Imagine a future where self-driving cars seamlessly navigate bustling streets, robotic hands orchestrate precision surgical procedures with unparalleled accuracy, and the notion of manufacturing undergoes a paradigm shift through the hands of automation.

It's not a distant dream but a reality meticulously crafted by the top robotics companies. These pioneers have embraced the synergy of mechanics, artificial intelligence and cutting-edge design to engineer solutions once confined to the pages of science fiction.

Right at the heart of this evolving landscape lies the USA's top robotics companies, the architects of innovation and the heralds of a technological revolution reshaping industries across the spectrum.

Overview of Robotics Companies

As you explore the top robotics companies in the United States, these companies are the architects of the future, blending artificial intelligence and automation to reshape industries and redefine what's possible.

Imagine a world where machines not only perform tasks but do so with the finesse of human intelligence. This is the driving force behind these robotics companies. They are at the forefront of developing robots that can sense, think and act — a convergence of technology poised to revolutionize how you live and work.

Digging deeper, you will discover that these companies have not confined to a single sector; their innovations ripple across multiple industries. In healthcare, robotics has ushered in a new era of precision in surgical procedures. Robots are becoming integral to production lines in manufacturing, boosting efficiency and quality. The agricultural landscape embraces automation to optimize yields and sustainable practices, while logistics is witnessing the rise of intelligent warehouses and delivery systems. It's not just about machines; it's about the symphony of human ingenuity and technological prowess.

Engineers and scientists work tirelessly to create robots that perform tasks and evolve in response to their environment. This marriage of mechanics and artificial intelligence lays the foundation for robots that can adapt, learn and collaborate with humans in ways that were once the realm of science fiction.

As we explore, you will understand that it's not just about the products; it's about the individuals who bring them to life. The visionaries driving these companies have a shared goal to push boundaries and redefine industrial norms. They believe in a future where technology isn't just a tool but a catalyst for positive change. Each company's journey is a testament to the inexhaustible spirit of human creativity and perseverance. These companies are creating robots and shaping a future where automation and intelligence coalesce to amplify our potential as a species.

Why Invest in Robotics Companies?

Investing in robotics companies offers tangible opportunities and strategic foresight. The rapid and substantial growth of the robotics sector, coupled with its innate capacity for disruption, underscores a compelling investment proposition for novice and seasoned investors. It fuses innovation and practical application in the robotics landscape.

- The eruption of industry growth: The global robotics market, valued at $162.2 billion in 2021, is projected to propel itself to an astounding $340.7 billion by 2028. This eruption in growth, bearing a formidable compound annual growth rate (CAGR) of 11.2%, punctuates the industry's vitality and amplifies the crescendo of robotics' ascension.

- Disruption: Robotics has an innate penchant for disruption. Robotics heralds a paradigm shift that evades oblivion. These ingenious mechanical entities can undertake tasks currently entrusted to humans. The implications reverberate through the industry, providing substantial cost savings and amped-up productivity. This capacity to revolutionize propels robotics into the vanguard of innovation, an irresistible beacon for enterprises seeking to bolster their financials.

- Global expanse: The global scope of robotics transcends geographic boundaries, demonstrating its resilience to limitations imposed by location. This expansive reach offers robotics a distinct allure, appealing to investors with a comprehensive global perspective who are attracted to an investment arena encompassing multiple continents.

- Diminished risk: While the industry may be in its infancy, its promise is evident. As it matures, the evolutionary trajectory foretells a future where the risk entailed in robotics investments mellows. A horizon looms where investing in robotics becomes a calculated move, potentially yielding substantial dividends.

Investing in robotics companies isn't just about numbers; it's a strategic alignment with an industry redefining how we interact with technology and our environment. The rapid growth, potential for disruption and expansive global reach make robotics investments a gateway to both financial gains and a front-row seat in the evolution of technology.

16 Top Robotics Companies in USA to Invest in

We've picked 16 American companies at the forefront of robotic technology production and integration. This selection showcases a strategic cross-section of companies that epitomize the convergence of cutting-edge technology and sound business prospects.

Each entry in this list represents a distinct facet of the dynamic robotics sector, providing investors with a pragmatic window into an evolving landscape with immense potential for substantial gains and strategic market positioning.

|

Company Name

|

Ticker

|

Location

|

Market Capitalization

|

|

Ambarella

|

NASDAQ: AMBA

|

Santa Clara, California

|

$2.67 billion

|

|

AMETEK

|

NYSE: AME

|

Berwyn, Pennsylvania

|

$35.87 billion

|

|

Azenta

|

NASDAQ: AZTA

|

Burlington, Massachusetts

|

$3.32 billion

|

|

Cadence Design Systems

|

NASDAQ: CDNS

|

San Jose, California

|

$62.46 billion

|

|

Deere & Company

|

NYSE: DE

|

Moline, Illinois

|

$113.89 billion

|

|

Emerson Electric

|

NYSE: EMR

|

St. Louis, Missouri

|

$54.93 billion

|

|

Helix Energy Solutions

|

NYSE: HLX

|

Houston, Texas

|

$1.45 billion

|

|

Intuitive Surgical

|

NASDAQ: ISRG

|

Sunnyvale, California

|

$101.26 billion

|

|

Nauticus Robotics

|

NASDAQ: KITT

|

Webster, Texas

|

$99.14 million

|

|

ServiceNow

|

NYSE: NOW

|

Santa Clara, California

|

$113.35 billion

|

|

NVIDIA

|

NASDAQ: NVDA

|

Santa Clara, California

|

$1.2 trillion

|

|

PTC

|

NASDAQ: PTC

|

Boston, Massachusetts

|

$16.85 billion

|

|

QUALCOMM

|

NASDAQ: QCOM

|

San Diego, California

|

$122.45 billion

|

|

Stryker

|

NYSE: SYK

|

Kalamazoo, Michigan

|

$110 billion

|

|

Thermo Fisher Scientific

|

NYSE: TMO

|

Waltham, Massachusetts

|

$209.45 billion

|

|

Zebra Technologies

|

NASDAQ: ZBRA

|

Lincolnshire, Illinois

|

$13.75 billion

|

Ambarella Inc.

