The United States economy just entered into a new cycle. Because markets shift according to their six to nine-month expectations, three stocks in the consumer discretionary sector are leading the way in this new rotation. Now that the Federal Reserve (the Fed) has announced its intentions to cut interest rates in 2024, retail investors would benefit from hopping on the wave.

Traders are now pricing these potential interest rate cuts to kick in by May or June 2024. Investors can follow this sentiment by keeping track of the FedWatch tool CME Group Inc. offers NASDAQ: CME. Lower interest rates and a brand-new high for consumer sentiment readings (not seen since 2021) could impact specific stocks.

Names like The Home Depot Inc. NYSE: HD, Starbucks Co. NASDAQ: SBUX, and even Nike Inc. NYSE: NKE are likely to call on a few investment dollars during the upcoming rotation. After all, the Consumer Discretionary Select Sector SPDR Fund NYSEARCA: XLY needs to catch up to the rest of the S&P 500, as it reads an underperformance of 7% over the past 6 months.

Home Depot’s Management is On Point

Home Depot’s management looked outside of its tried-and-tested business model to spur growth by spotting the newest trends in the real estate sector. Announcing a $18 billion acquisition of SRS Distribution, a roofing company, Home Depot is letting retail investors know where the money is.

Lower interest rates could make mortgage financing more accessible for new homebuyers. The construction stocks that Warren Buffett had been buying, like D.R. Horton Inc. NYSE: DHI, drive the way in a new race to prepare housing inventory before these buying sprees hit.

Home Depot is already set to benefit from the do-it-yourself demand and is looking to ride this construction tailwind in the roofing space.

Since November 2023, United States building permits have been rising, so builders and bankers may feel comfortable starting projects injected into the housing market when rates are cut.

Analysts at Mizuho Financial Group Inc. NYSE: MFG see Home Depot going as high as $415 a share. This valuation has yet to reflect the potential upside from the SRS acquisition. Asset managers running the consumer ETF agree that Home Depot is now the third largest holding in the fund for good reason.

Starbucks Drinks Back in Budget

What is more discretionary than a cup of Starbucks coffee? After the stock declined to 79% of its 52-week high, some investors aware of the company’s value could be circling with buying orders. While consumers may have cut back on spending due to stubbornly high inflation rates in the U.S., Starbucks came out on top.

With consumer sentiment at new cyclical highs, the average ticket amount at the coffee giant increased by 4%. Comparable sales in the U.S. rose by 5%, meaning consumers bought more products and were comfortable paying more for each trip to Starbucks.

That is the pricing power that a deeply penetrated brand carries; after all, stocks like The Coca-Cola Co. NYSE: KO can raise prices to keep up with inflation with very little impact on their sales. Investors can see this pricing power live inside Starbucks’ financials.

With a 27% gross margin, above average by all means, Starbucks has ample room to keep raising prices to combat rising input costs from inflation. More than that, sound management efficiency allows the stock to compound its capital at an average return on invested capital (ROIC) rate of over 20% during the past five years.

Analysts on Wall Street want to see the stock at $110 a share, 20% above today’s price. More than that, EPS is expected to grow by 16% in the next 12 months, which no $100 billion company can achieve unless backed by strong consumer and fundamentals.

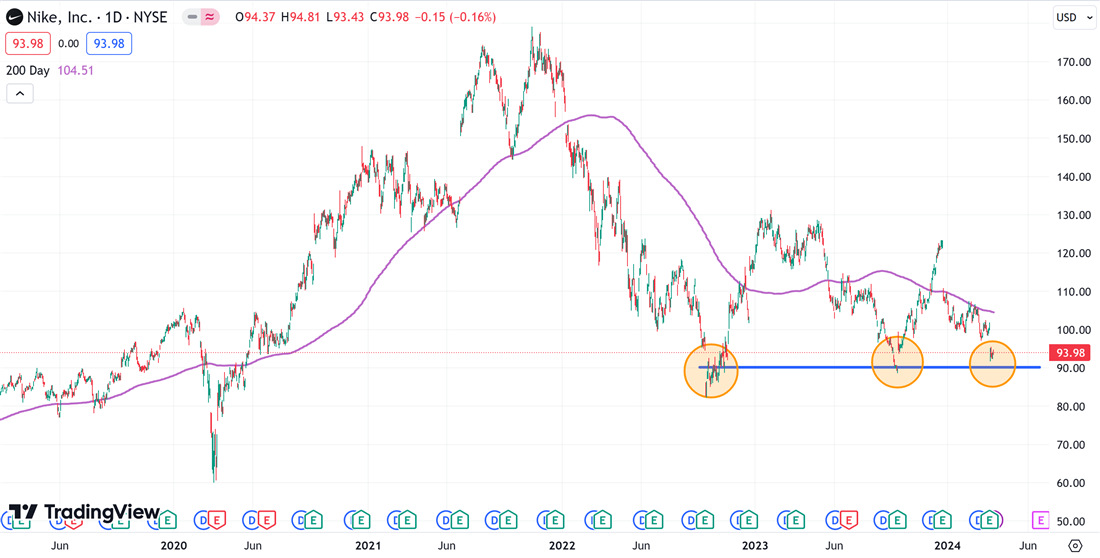

Nike Stock’s Triple Bottom

Another behemoth opening itself for a potential buying spree is Nike. After declining to 73% of its 52-week high price, the stock formed a triple-bottom pattern along the $90-$95 range.

Surprisingly, Nike underperformed the Consumer Discretionary Select Sector SPDR Fund NYSEARCA: XLY by as much as 49% in the past 12 months, creating an even wider gap for investors to fill.

Because of Nike’s international presence, the stock may offer an additional layer of safety in front of potential interest rate cuts coming from the Fed. If these cuts unexpectedly hurt the dollar, companies with an international presence, like Nike or Ermenegildo Zegna NYSE: ZGN, could cushion a slump with stronger currencies, such as the Euro or Yen.

With a $116.5 share price target today, Wall Street sees up to 24% upside in this timeless brand. More than that, even after bearish momentum, only 1.5% of total shares are shorted. Not even bears dare go against Nike this cycle.

Before you consider Ermenegildo Zegna, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ermenegildo Zegna wasn't on the list.

While Ermenegildo Zegna currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.