Human capital management and financial work flow solutions provider

Workday NASDAQ: WDAY stock has bottomed with the market indexes as it mounts a recovery off its recent lows under $206. The

enterprise cloud provider of its industry leading HCM applications and CFO suite of

financial software

tools continues to grow its top and bottom lines in the double-digits capitalizing the migration to the

cloud. Whereas HCM software is traditionally used on-premises, the Company is the leader in cloud-based HCM and riding the migration and adoption of

enterprise cloud as it pertains to both HCM and ERP. The Company is seeing strong growth internationally as sales surpassed the $1 billion mark in fiscal 2022 and bolstering its work force by 20% last year. Shares have been resilient in the wake of the Nasdaq market sell-off that briefly reached bear market (-20% off highs) status. Prudent investors seeking exposure in the HCM

cloud migration tailwinds can watch for opportunistic pullbacks in shares of Workday.

Fiscal Q4 2022 Earnings Release

On Feb. 28, 2022, Workday released its fiscal fourth-quarter 2022 results for the quarter ended January 2022. The Company reported earnings-per-share (EPS) profits of $0.78 versus a profit of $0.71 consensus analyst estimates, an $0.07 beat. Revenues grew 21.6% year-over-year (YoY) to $1.38 billion, beating analyst estimates for $1.36 billion. Subscription revenues rose 22.2% to $1.23 billion. Total subscription backlog rose 26.9% YoY to $12.81 billion. Workday Co-CEO Aneel Bhusri commented, "We continue to see increasing demand for our broad suite of finance and HR solutions, as we help some of the world's largest organizations – and more than 60 million users – navigate the changing world of work. This momentum, along with our employees' continued commitment, gives me great confidence in the opportunity ahead."

Conference Call Takeaways

Co-CEO Bhusri noted that its fiscal Q4 2022 achieved the fastest growth in new full-year ACV bookings in over five years, which is driving its growth towards the $10 billion annual revenue mark. Workday accommodates over 60 million users through 9,500 companies including 4.1K finance and HCM clients. It has a customer retention rate that surpasses 95%. Workday processed over 440 billion in transactions during fiscal 2022, up 67% YoY. The products are used by 50% of the Fortune 500 and over 25% of the Global 2000 companies. He noted that more companies are migrating their human capital management operations (HCM) to the cloud as evidenced by strong demand across their HCM portfolio of products. He mentioned a number of notable wins for the quarter including Allied Financial, Rite Aid, DICK’s Sporting Goods, 7-Eleven, U.S. Bank, Mass General Brigham, University of Melbourne and HCM go-lives including Wells Fargo and Anheuser-Busch InBev. Strong growth was evident in its core financial platform but also CFO tools including analytics, spending. “We continue to see very healthy attach rates for spend management solutions within our financial customers, illustrating health finances increasingly partnering with their procurement peers, drive visibility and bottom line impact for the single solution. and planning applications”, stated CEO Bhusri. Co-CEO Chano Fernandez raised guidance for fiscal 2023 subscription revenues to grow 22% to come in between $5.53 billion to $5.55 billion. He also raised 2023 non-GAAP operating margin to 18.5% as its market position as “never been stronger…”.