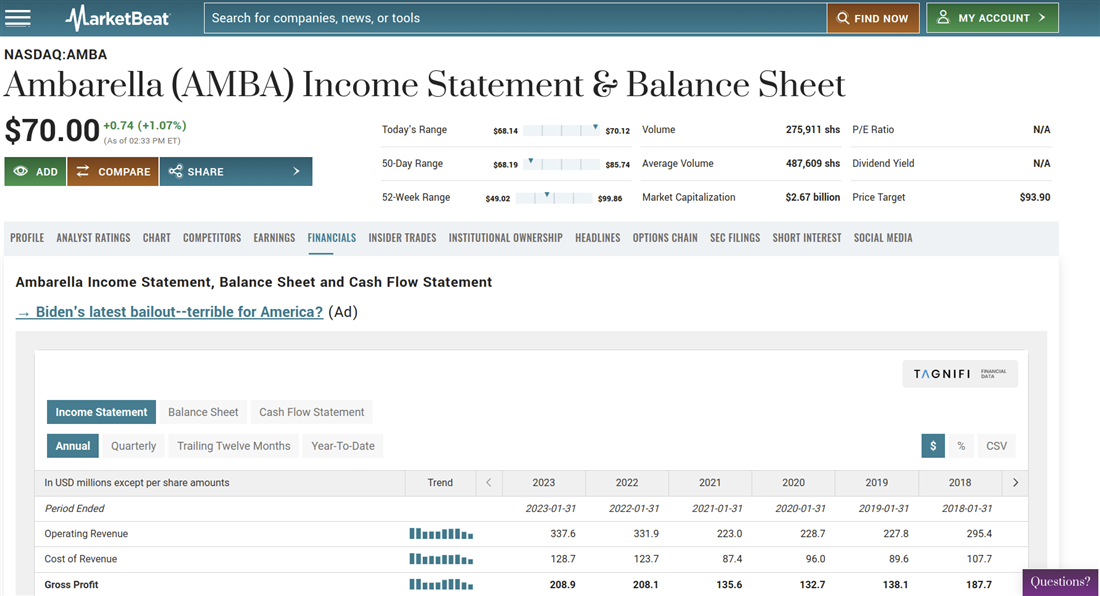

Operating at the forefront of semiconductor innovation, Ambarella Inc. NASDAQ: AMBA is a dynamic fabless company specializing in creating advanced system-on-a-chip (SoC) solutions tailored meticulously for video imaging applications. The utility of Ambarella's products extends far beyond its initial scope, encompassing diverse sectors like medical imaging, machine vision and surveillance, underscoring the versatile nature of its technology. An example of industry leadership, Ambarella commands a substantial market presence in the high-performance image processing SoC arena.

Reviewing Ambarella’s financials, you will find that profitability underpins Ambarella's financial prowess, with revenue figures reflecting steady growth.

Helmed by a seasoned management team led by CEO Fermi Wang, the company leverages over two decades of collective experience within the semiconductor industry. This factor plays a pivotal role in steering its strategic course. Ambarella's strategic alliances and partnerships position the company to contend with competitors like Sony Group NYSE: SONY, Intel Corp. NASDAQ: INTC and Qualcomm Inc. NASDAQ: QCOM within the semiconductor sector. Bolstering its robust growth outlook, Ambarella deftly navigates the foray into novel markets such as augmented reality and virtual reality, diversifying its product portfolio.

Embracing a trajectory of continuous innovation, Ambarella's investments in research and development bear witness to its commitment to pioneering new technologies, including artificial intelligence and machine learning. This strategic foresight positions the company to harness future opportunities arising from technological advancements. The competitive landscape presents challenges as Ambarella faces escalating rivalry from semiconductor giants. The company's adaptability and strategic collaborations will be instrumental in navigating this evolving environment. Ambarella's growth trajectory is full of regulatory considerations. The company operates within a framework of regulations, encompassing aspects such as privacy and security. Its steadfast commitment to compliance reflects a responsible approach to navigating the regulatory landscape.

AMETEK Inc.

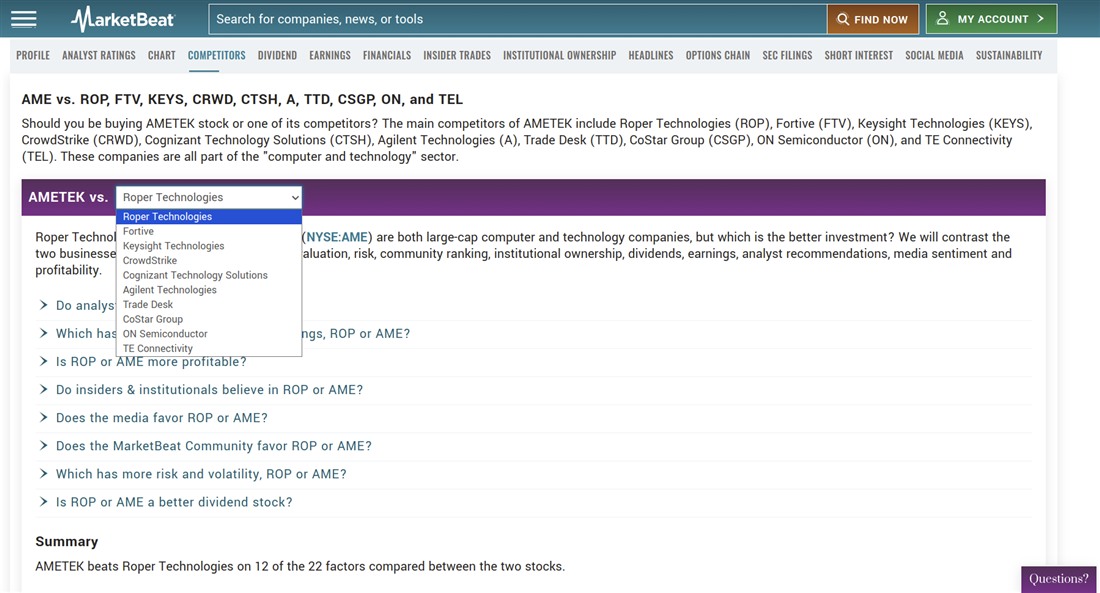

Encompassing diversified industrial technology, AMETEK Inc. NYSE: AME operates as a versatile entity designing, manufacturing and offering an expansive array of products and services catering to diverse end markets. Its comprehensive offerings include sensors, controls, electrical products, automation solutions and engineered products, underlining its commitment to multifaceted industrial innovation. AMETEK is not exclusively a robotics-focused entity but plays a pivotal role in robotics applications. The company's sensors and controls find their application within various robotic systems, while its automation solutions serve as integral components within robotic manufacturing cells. Although not a dominant player in the robotics sector, AMETEK emerges as a significant supplier of critical components and systems that drive robotics.

Reviewing AMETEK’s competitors, the company contends with industry giants and helps to shape the industrial automation sector and collectively commands substantial resources.

Strategic expansion lies at the heart of AMETEK's growth prospects. The company strategically targets growth across pivotal domains, including robotics, industrial automation and medical technology. Bolstered by investments in research and development, AMETEK actively pioneers new frontiers, including artificial intelligence and machine learning. AMETEK's intellectual property portfolio underpins its competitive edge. With over 15,000 patents and applications, the company boasts an arsenal of intellectual assets fortifying its market positioning. AMETEK's strategic partnerships within the robotics industry augment its market influence and expand its outreach, positioning it favorably for future growth.

Azenta Inc.

