While interest rates have risen over the last few years, there's still two things that fixed-income investments can't offer -- equity appreciation and dividend growth.

Dividend-paying stocks continue to be appealing to income investors because of their competitive yields, equity value appreciation, favorite tax treatment, and ability to grow payouts over time. While fixed interest rates from bond investments will lose purchasing power to inflation over time, the purchasing power of income from dividend growth stocks is more protected because companies tend to raise their dividend payments every year.

In this slideshow, we look at ten of the best high-dividend stocks that offer strong yields (above 3.5%), have consistent cash flow, and a strong track record of dividend growth. The companies in this slideshow have all raised their dividend for at least ten consecutive years.

These companies also have low payout ratios (below 75%), meaning that they will have the ability to continue to pay their dividend if their earnings have a temporary dip.

Stock prices will always fluctuate, but the dividends paid by these rock-solid dividend payers should remain secure with even moderate earnings growth.

#1 - Verizon Communications (NYSE:VZ)

- Dividend Yield

- 6.15%

- Track Record

- 20 Years of Consecutive Dividend Growth

- Payout Ratio

- 65.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $47.35 (10.3% Upside)

About Verizon Communications

Verizon Communications Inc, through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide. It operates in two segments, Verizon Consumer Group (Consumer) and Verizon Business Group (Business).

More about Verizon Communications

#2 - Cohen & Steers (NYSE:CNS)

- Dividend Yield

- 3.36%

- Track Record

- 16 Years of Consecutive Dividend Growth

- Payout Ratio

- 81.0%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $90.00 (17.5% Upside)

About Cohen & Steers

Cohen & Steers, Inc is a holding company, which operates as an investment manager specializing in liquid real assets, which include real estate securities, listed infrastructure, commodities, natural resource equities, preferred securities, and other income solutions. It manages investment vehicles, such as institutional accounts, open-end funds and closed-end funds.

More about Cohen & Steers

#3 - Philip Morris International (NYSE:PM)

- Dividend Yield

- 3.36%

- Track Record

- 17 Years of Consecutive Dividend Growth

- Payout Ratio

- 119.7%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $157.44 (7.2% Downside)

About Philip Morris International

Philip Morris International Inc operates as a tobacco company working to delivers a smoke-free future and evolving portfolio for the long-term to include products outside of the tobacco and nicotine sector. The company's product portfolio primarily consists of cigarettes and smoke-free products, including heat-not-burn, vapor, and oral nicotine products primarily under the IQOS and ZYN brands; and consumer accessories, such as lighters and matches.

More about Philip Morris International

#4 - Bank of Nova Scotia (NYSE:BNS)

- Dividend Yield

- 6.25%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 83.1%

- Consensus Rating

- Hold

- Consensus Price Target

- $81.00 (67.4% Upside)

About Bank of Nova Scotia

The Bank of Nova Scotia provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally. It operates through Canadian Banking, International Banking, Global Wealth Management, and Global Banking and Markets segments.

More about Bank of Nova Scotia

#5 - Canadian Imperial Bank of Commerce (NYSE:CM)

- Dividend Yield

- 4.56%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 48.0%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $92.00 (52.6% Upside)

About Canadian Imperial Bank of Commerce

Canadian Imperial Bank of Commerce, a diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally. The company operates through Canadian Personal and Business Banking; Canadian Commercial Banking and Wealth Management; U.S.

More about Canadian Imperial Bank of Commerce

#6 - Medtronic (NYSE:MDT)

- Dividend Yield

- 3.39%

- Track Record

- 48 Years of Consecutive Dividend Growth

- Payout Ratio

- 85.1%

- Consensus Rating

- Hold

- Consensus Price Target

- $96.14 (14.0% Upside)

About Medtronic

Medtronic plc develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. Its Cardiovascular Portfolio segment offers implantable cardiac pacemakers, cardioverter defibrillators, and cardiac resynchronization therapy devices; cardiac ablation products; insertable cardiac monitor systems; TYRX products; and remote monitoring and patient-centered software.

More about Medtronic

#7 - Manulife Financial (NYSE:MFC)

- Dividend Yield

- 4.28%

- Track Record

- 12 Years of Consecutive Dividend Growth

- Payout Ratio

- 58.5%

- Consensus Rating

- Buy

- Consensus Price Target

- $45.50 (51.1% Upside)

About Manulife Financial

Manulife Financial Corporation, together with its subsidiaries, provides financial products and services in the United States, Canada, Asia, and internationally. The company operates through Wealth and Asset Management Businesses; Insurance and Annuity Products; and Corporate and Other segments. The Wealth and Asset Management Businesses segment offers investment advice and solutions to retirement, retail, and institutional clients through multiple distribution channels, including agents and brokers affiliated with the company, independent securities brokerage firms and financial advisors pension plan consultants, and banks.

More about Manulife Financial

#8 - Toronto-Dominion Bank (NYSE:TD)

- Dividend Yield

- 4.83%

- Track Record

- 12 Years of Consecutive Dividend Growth

- Payout Ratio

- 85.6%

- Consensus Rating

- Hold

- Consensus Price Target

- $80.50 (29.8% Upside)

About Toronto-Dominion Bank

The Toronto-Dominion Bank, together with its subsidiaries, provides various financial products and services in Canada, the United States, and internationally. It operates through four segments: Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and Insurance, and Wholesale Banking.

More about Toronto-Dominion Bank

- Dividend Yield

- 4.95%

- Track Record

- 54 Years of Consecutive Dividend Growth

- Payout Ratio

- 50.6%

- Consensus Rating

- Hold

- Consensus Price Target

- $132.37 (39.2% Upside)

About Target

Target Corporation operates as a general merchandise retailer in the United States. The company offers apparel for women, men, boys, girls, toddlers, and infants and newborns, as well as jewelry, accessories, and shoes; and beauty and personal care, baby gear, cleaning, paper products, and pet supplies.

More about Target

#10 - Federal Agricultural Mortgage (NYSE:AGM)

- Dividend Yield

- 3.51%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 36.5%

- Consensus Rating

- Hold

- Consensus Price Target

- $230.00 (29.9% Upside)

About Federal Agricultural Mortgage

Federal Agricultural Mortgage Corporation provides a secondary market for various loans made to borrowers in the United States. It operates through four segments: Corporate AgFinance, Farm & Ranch, Rural Utilities, and Renewable Energy. The company's Agricultural Finance line of business engages in purchasing and retaining eligible loans and securities; guaranteeing the payment of principal and interest on securities that represent interests in or obligations secured by pools of eligible loans; servicing eligible loans; and issuing LTSPCs for eligible loans.

More about Federal Agricultural Mortgage

#11 - Bristol-Myers Squibb (NYSE:BMY)

- Dividend Yield

- 5.02%

- Track Record

- 17 Years of Consecutive Dividend Growth

- Payout Ratio

- -56.1%

- Consensus Rating

- Hold

- Consensus Price Target

- $58.00 (19.6% Upside)

About Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, and neuroscience diseases. The company's products include Eliquis for reduction in risk of stroke/systemic embolism in non-valvular atrial fibrillation, and for the treatment of DVT/PE; Opdivo for various anti-cancer indications, including bladder, blood, CRC, head and neck, RCC, HCC, lung, melanoma, MPM, stomach and esophageal cancer; Pomalyst/Imnovid for multiple myeloma; Orencia for active rheumatoid arthritis and psoriatic arthritis; and Sprycel for the treatment of Philadelphia chromosome-positive chronic myeloid leukemia.

More about Bristol-Myers Squibb

#12 - Canadian Natural Resources (NYSE:CNQ)

- Dividend Yield

- 5.77%

- Track Record

- 24 Years of Consecutive Dividend Growth

- Payout Ratio

- 77.9%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $63.00 (115.4% Upside)

About Canadian Natural Resources

Canadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs). The company offers light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil), and synthetic crude oil (SCO).

