Travel restrictions clamped down on domestic and international travel. Iconic investor Warren Buffett sold all his airline stocks during the pandemic, noting that the recovery would be long and slow. After three years, the airline industry is going through normalization with solid travel demand despite a weakening macroeconomic environment.

This article will review the airline industry and analyze the four largest airlines to help you answer the questions, "Will airline stock recover?" and "If they will, when will airlines stocks recover?"

Overview of Airline Stocks Pre-Pandemic

Airline stocks were already showing signs of weakness during the pre-pandemic 2019. The COVID-19 pandemic was the final straw for legendary investor Warren Buffett as Berkshire Hathaway sold all his airline stocks by March 20, 2020, taking an estimated $5 billion loss. His company owns major airline stakes, including 42.5 million shares of American Airlines (10% stake), 58.9 million shares of Delta Air Lines (9.2% stake), 51.3 million shares of Southwest Airlines (10.1% stake) and 21.9 million shares (7.6% stake) in United Airlines.

He noted that the recovery in the airline industry would be slow and costly. The U.S. Global Jets ETF NYSEARCA: JETS tracks the performance of airline industry stocks. Its four largest holdings include Delta Air Lines, United Airlines, Southwest Airlines and American Airlines. JETS illustrates the devastating impact that COVID had on airline stocks.

The weekly candlestick chart on JETS shows traded in a rectangle trading range oscillation between a $27.16 lower trendline and a $32.13 upper trendline in 2019. As the pandemic spread in 2020, JETS fell from the $32.13 upper trendline at the beginning of January 2020 to a low of $11.19 in March 2020, falling 65% in 10 weeks. This mirrors the S&P 500 Index drop, representing the U.S. stock market. Bankruptcy fears plagued the airlines as they sought federal relief for the vaporization of revenues. The U.S. government negotiated a $54 billion lifeline to the U.S. airlines to save them from bankruptcy and to continue funding its workforce.

JETS rallied from the lows to a high of $28.79 by March 2021 during the post-pandemic reopening period. As COVID-19 vaccinations spread, more and more geographies and industries reopened. Social distancing and mask restrictions slowly lifted, causing a demand spike leading to supply shock as the slow reopening of factories, processing and manufacturing plants led to global supply chain disruptions. Producers were frantically trying to meet the overwhelming demand for products, which triggered a surge in inflation.

The consumer price index (CPI) is the gauge of inflation. It had risen from 2% to a 40-year high of 9.1% by June 2022. The U.S. Federal Reserve initiated aggressive interest rate hikes to curb and reverse inflation, which caused the stock market to sell off again as investors took money off the table and into savings and money market accounts, which were finally earning respectable interest rates. JETS also sold off from its $28.79 peak in March 2021 to a low of $14.77 in October 2022. It has been trying to stage a recovery since then.

Overview of Airline Stocks Post-Pandemic

The airline business had a slow recovery during the post-pandemic period. Airline stocks, however, surged with the rest of the market on the reopening, including the best performing airline stocks. Investors wondered, "Why are airline stocks up today on no news?"

The answer is simple: the fear of missing out (FOMO) drove higher airline stocks and the stock market. Investors rushed into stocks with their stimulus checks, triggering a meme stock and special purpose acquisition company (SPAC) frenzy. JETS surged to a high of $28.79 at the peak of the post-pandemic rally in March 2021. The fundamentals didn't surge as quickly as airline stocks. Stocks fell in a weekly falling channel that bottomed out in October 2022. JETS has staged a rally from those lows heading into 2023 and hit a year-to-date (YTD) high of $21.24 in late January 2023. Airlines reported a return to profitability and volumes returning to pre-pandemic levels.

The travel and leisure industry has been in an upside normalization, with travel restrictions having been pulled even in China. Despite uncertain macroeconomic conditions driven by high inflation, travel demand has been strong and attributed to the shift in consumer discretionary spending to services from goods.