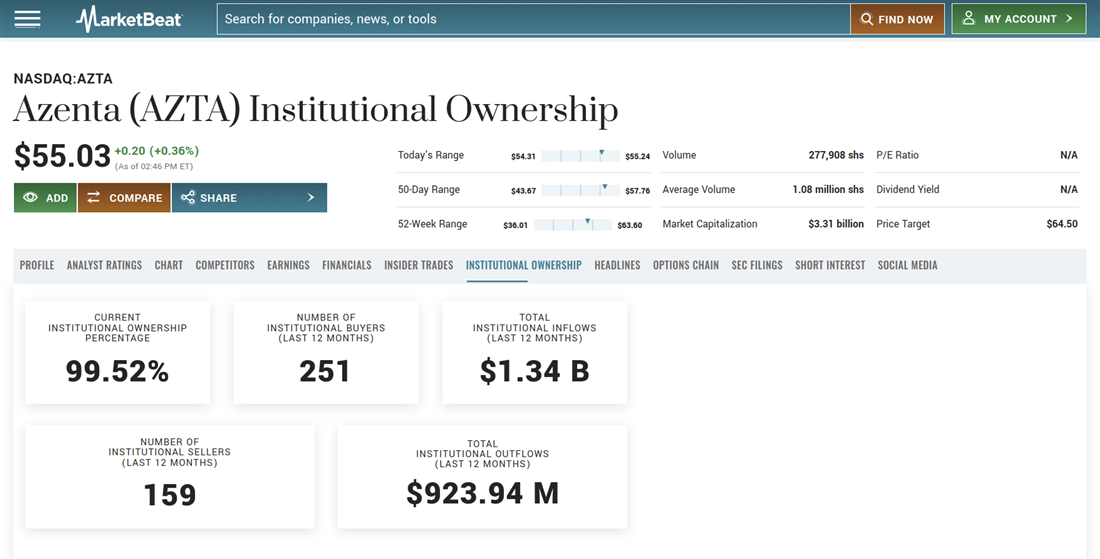

Pioneering life sciences automation, Azenta Inc. NASDAQ: AZTA is a notable provider of robotic sample handling automation solutions for research and clinical laboratories. Its offerings encompass various cutting-edge products, including robotic arms, grippers and software ingeniously designed to automate the intricate task of sample handling across multiple applications within drug discovery, clinical trials and diagnostics. While not a dominant force within the broader robotics industry, Azenta emerges as a critical player in the niche robotic sample handling automation market for life sciences. Its significant market share underscores its strategic positioning in this specialized domain.

A robust intellectual property portfolio empowers Azenta's competitive edge, boasting over 100 patents and patent applications that strategically position the company within the market. Strategic partnerships within the life sciences industry enhance Azenta's market footprint, allowing it to expand its reach and influence within its domain.

Azenta's prospects are anchored in the expanding life sciences automation market, projected to grow at a compound annual growth rate (CAGR) of 7% over the next five years. This strategic alignment positions Azenta for growth as it invests in research and development to introduce new products and services. A review of Azenta’s current institutional ownership shows that institutions own 99.52% of the company. This high level of institutional ownership reflects strong confidence in Azenta's growth potential and business prospects within the robotics industry. Institutions, including mutual funds, pension funds and investment firms, often conduct thorough research and analysis before making substantial investments. These entities hold a significant portion of Azenta's ownership, indicating a collective belief in the company's strategic direction, technological innovations and market positioning.

Cadence Design Systems Inc.

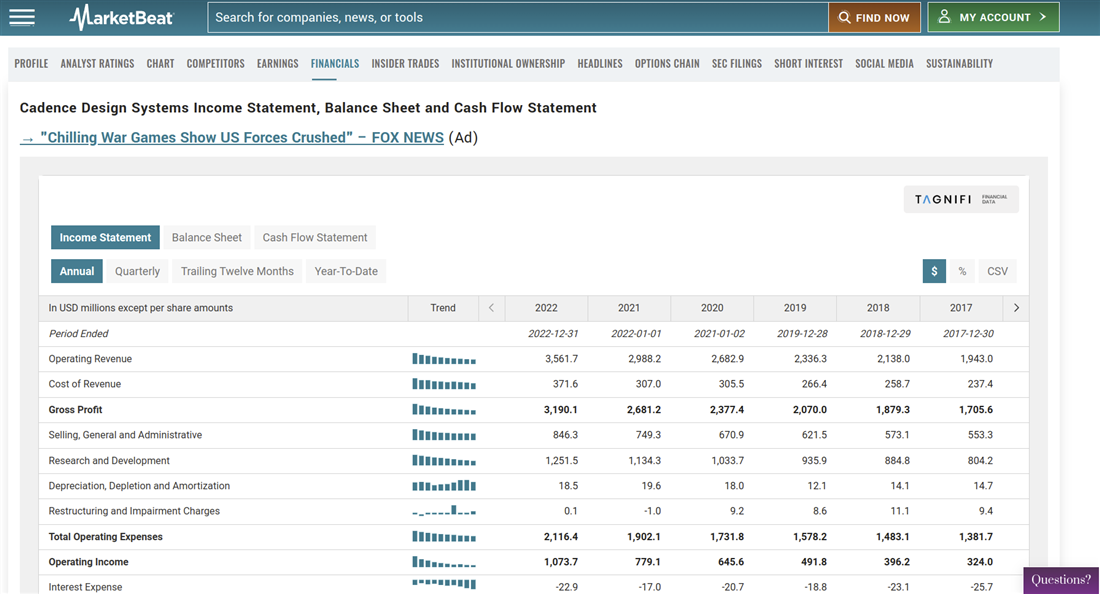

Cadence Design Systems Inc. NASDAQ: CDNS takes a commanding role in the robotics landscape as a premier provider of electronic design automation (EDA) software and hardware. Its product offerings are indispensable in designing and validating integrated circuits (ICs), systems on chips (SoCs) and various electronic systems that underpin modern robotics advancements. Cadence Design Systems is a leader within the competitive EDA market, with a significant market share. This dominance attests to the company's influential position within the industry.

Cadence Design Systems's financials are robust, and the company has achieved profitability and steady growth, generating substantial revenue and net income.

With a consistent CAGR of 8% over the last five years, the company's performance underscores its resilience and strategic direction. Guided by an experienced and qualified management team led by CEO Anirudh Devgan, who brings over two decades of semiconductor industry expertise, Cadence Design Systems demonstrates a strong foundation for effective leadership.

Seizing future growth opportunities, Cadence Design Systems can capitalize on the anticipated expansion of the semiconductor market, which should grow at a CAGR of 8% over the next five years. The company's investments in research and development further exemplify its commitment to innovation and progress.

A robust intellectual property portfolio, boasting an impressive collection of over 6,000 patents and patent applications, empowers Cadence Design Systems with a competitive edge, reinforcing its position as an industry leader. Cadence Design Systems is committed to compliance and responsible business practices amid a complex regulatory environment, including intellectual property protection and export control regulations.

Cadence Design Systems epitomizes a company poised for sustained growth and success.

With its impressive product portfolio, seasoned management team and forward-looking growth strategy, the company is primed to shape the trajectory of the semiconductor industry. However, you should be mindful of the sector's cyclicality and the investment challenges it may pose.

Deere & Company

Deere & Company NYSE: DE stands as a trailblazing presence within the realm of robotics, having strategically ventured into this innovative landscape. A testament to this commitment is the 2019 acquisition of Bear Flag Robotics, a pioneering developer of autonomous agricultural machinery. The company's ambitions extend beyond acquisitions, developing a line of autonomous robots for applications across agriculture, construction and forestry sectors.