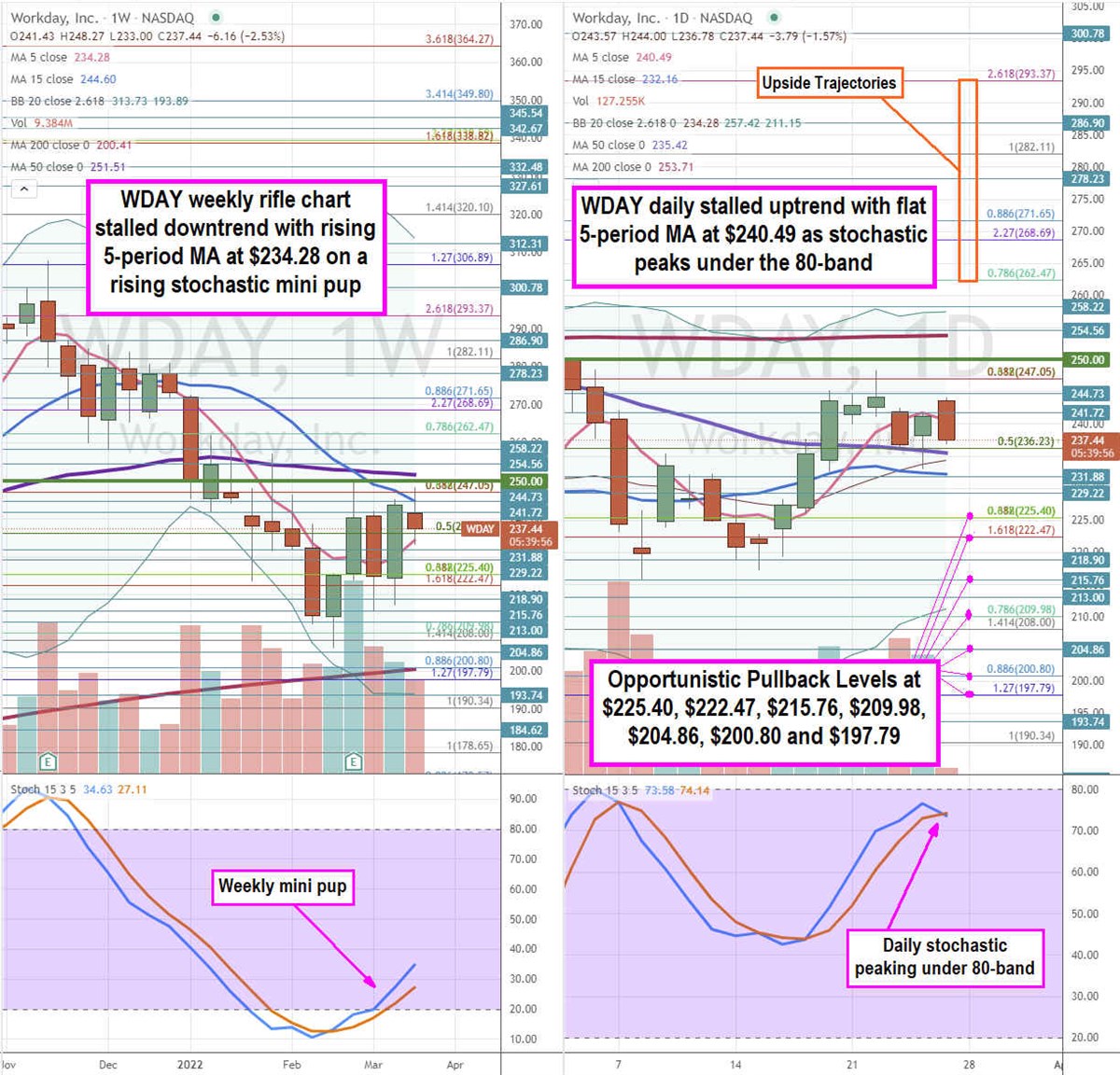

WDAY Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for WDAY stock. The weekly rifle chart peaked near the $306.89 Fibonacci (fib) level before a breakdown plunge to $205.90. The weekly rifle chart downtrend has stalled as the 5-period moving average (MA) starts to slope up at $234.28 as it tightens to the 15-period MA at 244.60. The weekly 50-period MA sits at $251.51. The weekly market structure low (MSL) buy triggers on the breakout above $250.00. The weekly stochastic triggered a mini pup through the 20-band as it rises towards the 40-band. The daily rifle chart breakout is starting to lose steam as the daily 5-period MA starts to slope down at $240.49 along with a flat daily 50-period MA at $235.42 and 15-period MA at $232.16. The daily stochastic peaked under the 80-band and is testing a potential crossover down or a mini pup through the 80-band. Prudent investors can look for opportunistic pullbacks at the $225.40 fib, $222.47 fib, $215.76, $209.98 fib, $204.86, $200.80 fib, and the $197.79 fib level. Upside trajectories range from the $262.47 fib up towards the $293.37 fib level.

Before you consider Workday, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workday wasn't on the list.

While Workday currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.