If you were an early investor in Chipotle Mexican Grill Inc. NYSE: CMG when it went public in January 2006 at just $22 a share, you'd be sitting pretty as it trades around $3,213. It's too easy (and painful) to look back and question why you "shoulda, woulda, coulda" bought shares before the meteoric rise when they were cheap. Unfortunately, they haven't invented a time machine for your investment portfolio to get in on stock winners during the early days.

However, one can learn from the past and try to identify stocks using a proven template that may repeat itself. Here are 3 stocks in the retail/wholesale sector that look like potential Chipotle-like growth candidates to consider for your portfolio.

CAVA Group Inc.

CAVA Group Today

$118.52 +0.68 (+0.58%) (As of 12/24/2024 05:19 PM ET)

- 52-Week Range

- $39.05

▼

$172.43 - P/E Ratio

- 257.65

- Price Target

- $143.80

Often considered the Chipotle of Mediterranean food, CAVA Group Inc. NYSE: CAVA operates over 330 Cava quick-service restaurants. Its garden-style, point-and-choose toppings format is similar to Chipotle's, as customers can select ingredients for their custom salad or grain bowls and pitas. Unlike Chipotle, the food at Cava is much healthier, comprised of fresh vegetables and lean meats, including lamb meatballs, Harissa honey chicken and toppings like hummus, Crazy feta cheese, roasted eggplant, pickled cabbage slaw, tomatoes, cucumbers, pickles and corn.

Shares are trading up 79.8% year-to-date (YTD) but may have much more upside as the company continues to expand.

Scorching Growth

Cava reported Q4 2024 EPS of 2 cents, beating consensus estimates by 2 cents. Revenues surged 52.6% YoY to $175.5 million, beating consensus estimates for $174.27 million. For the full year 2025, EBITDA is expected to be between $86 million and $92 million. Same-restaurant sales rose 11.4% YoY, and traffic increased 6.2% YoY. The company opened 19 net new restaurants ending the quarter with 309 total restaurants, up 30% YoY. Net income was $2 million, and adjusted EBITDA rose to $15.7 million, up $12.2 million from the year-ago period.