While Deere & Company's foray into robotics is still in its early stages, its potential to drive growth is undeniable. Facing challenges such as labor shortages and the need for increased crop yields, the agricultural industry has found a solution in robotics, which can automate tasks currently dependent on human labor. This vision extends to construction and forestry, where robotics can boost safety and productivity in the face of labor scarcity.

With the burgeoning growth anticipated in the robotics market, Deere & Company is well-positioned to leverage its strong brand, substantial financial resources and deep expertise in the agricultural machinery sector. Specifically, Deere & Company's strides in robotics encompass a range of applications, from autonomous tractors that enhance efficiency in planting, harvesting and spraying crops to harvesters and sprayers designed to elevate precision and reduce losses. The forestry sector benefits from Deere & Company's autonomous machines, reshaping timber harvesting, tree planting and land-clearing practices.

Deere & Company's journey into innovation continues. The company channels resources into research and development, harnessing technologies like artificial intelligence, machine learning and computer vision to augment the capabilities of its robotics offerings. The robotics venture undoubtedly takes center stage as a driving force for Deere & Company. Bolstered by its strong brand recognition, financial prowess and decades of experience in the agricultural machinery domain, the company is poised to ride the wave of impending growth in the robotics sector. The company also has a substantial history of providing a dividend. This appeals to income-seeking investors because Deere & Company’s dividend yield is robust and longstanding.

Emerson Electric Co.

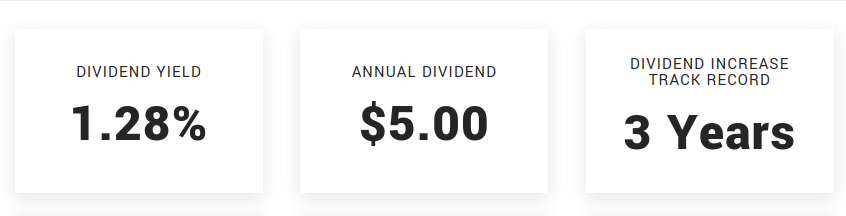

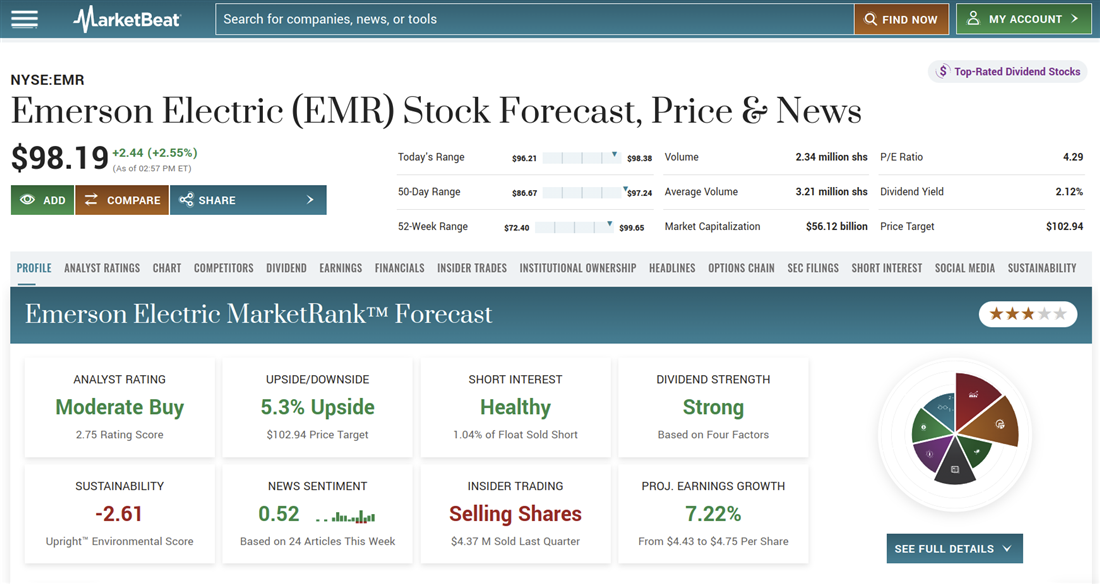

Emerson Electric Co. NYSE: EMR is a diversified industrial technology company catering to industrial, commercial and residential markets with a broad range of products and services. These offerings encompass sensors, controls, electrical products, automation solutions and software, reflecting the company's commitment to innovation across sectors.

Emerson Electric's growth prospects are promising, aligned with the anticipated 6% CAGR in the industrial automation market over the next five years. A proactive stance towards research and development underscores the company's dedication to pioneering new products and services, ensuring its competitiveness in the evolving landscape.

Emerson Electric leverages its intellectual property arsenal, housing over 10,000 patents and applications, to cultivate a competitive edge in the market. The company collaborates with industry peers to expand its market presence through strategic partnerships. Further highlighting Emerson Electric's role in the robotics landscape, the company's robotic automation solutions find applications in various industries, including manufacturing, packaging and logistics. Integrating its sensors and controls within robotic systems enhances precision and control, while its software facilitates the development and management of robotic operations.

The company's venture into designing proprietary robots for specific applications reinforces its position as a leader in the industrial automation market. With a strong management team, a well-defined growth strategy and a commitment to innovation, Emerson Electric is well-poised to capitalize on the burgeoning robotics industry.

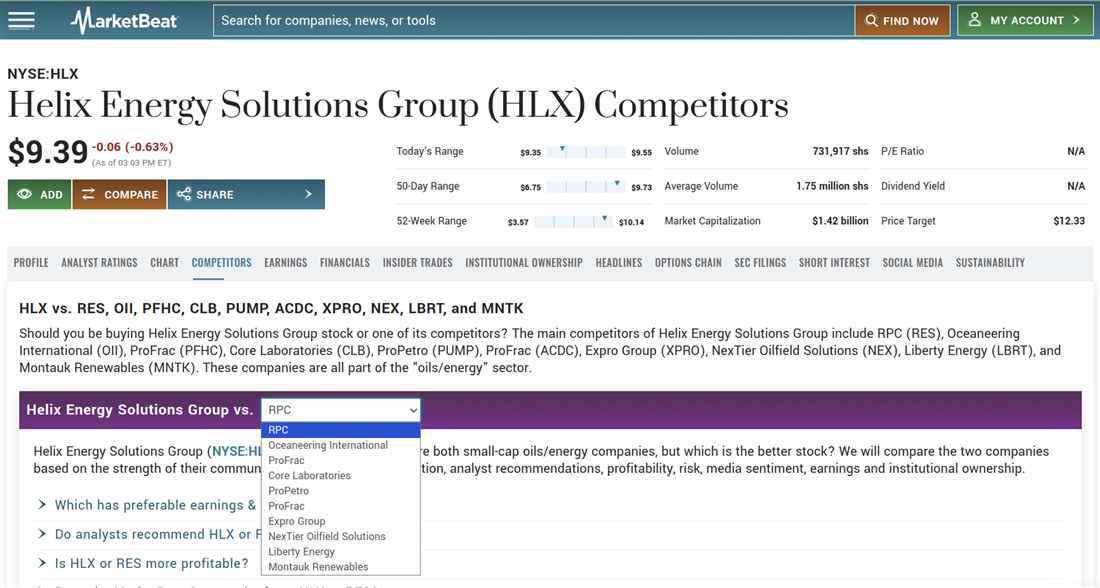

Helix Energy Solutions Group Inc.