Most major airlines had to renegotiate new contracts for their pilots, flight attendants and ground crews in 2023. Rising labor costs are a major expense partially offset by rising ticket costs. In most cases, labor contracts have been negotiated for the next five years but two years in others. These can have an impact on the answer to "When will airline stocks recover?"

It's best to research the major airline carriers to see which is suitable for you as the best airline stock to buy. Airlines are experiencing a solid recovery but are not blue chip stocks, as most have cut their dividends.

Airline Stocks in 2023

Here’s a profile of four major and arguably best airline stocks to gauge the industry.

Delta Air Lines Inc.

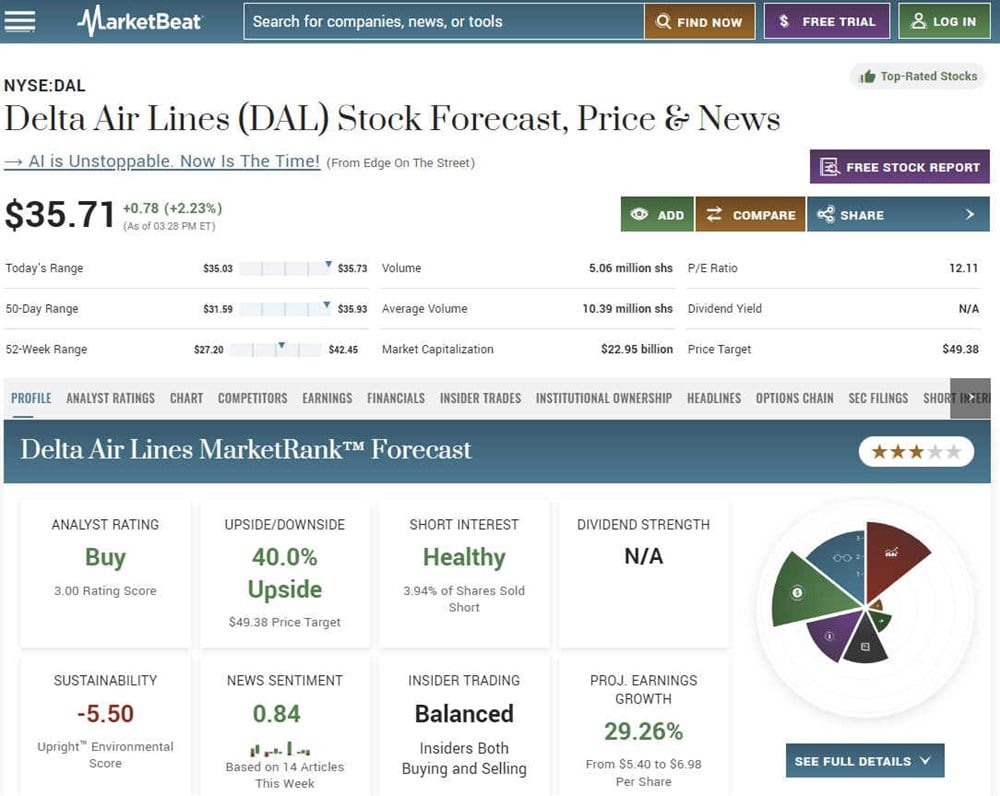

Delta Air Lines Inc. NYSE: DAL has improved its operations since the pandemic emerging as one of the most efficient airlines in the nation. Delta will be the largest U.S. airline in 2023.

It was named the top U.S. airline by the Wall Street Journal for 2022. The company started the year off with non-GAAP profitability in 2023. Operational costs rose, offset by the 17% increase in average airline ticket prices. The company maintains its status as the most on-time airline, with an 81% on-time arrival rate in 2022 by Forbes magazine. The company uses a hub-and-spoke flight network serving 200 million customers annually. Its Q1 2023 generated $2.62 billion in operating cash flow.

2023 Outlook

The company expects revenues to grow 15% in 2023 and generate $5 to $6 per share in earnings. The company claims that consumer demand is way ahead of pre-pandemic levels. The company paid down $1.2 billion in debt in the quarter to improve its balance sheet. Management stated that consumer spending shifting to services rather than products offset the macroeconomic weakness. DAL stock has a one-year performance of down (7.88%) with no dividend. Delta Air Lines analyst ratings and price targets are on MarketBeat.