More about Canadian Natural Resources

#13 - DTE Energy (NYSE:DTE)

- Dividend Yield

- 3.3%

- Track Record

- 16 Years of Consecutive Dividend Growth

- Payout Ratio

- 64.4%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $139.17 (1.1% Upside)

About DTE Energy

DTE Energy Company engages in the utility operations. The company's Electric segment generates, purchases, distributes, and sells electricity to various residential, commercial, and industrial customers in southeastern Michigan. It generates electricity through coal-fired plants, hydroelectric pumped storage, and nuclear plants, as well as wind and solar assets.

More about DTE Energy

#14 - Edison International (NYSE:EIX)

- Dividend Yield

- 5.88%

- Track Record

- 23 Years of Consecutive Dividend Growth

- Payout Ratio

- 100.3%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $76.75 (31.1% Upside)

About Edison International

Edison International, through its subsidiaries, engages in the generation and distribution of electric power. The company supplies and delivers electricity to approximately 50,000 square mile area of southern California to residential, commercial, industrial, public authorities, agricultural, and other sectors.

More about Edison International

#15 - Eastman Chemical (NYSE:EMN)

- Dividend Yield

- 4.33%

- Track Record

- 15 Years of Consecutive Dividend Growth

- Payout Ratio

- 43.2%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $107.08 (32.9% Upside)

About Eastman Chemical

Eastman Chemical Company operates as a specialty materials company in the United States, China, and internationally. The company's Additives & Functional Products segment offers amine derivative-based building blocks, intermediates for surfactants, metam-based soil fumigants, and organic acid-based solutions; specialty coalescent and solvents, paint additives, and specialty polymers; and heat transfer and aviation fluids.

More about Eastman Chemical

#16 - Enterprise Products Partners (NYSE:EPD)

- Dividend Yield

- 7.03%

- Track Record

- 28 Years of Consecutive Dividend Growth

- Payout Ratio

- 79.6%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $36.89 (17.8% Upside)

About Enterprise Products Partners

Enterprise Products Partners L.P. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products. It operates in four segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services.

More about Enterprise Products Partners

#17 - Hillenbrand (NYSE:HI)

- Dividend Yield

- 4.37%

- Track Record

- 18 Years of Consecutive Dividend Growth

- Payout Ratio

- -28.7%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $36.50 (62.7% Upside)

About Hillenbrand

Hillenbrand, Inc operates as an industrial company in the United States and internationally. The company operates through two segments, Advanced Process Solutions and Molding Technology Solutions. The Advanced Process Solutions segment designs, engineers, manufactures, markets, and services process and material handling equipment and systems comprising compounding, extrusion, and material handling equipment, equipment system design services, as well as offers mixing technology, ingredient automation, and portion process; and provides screening and separating equipment for various industries, including plastics, food and pharmaceuticals, chemicals, fertilizers, minerals, energy, wastewater treatment, forest products, and other general industrials.

More about Hillenbrand

#18 - Horace Mann Educators (NYSE:HMN)

- Dividend Yield

- 3.46%

- Track Record

- 17 Years of Consecutive Dividend Growth

- Payout Ratio

- 56.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $43.67 (7.2% Upside)

About Horace Mann Educators

Horace Mann Educators Corporation, together with its subsidiaries, operates as an insurance holding company in the United States. The company operates through Property & Casualty, Life & Retirement, and Supplemental & Group Benefits segments. Its Property & Casualty segment offers insurance products, including private passenger auto insurance, residential home insurance, and personal umbrella insurance; and provides auto coverages including liability and collision, and property coverage for homeowners and renters.

More about Horace Mann Educators

#19 - Alliant Energy (NASDAQ:LNT)

- Dividend Yield

- 3.36%

- Track Record

- 22 Years of Consecutive Dividend Growth

- Payout Ratio

- 75.5%

- Consensus Rating

- Hold

- Consensus Price Target

- $63.55 (3.2% Upside)

About Alliant Energy

Alliant Energy Corporation operates as a utility holding company that provides regulated electricity and natural gas services in the United States. It operates in three segments: Utility Electric Operations, Utility Gas Operations, and Utility Other. The company, through its subsidiary, Interstate Power and Light Company (IPL), primarily generates and distributes electricity, and distributes and transports natural gas to retail customers in Iowa; sells electricity to wholesale customers in Minnesota, Illinois, and Iowa; and generates and distributes steam in Cedar Rapids, Iowa.

More about Alliant Energy

#20 - Altria Group (NYSE:MO)

- Dividend Yield

- 7.12%

- Track Record

- 56 Years of Consecutive Dividend Growth

- Payout Ratio

- 62.3%

- Consensus Rating

- Hold

- Consensus Price Target

- $54.00 (8.0% Downside)

About Altria Group

Altria Group, Inc, through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States. The company offers cigarettes primarily under the Marlboro brand; large cigars and pipe tobacco under the Black & Mild brand; moist smokeless tobacco and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands; oral nicotine pouches under the on! brand; and e-vapor products under the NJOY ACE brand.

More about Altria Group

#21 - Morgan Stanley (NYSE:MS)

- Dividend Yield

- 3.43%

- Track Record

- 12 Years of Consecutive Dividend Growth

- Payout Ratio

- 43.4%

- Consensus Rating

- Hold

- Consensus Price Target

- $130.50 (13.2% Upside)

About Morgan Stanley

Morgan Stanley, a financial holding company, provides various financial products and services to corporations, governments, financial institutions, and individuals in the Americas, Europe, the Middle East, Africa, and Asia. It operates through Institutional Securities, Wealth Management, and Investment Management segments.

More about Morgan Stanley

#22 - NextEra Energy (NYSE:NEE)

- Dividend Yield

- 3.45%

- Track Record

- 31 Years of Consecutive Dividend Growth

- Payout Ratio

- 67.1%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $84.08 (27.5% Upside)

About NextEra Energy

NextEra Energy, Inc, through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear,natural gas, and other clean energy. It also develops, constructs, and operates long-term contracted assets that consists of clean energy solutions, such as renewable generation facilities, battery storage projects, and electric transmission facilities; sells energy commodities; and owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets.

More about NextEra Energy

#23 - Northwest Natural (NYSE:NWN)

- Dividend Yield

- 4.6%

- Track Record

- 70 Years of Consecutive Dividend Growth

- Payout Ratio

- 96.6%

- Consensus Rating

- Buy

- Consensus Price Target

- $43.50 (0.9% Downside)

About Northwest Natural

Northwest Natural Holding Company, through its subsidiary, Northwest Natural Gas Company, provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States. The company operates a mist gas storage facility contracted to other utilities, third-party marketers, and electric generators; offers natural gas asset management services; and operates an appliance retail center.

More about Northwest Natural

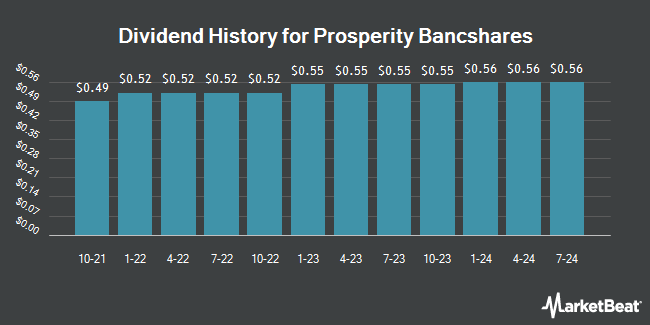

#24 - Prosperity Bancshares (NYSE:PB)

- Dividend Yield

- 3.53%

- Track Record

- 27 Years of Consecutive Dividend Growth

- Payout Ratio

- 45.8%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $83.35 (23.4% Upside)

About Prosperity Bancshares

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

More about Prosperity Bancshares

- Dividend Yield

- 7.8%

- Track Record

- 16 Years of Consecutive Dividend Growth

- Payout Ratio

- 122.0%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $29.57 (30.1% Upside)

About Pfizer

Pfizer Inc discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States, Europe, and internationally. The company offers medicines and vaccines in various therapeutic areas, including cardiovascular metabolic, migraine, and women's health under the Eliquis, Nurtec ODT/Vydura, Zavzpret, and the Premarin family brands; infectious diseases with unmet medical needs under the Prevnar family, Abrysvo, Nimenrix, FSME/IMMUN-TicoVac, and Trumenba brands; and COVID-19 prevention and treatment, and potential future mRNA and antiviral products under the Comirnaty and Paxlovid brands.

