So you're looking for top-rated AI mutual funds to cash in on the current gold rush into artificial intelligence without buying individual stock? After reading, you'll know which funds have a proven track record and might be worth investing in.

Although the brave new world of AI can be intimidating, you'll learn quickly that in AI, there's something for everyone, whether your interest lies with robotics and driverless vehicles or exploring the world of machine learning and chatbots.

Ready to find out if AI mutual funds are right for you? Let's dive in.

Overview of AI Mutual Funds

AI-based mutual funds — like all mutual funds — are a popular type of investment vehicle that pools multiple investors' money to purchase artificial intelligence stocks, bonds and other securities. They can help you diversify your portfolio, decrease risk and help generate higher returns than individual security investments.

AI funds are unique in focusing specifically on opportunities in artificial intelligence and managed by professional fund managers who bring a wealth of expertise to the table. They use research and market analysis to decide which AI-related stocks and securities they should buy and sell from the fund.

Some funds are AI managed mutual funds, which may sound contradictory, but it simply means that the fund manager uses artificial intelligence to help with decision-making.

As an investor interested in AI, you can spend less time poring over individual stocks. Instead, you can diversify your portfolio with one easy purchase. As for AI ETFs, they differ further in that they are traded publicly on the markets, typically tracking an index such as the S&P 500. You trade directly on an exchange instead of entrusting your money to a fund manager, which gives you more control but carries more risk since it's subject to market fluctuations and volatility.

One key factor when choosing an AI mutual fund is ensuring it has a proven track record of returns. You'll also need to carefully consider the fees, which can vary significantly between different types of AI mutual funds and ETFs.

Like any investment, there are risks involved with AI funds, especially because AI is a new and rapidly changing industry. These funds can be volatile due to the sheer complexity of the technology behind them. For example, AI companies can experience rapid success or failure due to swiftly changing market conditions, regulatory changes or unexpected technical challenges, so make sure you know what you’re getting into before buying into any specific fund.

The types of securities and investments in an best mutual funds for AI will depend on the type of fund. There are a few key categories to consider:

- Robotics funds: As the name suggests, robotics funds invest in companies that design and build robots for industrial, medical or military applications. This can include anything from drones to artificial limbs or driverless cars.

- Machine learning/deep learning funds: These funds focus on computer vision technologies like facial recognition software, virtual personal assistants (VPA), chatbots and other machine learning tools. These funds offer exposure to companies leading the way in developing the future of AI technology.

Why Invest in AI Mutual Funds?

So, is there an AI mutual fund? AI mutual funds are a prime opportunity to grab onto the massive hype around the artificial intelligence revolution, with lower risk than investing directly in individual AI-related stocks. As new technologies, products and services increase faster than ever, having access to a portfolio carefully managed by experienced professionals can mean greater returns as you stay ahead of potential market shifts.

Finding a fund with a competitive fee compared to other investments will give you a chance at higher returns (and less loss!) from your initial investment over time. Plus, with a single purchase of AI-powered mutual funds, you gain wholesale exposure across multiple stocks in one go, allowing you to benefit from different trends while protecting against any downturns.

Best AI Mutual Funds to Buy Now

AI-related mutual funds and ETFs are funds that fulfill at least one of the following:

Above all, always research when choosing a mutual fund, as many variables determine performance. Look for historical returns and risk levels before investing in any type of mutual fund, not just those focused on AI.

