Dividend Kings are high-quality income investments for long-term-oriented investors. Investors don't buy these stocks once and forget about them; they buy them repeatedly, building solid positions that drive portfolio value. Among the qualities of Dividend Kings is the ability to withstand economic cycles, market downturns and lapses in growth to come back better and stronger than before. The trick is knowing when to buy them, but the adage rings true: buy them when they are down.

Northwest Natural Is a High-Yielding King to Buy Now

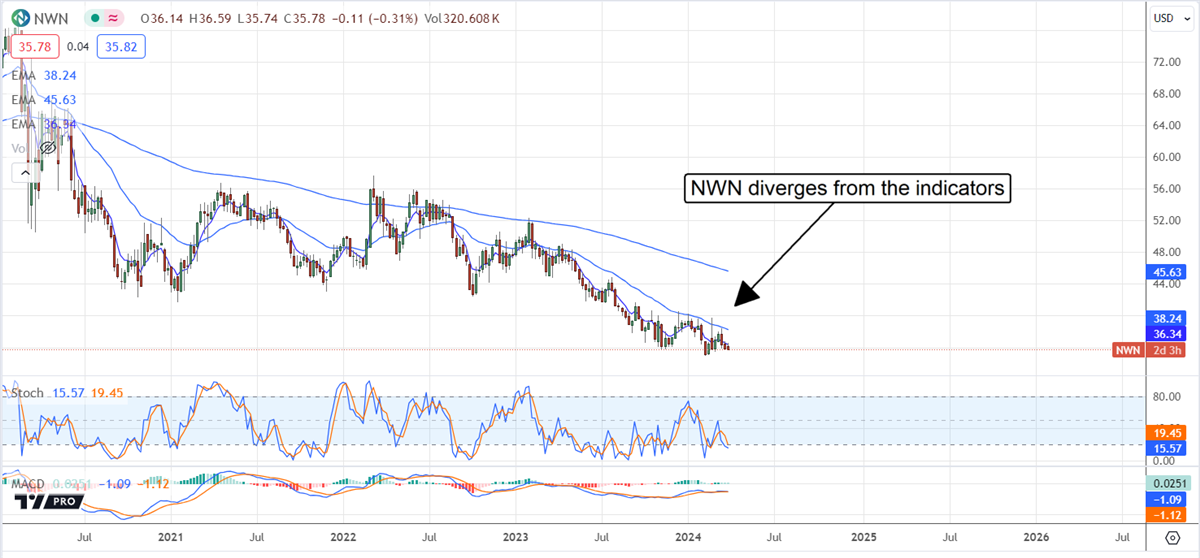

Northwest Natural NYSE: NWN is a high-yielding Dividend King, paying more than 5.25% with shares at a multi-year low. The multi-year low is due to a lack of interest in natural gas utilities; the company has sustained operations, invested in growth, and paid substantial dividends the entire time its stock price trended lower.

The takeaways are that the company is set up to continue sustaining its dividend and that the business is growing. Analysts also expect a significant margin expansion and earnings growth, improving the payout ratio and lowering it below 70%. Analysts rate the stock as a Hold and have trimmed their targets recently but still see deep value in it. The lowest price target is above the current price action, and consensus forecasts a 27% upside.

Federal Realty Investment Trust: Investing in Retail with Retail Estate

Federal Realty Investment Trust NYSE: FRT specializes in high-quality retail real estate properties across the United States. Its strategy allows exposure to the retail industry while minimizing risk to investors. The company earns rent, not sales, and is locked into long-term contracts. The stock yields nearly 4.4%, trading near the long-term low, and is reliably safe. The firm has paid and sustained annual distribution increases for 55 years and is on track to continue with increases for the foreseeable future. Analysts rate the stock as a Moderate Buy and see it advancing about 2% at the low end of their range. The consensus implies about 15% and may be reached soon.

Stanley Black & Decker Turned a Corner in 2023

Stanley Black & Decker NYSE: SWK hit the skids in 2023 because of a lack of growth and profitability. That changed late in the year, and now it is on track to produce profits and pivot back to growth later this year. Analysts expect top and bottom-line growth to continue in 2025, which is good news for the dividend. The payout ratio went above 100% in 2023 because of the struggle, which caused the company to lean on its balance sheet for support. With profits and growth in the forecast, the payout ratio is back at sustainable levels.

This stock yields 3.45%, with shares at a multi-year low. Analysts tracked by Marketbeat rate it as a Hold with a price target steady over the past year. As it is, consensus implies fair value for the stock at current levels, but that may change later in the year. FOMC rate cuts will reinvigorate the construction market.

Hormel’s 3.3% Dividend Is Tasty at These Levels

Hormel Food's NYSE: HRL shares hit bottom ahead of the FQ1 earnings report and rebounded higher. The consumer staples company outperformed its Q1 consensus figures and reaffirmed guidance, signaling that the pivot back to growth would gain momentum. Analysts hailed the news and started lifting their targets, although it may not become a tailwind until later in the year. As it is, the consensus rating reported by Marketbeat persists at Reduce, with a consensus target 10% below the recent action.

Target Analysts Aim for Higher Share Prices

Target’s NYSE: TGT shares are moving higher following a solid rebound affirmed by the latest earnings release. The market for Target shares is continuing to melt up on improving results and an outlook that includes a return to growth next year. Analysts rate this stock as a Moderate Buy, leading the market higher with revisions. The consensus is only 3% above current action but is up 15% following the earnings release, with most fresh targets well above.

Before you consider Federal Realty Investment Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Federal Realty Investment Trust wasn't on the list.

While Federal Realty Investment Trust currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.