More about Pfizer

#26 - The PNC Financial Services Group (NYSE:PNC)

- Dividend Yield

- 4.26%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 45.2%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $200.88 (25.6% Upside)

About The PNC Financial Services Group

The PNC Financial Services Group, Inc operates as a diversified financial services company in the United States. It operates through three segments: Retail Banking, Corporate & Institutional Banking, and Asset Management Group segments. The company's Retail Banking segment offers checking, savings, and money market accounts, as well as time deposit; residential mortgages, home equity loans and lines of credit, auto loans, credit cards, education loans, and personal and small business loans and lines of credit; and brokerage, insurance, and investment and cash management services.

More about The PNC Financial Services Group

#27 - Phillips 66 (NYSE:PSX)

- Dividend Yield

- 4.76%

- Track Record

- 13 Years of Consecutive Dividend Growth

- Payout Ratio

- 93.1%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $140.43 (34.4% Upside)

About Phillips 66

Phillips 66 operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally. It operates through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties (M&S). The Midstream segment transports crude oil and other feedstocks; delivers refined petroleum products to market; provides terminaling and storage services for crude oil and refined petroleum products; transports, stores, fractionates, exports, and markets natural gas liquids; provides other fee-based processing services; and gathers, processes, transports, and markets natural gas.

More about Phillips 66

- Dividend Yield

- 3.67%

- Track Record

- 22 Years of Consecutive Dividend Growth

- Payout Ratio

- 58.4%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $80.31 (7.6% Upside)

About Sempra

Sempra operates as an energy infrastructure company in the United States and internationally. It operates through three segments: Sempra California, Sempra Texas Utilities, and Sempra Infrastructure. The Sempra California segment provides electric services; and natural gas services to San Diego County.

More about Sempra

#29 - State Street (NYSE:STT)

- Dividend Yield

- 3.82%

- Track Record

- 13 Years of Consecutive Dividend Growth

- Payout Ratio

- 34.1%

- Consensus Rating

- Hold

- Consensus Price Target

- $102.15 (16.7% Upside)

About State Street

State Street Corporation, through its subsidiaries, provides a range of financial products and services to institutional investors worldwide. The company offers investment servicing products and services, including custody, accounting, regulatory reporting, investor, and performance and analytics; middle office products, such as IBOR, transaction management, loans, cash, derivatives and collateral, record keeping, and client reporting and investment analytics; finance leasing; foreign exchange, and brokerage and other trading services; securities finance and enhanced custody products; deposit and short-term investment facilities; investment manager and alternative investment manager operations outsourcing; performance, risk, and compliance analytics; and financial data management to support institutional investors.

More about State Street

#30 - Trinity Industries (NYSE:TRN)

- Dividend Yield

- 4.73%

- Track Record

- 16 Years of Consecutive Dividend Growth

- Payout Ratio

- 73.2%

- Consensus Rating

- Hold

- Consensus Price Target

- $29.33 (16.1% Upside)

About Trinity Industries

Trinity Industries, Inc provides rail transportation products and services under the TrinityRail name in North America. It operates in two segments, Railcar Leasing and Management Services Group, and Rail Products Group. The Railcar Leasing and Management Services Group segment leases freight and tank railcars; originates and manages railcar leases for third-party investors; and provides fleet maintenance and management services.

More about Trinity Industries

#31 - Tyson Foods (NYSE:TSN)

- Dividend Yield

- 3.3%

- Track Record

- 13 Years of Consecutive Dividend Growth

- Payout Ratio

- 67.6%

- Consensus Rating

- Hold

- Consensus Price Target

- $61.78 (0.3% Downside)

About Tyson Foods

Tyson Foods, Inc, together with its subsidiaries, operates as a food company worldwide. It operates through four segments: Beef, Pork, Chicken, and Prepared Foods. The company processes live fed cattle and hogs; fabricates dressed beef and pork carcasses into primal and sub-primal meat cuts, as well as case ready beef and pork, and fully cooked meats; raises and processes chickens into fresh, frozen, and value-added chicken products, including breaded chicken strips, nuggets, patties, and other ready-to-fix or fully cooked chicken parts; and supplies poultry breeding stock.

More about Tyson Foods

- Dividend Yield

- 4.57%

- Track Record

- 37 Years of Consecutive Dividend Growth

- Payout Ratio

- 59.1%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $28.33 (13.3% Downside)

About UGI

UGI Corporation, together with its subsidiaries, distributes, stores, transports, and markets energy products and related services in the United States and internationally. The company operates through four segments: AmeriGas Propane, UGI International, Midstream & Marketing, and UGI Utilities. It distributes propane to approximately 1.3 million residential, commercial/industrial, motor fuel, agricultural, and wholesale customers through 1,400 propane distribution locations.

More about UGI

#33 - U.S. Bancorp (NYSE:USB)

- Dividend Yield

- 5.29%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 49.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $50.66 (26.3% Upside)

About U.S. Bancorp

U.S. Bancorp, a financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities, and other financial institutions in the United States. It operates through Wealth, Corporate, Commercial and Institutional Banking; Consumer and Business Banking; Payment Services; and Treasury and Corporate Support segments.

More about U.S. Bancorp

- Dividend Yield

- 3.3%

- Track Record

- 22 Years of Consecutive Dividend Growth

- Payout Ratio

- 66.3%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $73.09 (3.8% Upside)

About Xcel Energy

Xcel Energy Inc, through its subsidiaries, engages in the generation, purchasing, transmission, distribution, and sale of electricity. It operates through Regulated Electric Utility, Regulated Natural Gas Utility, and All Other segments. The company generates electricity through wind, nuclear, hydroelectric, biomass, and solar energy sources, as well as coal, natural gas, oil, wood, and refuse-derived fuels.

More about Xcel Energy

#35 - Archer-Daniels-Midland (NYSE:ADM)

- Dividend Yield

- 4.42%

- Track Record

- 53 Years of Consecutive Dividend Growth

- Payout Ratio

- 56.5%

- Consensus Rating

- Reduce

- Consensus Price Target

- $52.75 (8.3% Upside)

About Archer-Daniels-Midland

Archer-Daniels-Midland Company engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally. It operates in three segments: Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition.

More about Archer-Daniels-Midland

- Dividend Yield

- 6.91%

- Track Record

- 12 Years of Consecutive Dividend Growth

- Payout Ratio

- 29.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $13.71 (35.2% Upside)

About AES

The AES Corporation, together with its subsidiaries, operates as a diversified power generation and utility company in the United States and internationally. The company owns and/or operates power plants to generate and sell power to customers, such as utilities, industrial users, and other intermediaries; owns and/or operates utilities to generate or purchase, distribute, transmit, and sell electricity to end-user customers in the residential, commercial, industrial, and governmental sectors; and generates and sells electricity on the wholesale market.