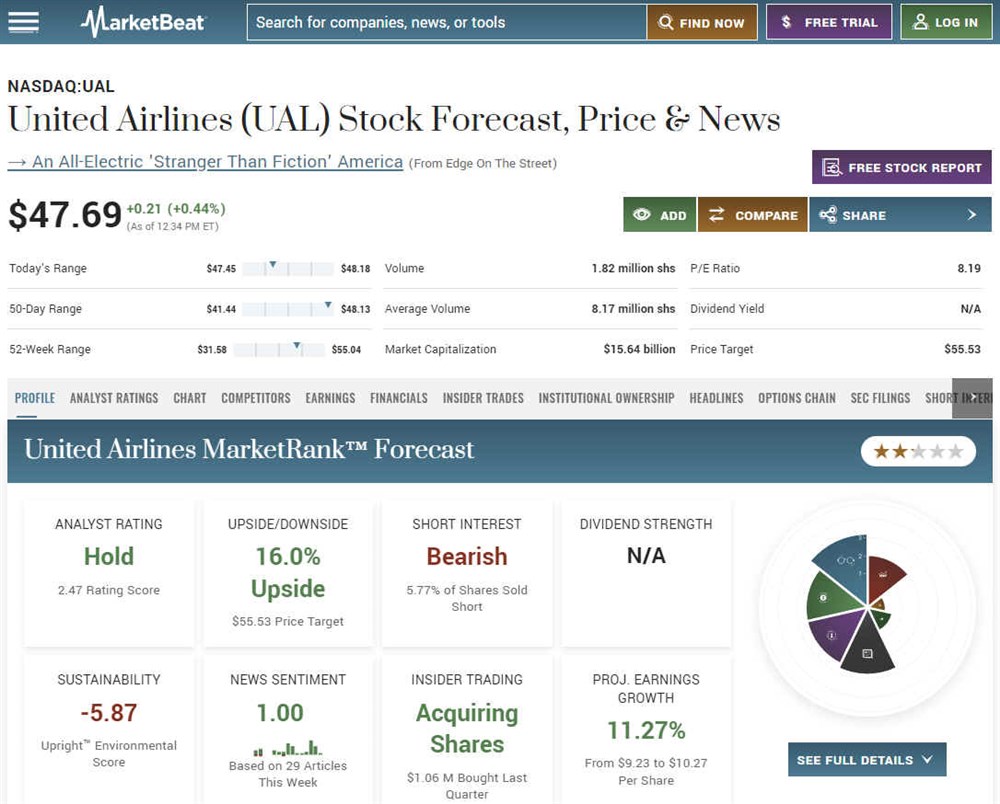

United Airlines Holdings Inc.

United Airlines Holdings Inc. NASDAQ: UAL also hit non-GAAP profitability going into the new year. Revenues surpassed pre-pandemic levels in 2022, coming in at $44.96 billion. The company negotiated with three labor unions to ensure no strikes or customer service interruptions. Its new five-year contract with the Air Line Pilots Association (ALPA), affecting 15,000 United pilots, calls for 14% wage increases and improved work rules and benefits. It should cost United an extra $3.6 billion throughout the contract's life.

United negotiated with the International Association of Machinists and Aerospace Workers (IAM), representing nearly 30,000 ground crew for a two-year contract, including 13% wage hikes costing $1.3 billion for the company. They also negotiated with the Transport Worker Union (TWU) representing 10,000 United flight attendants for a 15% wage hike under a five-year agreement. United will take a $2.2 billion charge on that deal.

The total additional costs of the negotiated contracts amount to $7.1 billion over the lift of those respective contracts. United took a $1.1 billion charge in Q1 2023 to adjust for the labor union contracts. Delta and American Airlines also took charge in their Q1 2023 for higher labor costs stemming from the new union contracts for their employees.

