WSM

Williams-Sonoma

$276.89 -5.48 (-1.94%) (As of 04:32 PM ET)

- 52-Week Range

- $120.74

▼

$348.51 - Dividend Yield

- 1.63%

- P/E Ratio

- 17.00

- Price Target

- $262.13

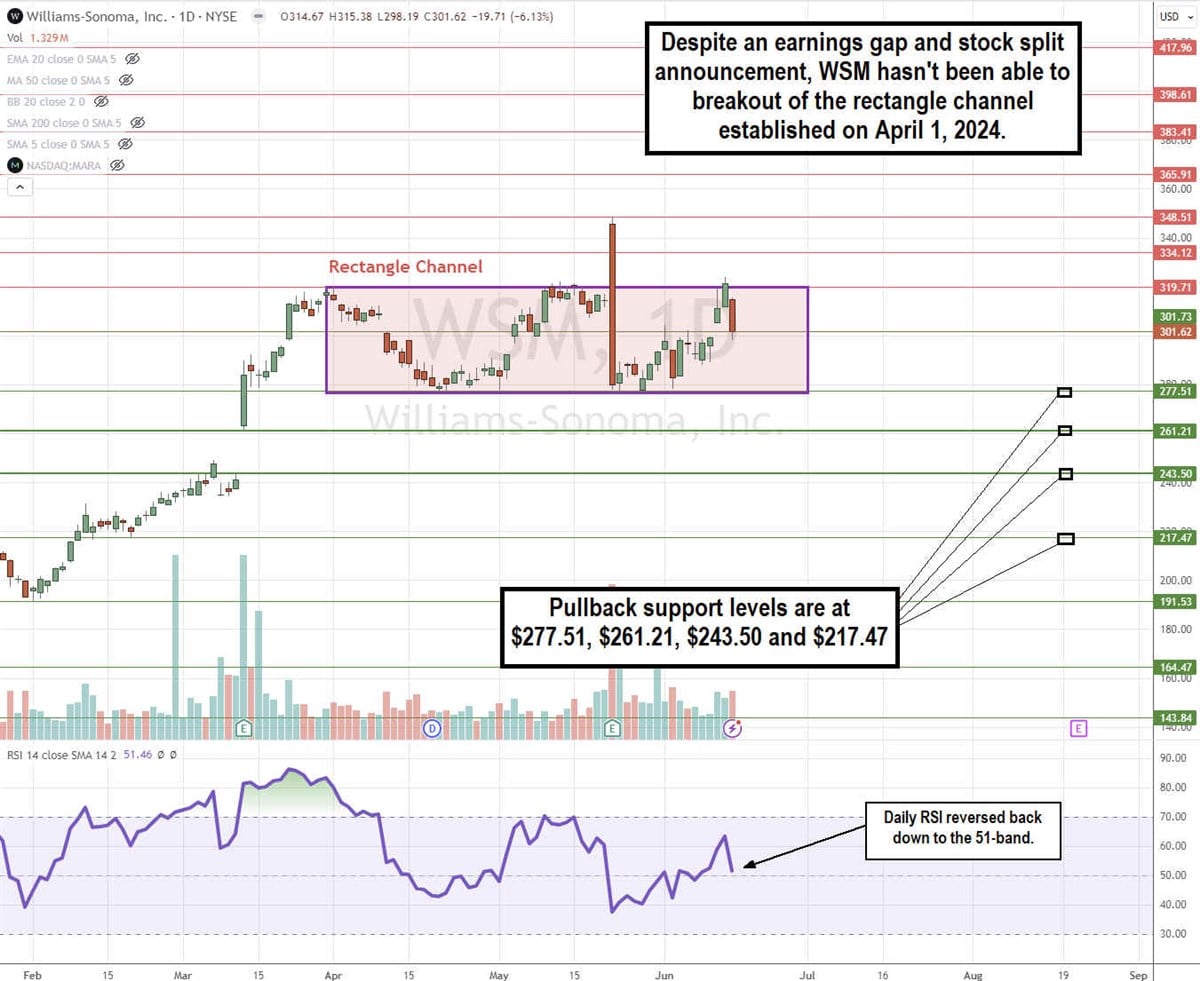

Upscale specialty retailer Williams-Sonoma Inc. NYSE: WSM has seen its stock price climb nearly 400% in the past 5 years. Like its expensive products, its share price has gotten out of reach for many investors. For this reason, the company announced a 2-for-1 stock split on June 13, 2024, to make its stock more accessible to investors and employees. The news initially caused shares to rise 3% on the day of the announcement, but the stock fell 6% the following day as it couldn’t seem to break out of its daily rectangle channel.

Williams-Sonoma operates in the consumer discretionary sector with upscale retailers like RH NYSE: RH, formerly known as Restoration Hardware, Haverty Furniture Co. NYSE: HVT, and Arhaus Inc. NASDAQ: ARHS.