More about AES

- Dividend Yield

- 4.5%

- Track Record

- 15 Years of Consecutive Dividend Growth

- Payout Ratio

- 94.2%

- Consensus Rating

- Buy

- Consensus Price Target

- $67.00 (2.6% Upside)

About ALLETE

ALLETE, Inc operates as an energy company. The company operates through Regulated Operations, ALLETE Clean Energy, and Corporate and Other segments. It generates electricity from coal-fired, biomass co-fired / natural gas, hydroelectric, wind, and solar. In addition, the company provides regulated utility electric services in northwestern Wisconsin to approximately 15,000 electric customers, 13,000 natural gas customers, and 10,000 water customers, as well as regulated utility electric services in northeastern Minnesota to approximately 150,000 retail customers and 14 non-affiliated municipal customers.

More about ALLETE

- Dividend Yield

- 3.27%

- Track Record

- 15 Years of Consecutive Dividend Growth

- Payout Ratio

- -245.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $73.20 (37.7% Upside)

About Ashland

Ashland Inc provides additives and specialty ingredients in the North and Latin America, Europe, Asia Pacific, and internationally. It operates through Life Sciences, Personal Care, Specialty Additives, and Intermediates segments. The Life Sciences segment offers pharmaceutical solutions, including controlled release polymers, disintegrants, tablet coatings, thickeners, solubilizers, and tablet binders; nutrition solutions, such as thickeners, stabilizers, emulsifiers, and additives; and nutraceutical solutions comprising products for weight management, joint comfort, stomach and intestinal health, sports nutrition, and general wellness, as well as custom formulation, toll processing, and particle engineering solutions.

More about Ashland

- Dividend Yield

- 4.71%

- Track Record

- 23 Years of Consecutive Dividend Growth

- Payout Ratio

- 86.3%

- Consensus Rating

- Reduce

- Consensus Price Target

- $37.33 (9.9% Downside)

About Avista

Avista Corporation, together with its subsidiaries, operates as an electric and natural gas utility company. It operates in two segments, Avista Utilities and AEL&P. The Avista Utilities segment provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho; and natural gas distribution services in parts of northeastern and southwestern Oregon, as well as generates electricity in Washington, Idaho, Oregon, and Montana.

More about Avista

#40 - Best Buy (NYSE:BBY)

- Dividend Yield

- 6.37%

- Track Record

- 22 Years of Consecutive Dividend Growth

- Payout Ratio

- 89.0%

- Consensus Rating

- Hold

- Consensus Price Target

- $91.28 (38.5% Upside)

About Best Buy

Best Buy Co, Inc engages in the retail of technology products in the United States, Canada, and international. Its stores provide computing and mobile phone products, such as desktops, notebooks, and peripherals; mobile phones comprising related mobile network carrier commissions; networking products; tablets covering e-readers; smartwatches; and consumer electronics consisting of digital imaging, health and fitness products, portable audio comprising headphones and portable speakers, and smart home products, as well as home theaters, which includes home theater accessories, soundbars, and televisions.

More about Best Buy

#41 - Franklin Resources (NYSE:BEN)

- Dividend Yield

- 7.29%

- Track Record

- 45 Years of Consecutive Dividend Growth

- Payout Ratio

- 196.9%

- Consensus Rating

- Reduce

- Consensus Price Target

- $18.96 (0.9% Upside)

About Franklin Resources

Franklin Resources, Inc is a publicly owned asset management holding company. Through its subsidiaries, the firm provides its services to individuals, institutions, pension plans, trusts, and partnerships. It launches equity, fixed income, balanced, and multi-asset mutual funds through its subsidiaries.

More about Franklin Resources

#42 - Black Hills (NYSE:BKH)

- Dividend Yield

- 4.5%

- Track Record

- 55 Years of Consecutive Dividend Growth

- Payout Ratio

- 68.9%

- Consensus Rating

- Hold

- Consensus Price Target

- $62.33 (2.8% Upside)

About Black Hills

Black Hills Corporation, through its subsidiaries, operates as an electric and natural gas utility company in the United States. The company operates in two segments: Electric Utilities and Gas Utilities. The Electric Utilities segment generates, transmits, and distributes electricity to approximately 222,000 electric utility customers in Colorado, Montana, South Dakota, and Wyoming; and owns and operates 1,394 megawatts of generation capacity and 9,106 miles of electric transmission and distribution lines.

More about Black Hills

#43 - Community Bank System (NYSE:CBU)

- Dividend Yield

- 3.45%

- Track Record

- 33 Years of Consecutive Dividend Growth

- Payout Ratio

- 53.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $71.00 (27.3% Upside)

About Community Bank System

Community Bank System, Inc operates as the bank holding company for Community Bank, N.A. that provides various banking and other financial services to retail, commercial, institutional, and municipal customers. It operates through three segments: Banking, Employee Benefit Services, and All Other. The company offers various deposits products, such as interest and noninterest -bearing checking, savings, and money market deposit accounts, as well as time deposits.

More about Community Bank System

#44 - Cullen/Frost Bankers (NYSE:CFR)

- Dividend Yield

- 3.4%

- Track Record

- 31 Years of Consecutive Dividend Growth

- Payout Ratio

- 42.8%

- Consensus Rating

- Reduce

- Consensus Price Target

- $132.57 (14.1% Upside)

About Cullen/Frost Bankers

Cullen/Frost Bankers, Inc operates as the bank holding company for Frost Bank that provides commercial and consumer banking services in Texas. The company offers commercial banking services to corporations, including financing for industrial and commercial properties, interim construction related to industrial and commercial properties, equipment, inventories and accounts receivables, and acquisitions; and treasury management services, as well as originates commercial leasing services.

More about Cullen/Frost Bankers

- Dividend Yield

- 3.49%

- Track Record

- 47 Years of Consecutive Dividend Growth

- Payout Ratio

- 133.3%

- Consensus Rating

- Reduce

- Consensus Price Target

- $153.83 (11.2% Upside)

About Clorox

The Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International. The Health and Wellness segment offers cleaning products, such as laundry additives and home care products primarily under the Clorox, Clorox2, Scentiva, Pine-Sol, Liquid-Plumr, Tilex, and Formula 409 brands; professional cleaning and disinfecting products under the CloroxPro and Clorox Healthcare brands; professional food service products under the Hidden Valley brand; and vitamins, minerals and supplement products under the RenewLife, Natural Vitality, NeoCell, and Rainbow Light brands in the United States.

More about Clorox

- Dividend Yield

- 5.05%

- Track Record

- 38 Years of Consecutive Dividend Growth

- Payout Ratio

- 70.4%

- Consensus Rating

- Hold

- Consensus Price Target

- $165.71 (19.1% Upside)

About Chevron

Chevron Corporation, through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally. The company operates in two segments, Upstream and Downstream. The Upstream segment is involved in the exploration, development, production, and transportation of crude oil and natural gas; processing, liquefaction, transportation, and regasification of liquefied natural gas; transportation of crude oil through pipelines; transportation, storage, and marketing of natural gas; and carbon capture and storage, as well as a gas-to-liquids plant.

More about Chevron

#47 - Duke Energy (NYSE:DUK)

- Dividend Yield

- 3.47%

- Track Record

- 20 Years of Consecutive Dividend Growth

- Payout Ratio

- 73.2%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $123.87 (2.4% Upside)

About Duke Energy

Duke Energy Corporation, together with its subsidiaries, operates as an energy company in the United States. It operates through two segments: Electric Utilities and Infrastructure (EU&I), and Gas Utilities and Infrastructure (GU&I). The EU&I segment generates, transmits, distributes, and sells electricity in the Carolinas, Florida, and the Midwest.

