Sports entertainment and media company

World Wrestling Entertainment NYSE: WWE stock has maintained a choppy range between $45 to $65 for over a year. The iconic wrestling brand survived the stay-at-home mandates to usher in the return of live events. Top and bottom lines were bolstered by its media deal launching the WWE Network on the NBCU Peacock TV

streaming service. Its popularity continues to grow with new streaming and

content deals with A&E as well as MBC and fictional TV shows to appear on

Netflix NASDAQ: NFLX. WWE branded lottery tickets are expected to hit the market in specific states in 2022.

Gaming is a key focus as 85% of WWE’s audience identify themselves as gamers. The Company continues to diversify its revenue streams leaning heavily on expanding streaming and content deals and harvesting the next generation of fans and WWE Superstars. WWE’s

Facebook NASDAQ: META page has the highest number of

followers among any sports league and highest engagement with revenue growth rising 225% and doubling hours watched. Prudent investors seeking exposure to a growing content media empire can look to scale into shares of World Wrestling Entertainment at opportunistic pullback levels.

Q4 2021 Earnings Release

On Feb. 3, 2022, WWE released its fiscal fourth-quarter 2021 results for the quarter ending December 2021. The Company reported an adjusted earnings-per-share (EPS) profit of $0.70 excluding non-recurring items versus consensus analyst estimates for a profit of $0.54, beating estimates by $0.16. Revenues rose 30.3% year-over-year (YOY) to $310.3 million, falling short of analyst estimates for $324.7 million. Adjusted OIBDA rose 90% to $97.2 million. Full-year 2021 revenues rose 12% to the highest in WWE history at $1.095 billion. The Company expects fiscal Q1 2022 adjusted OIBDA of $90 million to $100 million, representing 7% to 19% YoY growth. The Company launched the Next in Line program that recruits next generation WWE Superstars with 16 collegiate athletes les by Olympic gold medalist Gable Steveson.

Stephanie McMahon Comments

WWE Chief Brand Office and Director Stephanie McMahon underscored that WWE Superstars are in high demand from studios, media outlets and sports properties. Big events help push the brand and drive new deals for media rights and consumer products. She noted that Sascha Banks starred in the cold open for ESPN’s College National Football Championships. Drew MacIntyre presented at the MTV European Music Awards and Big E starred in the cold open of the greatest heavyweight fight in decades between Tyson Fury and Deontay Wilder. Additionally, celebrities and artists from other genres are attending, appearing and in some cases performing at WWE events like Grammy Award-winning artist Bad Bunny in the 2022 Royal Rumble. Mobile games like WWE SuperCard was downloaded 24 million times making it the 2K’s highest grossing mobile game. Director McMahon noted that gamers make up 85% of its audience, therefore gaming is a key focus for the Company as WWE looks to harvest the next generation of fans. Their Next in Line (NIL) program looks for elite athletes with big personalities and large social media followings like John Seton of Elon University with 1.6 million TikTok followers. NIL is a pipeline for next-gen WWE Superstars. The inaugural batch of 16 athletes hail from 13 universities, 7 conferences and 4 sports. She also pointed out a statistic from YouGov that the WWE has more fans 18 to 34 than the NFL, NLB, NBA, UFC, NHL, and NASCAR with 83.7 million subscribers across all platforms and YouTube.

WrestleMania 38

The Company announced that its two-day WrestleMania 38 event was the highest attended and grossed event in its history. Attendance for the event had 156,352 fans at the AT&T Stadium in Dallas, Texas. This broke the previous records set in 2016. WrestleMania is scheduled to occur in Los Angeles at the SoFi Stadium/Hollywood Park in 2023.

