AI is here to stay, and it is a problem for some because of the massive increase in power consumption associated with the rise of AI. AI lives in data centers and uses the exact (often more powerful) GPUs and accelerators as Bitcoin mining, making it an unfriendly business for the planet. Dominion Energy NYSE: D, the largest power utility in data center-rich Virginia, must build new natural gas power plants to meet the rising need.

However, every problem brings a solution, and the solution for data centers is to go green. Greener than natural gas. The proliferation of data centers driven by cloud and AI demand is leading to a boom in the renewable energy market, and solar energy is a leading choice. Data centers can range in size and shape but are essentially warehouses filled with racks of servers; warehouses have ample acreage on their roofs well-suited to solar capture.

First Solar Rises on News, Analysts Support, and Outlook

First Solar Today

$136.53 +5.43 (+4.14%) As of 01:58 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $116.56

▼

$306.77 - P/E Ratio

- 11.78

- Price Target

- $250.58

First Solar’s NASDAQ: FSLR stock price began to increase following the Q1 results and went into overdrive on word it had achieved a notable milestone. The EPS assigned First Solar products the EPEAT Climate+ designation, a first for the solar industry, making it a preferred supplier for US government contracts. More importantly, the designation is a globally recognized eco-standard that paves the way for expanded business opportunities as a go-to supplier for solar projects.

The details from Q1 are solid. The company accelerated growth to nearly 45% compared to lower rates in the prior quarter and year. The increase in revenue was accompanied by margin improvement and solid guidance that suggests sustained strength this year. The pace of growth will slow below 30% by year’s end but remains solidly in the double-digits, and the outlook may be cautious.

The analysts' response to FSLR earnings and news updates has been overwhelmingly positive. MarketBeat tracks 25 analysts, and the group is upgrading the stock and raising price targets. The sentiment is up to Moderate Buy from Hold with a price target up 25% in the last twelve months. This tailwind supports the price action, and revisions are leading it higher. All price target revisions issued in June are above the consensus, as are most issued since the Q1 report.

Nextracker Optimizes Output for Solar Operations

Nextracker Today

$41.88 +1.75 (+4.37%) As of 01:58 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $30.93

▼

$62.31 - P/E Ratio

- 10.67

- Price Target

- $55.43

The pedestal on which a solar panel sits is as important, if not more so, than the panel because it impacts efficiency. Panels that don’t track along with the sun’s angle are far less efficient than those that do, and Nextracker NASDAQ: NXT is the leader in that regard. Its solar-tracking panel mounting systems track the sun and use an AI-powered software platform to ensure peak output, and they are fast becoming a must-have item for solar farms.

Nextracker’s FQ4/CQ1 results are equally impressive, with revenue growth accelerating sequentially and YoY to 42%. Margin is also widening due to sales leverage, and operational quality and strengths are expected to continue. The analysts' activity following the report is mixed, but the takeaway is bullish. The few analysts who lowered their targets aligned with the consensus estimate for a gain of 25%; the remainder were upgrades, initiated buy ratings, and price target revisions, leading the market to an all-time high.

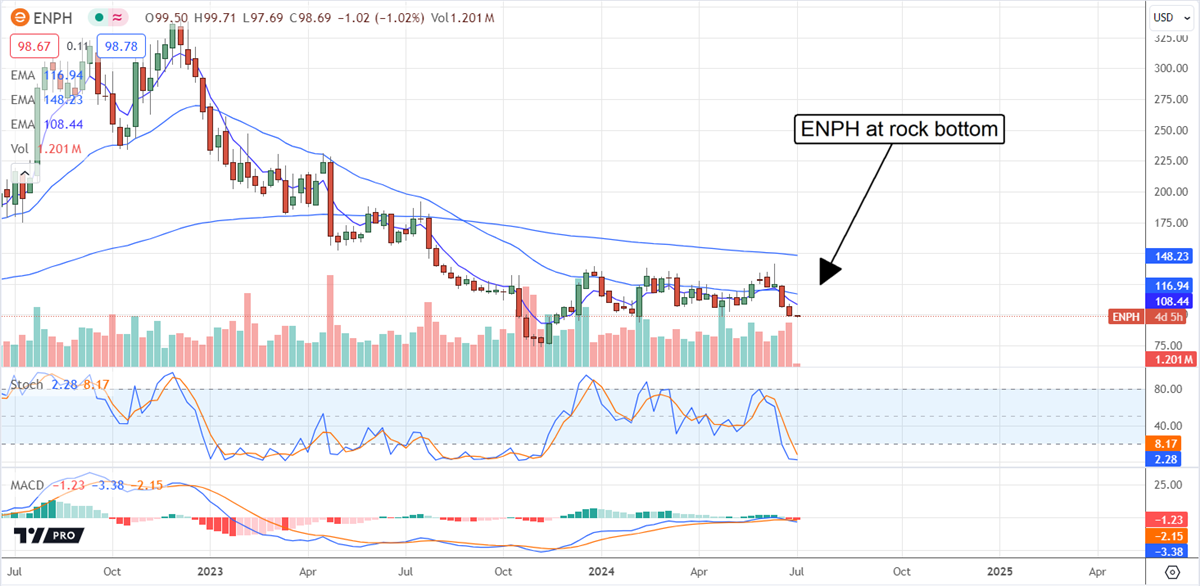

Enphase: Looking at a 25% Industry CAGR Through 2028

Enphase Energy Today

$45.89 +0.82 (+1.83%) As of 01:58 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $44.88

▼

$141.63 - P/E Ratio

- 62.05

- Price Target

- $72.17

Enphase NASDAQ: ENPH business dived this year, but the takeaway is bullish. Oversupply of microinverters and end-market normalization is leading to undersupply and sustained growth. Microinverters are critical to solar power efficiency for many reasons, including optimal panel-level operations and safety. Microinverters convert DC to AC closer to the source, alleviating the need for high-voltage DC delivery systems and reducing the risks of electrocution or fires.

Enphase is at a pivotal moment. The company is expected to return to sequential growth this quarter and accelerate growth through the end of the year. YoY growth is expected next year, but the critical detail is earnings. Revenue is forecast to grow by 45%, but earnings are expected to double.

Analysts' activity has been mixed this year with numerous rating and price target reductions. However, the community continues to rate the stock at Hold, and most of the recent targets assume a slight single to small double-digit upside for the stock. The next catalyst will be the Q2 results released in late July. Analysts have the bar low, so outperformance is expected.

Before you consider First Solar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Solar wasn't on the list.

While First Solar currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.