United Airlines is updating its fleet. On February 14, 2023, United placed a $100 billion order with The Boeing Co. NYSE: BA to deliver 200 Boeing 737 MAX 10 aircraft with the option to buy 100 more. The 737 MAX 10 is the largest variant of the Boeing 737 MAX portfolio. These airplanes will replace its aging fleet of 757-200s and 767-200s.

2023 Outlook

Small business volume is back to pre-pandemic levels. Bookings will continue to be strong. Lowe jet fuel prices will be a tailwind if the economy weakens. The company expects an extensive international travel season in the summer of 2023. United expects full-year 2023 to generate $10 to $12 per share versus $8.68 consensus analyst estimates, a driver for analyst upgrades. UAL stock is one of the best-performing airline stocks, with a one-year performance of 2.5% with no dividend. United Airlines analyst ratings and price targets are on MarketBeat.

American Airlines Group Inc.

American Airlines Group Inc. is the second largest airline in the U.S., with a fleet of more than 900 airplanes and over 350 destinations in more than 50 countries. The company's revenues in 2022 surpassed pre-pandemic levels at $48.97 billion. American Airlines has had four straight quarters of record revenues. The reopening of international markets continues to be a tailwind in its recovery. The company expects robust travel demand to continue through 2023. The company also sees its financial performance continue to improve. They expect to deliver 50 new airplanes in 2023 to modernize their fleet and improve efficiency. The company negotiated new labor contracts with the Allied Pilots Association (APA), which represents 15,000 American Airlines pilots.

2023 Outlook

American Airlines expects full-year 2023 earnings per share of $2.50 to $3.50 versus consensus analyst estimates of $2.35. Management says international travel will be strong in 2023, and robust travel demand will continue. On May 19, 2023, a U.S. judge ruled in favor of the U.S. Department of Justice, calling for an end to its Northeast Alliance with JetBlue Airways Co. NASDAQ: JBLU. This will impact American Airlines while competitors Delta Air Lines and United Airlines benefit. AAL stock has a one-year performance of down (17%) with no dividend. Check out American Airlines analyst ratings and price targets on MarketBeat.