WWE Opportunistic Pullback Levels

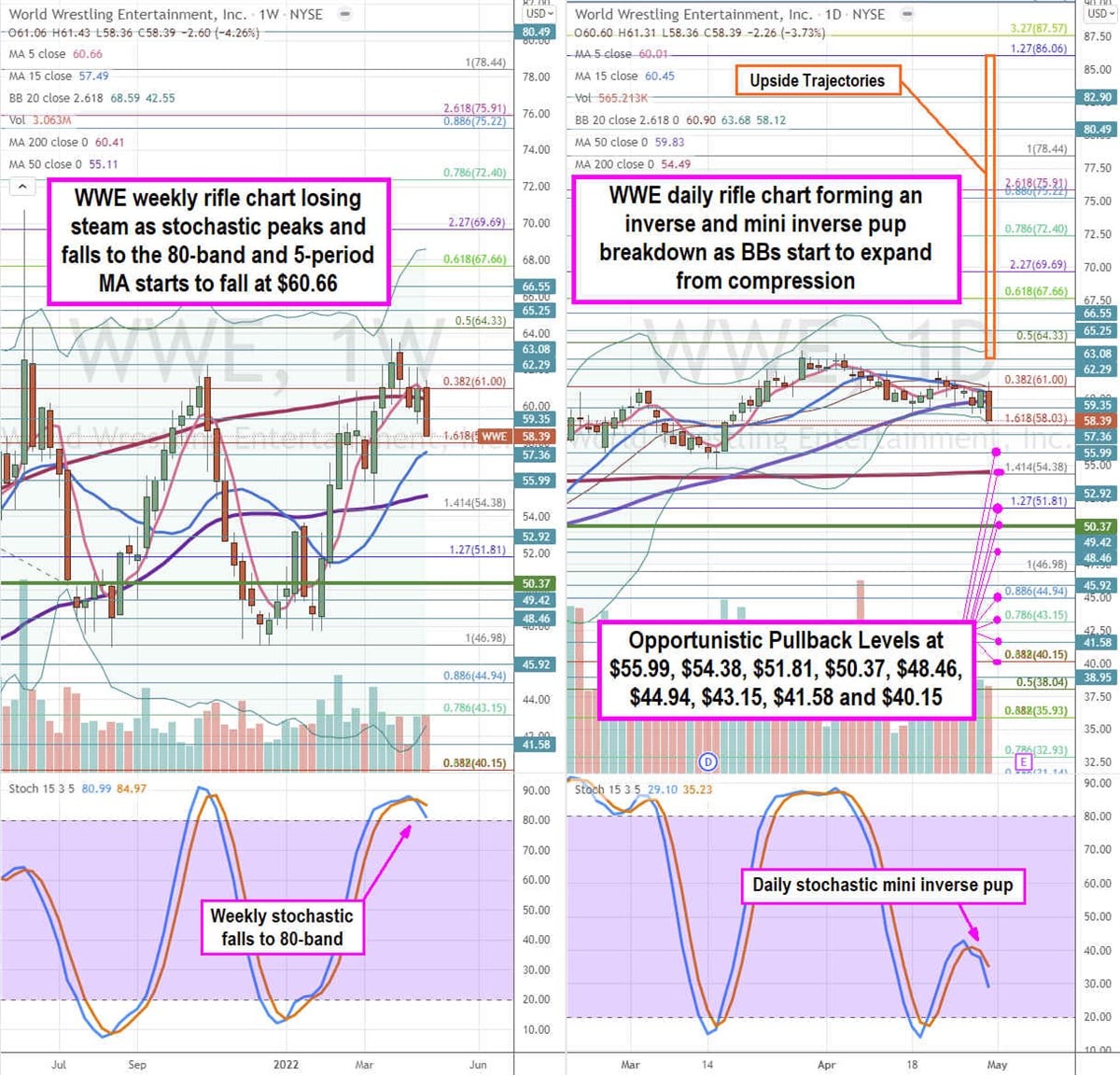

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for WWE stock. The weekly rifle chart has been in a trading range peaking near the $64.33 Fibonacci (fib) level and bottoming near the $46.98 fib. The weekly uptrend peaked as shares fell under the weekly 200-period moving average (MA) support at $60.41 as the weekly 5-period MA slopes back down at $60.66. The weekly 15-period MA support is stalled at $57.49, and the weekly 50-period MA is rising at $55.11. The weekly stochastic peaked and crossed back down from the 90-band as it leans to test the critical 80-band. The weekly market structure low (MSL) buy triggered above $50.37. The daily rifle chart is forming an inverse pup breakdown with a falling 5-period MA at $60.01 followed by the 15-period MA at $60.45. The daily 50-period MA sits at $59.83 and daily 200-period MA sits at $54.49. The daily stochastic formed a mini inverse pup falling through the 30-band. The daily Bollinger Bands (BBs) have been in a compression and is starting to expand as the lower BBs fall at $58.12 and upper BBs rise at $60.90. Prudent investors can look for opportunistic pullback levels at the $55.99, $54.38 fib, $51.81 fib, $50.37 daily MSL trigger, $48.46, $44.94 fib, $43.15 fib, $41.58, and the $40.15 fib level. Upside trajectories range from the $63.08 level up towards the $86.06 fib level.

Before you consider World Wrestling Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and World Wrestling Entertainment wasn't on the list.

While World Wrestling Entertainment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.