Helix Energy Solutions Group Inc. NYSE: HLX operates as a prominent international offshore energy company, offering various services that encompass subsea construction, maintenance, salvage, robotics and full-field decommissioning operations. Helix provides vital robotic services, including the deployment of robots for subsea infrastructure inspection and repair, highlighting its pivotal role in the industry.

Embracing favorable growth prospects, Helix Energy Solutions sets its sights on the offshore energy sector, which should expand at a 3% CAGR over the coming five years. The company's investment in research and development underscores its commitment to pioneering new robotic services and fortifying its growth trajectory. While the company's stronghold in the robotics industry lacks the robustness of an intellectual property portfolio, it compensates with its substantial patent and patent application holdings in other areas, such as subsea construction and maintenance. This strategic approach further bolsters its competitive edge in diverse business domains.

The deployment of robots in hazardous underwater conditions for tasks such as welding and cutting demonstrates the company's innovative approach to addressing dangerous or strenuous challenges for human intervention. The company's ongoing development of new robotic services, including installing and maintaining offshore wind turbines, underscores its commitment to pioneering solutions in the sector. A review of Helix Energy Solutions competition reveals itself as a leader in the offshore energy industry.

Helix Energy Solutions is well-primed to harness the growth potential of the offshore energy market. The company is supported by a robust management team, a well-defined growth strategy and a dedication to innovation, ready to leverage its robotics products and services. However, prospective investors are encouraged to consider the industry's inherent risks before making investment decisions.

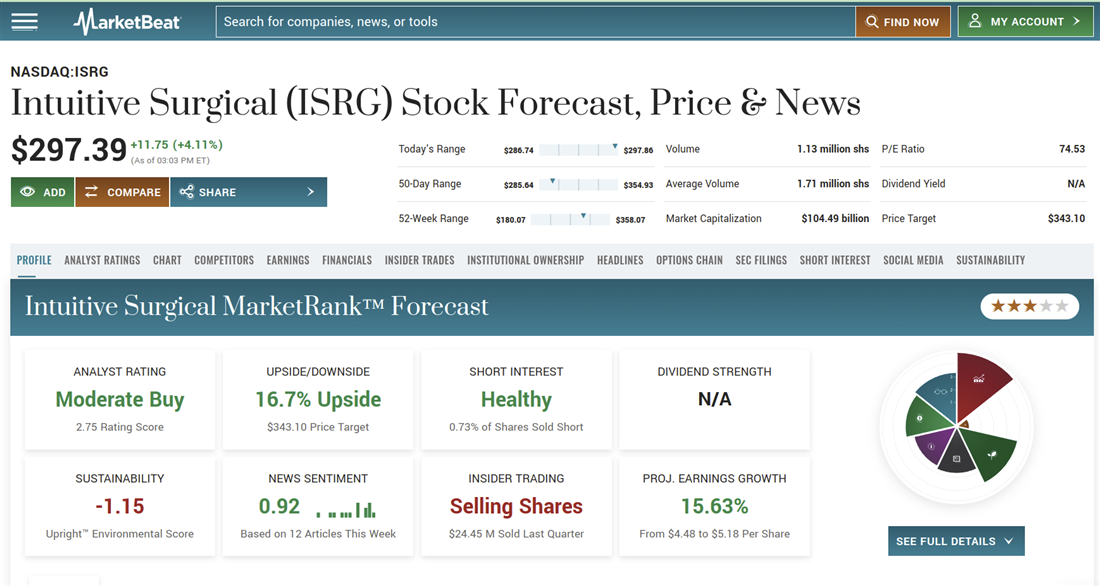

Intuitive Surgical Inc.

Intuitive Surgical Inc. NASDAQ: ISRG is a distinguished medical device company specializing in developing, manufacturing and distributing robotic surgical systems. These advanced tools find application in various minimally invasive surgeries, ranging from gynecology and urology to general surgery. Intuitive Surgical emerges as a dominant force, commanding an impressive market share exceeding 70%. This substantial foothold underscores the company's prominence and leadership within the industry.

Backing its operational excellence is a seasoned management team, with CEO Gary Guthart wielding over two decades of invaluable experience within the medical device domain. This leadership ensures adept navigation in a competitive landscape where rivals such as Medtronic and Stryker strive to make their mark. Although vying for market share, these contenders remain considerably smaller and less influential than Intuitive Surgical.

Intuitive Surgical's strong intellectual property portfolio, boasting over 500 patents and applications, is a formidable barrier to competition. This portfolio safeguards the company's innovations and cements its competitive edge within the market. Forging essential alliances, Intuitive Surgical has cultivated partnerships with various hospitals and medical centers, fostering an extended reach and augmenting its market influence.

The crown jewel of Intuitive Surgical's offerings is the da Vinci Surgical System, a revolutionary tool employed in an array of minimally invasive surgeries. This system enables surgeons to operate through small incisions, a feat that minimizes patient discomfort and reduces scarring. Complementing this flagship system are offerings like the da Vinci Xi Surgical System and the da Vinci SP Surgical System, underscoring the company's continuous innovation.

Nauticus Robotics Inc.

Nauticus Robotics Inc. NASDAQ: KITT emerges as a trailblazing force in ocean robotics, harnessing cutting-edge technology to deliver comprehensive offerings to the ocean industry. The company's portfolio encompasses various products, ranging from autonomous underwater vehicles (AUVs) and surface robots to innovative cloud software solutions. As a participant in the robotics industry, Nauticus Robotics stands as a modest contender, not wielding a significant market share. However, this factor doesn't diminish the company's potential impact within its niche.

Nauticus Robotics boasts a range of AUVs, effectively employed for diverse applications, including inspection, mapping and sampling. Its software solutions are a control hub for managing and directing AUV operations. Breaking barriers in underwater environments, Nauticus Robotics pioneers groundbreaking technologies such as its aquanaut robot, designed to work with human operators.

