

First, real assets are tangibles like commodities, infrastructure, and real estate. Businesses like Apple sell a tangible product but their revenue streams are subject to the whims of the market. Where consumer goods rely on the wants of a fickle marketplace real assets are forever.

Second, real assets often benefit from high barriers to entry. Regulations and contracts provide a deep moat protecting the revenue and future profits of real asset companies. Any old start-up from Silicon Valley could disrupt Apple’s revenue stream, you can’t just build a road or open a power plant, and they aren’t making any more land.

Finally, real assets offer a measure of inflation protection you can’t get from the average equity. This is because the value and/or revenue streams are protected from inflation either intrinsically (like gold) or extrinsically through contractual price increases. What this means for investors is twofold, a hedge against inflation and safe dividends.

Gold And The Gold Complex

Gold and the gold complex are getting a real boost from market conditions right now. The fundamental outlook for gold was already bullish, the flight-to-safety safe-haven trade sparked by the coronavirus and today's equity sell-off has turbo-charged the rally. While it is likely gold prices will continue to rise, in the near-term at least, I prefer the gold complex, the miners that dig the yellow metal out of the ground, because they pay dividends.

Newmont Gold (NEM) is the best-of-breed choice for me right now. Newmont just released a blow-out earnings report citing increased production, both organic and via the Goldcorp purchase, and higher gold prices. The company also announced plans, pending approval, to up the dividend to $1.00 per share. Considering that gold prices are 6% higher now than at the highest level last quarter, it looks certain they will follow through with their plan.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.