|

Name

|

Ticker

|

Market Cap

|

Industry

|

|

VanEck Robotics ETF

|

NASDAQ: IBOT

|

$2.88 million

|

Technology

|

|

Global X Robotics and Artificial Intelligence Thematic ETF

|

NASDAQ: BOTZ

|

$2.25 billion

|

Technology

|

|

Fidelity Disruptive Automation ETF

|

NASDAQ: FBOT

|

$104.05 million

|

Technology

|

|

iShares Robotics and Artificial Intelligence Multisector ETF

|

NYSEARCA: IRBO

|

$444.72 million

|

Technology

|

|

ROBO Global Robotics and Automation ETF

|

NYSEARCA: ROBO

|

$1.37 billion

|

Technology

|

|

Fidelity Select Technology Portfolio

|

MUTF: FSPTX

|

N/A

|

Technology

|

|

T. Rowe Price Science & Technology Fund

|

MUTF: PRSCX

|

N/A

|

Technology

|

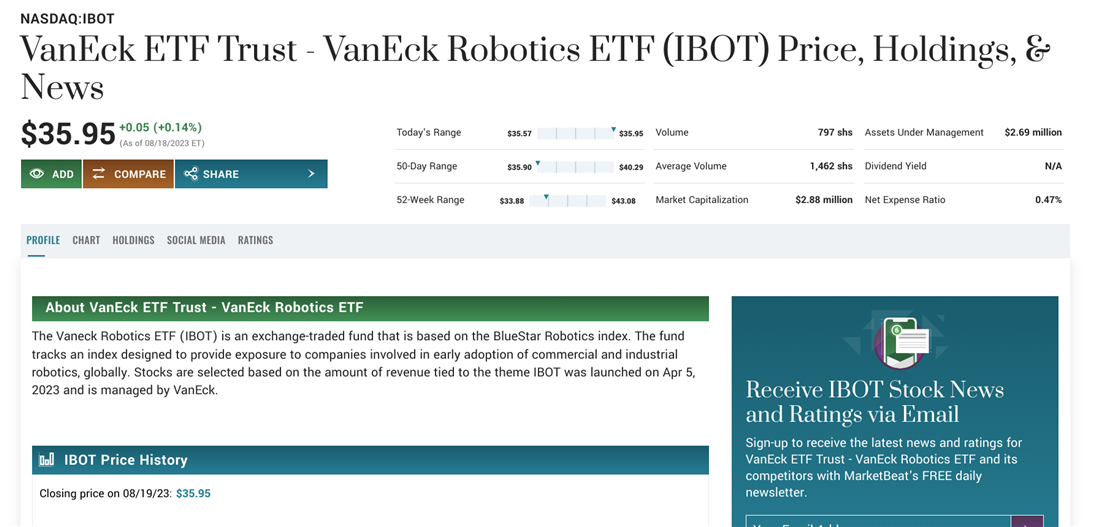

1. VanEck Robotics ETF

The VanEck Robotics ETF NASDAQ: IBOT invests in companies leading the way in the production, design and development of robots and other automated equipment. This ETF is designed to track the performance of companies focusing on three key areas: industrial automation and production, non-industrial automation (such as consumer products) and autonomous vehicles.

IBOT currently holds about 85 stocks, with the top three IBOT holdings including NVIDIA Inc. NASDAQ: NVDA, Emerson Electric NASDAQ: EMR and Swiss company ABB Ltd. Its expense ratio is 0.47%, which is slightly higher than some other ETFs in the AI industry but still competitive. According to analyst ratings, IBOT has a "moderate buy" rating with a target price of $58.81 per share.