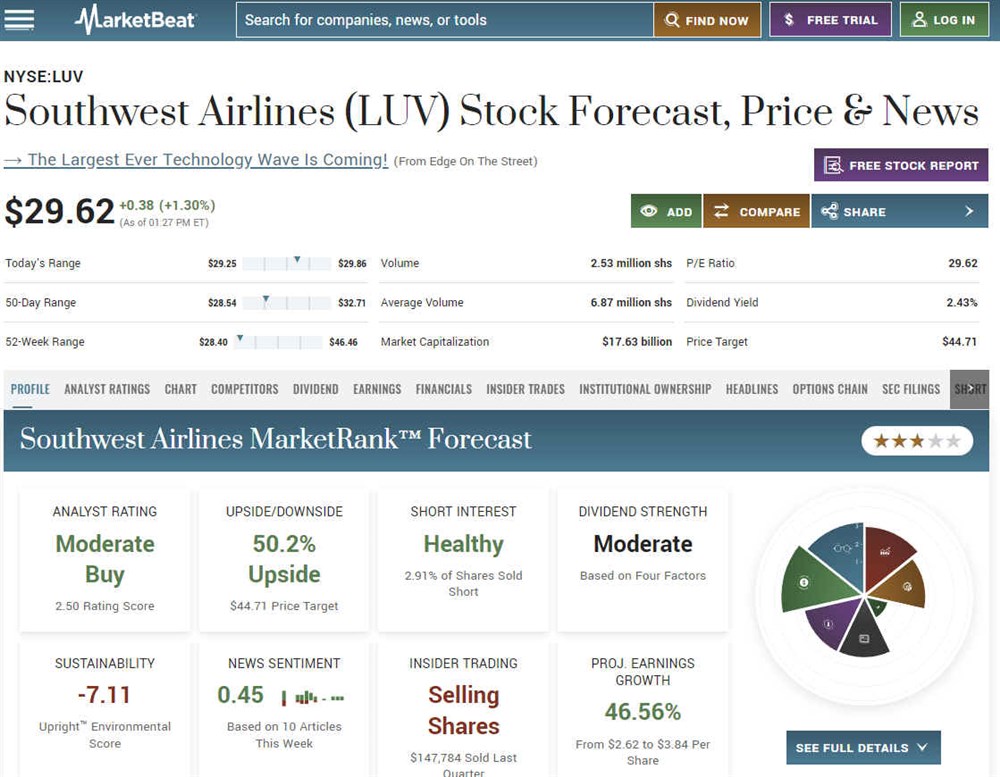

Southwest Airlines Co. NYSE: LUV

Low-cost airline Southwest Airlines Co. NYSE: LUV is about efficiency and keeping costs down to support low fares. The company has grown from a small airline delivering mail in Texas to the nation's fourth-largest carrier, with over 790 planes serving more than 100 destinations, mainly in the U.S. and Mexico. The company generated $23.81 billion in revenues in 2022. The airline continues negotiating new labor contracts with its various work unions, including Southwest Airlines Pilots Association (SWAPA).

Southwest suffered a significant blow when its computer system crashed in December 2022 during its peak holiday season. The flight scheduling system crash was a significant disruption, causing the airline to cancel over 2,000 flights. Financial damages range from $725 million to $825 million in refunds, compensation and system upgrades. It also damaged its reputation and launched an investigation by the Federal Aviation Association (FAA) and Transportation Security Administration (TSA). System disruptions caused a ($380 million) impact in Q1 2023, turning earnings negative.

2023 Outlook

Southwest expects profits in the full-year 2023 of $4.50 earnings per share. It's committed to restoring its reputation and customer loyalty. The company expects 70 new aircraft from Boeing in 2023, down from 90. Southwest expects "solid profits," year-over-year margin growth and return on invested capital in 2023. Southwest expects a load factor of 80% and an operating margin of 15%. The company expects its network to restore to pre-pandemic levels by the end of 2023. LUV stock has a one-year performance of down (34%) and pays a 1.34% dividend yield. Check out Southwest Airlines analyst ratings and price targets on MarketBeat.

Outlook for the Airline Industry

Judging from the 2023 outlook among the top four U.S. airlines, the recovery should continue in 2023. Airlines are seeing robust travel demand continue even with uncertain macroeconomic conditions.

Consumers have pulled back their discretionary spending and shifted from spending on products to services, which fuels the robust demand for travel and leisure. Union contract negotiations are causing labor expenses to rise, but rising ticket prices offset that. The recovery in airline stocks should continue throughout 2023 as fundamentals improve. However, consumer spending behavior can be fickle and turn on a dime, so exercise caution regarding the best airline stock to buy.

FAQs

Here are some answers to your frequently asked questions.

Will airline stocks recover in 2023?

The airline industry looks to continue its recovery in 2023 based on robust travel demand. Many airlines expect solid international travel. Consumers have shifted their spending to services rather than goods and products. Airline stocks should but not always follow the improvements in fundamentals as sentiment is a key mover of stocks.

What is the outlook for the airlines in 2023?

Airlines should earn non-GAAP profits in 2023 as business recovers to and above pre-pandemic levels. Airlines are expecting higher labor costs due to negotiations with respective labor unions. Airlines are also upgrading their aircraft fleets to stay efficient and competitive in the coming years.

Why are airline stocks down?

Like most stocks, airline stocks recovered too fast in 2021, causing a mini-bubble burst when the U.S. Federal Reserve started its aggressive monetary tightening policy, raising interest rates to combat inflation. The U.S. consumer price index (CPI) is the inflation gauge, and it hit a 40-year high of 9.1% in June 2022. After the post-pandemic sell-off in 2022, stocks are attempting to stage a rally as interest rate hikes get closer to a conclusion.

Before you consider Delta Air Lines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Delta Air Lines wasn't on the list.

While Delta Air Lines currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.