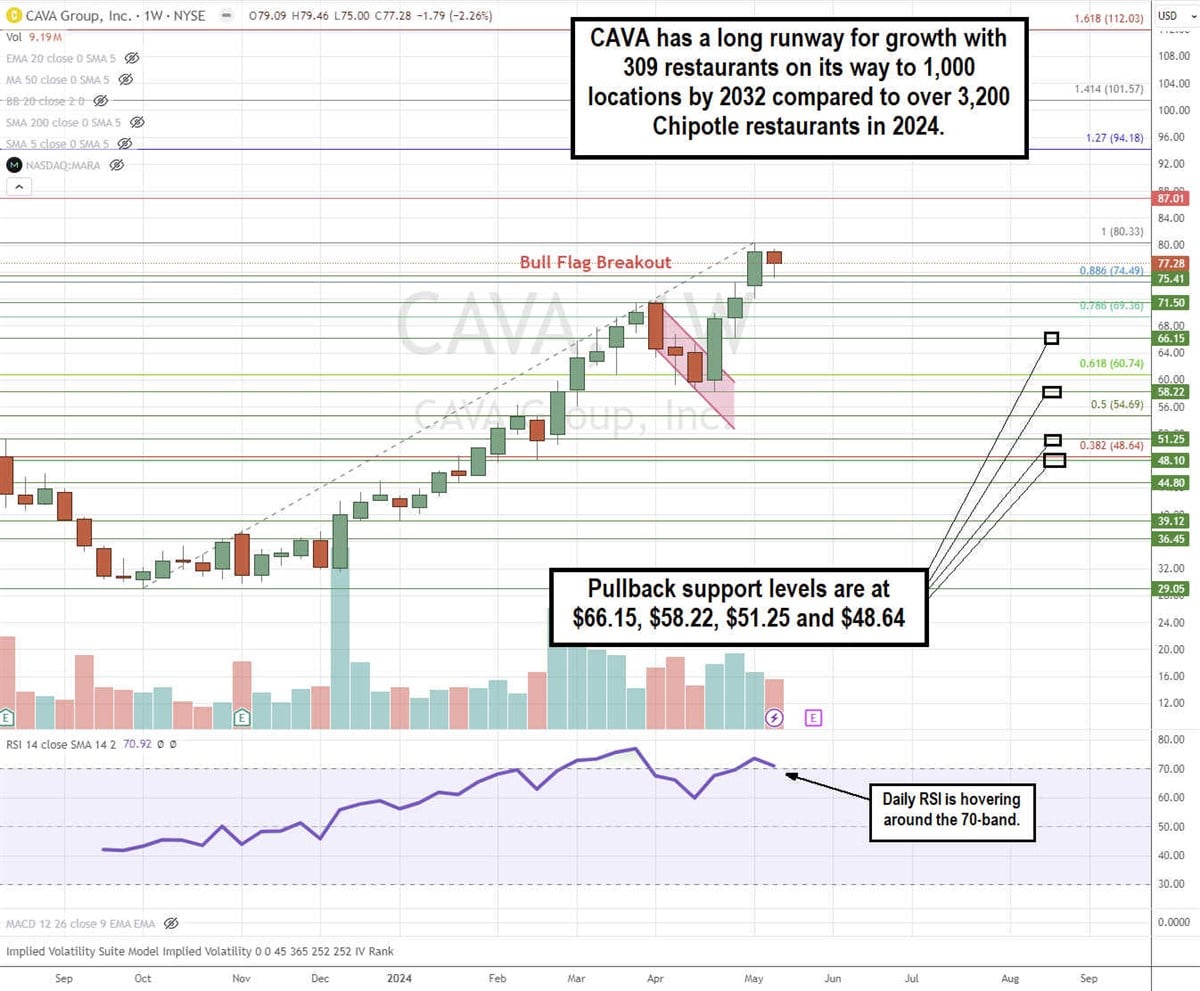

Ready to Expand: Promote From Within

Cava has a presence in 24 states, opening a total of 72 new restaurants in 2023. Despite macroeconomic and geopolitical uncertainty, the company continues to grow at a 15% target annual unit growth rate. Cava is on a growth path towards 1,000 restaurants by 2032. Chipotle has over 3,200 restaurants, which leaves Cava with a long runway for growth to catch up.

The company also practices a promote-from-within method of promoting general managers through its in-house manager development pipeline. The company ended the year with 55 Academy general managers (GMs) and 7 promoted to multi-unit leader positions. In 2023, the company placed 75% of its new restaurant GMs internally.

Vertically Integrated Model

Cava produces its line of sauces and dips for its restaurants. They are also commercially available in grocery stores. The company commenced operations of its new 55,000-square-foot manufacturing facility in Verona, Virginia, to produce CAVA dips and spreads in addition to its Largo, Maryland facility, which has the capacity to support up to 750 restaurants.

Weekly Bull Flag Breakout

The weekly candlestick chart for CAVA illustrates a bull flag breakout pattern. The flag formed at $71.50, indicating parallel lower highs and lows until the breakout triggered surging shares to new highs at $80.33. The weekly relative strength index (RSI) is hovering around the 70-band. Pullback support levels are at $66.15, $58.22, $51.25 and $48.64.

CAVA Group analyst ratings and price targets are on MarketBeat.

Sweetgreen

Sweetgreen Today

SG

Sweetgreen

$33.31 +0.18 (+0.54%) (As of 12/24/2024 05:19 PM ET)

- 52-Week Range

- $9.66

▼

$45.12 - Price Target

- $39.80

Like Cava, Sweetgreen Inc. NYSE: SG also serves healthy, choose-your-own-ingredient salad and grain bowls. Its shares recently spiked 30% on a solid Q1 2024 earnings report. Sweetgreen allows customers to choose pre-selected salads and bowls or customize them using up to 30 freshly chopped, locally sourced ingredients. The company pivoted to include proteins, including salmon, chicken and steak options, which were a smashing hit. In a test study, Sweetgreen discovered that its caramelized garlic steak was a dinner-time favorite, being selected in 1 out of every 5 dinner orders.

Growth Accelerating

Sweetgreen reported a 5-cent EPS miss in its Q1 2024 earnings report. However, its same-store sales grew 5% YoY as the company recorded an adjusted EBITDA of $100,000, which was a strong reversal from a $6.7 million loss in the year-ago period. The average unit volume (AUV) was $2.9 million. Its loyalty program helped grow digital orders to 59% of total sales as the company opened 6 net new restaurants in the quarter.

Raised Guidance

Sweetgreen raised its revenue guidance for the full year 2024 to come in between $600 million and $675 million. The company also raised its adjusted EBITDA to $19 million, up from $10 million. Comparable store sales guidance was also raised to the 4% to 6% range, up from the previous 3% to 5% range. Like Cava, Sweetgreen plans on 15% annual unit growth.

Sweetgreen analyst ratings and price targets are at MarketBeat.

Kura Sushi

Kura Sushi USA Today

$90.64 +1.38 (+1.55%) (As of 12/24/2024 05:19 PM ET)

- 52-Week Range

- $48.66

▼

$122.81 - Price Target

- $84.88

Switching to an Asian theme, Kura Sushi USA Inc. NASDAQ: KRUS operates over 400 technology-enabled Japanese sushi restaurants globally, with 63 in the United States. These restaurants employ conveyor belts with small sushi plates, allowing customers to select and consume the sushi they desire as they come around. The restaurants have over 140 freshly prepared items. The company has opened 10 restaurants in 2024 and raised its guidance to open a total of 13 to 14 this year.

Cost Cutting While Revenues Growing

Kura Sushi reported a Q2 2024 EPS loss of 9 cents, missioned estimates by 6 cents. Revenues surged 30.4% YoY to $57.3 million, beating consensus estimates for $56.6 million. Comparable sales growth was up 3%. Adjusted EBITDA grew 23% YoY. The company was able to drop G&A expenses down to 14.3% of sales, compared to 16.3% in the year-ago period. The company opened 5 new restaurants in the quarter, including locations in Kansas City, Missouri, Illinois, Ohio and Texas. Its rewards program has helped boost U.S. sales to a third of total sales compared to less than 25% of total sales in the year-ago period. Rewards program members also spend 10% more per ticket and visit 1.3 times per month.

Sushi Slider

Kura Sushi is currently getting certified in the U.S. for a new battle-tested technology from Kura, Japan, called the Sushi Slider. The company hopes to test and retrofit the Sushi Slider this summer. The Sushi Slider puts rice balls directly onto the sushi plates and takes them directly to each dine-in employee. This speeds up the process, whereas it takes 2 to 3 employees to spend half their shift during peak hours placing rice balls manually on the sushi plates and handing them to the next person on the making line. This automation would dramatically improve operational output.

Kura Sushi analyst ratings and price targets are at MarketBeat.

Before you consider CAVA Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CAVA Group wasn't on the list.

While CAVA Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report