More about Duke Energy

#48 - Consolidated Edison (NYSE:ED)

- Dividend Yield

- 3.05%

- Track Record

- 52 Years of Consecutive Dividend Growth

- Payout Ratio

- 64.9%

- Consensus Rating

- Hold

- Consensus Price Target

- $103.30 (7.4% Downside)

About Consolidated Edison

Consolidated Edison, Inc, through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States. It offers electric services to approximately 3.7 million customers in New York City and Westchester County; gas to approximately 1.1 million customers in Manhattan, the Bronx, parts of Queens, and Westchester County; and steam to approximately 1,530 customers in parts of Manhattan.

More about Consolidated Edison

#49 - First American Financial (NYSE:FAF)

- Dividend Yield

- 3.67%

- Track Record

- 15 Years of Consecutive Dividend Growth

- Payout Ratio

- 172.8%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $74.50 (18.2% Upside)

About First American Financial

First American Financial Corporation, through its subsidiaries, provides financial services. It operates through Title Insurance and Services, and Home Warranty segments. The Title Insurance and Services segment issues title insurance policies on residential and commercial property, as well as offers related products and services internationally.

More about First American Financial

#50 - Genuine Parts (NYSE:GPC)

- Dividend Yield

- 3.67%

- Track Record

- 70 Years of Consecutive Dividend Growth

- Payout Ratio

- 63.7%

- Consensus Rating

- Hold

- Consensus Price Target

- $130.86 (12.0% Upside)

About Genuine Parts

Genuine Parts Company distributes automotive replacement parts, and industrial parts and materials. It operates in two segments: Automotive Parts Group and Industrial Parts Group segments. The company distributes automotive replacement parts for hybrid and electric vehicles, trucks, SUVs, buses, motorcycles, recreational vehicles, farm vehicles, small engines, farm equipment, marine equipment, and heavy duty equipment; and equipment and parts used by repair shops, service stations, fleet operators, automobile and truck dealers, leasing companies, bus and truck lines, mass merchandisers, farms, and individuals.

More about Genuine Parts

- Dividend Yield

- 3.2%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 45.7%

- Consensus Rating

- Buy

- Consensus Price Target

- $63.00 (49.4% Upside)

About HNI

HNI Corporation, together with its subsidiaries, engages in the manufacture, sale, and marketing of workplace furnishings and residential building products primarily in the United States and Canada. The company operates through two segments, Workplace Furnishings and Residential Building Products. The Workplace Furnishings segment offers a range of commercial and home office furniture, including panel-based and freestanding furniture systems, seating, storage, benching, tables, architectural products, and ancillary and hospitality products, as well as social collaborative items under the HON, Allsteel, Beyond, Gunlocke, HBF, HBF Textiles, HNI India, Kimball, National, Etc., Interwoven, David Edward, Kimball Hospitality, and D'style brands.

More about HNI

- Dividend Yield

- 4.93%

- Track Record

- 15 Years of Consecutive Dividend Growth

- Payout Ratio

- 41.4%

- Consensus Rating

- Hold

- Consensus Price Target

- $34.00 (34.9% Upside)

About HP

HP Inc provides products, technologies, software, solutions, and services to individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors worldwide. It operates through Personal Systems and Printing segments. The Personal Systems segment offers commercial personal computers (PCs), consumer PCs, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support, and services for the commercial and consumer markets.

More about HP

#53 - Hormel Foods (NYSE:HRL)

- Dividend Yield

- 3.84%

- Track Record

- 60 Years of Consecutive Dividend Growth

- Payout Ratio

- 84.7%

- Consensus Rating

- Hold

- Consensus Price Target

- $32.33 (6.7% Upside)

About Hormel Foods

Hormel Foods Corporation develops, processes, and distributes various meat, nuts, and other food products to retail, foodservice, deli, and commercial customers in the United States and internationally. It operates through three segments: Retail, Foodservice, and International segments. The company provides various perishable products that include fresh meats, frozen items, refrigerated meal solutions, sausages, hams, guacamoles, and bacons; and shelf-stable products comprising canned luncheon meats, nut butters, snack nuts, chili, shelf-stable microwaveable meals, hash, stews, tortillas, salsas, tortilla chips, nutritional food supplements, and others.

More about Hormel Foods

#54 - Interpublic Group of Companies (NYSE:IPG)

- Dividend Yield

- 5.67%

- Track Record

- 13 Years of Consecutive Dividend Growth

- Payout Ratio

- 72.1%

- Consensus Rating

- Hold

- Consensus Price Target

- $33.67 (35.0% Upside)

About Interpublic Group of Companies

The Interpublic Group of Companies, Inc provides advertising and marketing services worldwide. It operates in three segments: Media, Data & Engagement Solutions, Integrated Advertising & Creativity Led Solutions, and Specialized Communications & Experiential Solutions. The Media, Data & Engagement Solutions segment provides media and communications services, digital services and products, advertising and marketing technology, e-commerce services, data management and analytics, strategic consulting, and digital brand experience under the IPG Mediabrands, UM, Initiative, Kinesso, Acxiom, Huge, MRM, and R/GA brand names.

More about Interpublic Group of Companies

#55 - Johnson & Johnson (NYSE:JNJ)

- Dividend Yield

- 3.22%

- Track Record

- 64 Years of Consecutive Dividend Growth

- Payout Ratio

- 57.8%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $171.82 (11.0% Upside)

About Johnson & Johnson

Johnson & Johnson is a holding company, which engages in the research, development, manufacture, and sale of products in the healthcare field. It operates through the Innovative Medicine and MedTech segments. The Innovative Medicine segment focuses on immunology, infectious diseases, neuroscience, oncology, cardiovascular and metabolism, and pulmonary hypertension.

More about Johnson & Johnson

#56 - Kimberly-Clark (NYSE:KMB)

- Dividend Yield

- 3.65%

- Track Record

- 54 Years of Consecutive Dividend Growth

- Payout Ratio

- 68.7%

- Consensus Rating

- Hold

- Consensus Price Target

- $145.83 (10.2% Upside)

About Kimberly-Clark

Kimberly-Clark Corporation, together with its subsidiaries, manufactures and markets personal care and consumer tissue products in the United States. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional. The company's Personal Care segment offers disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, reusable underwear, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Thinx, Poise, Depend, Plenitud, Softex, and other brand names.

More about Kimberly-Clark

#57 - LyondellBasell Industries (NYSE:LYB)

- Dividend Yield

- 9.58%

- Track Record

- 13 Years of Consecutive Dividend Growth

- Payout Ratio

- 129.5%

- Consensus Rating

- Hold

- Consensus Price Target

- $76.50 (28.9% Upside)

About LyondellBasell Industries

LyondellBasell Industries N.V. operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally. The company operates in six segments: Olefins and PolyolefinsAmericas; Olefins and PolyolefinsEurope, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology.

More about LyondellBasell Industries

- Dividend Yield

- 3.04%

- Track Record

- 11 Years of Consecutive Dividend Growth

- Payout Ratio

- 36.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $92.46 (21.8% Upside)

About MetLife

MetLife, Inc, a financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide. It operates through six segments: Retirement and Income Solutions; Group Benefits; Asia; Latin America; Europe, the Middle East and Africa; and MetLife Holdings. The company offers life, dental, group short-and long-term disability, individual disability, pet insurance, accidental death and dismemberment, vision, and accident and health coverages, as well as prepaid legal plans; administrative services-only arrangements to employers; and general and separate account, and synthetic guaranteed interest contracts, as well as private floating rate funding agreements.

More about MetLife

#59 - Merck & Co., Inc. (NYSE:MRK)

- Dividend Yield

- 4.15%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 48.1%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $111.13 (39.7% Upside)

About Merck & Co., Inc.

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

More about Merck & Co., Inc.

