Sports entertainment and media company

World Wrestling Entertainment NYSE: WWE stock has been on the rebound off 2022 lows driven by both top and bottom-line improvement. The popular pro wrestling brand survived through the pandemic lockdowns until the

reopening and resumption of live events. The Company has masterfully navigated through every obstacle to emerge with the highest revenues recorded in its history for Q4 2021. The partnership to launch WWE Network content on the NBCU Peacock network helped drive larger audience

streaming viewership. WWE has launched non-fungible tokens (NFTs), renewed its WWE

action figure production deal with

Mattel NYSE: MAT to produce and distribute its branded merchandise in over 50 global markets. The WWE struck a deal with

International Gaming Technology NYSE: IGT to produce WWE branded lottery tickets in a number of states in 2022. The Company is truly diversifying and

operating on all cylinders as it actively works to accommodate a new generation of viewers. Prudent investors seeking exposure in the leader in sports entertainment can watch for opportunistic pullbacks in shares of WWE.

Q4 2020 Earnings Release

On Feb. 3, 2021, WWE released its fiscal fourth-quarter 2021 results for the quarter ending December 2021. The Company reported an adjusted earnings-per-share (EPS) profit of $0.70 excluding non-recurring items versus consensus analyst estimates for a profit of $0.54, beating estimates by $0.16. Revenues rose 30.3% year-over-year (YOY) to $310.3 million, falling short of analyst estimates for $324.7 million. Adjusted OIBDA rose 90% to $97.2 million. Full-year 2021 revenues rose 12% to the highest in WWE history at $1.095 billion. The Company launched its WWE Network content on Peacock which provided a larger audience and increased viewership. The Company has a new strategy for staging premium events in stadiums rather than arenas. The Company estimates Q1 2022 adjusted OIBDA in the range of $90 million to $100 million, or 7% to 19% YoY. WWE expects full year 2022 adjusted OIBDA1 range of $360 million to $375 million.

CEO Comments

WWE Chairman and CEO Vince McMahon commented, “In 2021, we reached a significant milestone of over $1 billion in revenue, for the first time in the Company’s history. We ended the year with strong performance across each of our business lines that reflected the engagement of a wider audience with distribution on new digital platforms, including Peacock, and the return of fans at our live events. We expect the execution of key initiatives in the coming year, such as the licensing of network content in international markets, monetization of new original series, and the continued shift to a stadium strategy for WWE’s premium live events, will further expand the reach of our brands and enhance the value of our content.”

Conference Call Takeaways

WWE President Nick Khan highlighted milestones including over 3.5 million paid Peacock subscribers have tuned into WWE content. This bolstered viewership beyond its 1.1 million subscriber WWE Network. The WWE is experiencing the most people viewing WWE Premium Live Events ever. For example, viewership for the Royal Rumble event was 45% higher than pre-pandemic levels. President Khan noted, “It's evident that the marketplace puts considerable value on our IP, which has allowed us to drive more value for existing partnerships and enter into a number of new categories. We currently have over a dozen scripted and unscripted projects sold based on our IP. Look for an announcement on each and every one of those in the not-too-distant future. Those are with existing content partners in the U.S. in addition to new buyers, networks and streamers.” The Company will be launching its WWE 2K22 in March 2022. President Khan expects the video game segment to consolidate resulting in four to five large players with the winners being determined by their intellectual property (IP). Content and distribution are key amongst the top streaming networks. He concluded, “In sum, with our company focus on extracting value from our IP across all lines of business, matched with a marketplace that is hungry to partner with and build around premium brands, we couldn't be more optimistic to drive further growth in 2022 and beyond.”

