Carvana Today

$234.67 +13.73 (+6.21%) As of 03:59 PM Eastern

- 52-Week Range

- $71.39

▼

$292.84 - P/E Ratio

- 149.47

- Price Target

- $253.88

Carvana Co. NYSE: CVNA operates an eCommerce platform selling used cars online to consumers. It’s most well-known for its towering car vending machines placed alongside highways and in cities across the nation. Users can frictionlessly find and finance their car purchases online and then pick up the vehicles at a Carvana vending machine. The convenience of the seamless car-buying business experience has made it a disrupter in the auto/trucks/tires sector.

Carvana competes with other used-car retailers, such as Vroom Inc. NASDAQ: VRM, CarMax Inc. NYSE: KMX, and AutoNation Inc. NYSE: AN.

The Iconic Carvana Vending Machines

Starting as a gimmick novelty, Carvana differentiated itself from other online used car platforms with its giant, towering physical car vending machines. The state-of-the-art steel and glass structures stand anywhere from six to 12 stories high. Customers handle all the paperwork and processing online and then make an appointment to have their car delivered or to pick it up from the nearest vending machine. Once at the dealership, the customer places a large token into a slot. Like a giant automated soda machine, their car is transported down from the tower to the ground floor delivery bay, ready to be driven off. These machines can hold up to 27 cars. Carvana has 40 car vending machines with plans to add many more. The cars inside the machines are already sold.

Carvana Roars Back With More Upside to Come

Carvana stock has traded as high as $376.83 in August 2021 to a low of $3.55 in December 2022. The company faced very real fears of bankruptcy at that time as it faced a liquidity crisis and public relations nightmare as customers complained about late titles and registration problems. The company lost $15.74 per share in 2022. The company was overleveraged with debt but was able to make a deal with its creditors to lower its interest expense, enabling it to spring back. The company was able to extinguish $878 million in debt through a corporate debt exchange in 2023, resulting in a net income of $150 million for the year.

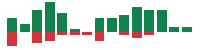

CVNA Completes a Cup Pattern

The daily candlestick chart for CVNA illustrates a cup pattern. The cup lip line formed at $147.25 on July 16, 2024, as CVNA fell to $122.14, forming a rounding bottom. Shares rallied back through the cup lip line, peaking at $154.00 on Aug. 1, 2024, in reaction to its Q2 2024 earnings release. Shares have since fallen back under the cup lip line to potentially form a handle or reverse back down. The daily relative strength index (RSI) peaked and has fallen to the 56-band. Pullback support levels are at $123.04, $111.45, $105.27, and $97.92.

Carvana Reported a Strong Q2 2024

Carvana reported Q2 2024 EPS of 39 cents, crushing consensus estimates by 51 cents and turning a surprise profit. Revenues rose 15% YoY to $3.41 billion, beating consensus analyst estimates by $150.92 million. Net income was $48 million and net income margin was 1.4%. Carvana had 33% YoY retail unit growth and a record 10.4% adjusted EBITDA margin. Carvana hit record adjusted EBITDA of $355 million and a record gap operating income of $259 million. The company sold 101,440 vehicles, up 33% YoY.

Carvana Co-Founder and CEO Ernie Garcia commented, “Carvana's second-quarter results clearly demonstrate the differentiated strength of our customer offering and business model. We not only led the industry in retail unit growth, which accelerated from Q1, but also delivered 1.4% Net Income margin and a new record 10.4% Adjusted EBITDA margin, which sets an all-time high water mark for public automotive retailers.”

Carvana Issues Upside Guidance, and Analysts Chime In

Carvana MarketRank™ Stock Analysis

- Overall MarketRank™

- 80th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 8.2% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- -2.66

- News Sentiment

- 1.20

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 78.25%

See Full AnalysisThe company provided upside guidance for Q3 2024 as it expects a sequential increase in retail units compared to Q2 2024. Full-year 2024 adjusted EBITDA is expected between $1 to 1.2 billion, up from $339 million in 2023. The caveat is that as long as the environment remains stable.

After its strong Q2 2024 earnings report, several analysts took action. Morgan Stanley commended Carvana’s performance but kept its Underweight rating due to the softness in the used car market. JP Morgan raised their rating to Overweight with a price target of $185 per share.

Wells Fargo upgraded Carvana's shares to Overweight from Equal Weight with a $175 price target. Robert Baird resumed rating shares of Carvana with a Neutral and a $160 price target. Carvana analyst ratings and price targets are at MarketBeat. There are 17 analyst ratings on CVNA stock, comprised of six Buys, 10 Holds, and one Sell, with a 4.66% upside to the consensus price target of $143.60. CVNA has a 9.31% short interest.

Before you consider Carvana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carvana wasn't on the list.

While Carvana currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.