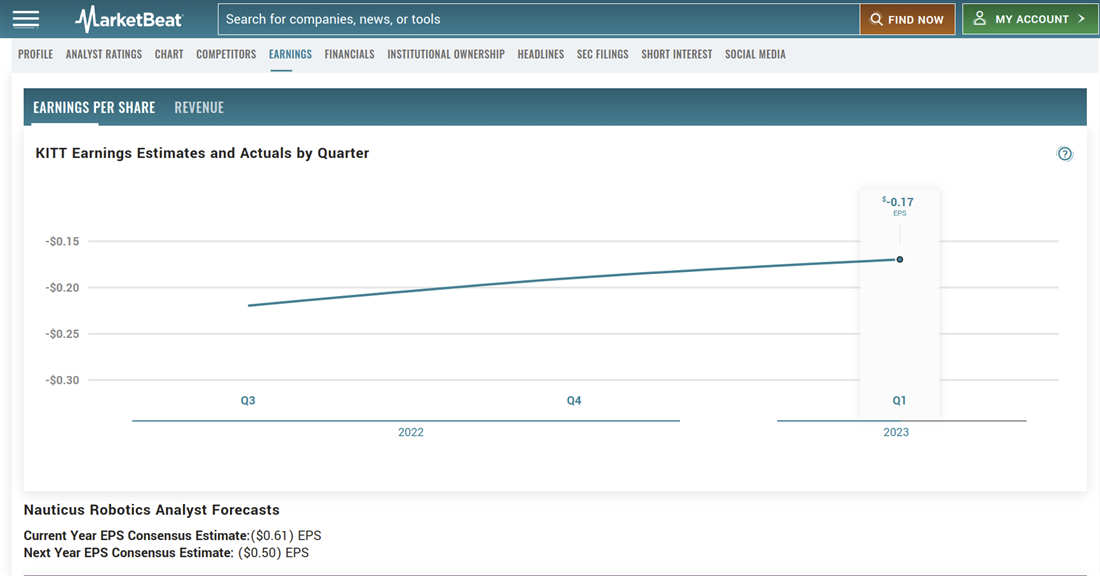

While not yet profitable, Nauticus Robotics earnings per share metrics show that it is working hard to reach profitability. The company's growth prospects hold considerable promise, particularly within the vast ocean economy valued at $2.5 trillion annually.

Moreover, with the offshore wind power sector projected to soar to a capacity of 235 GW by 2030, Nauticus Robotics strategically positions its AUVs and software to tap into these lucrative markets. Nauticus Robotics presents a compelling proposition fueled by adept management, a clear growth trajectory and an unwavering commitment to innovation.

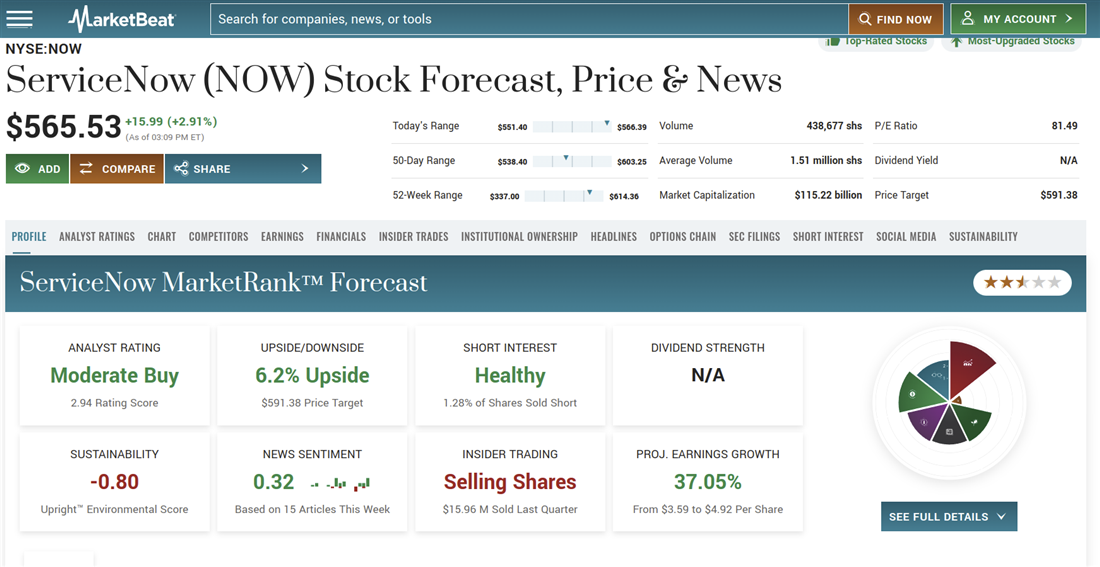

ServiceNow Inc.

ServiceNow Inc. NYSE: NOW operates within robotic process automation (RPA) rather than directly developing or selling physical robots. This strategic focus revolves around offering solutions to streamline operations by automating repetitive tasks spanning activities like data entry and customer service interactions. ServiceNow's RPA solutions seamlessly integrate with its other offerings, enabling end-to-end process automation. ServiceNow's growth prospects anticipate a promising future and fit the projected growth trajectory of the RPA market, which should expand at a commendable CAGR of 20% over the next five years.

This growth is complemented by the company's strategic diversification efforts, entering into new healthcare and financial services sectors. While ServiceNow may not hold a dominant stance within the robotics industry, its RPA solutions resonate with a diverse client base and its strategic trajectory positions it for future growth in alignment with the evolving demands of automation and efficiency.

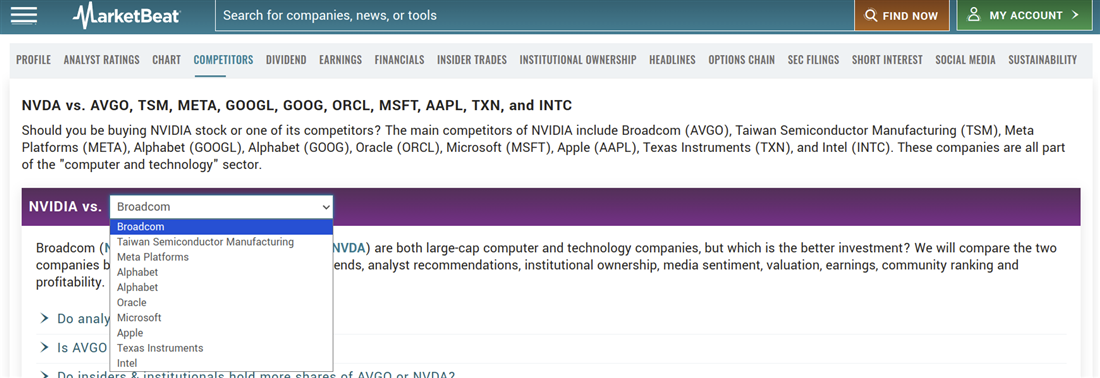

NVIDIA Corp.

NVIDIA Corp. NASDAQ: NVDA provides crucial technology rather than directly crafting robots. NVIDIA's graphics processing units (GPUs) are pivotal in shaping robotic applications, from autonomous vehicles to drones and manufacturing robots. Within the autonomous vehicle sphere, NVIDIA's Drive AGX Xavier SoC emerges as a comprehensive solution integrating GPU, CPU and pivotal components vital for autonomous driving. Likewise, the domain of drones benefits from NVIDIA's Jetson Nano development kit, which bestows these airborne machines with computational prowess via GPUs.

Furthermore, the utility of NVIDIA's GPUs extends to the manufacturing realm, facilitated by the Clara Parabricks software platform. This convergence of GPU, CPU and other key elements underscores the company's commitment to empowering robots across myriad sectors. NVIDIA's GPUs have seamlessly integrated into various robotic implementations, solidifying their significance within the ecosystem.