WWE Opportunistic Pullback Levels

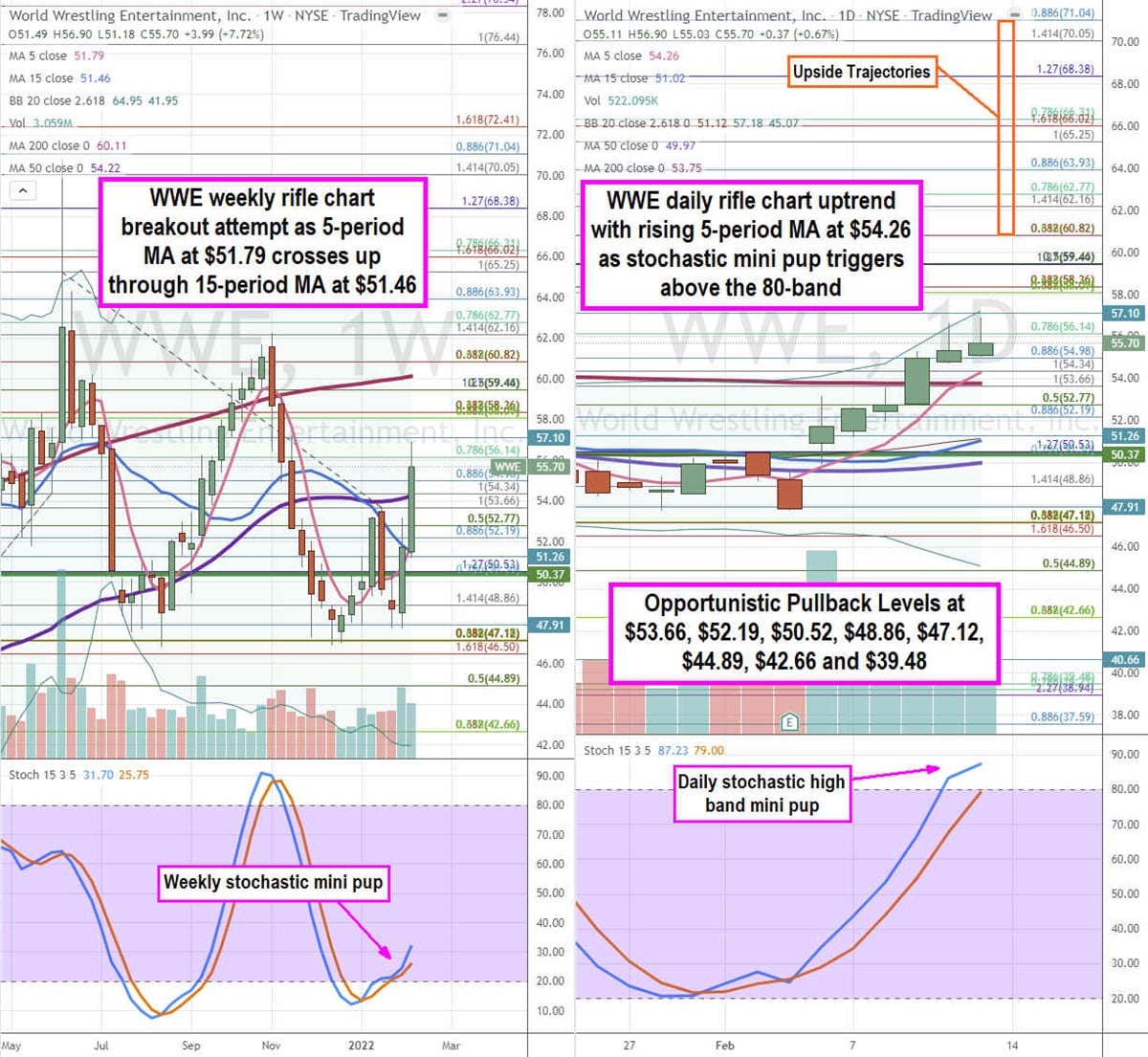

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for WWE stock. The weekly rifle chart is attempting to breakout after peaking off the $63.16 Fibonacci (fib) level and bouncing off the $47.18 fib. The weekly 5-period moving average (MA) at $51.79 is crossing up through the 15-period MA at $51.46. Shares actually spiked through the weekly 50-period MA at $54.22. The weekly market structure low (MSL) buy triggered above $50.37 powered by the weekly stochastic mini pup through the 20-band. The daily rifle chart has been uptrending as shares broke through the daily 200-period MA at $53.75 with a rising 5-period MA at $54.26 and daily upper Bollinger Bands (BBs) at $57.18. The daily stochastic mini pup made a full oscillation to triggered another mini pup above the 80-band. Rather than chase entries up here, prudent investors can look for opportunistic pullback levels at the $53.66 daily 200-period MA/fib, $52.19 fib, $50.52 fib, $48.86 fib, $47.12 fib, $44.89 fib, $42.66 fib, and the $39.48 fib level. Upside trajectories range from the $60.82 fib level up towards the $71.04 fib level.

Before you consider World Wrestling Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and World Wrestling Entertainment wasn't on the list.

While World Wrestling Entertainment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.