Williams-Sonoma Has a Portfolio of Upscale Store Brands

Williams-Sonoma is known for its namesake, upscale, and elegant kitchen and cookware stores, which are often found in shopping malls and strip centers. It also owns additional luxury brand stores specializing in different design and style preferences of furniture and housewares. Pottery Barn and Pottery Barn Kids provide furniture and bedding décor focusing on colorful and classic styles. West Elm offers upscale modern and contemporary furniture, rugs, bath and bedding. Rejuvenation offers vintage and industrial-style furnishings, light fixtures, décor, and hardware.

Catering to the Upper Middle Income and Affluent Consumers

Williams-Sonoma is known for its high-quality wares and exemplary customer service, fostering brand loyalty among affluent consumers. They offered curated collections, establishing their stores as premium destinations for families, with a significant portion of customers in the 45 to 65 age range with disposable income for discretionary home improvement spending. Its stores are located in major cities and affluent suburban communities, targeting higher household incomes. This demographic is often considered bulletproof and recession-resistant.

The company has been able to bolster margins and lower inventories thanks to its strong in-house design capabilities, robust first-party data that enables it to run more effective digital marketing campaigns and extraordinary customer service.

WSM Stock Continues to Trade in a Rectangle Channel

The daily candlestick chart for WSM illustrates the prevalence of its rectangle channel. The upper trendline resistance at $319.71 and lower trendline support at $277.51 have held their range since establishing themselves on April 1, 2024. Each breakout or breakdown attempt has been contained multiple times.

Most recently, the large earnings price gap to $349.51 on May 22, 2024, appeared to finally break out of the range, but WSM fell right back into the rectangle and even tested the lower trendline. The stock split announcement was another failed attempt at a breakout, which lasted a single day. The daily relative strength index has turned back down to the 51-band. Pullback support levels are at $277.51, $261.21, $243.50, and $217.51.

Blowout Q1 2024 Earnings But Revenue Softens

Williams-Sonoma reported EPS of $3.48 for Q1 2024, crushing the $2.74 consensus estimates by 74 cents. Revenue grew 5.4% YoY to $1.66 billion, which still beat the $1.65 billion consensus analyst estimates. Comparable (comp) brand revenue fell 4.9%, with a 2-year comp falling 10.9% and a 3-year comp down 1.4% YoY. Liquidity was strong, with $1.3 billion in cash and $227 million in operating cash flow.

Robust Kitchenware Sales Offset by Weak Furnishings

Williams-Sonoma continued to experience robust sales in its kitchen business, posting positive comps for 4 consecutive quarters, with its banner brand delivering 0.9% and 1.6% in Q1 2024 and Q4 2023. Unfortunately, furnishings continued its weakness driven by the slow housing market and sluggish consumer spending trends on large ticket items like furniture. This was reflected by the -10.8% comp in Q1 2024 and -9.6% comp in its previous Q4 2023 for Pottery Barn.

Solid Gross Margin Improvement Driven by 13.1% YoY Lower Merchandise Inventories

Gross margin rose 690 bps to 45.4%, driven by higher merchandise margins of 480 bps coupled with supply chain efficiencies of 240 bps, which were partially offset by 30 bps of occupancy deleveraging. The company's merchandise inventories fell 13.1% YoY. The company has also gained market share and remains committed to not running extensive promotional campaigns to protect margins further.

Without backing out 290 bps of out-of-period adjustment, the gross margin was 48.3%. The out-of-period adjustment was for a cumulative amount of $49 million attributed to over-recognized freight expenses in fiscal 2021, 2022, and 2023.

The Company Reiterated 2024 Guidance, Market Was Not Impressed

- Overall MarketRank™

- 3.46 out of 5

- Analyst Rating

- Hold

- Upside/Downside

- 5.7% Downside

- Short Interest

- Bearish

- Dividend Strength

- Moderate

- Sustainability

- -1.80

- News Sentiment

- 0.45

- Insider Trading

- Selling Shares

- Projected Earnings Growth

- 4.10%

See Full Details Williams-Sonoma reiterated its 2024 outlook of -3% to +3% annual net revenue growth, or $7.52 billion to $7.98 billion versus $7.72 billion, and comps in the range of -4.5% to +1.5%. Operating margin guidance was raised from 17.6% to 18%, which includes the 60 bps out-of-period adjustment. The company expects an operating margin between 17% and 17.4% after the adjustment. The company expects mid-to-high single-digit yearly net revenue growth with a mid-to-high teen operating margin.

The market gapped and sold off WSM shares, not only giving back its gains but losing nearly 11% on the day as it expected the company to raise rather than reaffirm its guidance.

Williams-Sonoma analyst ratings and price targets are at MarketBeat.

Before you consider Williams-Sonoma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Williams-Sonoma wasn't on the list.

While Williams-Sonoma currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.