#60 - New Jersey Resources (NYSE:NJR)

- Dividend Yield

- 3.62%

- Track Record

- 29 Years of Consecutive Dividend Growth

- Payout Ratio

- 54.2%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $51.50 (4.2% Upside)

About New Jersey Resources

New Jersey Resources Corporation, an energy services holding company, distributes natural gas. The company operates through four segments: Natural Gas Distribution, Clean Energy Ventures, Energy Services, and Storage and Transportation. The Natural Gas Distribution segment offers regulated natural gas utility services to approximately 576,000 customers in Burlington, Middlesex, Monmouth, Morris, Ocean, and Sussex counties in New Jersey; provides capacity and storage management services; and participates in the off-system sales and capacity release markets.

More about New Jersey Resources

#61 - NorthWestern Energy Group (NYSE:NWE)

- Dividend Yield

- 4.55%

- Track Record

- 21 Years of Consecutive Dividend Growth

- Payout Ratio

- 72.3%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $59.92 (2.6% Upside)

About NorthWestern Energy Group

NorthWestern Energy Group, Inc provides electricity and natural gas to residential, commercial, and various industrial customers. It generates, purchases, transmits, and distributes electricity; and produces, purchases, stores, transmits, and distributes natural gas, as well as owns municipal franchises to provide natural gas service in the communities.

More about NorthWestern Energy Group

#62 - OGE Energy (NYSE:OGE)

- Dividend Yield

- 3.77%

- Track Record

- 18 Years of Consecutive Dividend Growth

- Payout Ratio

- 76.4%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $46.25 (1.9% Upside)

About OGE Energy

OGE Energy Corp., together with its subsidiaries, operates as an energy services provider in the United States. The company generates, transmits, distributes, and sells electric energy. In addition, it provides retail electric service to approximately 896,000 customers, which covers a service area of approximately 30,000 square miles in Oklahoma and western Arkansas; and owns and operates coal-fired, natural gas-fired, wind-powered, and solar-powered generating assets.

More about OGE Energy

#63 - Old Republic International (NYSE:ORI)

- Dividend Yield

- 3.08%

- Track Record

- 45 Years of Consecutive Dividend Growth

- Payout Ratio

- 44.1%

- Consensus Rating

- Buy

- Consensus Price Target

- $43.00 (11.8% Upside)

About Old Republic International

Old Republic International Corporation, through its subsidiaries, engages in the insurance underwriting and related services business primarily in the United States and Canada. It operates through three segments: General Insurance, Title Insurance, and Republic Financial Indemnity Group Run-off Business.

More about Old Republic International

#64 - Public Service Enterprise Group (NYSE:PEG)

- Dividend Yield

- 3.04%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 71.2%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $89.35 (9.1% Upside)

About Public Service Enterprise Group

Public Service Enterprise Group Incorporated, through its subsidiaries, operates in electric and gas utility business in the United States. It operates through PSE&G and PSEG Power segments. The PSE&G segment transmits electricity; distributes electricity and natural gas to residential, commercial, and industrial customers; and appliance services and repairs to customers through its service territory, as well as invests in solar generation projects, and energy efficiency and related programs.

More about Public Service Enterprise Group

- Dividend Yield

- 3.82%

- Track Record

- 53 Years of Consecutive Dividend Growth

- Payout Ratio

- 78.0%

- Consensus Rating

- Hold

- Consensus Price Target

- $165.50 (22.4% Upside)

About PepsiCo

PepsiCo, Inc engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide. The company operates through seven segments: Frito-Lay North America; Quaker Foods North America; PepsiCo Beverages North America; Latin America; Europe; Africa, Middle East and South Asia; and Asia Pacific, Australia and New Zealand and China Region.

More about PepsiCo

#66 - Regions Financial (NYSE:RF)

- Dividend Yield

- 5.22%

- Track Record

- 12 Years of Consecutive Dividend Growth

- Payout Ratio

- 48.1%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $25.53 (24.4% Upside)

About Regions Financial

Regions Financial Corporation, a financial holding company, provides banking and bank-related services to individual and corporate customers. It operates through three segments: Corporate Bank, Consumer Bank, and Wealth Management. The Corporate Bank segment offers commercial banking services, such as commercial and industrial, commercial real estate, and investor real estate lending; equipment lease financing; deposit products; and securities underwriting and placement, loan syndication and placement, foreign exchange, derivatives, merger and acquisition, and other advisory services.

More about Regions Financial

#67 - Robert Half (NYSE:RHI)

- Dividend Yield

- 5.2%

- Track Record

- 22 Years of Consecutive Dividend Growth

- Payout Ratio

- 96.7%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $61.08 (37.4% Upside)

About Robert Half

Robert Half Inc provides talent solutions and business consulting services in North America, South America, Europe, Asia, and Australia. The company operates through Contract Talent Solutions, Permanent Placement Talent Solutions, and Protiviti segments. The Contract Talent Solutions segment provides contract engagement professionals in the fields of finance and accounting, technology, marketing and creative, legal and administrative, and customer support.

More about Robert Half

#68 - Royal Bank of Canada (NYSE:RY)

- Dividend Yield

- 3.56%

- Track Record

- 15 Years of Consecutive Dividend Growth

- Payout Ratio

- 46.2%

- Consensus Rating

- Buy

- Consensus Price Target

- $156.50 (33.5% Upside)

About Royal Bank of Canada

Royal Bank of Canada operates as a diversified financial service company worldwide. The company's Personal & Commercial Banking segment offers checking and savings accounts, home equity financing, personal lending, private banking, indirect lending, including auto financing, mutual funds and self-directed brokerage accounts, guaranteed investment certificates, credit cards, and payment products and solutions; and lending, leasing, deposit, investment, foreign exchange, cash management, auto dealer financing, trade products, and services to small and medium-sized commercial businesses.

More about Royal Bank of Canada

- Dividend Yield

- 3.28%

- Track Record

- 57 Years of Consecutive Dividend Growth

- Payout Ratio

- 69.7%

- Consensus Rating

- N/A

About Stepan

Stepan Company, together with its subsidiaries, produces and sells specialty and intermediate chemicals to other manufacturers for use in various end products worldwide. It operates through three segments: Surfactants, Polymers, and Specialty Products. The Surfactants segment offers surfactants that are used in consumer and industrial cleaning and disinfection products, including detergents for washing clothes, dishes, carpets, and floors and walls, as well as shampoos and body washes; and other applications, such as fabric softeners, germicidal quaternary compounds, disinfectants, and lubricating ingredients.

More about Stepan

#70 - J. M. Smucker (NYSE:SJM)

- Dividend Yield

- 3.76%

- Track Record

- 27 Years of Consecutive Dividend Growth

- Payout Ratio

- -179.3%

- Consensus Rating

- Hold

- Consensus Price Target

- $126.50 (9.5% Upside)

About J. M. Smucker

The J. M. Smucker Company manufactures and markets branded food and beverage products worldwide. It operates in three segments: U.S. Retail Pet Foods, U.S. Retail Coffee, and U.S. Retail Consumer Foods. The company offers mainstream roast, ground, single serve, and premium coffee; peanut butter and specialty spreads; fruit spreads, toppings, and syrups; jelly products; nut mix products; shortening and oils; frozen sandwiches and snacks; pet food and pet snacks; and foodservice hot beverage, foodservice portion control, and flour products, as well as dog and cat food, frozen handheld products, juices and beverages, and baking mixes and ingredients.

More about J. M. Smucker

#71 - Southern (NYSE:SO)

- Dividend Yield

- 3.18%

- Track Record

- 24 Years of Consecutive Dividend Growth

- Payout Ratio

- 71.8%

- Consensus Rating

- Hold

- Consensus Price Target

- $92.54 (1.5% Upside)

About Southern

The Southern Company, through its subsidiaries, engages in the generation, transmission, and distribution of electricity. The company also develops, constructs, acquires, owns, and manages power generation assets, including renewable energy projects and sells electricity in the wholesale market; and distributes natural gas in Illinois, Georgia, Virginia, and Tennessee, as well as provides gas marketing services, gas distribution operations, and gas pipeline investments operations.