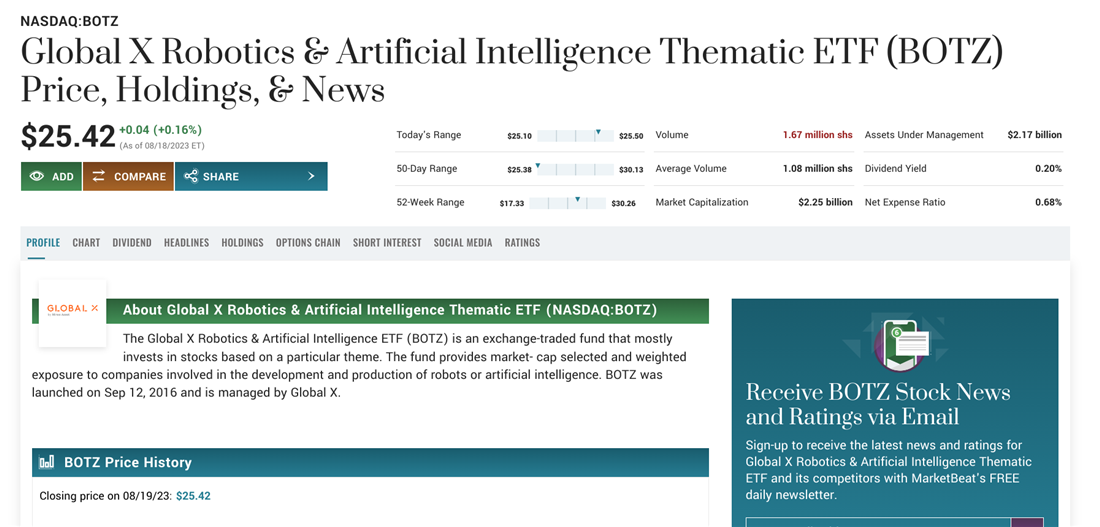

2. Global X Robotics and Artificial Intelligence Thematic ETF

The Global X Robotics and Artificial Intelligence Thematic ETF NASDAQ: BOTZ seeks to correspond to the price and yield of the Indxx Global Robotics & Artificial Intelligence Thematic Index. This index is designed to measure the performance of companies related to the robotics and AI industry. BOTZ could be a great option if you want to invest in mutual funds for AI that have exposure to the entire robotics and AI industry.

BOTZ has a diverse portfolio of companies, including firms working on the industry's hardware and software. Some top BOTZ holdings include Nvidia, Intuitive Surgical NASDAQ: ISRG and Keyence Corp. These companies have all been pioneers in robotics and AI and are likely to grow significantly.

One thing to note about BOTZ is that at 0.68%, it does have a relatively high expense ratio compared to other AI mutual funds and ETFs. However, the fund has a solid track record of returns, making it a great option if you're bullish on the long-term growth potential of the AI industry.

3. Fidelity Select Technology Portfolio

The Fidelity Select Technology Portfolio is a mutual fund that invests in AI, offering a diversified portfolio of 30-plus stocks and securities, many of which are related to machine learning and big data analytics, including companies such as Microsoft and NVIDIA. It has a track record spanning over 40 years and has returned 19.92% annually for the past 10 years, outperforming its benchmark index.

