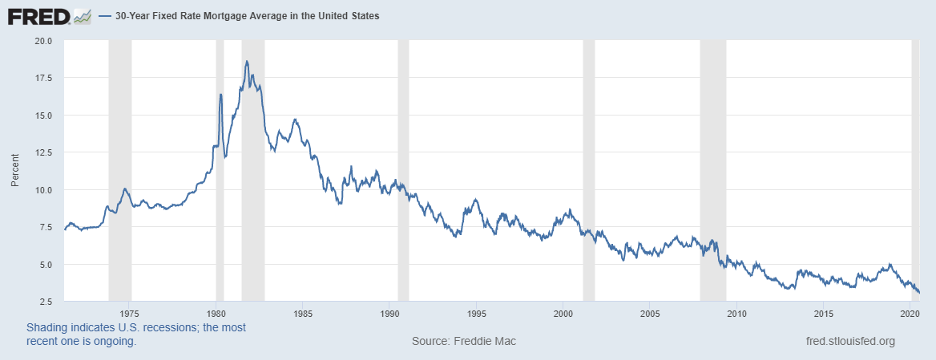

Last week the average U.S. 30-year fixed mortgage rate fell to a historic low of 2.98%. Considering the weekly release dates to 1971, this is one economic data point that should grab investors' attention. Although the sub-3% rate reflects ultra-low interest rates in a recessionary economy induced by the COVID-19 pandemic, it nevertheless appears to bode well for the housing market.

Despite high unemployment and personal budget pressures, all-time low home loan rates are likely to entice American homeowners to refinance and introduce a wave of homebuyers into the market. Amid tight housing supply nationwide, increased demand for existing and new homes should be a sustainable tailwind for housing as the U.S. economy recovers.

Homebuilders are one group that is expected to get a significant boost. A sharp rebound in monthly U.S. housing starts and building permits since April 2020 suggest that people are taking advantage of low mortgage rates by building the dream home they have long put off.

The encouraging housing market data means investing in homebuilding and construction-related stocks may be a good move. Going into second-quarter earnings reports these companies have the wind at their backs and are well-positioned to exceed market expectations.

Tight Supply + Increasing Demand = Homebuilders' Dream

Homebuilders are also benefitting from a rise in the number of people wanting to migrate from cities to suburban areas in the dawn of social distancing. As reported by U.S. News, a recent Harris Poll survey of over 2,000 U.S. adults living in urban areas showed that almost 40% would consider moving into rural areas.

As these urbanites look to spread their wings in search of a bit of country fresh air, many are choosing to purchase land and build. Suddenly homebuilders' construction backlogs are building.

Much of the interest in building stems from the fact that there simply are not enough homes to go around. Realtor.com's latest monthly housing trend report showed that national home inventory fell 27% year-over-year in June.

Tight market supply on top of an increasing appetite for a "clean" new beginning in the post-pandemic world is a favorable combination for homebuilding stocks.

What are the Best Homebuilder Stocks?

While the space seems like a great play this environment, not all home builders are created equal. Some are exposed to areas that are experiencing strong growth while others are more focused in slow or no growth areas. For instance, the recent surge in coronavirus cases in places like Florida, California, and Arizona hurts some companies but favors others.

D.R. Horton (NYSE: DHI) is one of the more compelling homebuilder plays. It has been a standout performer in the homebuilding space over the past year and the positive headlines continue to roll in. The market share leader has a large supply of lots and land and a range of affordable products through its various brands. A strong balance sheet with ample liquidity and low leverage should enable it to capitalize on the current market opportunities and further assert its leadership position.

In the past week, four sell-side analysts have reiterated their buy ratings on D.R. Horton and issued price targets ranging from $64 to $70. D.R. Horton reports second-quarter earnings before the market open on July 28th. The company has topped earnings expectations in each of the last five quarters including a 16% beat in Q1, and the $1.15 Zacks consensus EPS estimate for Q2 looks likely to be surpassed.

Other companies that should be considered for the buy list are PulteGroup (NYSE: PHM) and Meritage Homes (NYSE: MTH). Each should benefit from more firm pricing in their respective markets and be able to maintain their healthy gross margins. Both companies' focus on entry-level homebuyers such as millennials and empty-nesters should drive performance in the current environment. Meritage reports second-quarter results after the close on July 22nd and Pulte Group reports pre-market on July 23rd.

KB Home (KBH), on the other hand, is a stock that investors may want to hold off on before breaking ground. This is because the company has greater exposure to regional economies that have been more severely impacted by COVID-19. KB Home's geographic footprint includes warmer weather areas like the West Coast, Southwest, Southeast, and Texas.

Are There Other Ways to Play the Homebuilder Space?

A "backdoor" approach to gaining exposure to homebuilders is investing in construction and building product companies such as Lowe's (NYSE: LOW) or Home Depot (NYSE: HD). Many homebuilders, big national players, and local operations alike, rely on these big-box retailers for their supplies. The busier they become building homes, the more orders they will place with Lowe's and Home Depot, whose financial performances are known to highly correlate with homebuilder activity.

Investors that prefer to go the ETF route may consider the SPDR S&P Homebuilders ETF (NYSEARCA: XHB). It is a passively managed fund that tracks the S&P Homebuilders Select Industry Index and contains approximately 36 homebuilding related stocks including D.R. Horton, PulteGroup, and Lowe's. The fund carries a 35-basis points expense ratio and has a 0.9% dividend yield.

Extreme volatility in homebuilding activity in 2020 has swung into homebuilders' favor in recent months and appears to have staying power. While plenty of uncertainty around COVID-19 remains, the timing looks good to build a position in the resilient homebuilding stocks. Record low mortgage rates and favorable supply-demand dynamics should result in some impressive earnings surprises and upbeat outlooks when these companies report in the days and weeks ahead.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.