Datadog Today

$91.88 -0.67 (-0.72%) As of 04/16/2025 04:00 PM Eastern

- 52-Week Range

- $81.63

▼

$170.08 - P/E Ratio

- 180.16

- Price Target

- $152.37

Datadog Inc. NASDAQ: DDOG provides a cloud-based security information and events management (SIEM) observability platform, enabling developers, engineers, and IT departments to monitor the performance of their data and operations infrastructure. Its AI-powered platform provides a comprehensive view of a client's entire IT environment, simplifying troubleshooting and threat response on a single unified system.

Datadog operates in the computer and technology sector, competing with SIEM providers like Splunk Inc. NASDAQ: SPLK, Dynatrace Inc. NYSE: DT, and Gitlab Inc. NASDAQ: GTLB.

Datadog’s Competitive Advantage

SEIM platforms offer many security benefits, but Datadog’s competitive advantage lies in the scalability and flexibility to integrate with various ecosystems consisting of different cloud providers, including Amazon.com Inc. NASDAQ: AMZN AWS, Google Cloud NASDAQ: GOOGL, Microsoft Co. NASDAQ: MSFT Azure and Oracle Co. (NASDAQ ORCL) Oracle Cloud, applications and technologies. It provides a single source of truth, enabling easy monitoring of diverse and complex environments.

It collects, unifies, and monitors all data from all sources, including applications, servers, databases, and networks, and finds correlations, enabling real-time alerts and insights. Users can automate functions, security incident analysis and responses. AI is leveraged for proactive threat, anomaly detection, and predictive analytics with actionable real-time insights.

Bits AI Is the Generative AI Co-Pilot for DevOps

Its generative AI interface, "Bits AI," enables conversational queries, acting as a DevOps co-pilot. Bits can promptly assist in efficiently investigating and responding to incidents without switching contexts across the Datadog mobile app, web app, and Slack. Bits helps surface insights about the environment in a conversational format by correlating data across the Datadog platform, including metrics, events, log and trace anomalies, user transactions, and security signals. Bits will diagnose issues and suggest automated code fixes to accelerate investigations, streamline incident responses, and prevent recurrence.

Datadog’s Robust Double-Digit Growth Makes It the Best-of-Breed

Datadog Stock Forecast Today

12-Month Stock Price Forecast:$152.3765.84% UpsideModerate BuyBased on 31 Analyst Ratings | Current Price | $91.88 |

|---|

| High Forecast | $200.00 |

|---|

| Average Forecast | $152.37 |

|---|

| Low Forecast | $115.00 |

|---|

Datadog Stock Forecast DetailsDatadog reported Q2 2024 EPS of 43 cents, beating consensus estimates by 6 cents. Its revenue surged 26.7% YoY to $645.28 million, firmly beating consensus estimates of $624.92 million. Non-GAAP operating margin was 24%. It grew its $100,000+ contract customers by 13% to 3,390, up from 2,990 a year ago. Datadog closed the quarter with $3 billion in cash and cash equivalents.

For its third quarter of 2024, Datadog expects EPS between 38 cents and 40 cents versus consensus estimates of 38 cents. Revenues are expected to be between $660 million and $664 million, versus the consensus estimates of $664.58 million.

For full-year 2024, Datadog sees EPS of $1.62 to $1.66 versus $1.61 consensus estimates. Full-year revenues are expected to be between $2.62 billion and $2.63 billion versus the consensus estimates of $2.61 billion.

Observations of the Quarter

The headline numbers were impressive, especially the guidance raised. However, the EPS beat came in slimmer than it was in the last quarter, while the raised guidance was identical to its second-quarter margin of upside. The company did note that deal scrutiny was evident in a tough macroeconomic backdrop. The company had a 10% YoY growth of customers, including a 13% YoY growth in the bigger contract customers with annualized recurring revenue (ARR) over $100,000. Platform adoption grew, evidenced by the 1% jump in clients using two or more products and the 4% jump in customers using eight or more products. This underscores the stickiness of its platform.