NVIDIA’s competition review reveals it squares off against stalwarts like Intel and AMD. These industry giants also contribute GPUs to the robotics sector, shaping the competitive dynamic within the field.

As the robotics industry embarks on a trajectory of swift growth, poised at a CAGR of 20% across the upcoming five years, NVIDIA stands ready to ride this wave. The burgeoning demand for its GPUs is poised to soar with the industry's expansion, underscoring the pivotal role of computational prowess in propelling robotic advancements.

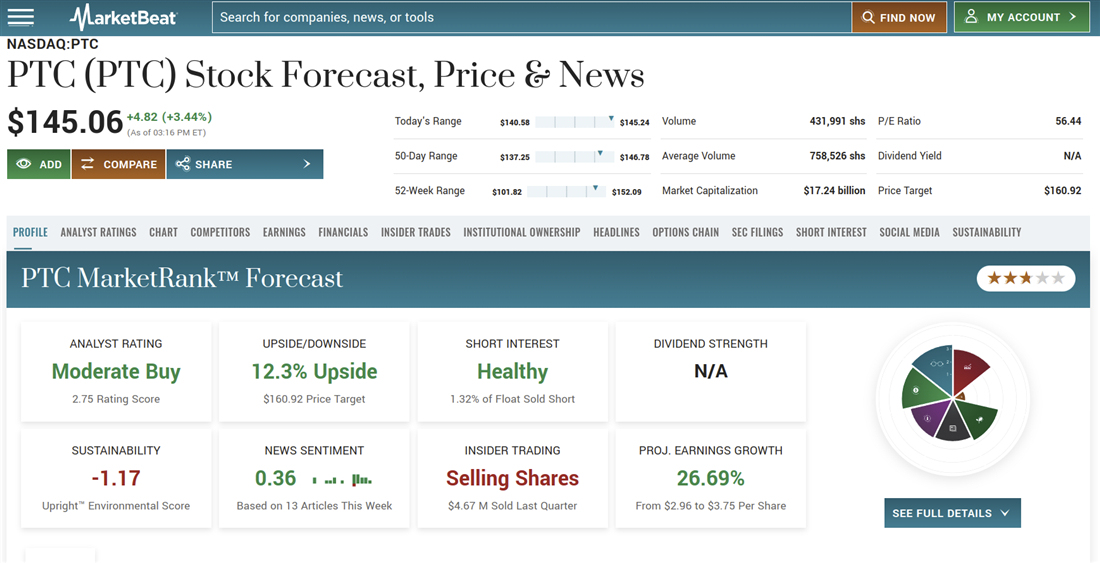

PTC Inc.

PTC Inc. NASDAQ: PTC provides pivotal software solutions rather than a direct contributor to robot development. PTC's software, including the Onshape and ThingWorx platforms, plays an instrumental role in designing, developing and deploying robots. Onshape facilitates collaborative design and simulation of robot behavior, while ThingWorx enables data collection from robots for performance enhancement.

PTC's strategic partnerships with prominent robotics companies like ABB, Fanuc and Yaskawa underline its commitment to expanding its influence and market presence within the industry. This collaboration empowers PTC to navigate the dynamic robotics landscape.

PTC's intellectual property portfolio within the robotics sector stands strong, underpinning its influence. With over 2,000 patents and patent applications dedicated to software for product development and deployment, PTC bolsters its competitive edge. PTC's software solutions hold a pivotal status within various robotics companies. As an influential enabler, PTC's growth trajectory aligns with the expanding robotics landscape, cementing its role as a fundamental technological partner.

QUALCOMM Inc.

Qualcomm Inc. NASDAQ: QCOM substantially influences the robotics industry through its Snapdragon processors, which are instrumental in shaping various robotic applications spanning autonomous vehicles, drones and manufacturing robots. Qualcomm's Snapdragon Ride platform emerges as a comprehensive solution, uniting software and hardware for autonomous driving.

Similarly, Snapdragon processors empower drone development through the Snapdragon Flight platform, offering a holistic suite of components. Moreover, Qualcomm's Snapdragon processors lend their prowess to manufacturing robots, facilitated by the Snapdragon Industrial platform, an integrated solution for such applications. This convergence underscores Qualcomm's commitment to shaping the robotic landscape.

Supporting its influence, Qualcomm's intellectual property portfolio within the robotics sector looms large, boasting over 16,000 patents and patent applications related to processors and semiconductor technologies. This substantial portfolio serves as a pillar of its competitive advantage. Qualcomm's Snapdragon processors play a pivotal role across various robotic applications.

As an integral enabler, Qualcomm's growth trajectory aligns with the burgeoning robotics landscape, cementing its role as a technological partner poised for the future. Income-seeking investors will find that QUALCOMM’s dividend structure is quite generous and has over twenty years of historical data showing dividend increases.

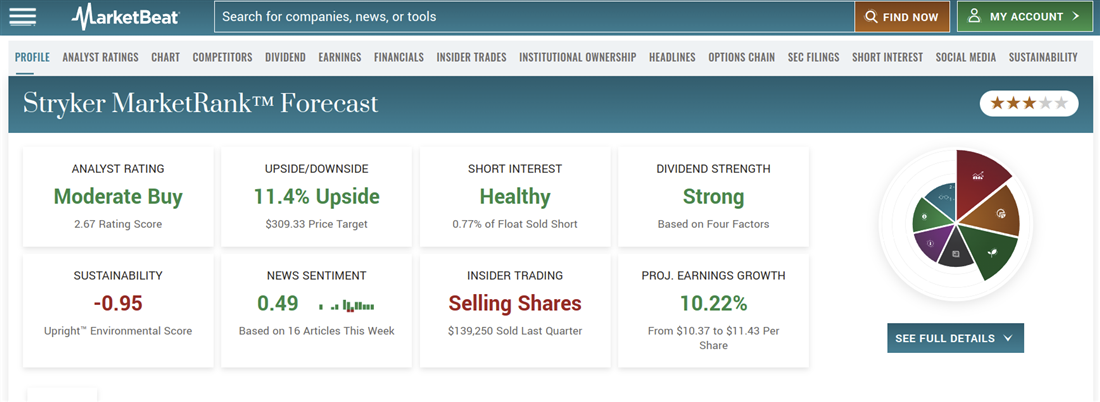

Stryker Corporation

Stryker Corporation NYSE: SYK is pivotal in advancing surgical procedures through its range of robotic surgical systems. These systems are designed explicitly for intricate procedures such as knee replacements, hip replacements and spine surgeries, where precision is paramount.

Stryker's flagship products include the Mako Robotic-Arm Assisted Surgery System, catering to knee and hip replacement procedures. The system employs a robotic arm to assist surgeons in making precise incisions and placing implants accurately. Similarly, the ROSA Robotic System for Spine Surgery aids surgeons in navigating the spine and implant placement.