More about Southern

#72 - Stanley Black & Decker (NYSE:SWK)

- Dividend Yield

- 5.77%

- Track Record

- 58 Years of Consecutive Dividend Growth

- Payout Ratio

- 169.1%

- Consensus Rating

- Hold

- Consensus Price Target

- $102.20 (65.5% Upside)

About Stanley Black & Decker

Stanley Black & Decker, Inc engages in the provision of power and hand tools, and related accessories, products, services and equipment for oil and gas, infrastructure applications, commercial electronic security and monitoring systems, healthcare solutions, and mechanical access solutions. It operates through the Tools and Outdoor and Industrial segments.

More about Stanley Black & Decker

#73 - T. Rowe Price Group (NASDAQ:TROW)

- Dividend Yield

- 5.95%

- Track Record

- 39 Years of Consecutive Dividend Growth

- Payout Ratio

- 55.5%

- Consensus Rating

- Reduce

- Consensus Price Target

- $96.00 (7.1% Upside)

About T. Rowe Price Group

T. Rowe Price Group, Inc is a publicly owned investment manager. The firm provides its services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed income mutual funds. The firm invests in the public equity and fixed income markets across the globe.

More about T. Rowe Price Group

#74 - Exxon Mobil (NYSE:XOM)

- Dividend Yield

- 3.7%

- Track Record

- 42 Years of Consecutive Dividend Growth

- Payout Ratio

- 50.5%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $126.50 (16.7% Upside)

About Exxon Mobil

Exxon Mobil Corporation engages in the exploration and production of crude oil and natural gas in the United States and internationally. It operates through Upstream, Energy Products, Chemical Products, and Specialty Products segments. The Upstream segment explores for and produces crude oil and natural gas.

More about Exxon Mobil

#75 - United Bankshares (NASDAQ:UBSI)

- Dividend Yield

- 4.42%

- Track Record

- 26 Years of Consecutive Dividend Growth

- Payout Ratio

- 54.0%

- Consensus Rating

- Hold

- Consensus Price Target

- $41.88 (21.8% Upside)

About United Bankshares

United Bankshares, Inc, through its subsidiaries, primarily provides commercial and retail banking products and services in the United States. It operates through two segments, Community Banking and Mortgage Banking. The company accepts checking, savings, and time and money market accounts; individual retirement accounts; and demand deposits, statement and special savings, and NOW accounts.

More about United Bankshares

#76 - WEC Energy Group (NYSE:WEC)

- Dividend Yield

- 3.33%

- Track Record

- 23 Years of Consecutive Dividend Growth

- Payout Ratio

- 73.9%

- Consensus Rating

- Hold

- Consensus Price Target

- $104.38 (4.3% Downside)

About WEC Energy Group

WEC Energy Group, Inc, through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States. It operates through Wisconsin, Illinois, Other States, Electric Transmission, and Non-Utility Energy Infrastructure segments.

More about WEC Energy Group

#77 - Microchip Technology (NASDAQ:MCHP)

- Dividend Yield

- 4.8%

- Track Record

- 23 Years of Consecutive Dividend Growth

- Payout Ratio

- 325.0%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $69.32 (47.8% Upside)

About Microchip Technology

Microchip Technology Incorporated engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit mixed-signal microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

More about Microchip Technology

#78 - Westamerica Bancorporation (NASDAQ:WABC)

- Dividend Yield

- 3.86%

- Track Record

- 33 Years of Consecutive Dividend Growth

- Payout Ratio

- 35.3%

- Consensus Rating

- Hold

- Consensus Price Target

- $52.50 (8.8% Upside)

About Westamerica Bancorporation

Westamerica Bancorporation operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers. The company accepts various deposit products, including retail savings and checking accounts, as well as certificates of deposit.

More about Westamerica Bancorporation

#79 - Brunswick (NYSE:BC)

- Dividend Yield

- 3.97%

- Track Record

- 13 Years of Consecutive Dividend Growth

- Payout Ratio

- 90.5%

- Consensus Rating

- Hold

- Consensus Price Target

- $76.67 (62.3% Upside)

About Brunswick

Brunswick Corporation designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally. It operates through four segments: Propulsion, Engine P&A, Navico Group, and Boat. The Propulsion segment provides outboard, sterndrive, inboard engines, propulsion-related controls, rigging, and propellers for boat builders through marine retail dealers under the Mercury, Mercury MerCruiser, Mariner, Mercury Racing, Mercury Diesel, Avator, and Fliteboard brands.

More about Brunswick

#80 - ManpowerGroup (NYSE:MAN)

- Dividend Yield

- 6.22%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 133.9%

- Consensus Rating

- Hold

- Consensus Price Target

- $57.50 (36.6% Upside)

About ManpowerGroup

ManpowerGroup Inc provides workforce solutions and services worldwide. The company offers recruitment services, including permanent, temporary, and contract recruitment of professionals, as well as administrative and industrial positions under the Manpower and Experis brands. It also offers various assessment services; training and development services; career and talent management; and outsourcing services related to human resources functions primarily in the areas of large-scale recruiting and workforce-intensive initiatives.

More about ManpowerGroup

#81 - Associated Banc (NYSE:ASB)

- Dividend Yield

- 4.61%

- Track Record

- 13 Years of Consecutive Dividend Growth

- Payout Ratio

- 116.5%

- Consensus Rating

- Hold

- Consensus Price Target

- $26.67 (21.8% Upside)

About Associated Banc

Associated Banc-Corp, a bank holding company, provides various banking and nonbanking products to individuals and businesses in Wisconsin, Illinois, and Minnesota. The company offers lending solutions, including commercial loans and lines of credit, commercial real estate financing, construction loans, letters of credit, leasing, asset based lending and equipment finance, loan syndications products, residential mortgages, home equity loans and lines of credit, personal and installment loans, auto finance and business loans, and business lines of credit.

More about Associated Banc

- Dividend Yield

- 4.05%

- Track Record

- 22 Years of Consecutive Dividend Growth

- Payout Ratio

- 76.0%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $76.70 (1.5% Downside)

About Spire

Spire Inc, together with its subsidiaries, engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States. The company operates through three segments: Gas Utility, Gas Marketing, and Midstream. It is also involved in the marketing of natural gas and related services; and transportation and storage of natural gas.

More about Spire

- Dividend Yield

- 3.82%

- Track Record

- 53 Years of Consecutive Dividend Growth

- Payout Ratio

- 273.3%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $211.19 (17.2% Upside)

About AbbVie

AbbVie Inc discovers, develops, manufactures, and sells pharmaceuticals worldwide. The company offers Humira, an injection for autoimmune and intestinal Behçet's diseases, and pyoderma gangrenosum; Skyrizi to treat moderate to severe plaque psoriasis, psoriatic disease, and Crohn's disease; Rinvoq to treat rheumatoid and psoriatic arthritis, ankylosing spondylitis, atopic dermatitis, axial spondyloarthropathy, ulcerative colitis, and Crohn's disease; Imbruvica for the treatment of adult patients with blood cancers; Epkinly to treat lymphoma; Elahere to treat cancer; and Venclexta/Venclyxto to treat blood cancers.