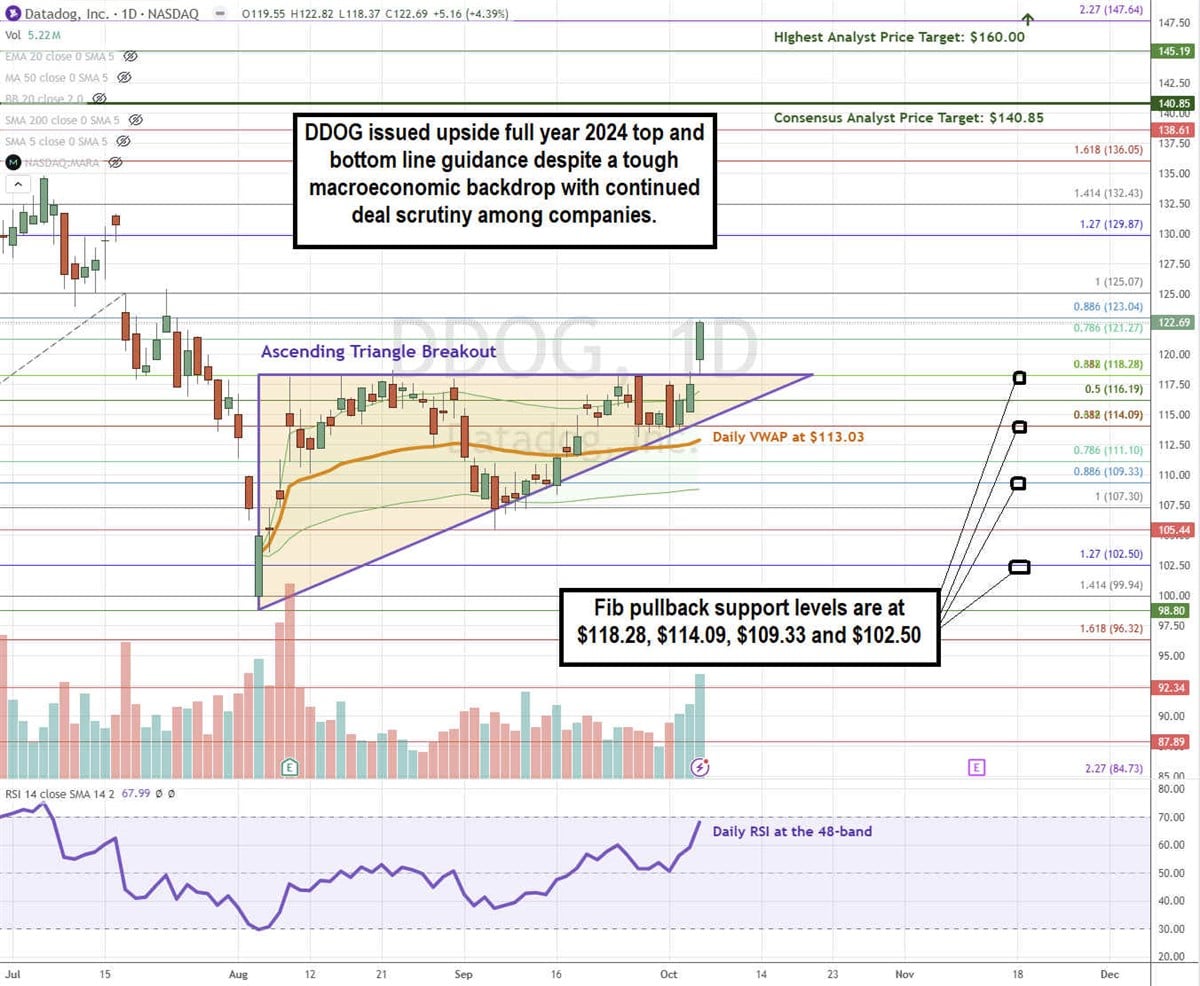

DDOG Stock Triggers an Ascending Triangle Breakout

An ascending triangle is comprised of a flat-top upper trendline resistance conversing with an ascending lower trendline at the apex point. The breakout triggers when the stock surges through the upper trendline resistance.

Since Aug. 8, 2024, DDOG has been struggling to break through its flat-top upper trendline resistance at $118.28. After four tests, DDOG fell back to the ascending lower trendline, rising through the daily anchored VWAP of $113.03 to retest the flat-top resistance two more times before finally breaking out through $118.28 powered by the daily RSI, rising towards the 70-band. Fibonacci (Fib) pullback support levels are at $118.28, $114.09, $109.33, and $102.50.

Datadog’s average consensus price target is $140.85, and its highest analyst price target sits at $160.00. It has 26 Buy ratings and 4 Hold ratings. The stock trades at an expensive 292x forward earnings.

Actionable Options Strategies: While the forward PE looks expensive, DDOG has been preparing for a two-month breakout. Bullish investors can consider using cash-secured puts to buy DDOG at the fib pullback support levels but should also maintain stop-losses under the $98.80 swing low. Be aware of the highly volatile nature of its earnings report, which is expected in mid-November 2024.

Before you consider Datadog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Datadog wasn't on the list.

While Datadog currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report