Stryker forges partnerships with hospitals and medical centers, strengthening its presence, facilitating surgeon training and promoting the adoption of its robotic surgical systems. This collaborative approach enhances the company's market reach and aids in establishing its systems as standard practice.

Stryker shines as a leader in developing and manufacturing robotic surgical systems. Its stature is affirmed by its substantial market share and strong position, further cemented by its established presence in the market.

Stryker is poised to capitalize on this growth as the robotic surgical systems market gears up for a projected CAGR of 10% over the next five years. Its position as a leading player positions it to harness the momentum generated by the market expansion. Stryker's prowess is reflected in its robust intellectual property portfolio, encompassing over 1,000 patents and applications linked to robotic surgical systems. This portfolio fortifies its competitive edge and innovation capacity.

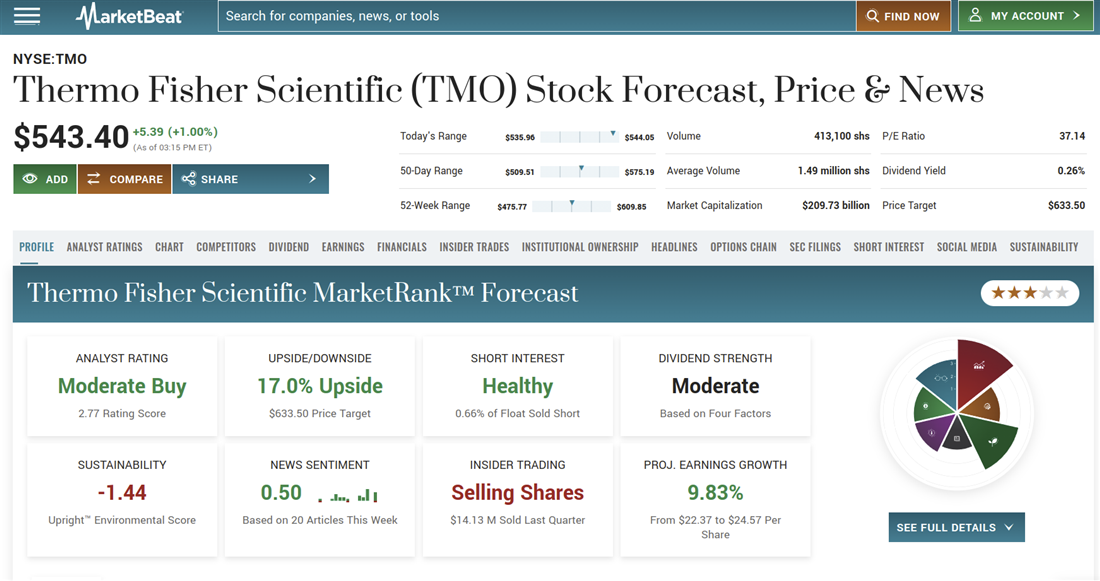

Thermo Fisher Scientific Inc.

Thermo Fisher Scientific Inc. NYSE: TMO focuses on automated laboratory systems that revolutionize various applications. These systems find utility across domains such as drug discovery, clinical diagnostics and food safety testing, showcasing their versatility and potential to enhance efficiency.

Thermo Fisher Scientific's automated laboratory systems are key enablers in streamlining drug discovery, a process crucial to the pharmaceutical industry. By automating intricate steps, these systems can significantly accelerate drug development timelines and reduce associated costs, fostering innovation.

Thermo Fisher Scientific's automated laboratory systems play a pivotal role. Automating diagnostic procedures enhances accuracy and expedites patient care, a vital contribution to healthcare. Furthermore, the systems are harnessed for food safety testing, ensuring the quality and safety of food products. Their role in this context underscores Thermo Fisher Scientific's commitment to public health and safety.

With the automated laboratory systems market poised to expand at a projected CAGR of 8% over the next five years, Thermo Fisher Scientific is well-positioned to harness this growth. Its standing as a leader in the market positions it to capitalize on the opportunities arising from this expansion. Thermo Fisher Scientific's extensive intellectual property portfolio, comprising over 10,000 patents and applications related to automated laboratory systems, underscores its commitment to innovation and competitive prowess. While not dominating the wider robotics industry, Thermo Fisher Scientific excels as a leader in developing and manufacturing automated laboratory systems.

Zebra Technologies Corp.

When examining Zebra Technologies Corp. NASDAQ: ZBRA, it becomes evident that the company seeks automation solutions rather than direct robot development. Zebra's various products and services find their applications within diverse automated scenarios.

Within warehouse environments, Zebra's offerings shine as essential components of automation. Barcode scanners and RFID readers streamline the movement of goods, while automated guided vehicles (AGVs) navigate these spaces efficiently. In manufacturing plants, Zebra's contributions extend to manufacturing automation, where vision systems and data collection devices optimize production processes. The utilization of pick-and-place robots underscores the company's commitment to enhancing manufacturing efficiency.

Zebra's products automate the delivery of healthcare services, epitomized by robots that ensure precise medication delivery to patients.

Although not dominant in the broader robotics industry, Zebra's products and services have permeated automation applications across warehouses, manufacturing plants and hospitals, reaffirming their practicality and widespread adoption.

Zebra Technologies' strong intellectual property portfolio of over 1,000 patents and patent applications about its products and services reinforces its competitive standing. Strategic partnerships with industry giants like Amazon Robotics, Honeywell and SSI Schaefer contribute to Zebra's market presence and growth.

Robotic Synergy Ignites a Bold New Era

Robotic synergy encapsulates how diverse industries are collaboratively shaping a transformative age through the fusion of technology and human ingenuity. These companies not only influence their respective sectors but remind us that the impact of technology transcends limitations, enriching human lives in ways previously unimagined.

Amid the convergence of technology and human ingenuity, the symphony of robotic synergy resounds, promising better lives, safer societies and an interconnected world where potential boundaries are pushed ever further.

Methodology

The stock selection process featured in this article was a meticulous journey driven by comprehensive research, key metrics analysis and expert insights from analyst reports. Finding new technologies to invest in required a rigorous review of every USA-based robotics sector stock. We scoured the New York Stock Exchange (NYSE) and the Nasdaq, looking for robotics companies. Then, we embarked on a quest to distill a diversified yet cohesive set of companies that collectively reflect the dynamism of the robotics industry. The following factors played a pivotal role in determining the final selection of these 16 stocks.

We examined the financial metrics and market capitalizations. Stocks showcasing stability, sustained growth and a considerable market capitalization were considered. The sixteen chosen emerged as standout contenders that met these criteria. Moreover, the endorsement from financial analysts in the form of buy ratings added a layer of credibility to these selections.

A unanimous vote of confidence from analysts solidified the belief that these companies were poised for future growth, aligning with the burgeoning trajectory of the robotics industry. Their expertise in evaluating these stocks affirmed the strategic potential of each company in contributing to the broader narrative of technological evolution.

The chosen stocks represent a mosaic of technological innovation, financial viability and future prospects. This selection process ensured that the companies showcased in the article are significant players within the realm of robotics and reflect the industry's dynamic growth and transformative potential.

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report