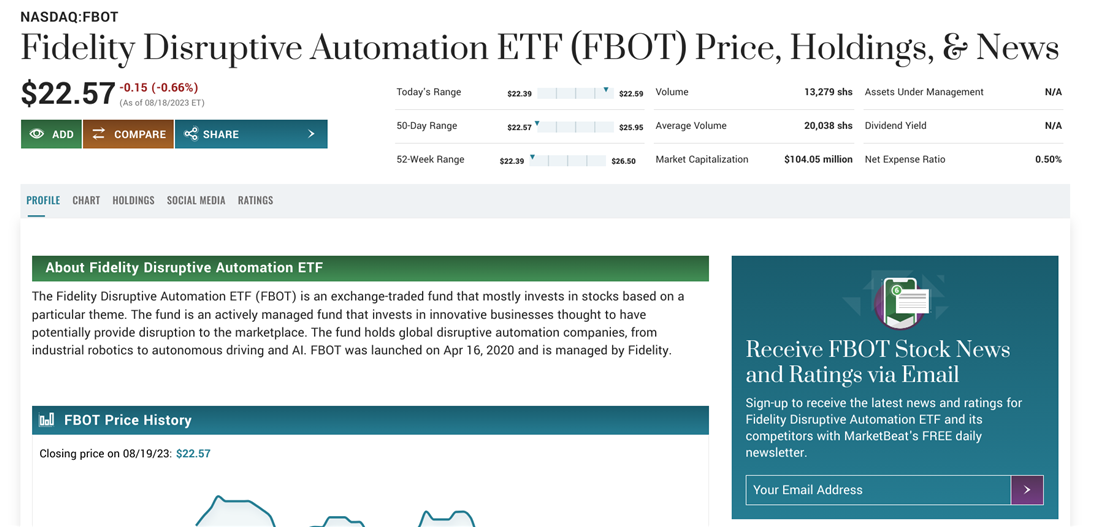

4. Fidelity Disruptive Automation ETF

The Fidelity Disruptive Automation ETF NASDAQ: FBOT focuses on investing in companies that develop innovative automation technologies. That means firms working on automation software, industrial robotics and machine learning algorithms. Besides large companies like Amazon, Microsoft Co. NASDAQ: MSFT and Alphabet, major FBOT holdings include Keyence, Fanuc and PTC Inc. NASDAQ: PTC.

One notable aspect of FBOT is its focus on companies that have the potential to disrupt traditional industries, meaning that the fund may invest in firms outside of the traditional AI sector, such as those involved in logistics or transportation, such as Deere & Company, a major manufacturer of farm equipment. FBOT seeks to provide above-average returns and potentially greater risk than other AI mutual funds by investing in disruptive technologies.

However, FBOT also has relatively low fees compared to other mutual funds, making it an attractive option to capitalize on the potential disruption of various industries. With its focus on innovative and disruptive technologies, FBOT has the potential for long-term growth.

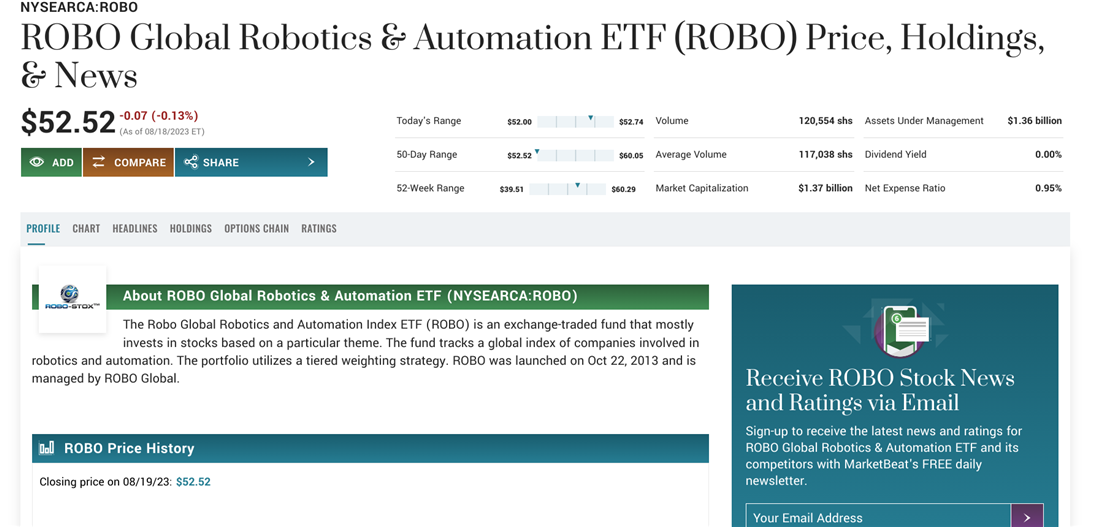

5. ROBO Global Robotics and Automation ETF

The ROBO Global Robotics and Automation ETF NYSEARCA: ROBO is actively managed by ROBO Global, one of the world’s largest providers of robotics and automation investment management services – which seeks to invest in companies leading the way in robotics and automation technology. The fund’s portfolio is diversified across multiple countries and sectors, including healthcare, industrial automation and AI.

Some top ROBO holdings include Japan-based Yaskawa Electric Corp, ABB Ltd. and Teradyne Inc. NASDAQ: TER. These are all leaders in the robotics and automation space and could see significant growth in the coming years.

With a focus on companies that are leaders in their respective fields, ROBO has shown strong returns over the years, making it an attractive investment option.