More about AbbVie

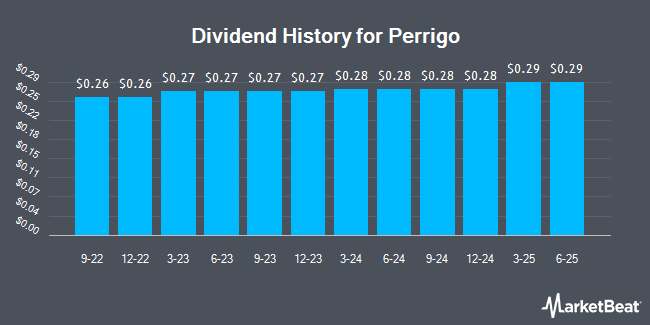

- Dividend Yield

- 4.61%

- Track Record

- 23 Years of Consecutive Dividend Growth

- Payout Ratio

- -92.8%

- Consensus Rating

- Hold

- Consensus Price Target

- $33.00 (32.2% Upside)

About Perrigo

Perrigo Company plc provides over-the-counter health and wellness solutions to enhance individual well-being in the United States, Europe, and internationally. It operates through Consumer Self-Care Americas and Consumer Self-Care International segments. The company develops, manufactures, markets, and distributes self-care consumer products, such as upper respiratory products, including cough suppressants, expectorants, and sinus and allergy relief; nutrition products consisting of infant formulas and nutritional beverages; digestive health products, including antacids, anti-diarrheal, and anti-heartburn; pain and sleep-aids products comprising pain relievers and fever reducers; and oral care products, which include toothbrushes, toothbrush replacement heads, floss, flossers, whitening products, and toothbrush covers.

More about Perrigo

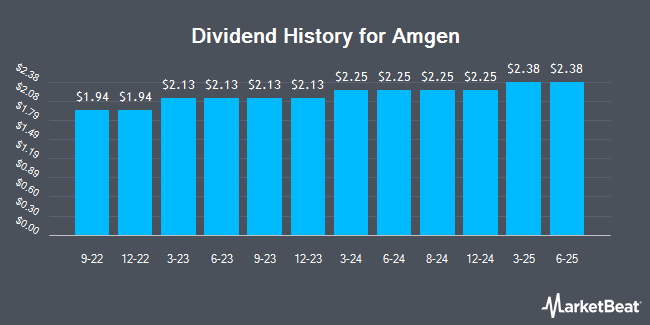

- Dividend Yield

- 3.43%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 126.1%

- Consensus Rating

- Hold

- Consensus Price Target

- $310.57 (11.3% Upside)

About Amgen

Amgen Inc discovers, develops, manufactures, and delivers human therapeutics worldwide. The company's principal products include Enbrel to treat plaque psoriasis, rheumatoid arthritis, and psoriatic arthritis; Otezla for the treatment of adult patients with plaque psoriasis, psoriatic arthritis, and oral ulcers associated with Behçet's disease; Prolia to treat postmenopausal women with osteoporosis; XGEVA for skeletal-related events prevention; Repatha, which reduces the risks of myocardial infarction, stroke, and coronary revascularization; Nplate for the treatment of patients with immune thrombocytopenia; KYPROLIS to treat patients with relapsed or refractory multiple myeloma; Aranesp to treat a lower-than-normal number of red blood cells and anemia; EVENITY for the treatment of osteoporosis in postmenopausal for men and women; Vectibix to treat patients with wild-type RAS metastatic colorectal cancer; BLINCYTO for the treatment of patients with acute lymphoblastic leukemia; TEPEZZA to treat thyroid eye disease; and KRYSTEXXA for the treatment of chronic refractory gout.

More about Amgen

#86 - Cadence Bank (NYSE:CADE)

- Dividend Yield

- 3.99%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 38.6%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $37.36 (28.8% Upside)

About Cadence Bank

Cadence Bank provides commercial banking and financial services. Its products and services include consumer banking, consumer loans, mortgages, home equity lines and loans, credit cards, commercial and business banking, treasury management, specialized and asset-based lending, commercial real estate, equipment financing, and correspondent banking services.

More about Cadence Bank

#87 - Home Bancshares, Inc. (Conway, AR) (NYSE:HOMB)

- Dividend Yield

- 3%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 37.1%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $32.40 (16.5% Upside)

About Home Bancshares, Inc. (Conway, AR)

-logo.png?v=20240417094222)

Home Bancshares, Inc (Conway, AR) operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities. Its deposit products include checking, savings, and money market accounts, as well as certificates of deposit.

More about Home Bancshares, Inc. (Conway, AR)

- Dividend Yield

- 3.02%

- Track Record

- 15 Years of Consecutive Dividend Growth

- Payout Ratio

- 78.7%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $103.00 (23.4% Upside)

About Starbucks

Starbucks Corporation, together with its subsidiaries, operates as a roaster, marketer, and retailer of coffee worldwide. The company operates through three segments: North America, International, and Channel Development. Its stores offer coffee and tea beverages, roasted whole beans and ground coffees, single serve products, and ready-to-drink beverages; and various food products, such as pastries, breakfast sandwiches, and lunch items.

More about Starbucks

#89 - Skyworks Solutions (NASDAQ:SWKS)

- Dividend Yield

- 5.01%

- Track Record

- 11 Years of Consecutive Dividend Growth

- Payout Ratio

- 85.9%

- Consensus Rating

- Reduce

- Consensus Price Target

- $82.39 (34.3% Upside)

About Skyworks Solutions

Skyworks Solutions, Inc, together with its subsidiaries, designs, develops, manufactures, and markets proprietary semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific. Its product portfolio includes amplifiers, antenna tuners, attenuators, automotive tuners and digital radios, DC/DC converters, demodulators, detectors, diodes, wireless analog system on chip products, directional couplers, diversity receive modules, filters, front-end modules, hybrids, light emitting diode drivers, low noise amplifiers, mixers, modulators, optocouplers/optoisolators, phase locked loops, phase shifters, power dividers/combiners, power over ethernet, power isolators, receivers, switches, synthesizers, timing devices, voltage controlled oscillators/synthesizers, and voltage regulators.

More about Skyworks Solutions

#90 - Fifth Third Bancorp (NASDAQ:FITB)

- Dividend Yield

- 4.3%

- Track Record

- 14 Years of Consecutive Dividend Growth

- Payout Ratio

- 47.0%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $46.24 (29.3% Upside)

About Fifth Third Bancorp

Fifth Third Bancorp operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States. It operates through three segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

More about Fifth Third Bancorp

#91 - Zions Bancorporation, National Association (NASDAQ:ZION)

- Dividend Yield

- 3.97%

- Track Record

- 12 Years of Consecutive Dividend Growth

- Payout Ratio

- 34.7%

- Consensus Rating

- Hold

- Consensus Price Target

- $59.00 (30.9% Upside)

About Zions Bancorporation, National Association

Zions Bancorporation, National Association provides various banking products and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. It operates through Zions Bank, California Bank & Trust, Amegy Bank, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and The Commerce Bank of Washington segments.

More about Zions Bancorporation, National Association

- Dividend Yield

- 3.88%

- Track Record

- 18 Years of Consecutive Dividend Growth

- Payout Ratio

- 31.8%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $42.50 (27.9% Upside)

About Comcast

Comcast Corporation operates as a media and technology company worldwide. It operates through Residential Connectivity & Platforms, Business Services Connectivity, Media, Studios, and Theme Parks segments. The Residential Connectivity & Platforms segment provides residential broadband and wireless connectivity services, residential and business video services, sky-branded entertainment television networks, and advertising.

More about Comcast

#93 - German American Bancorp (NASDAQ:GABC)

- Dividend Yield

- 3.28%

- Track Record

- 13 Years of Consecutive Dividend Growth

- Payout Ratio

- 41.1%

- Consensus Rating

- Moderate Buy

- Consensus Price Target

- $46.40 (25.8% Upside)

About German American Bancorp

German American Bancorp, Inc operates as a financial holding company for German American Bank that provides retail and commercial banking services. The company operates through three segments: Core Banking, Wealth Management Services, and Insurance Operations. The Core Banking segment accepts deposits from the general public; and originates consumer, commercial and agricultural, commercial and agricultural real estate, and residential mortgage loans, as well as sells residential mortgage loans in the secondary market.

More about German American Bancorp