Share repurchases are a controversial topic because they often do little more than hide the impact of share-based compensation or amplify (at face value) sluggish earnings growth. However, as with the stocks today, share repurchases can drive shareholder value by reducing the share count. The long and short of it is that X value divided by fewer shares equals more value per share for shareholders than before. However, share repurchases alone are insufficient to impact share prices positively. Investment success requires a solid business and an outlook for sustainable growth.

Gen Digital Ups the Ante With Share Repurchases; Guides for Sustainable Growth

Gen Digital Today

$27.77 -0.06 (-0.22%) (As of 02:29 PM ET)

- 52-Week Range

- $19.08

▼

$31.72 - Dividend Yield

- 1.80%

- P/E Ratio

- 28.34

That’s worth 20% of the market cap and more than offsets the impact of share-based compensation. The net result of share-based compensation, dilutive actions, and share repurchases reduced the share count by 1% in FQ4/CQ1 and should continue to do so this year.

A dividend compounds Gen Digital's capital return. The stock pays about 2.0%, with shares trading near a two-year high. The payout is reasonably safe, with a payout ratio of 25% and a healthy balance sheet. The company carries some debt and has a moderately elevated 4X leverage ratio, but no red flags are raised. Highlights from the latest report include increased cash, flat assets, debt and liabilities down, and equity flat.

The recent pop in share prices is due to the results, which were better than expected and point to sustained growth with margin expansion this year and next. Eight analysts rate this stock with a consensus of Moderate Buy and a price target of $26, about 6% above the latest close.

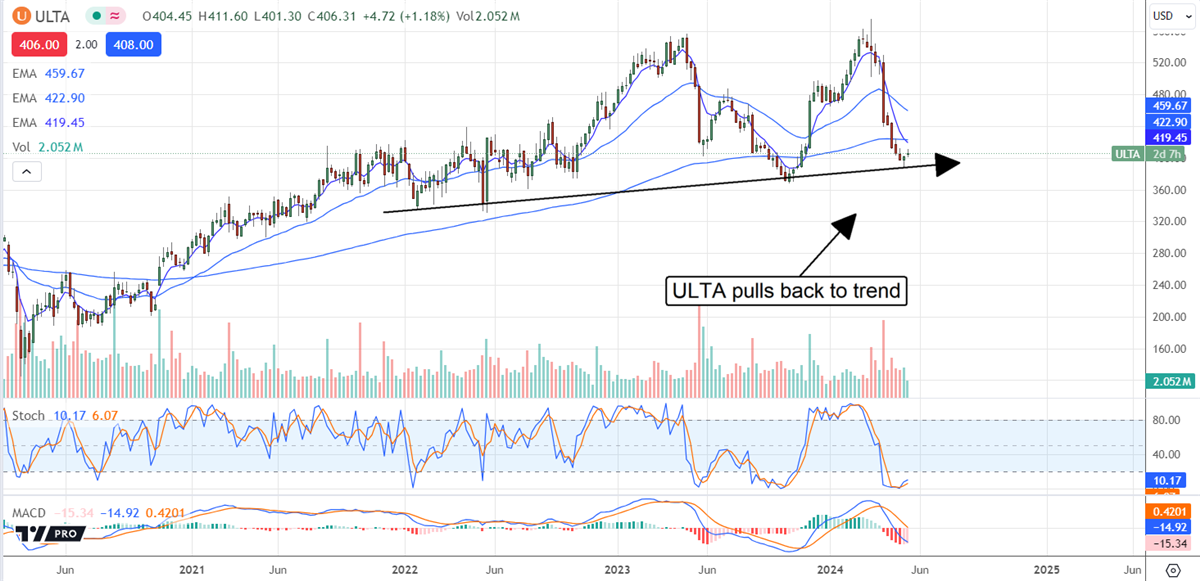

Ulta Beauty has a Beautiful Repurchase Program

Ulta Beauty Today

$425.36 -4.65 (-1.08%) (As of 02:34 PM ET)

- 52-Week Range

- $318.17

▼

$574.76 - P/E Ratio

- 17.02

- Price Target

- $439.30

Analysts moderated their price targets following the last earnings report, but the sell-off was overblown. Marketbeat tracks seventeen revisions from twenty-one analysts since the report, including an upgrade, a downgrade, and numerous price target reductions. The takeaway is that the range of targets is narrowing, and the consensus fell compared to last quarter but is still well within the one-year range; analysts still view this stock as a Moderate Buy and imply a 35% upside for its price.

Darden Restaurants Has Tasty Returns to Drive Shareholder Value

Darden Restaurants Today

DRI

Darden Restaurants

$183.06 -4.53 (-2.41%) (As of 02:28 PM ET)

- 52-Week Range

- $135.87

▼

$188.88 - Dividend Yield

- 3.06%

- P/E Ratio

- 21.11

- Price Target

- $187.44

Darden’s balance sheet is still recovering from Ruth’s Chris acquisition but is in fine shape. The cash and current assets are down, but total assets are up, long-term debt is well-managed, and equity is flat. The salient point is that the company is well capitalized, has positive and growing cash flow, and has a low leverage ratio below 1X equity. The company can continue increasing its distribution and repurchasing shares.

Before you consider Gen Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gen Digital wasn't on the list.

While Gen Digital currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.