One thing to note about this ETF is that at 0.95%, it does have a high expense ratio compared to other AI mutual funds and ETFs. However, ROBO's diverse portfolio across multiple countries and sectors also helps to mitigate risk while still providing exposure to key players. With analysts' "moderate buy" rating and a target price of $63.63 per share, ROBO is a strong investment option to enter the AI market.

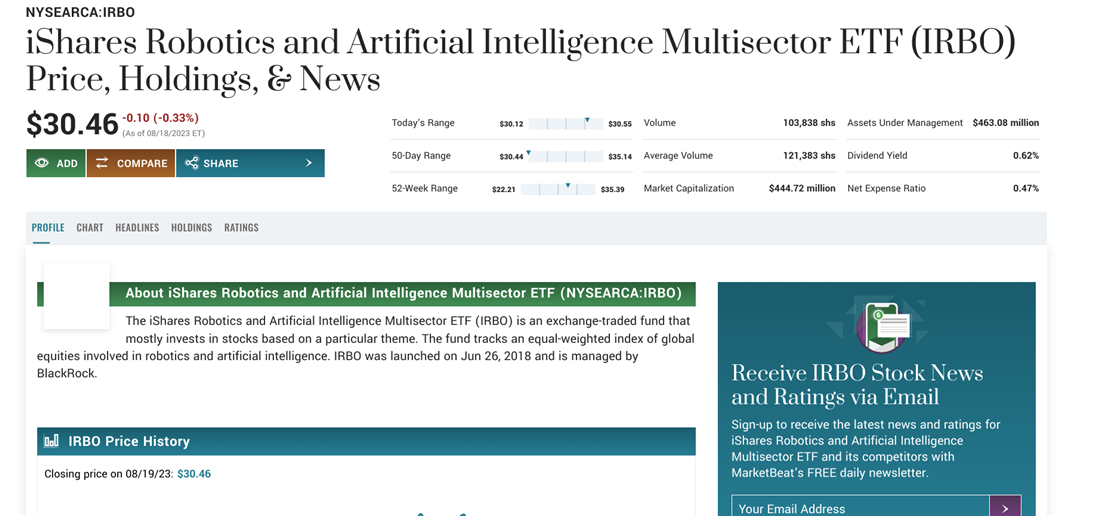

6. iShares Robotics and Artificial Intelligence Multisector ETF

The iShares Robotics and Artificial Intelligence Multisector ETF NYSEARCA: IRBO aims to track an index of global equities in robotics investments and the AI sector. The fund offers exposure to firms at the forefront of robotics and AI technology. Some of the major IRBO holdings include Meta Platforms NASDAQ: META, Nvidia and Apple.

IRBO's index focuses on companies involved in various subsectors of robotics and AI, including industrial robots, 3D printing, drones and software and hardware development for these technologies. IRBO's diverse portfolio includes companies worldwide, making it a great option for global robotics and AI industry exposure.

IRBO has a relatively low expense ratio, 0.47%, compared to other AI mutual funds and ETFs. The fund has performed well, with solid returns over several years. It could be a solid option if you're bullish on AI's long-term growth potential.

7. T. Rowe Price Science and Technology Fund

The T. Rowe Price Science and Technology Fund is an AI-driven mutual fund that invests in companies in developing and applying technology across various sectors, including AI, robotics and automation. With a return of 15.77% over the past decade, the fund has a diversified portfolio of well-established tech giants such as Alphabet, Amazon and Microsoft. It also boasts small- and mid-cap stocks focusing on disruptive technologies, which have shown strong performance in recent years.

AI Mutual Funds: An Intelligent Option for Investors

As more companies flock to embrace the transformative potential of artificial intelligence, you have a range of intelligent options to get in on the ground floor of mutual funds that invest in AI. From actively managed funds to ETFs specializing in AI-focused investments, you can select the approach that best fits your needs and risk tolerance. AI-focused mutual funds are creating an exciting chance to capitalize on the potential of this revolutionary technology.

Before you consider ABB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ABB wasn't on the list.

While ABB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report