2024 was a breakout year for space stocks, with many companies making headlines for their rapid growth and innovative advancements. Rocket Lab NASDAQ: RKLB, for instance, was a standout, with its stock skyrocketing over 360% in 2024 as the company met rising demand for small satellite launches. President Trump’s renewed focus on space exploration, including bold ambitions briefly mentioned in his inauguration speech to return to the Moon and reach Mars, has added fresh excitement and enthusiasm for space stocks.

Despite their already impressive performance year-over-year, many of these companies remain largely under the radar for investors. However, given Trump's latest comments and increasing commercial interest, the space industry might be poised for further expansion.

5 Space Stocks to Watch in 2025 as Excitement Grows

1. Rocket Lab

Rocket Lab USA Today

$19.04 +0.39 (+2.09%) As of 04:00 PM Eastern

- 52-Week Range

- $3.56

▼

$33.34 - Price Target

- $22.72

Rocket Lab continues to impress investors by focusing on small satellite launches, spacecraft systems, and reusable rockets like the Electron. In 2024, the stock surged over 360%, driven by strong execution and growing demand for space access. With nearly 70% of its revenue coming from launch services and space systems, Rocket Lab is well-positioned to meet the need for satellite deployment, expected to exceed 10,000 satellites by 2030.

Looking ahead, the company’s medium-lift Neutron rocket, set to debut in 2025, is a potential game-changer. This rocket will allow for larger payloads, opening the door to new customers and revenue streams. Rocket Lab’s expanded partnership with NASA under the VADR program also strengthens its position as a leader in cost-effective, reliable launches.

2. Redwire Corporation

Redwire Today

$9.44 +0.11 (+1.13%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $3.68

▼

$26.66 - Price Target

- $17.71

Redwire NYSE: RDW specializes in space infrastructure and technology, providing essential components such as solar arrays, sensors, and deployable booms. The company’s stock has gained an incredible 650% over the previous year, reflecting its vital role in supporting government and commercial space missions. Notable projects include contributions to the European Space Agency’s Hera mission and involvement in Firefly Aerospace’s lunar lander.

As demand for space-based manufacturing and biotech solutions grows, Redwire’s expertise positions it well for future growth. With its innovative product portfolio and early success in 2025, the company is a compelling pick for investors seeking exposure to space infrastructure.

3. Virgin Galactic

Virgin Galactic Today

$2.54 +0.07 (+2.63%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $2.18

▼

$28.20 - Price Target

- $19.85

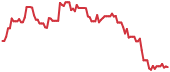

Virgin Galactic NYSE: SPCE has been a pioneer in commercial space tourism, offering customers the chance to experience space travel firsthand. However, the company faced significant headwinds in 2024, with its stock dropping 86%. Despite these challenges, the company’s vision remains ambitious, focusing on both tourism and research collaborations.

Analysts have mixed views on the stock, but with a consensus price target forecasting a 374% upside, Virgin Galactic could be a high-risk, high-reward opportunity if it can overcome operational and financial hurdles and reignite investor confidence.

4. Intuitive Machines

Intuitive Machines Today

LUNR

Intuitive Machines

$7.36 +0.32 (+4.55%) As of 04:00 PM Eastern

- 52-Week Range

- $3.15

▼

$24.95 - Price Target

- $16.00

Intuitive Machines NASDAQ: LUNR has carved out a niche in lunar exploration, positioning itself as a critical partner for NASA’s Artemis program. In 2024, the company secured a $4.82 billion contract to support lunar missions, including deploying communication systems and infrastructure on the Moon. Its upcoming IM-2 mission in 2025, which will establish a cellular network on the lunar surface, highlights its innovative approach.

After a 700% surge over the previous year, Intuitive Machines is already off to a strong start in 2025, reflecting optimism about its role in enabling humanity’s return to the Moon.

5. AST SpaceMobile

AST SpaceMobile Today

$21.30 +0.54 (+2.60%) As of 04:00 PM Eastern

- 52-Week Range

- $2.10

▼

$39.08 - Price Target

- $42.82

AST SpaceMobile NASDAQ: ASTS is on a mission to provide satellite-based broadband connectivity to areas beyond the reach of traditional networks. While the company is still mainly in its pre-revenue stage, its stock rose over 538% over the previous year, reflecting enthusiasm for its disruptive potential.

Currently trading in a bullish formation near a key breakout level, AST SpaceMobile is positioned to benefit from government support for space-based communications. Although speculative, the company’s innovative approach to global connectivity could drive long-term value if it can achieve its ambitious goals.

Before you consider AST SpaceMobile, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AST SpaceMobile wasn't on the list.

While AST SpaceMobile currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.