Ally Financial Today

$32.11 +0.70 (+2.23%) As of 04/23/2025 03:59 PM Eastern

- 52-Week Range

- $29.52

▼

$45.46 - Dividend Yield

- 3.74%

- P/E Ratio

- 12.35

- Price Target

- $41.69

Ally Financial Inc. NYSE: ALLY is a digital financial services company offering a range of financial products to consumers and businesses. The company is a one-stop shop for financing and banking services. The company has over 3 million customers and was ranked #1 for mid-sized banking and financial services company for 2024 by Time Magazine. The stock triggered a sell-the-news reaction upon releasing its Q2 2024 earnings, which handily exceeded consensus EPS estimates by more than 50%.

Ally Financial operates in the financial services sector and competes with fintech companies like Sofi Technologies Inc. NASDAQ: SOFI, Robinhood Markets Inc. NASDAQ: HOOD, and Discover Financial Services Inc. NYSE: DFS.

Ally Financial’s Portfolio of Financial Products

Ally Financial is an all-digital direct bank serving over 3 million customers. It is also the largest car auto finance provider in the country, serving 22,000 dealers and processing over $400 billion in application volume annually. Ally offers commercial property and casualty (P&C) insurance through 4,000 P&C dealers offering inventory and garage coverage. It offers consumer finance and insurance (F&I) through 2,000 dealers.

Ally Bank offers a range of online banking services, including checking and savings accounts. It boasts 3.2 million deposit customers, maintaining a 96% retention rate, and reports $142.1 billion in retail deposits, 92% of which are FDIC-insured. Additionally, Ally achieves a 90% customer satisfaction rating and has 1.2 million customers actively engaged with core savings products. Approximately 10% of its depositors also hold accounts with Ally Invest and Ally Home or have card relationships.

Robo Portfolios Are Human Designed and Machine Automated

Ally Invest offers stock brokerage services with research tools and professional insights. It also offers robo portfolios, which are a step above conventional robo-advisors. They combine humans with machine algorithms. The four portfolio recommendations are comprised of diversified ETFs tailored to the customer’s risk tolerance, time frames, and goals. It automatically rebalances and updates portfolio positions.

Cash-enhanced robo portfolios have no advisory fees and put aside 30% in interest-bearing accounts to act as a buffer against volatility. Currently, the interest is 4.2% annually, paid out monthly. Market-focused portfolios have a 0.30% annual advisory fee charged monthly and set aside 2% in cash.

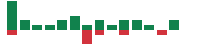

ALLY Stock Attempts an Ascending Triangle Breakout

The daily candlestick chart on ALLY illustrates an ascending triangle breakout pattern. The pattern is comprised of a flat upper trendline resistance at $41.77, converging with a lower ascending trendline, indicating higher lows. The breakout triggered heading into its Q2 2024 earnings release. A sell-the-news reaction occurred in the following days, sending shares back toward the upper triangle resistance level at $41.77. The daily relative strength index (RSI) peaked at the 80-band and fell back under the 55-band. Pullback support levels are at $41.77, $39.04, $37.23, and $34.85.

Ally Financial Posts a Strong Q2 2024 EPS Beat

Ally reported Q2 2024 EPS of 97 cents, beating analyst expectations by 33 cents. Revenues fell 3.8% YoY to $2 billion, falling short of the $2.03 billion consensus analyst estimates. The net interest margin (NIM) fell 11 bps to 3.27% due primarily to higher funding costs, which were partially offset by the continuing strength of new origination yields. Provisions for credit losses increased by $30 million YoY to $457 million, driven by higher net charge-offs. Ally expects a full-year NIM of 3.30% versus 3.25% to 3.30% prior guidance. Adjusted operating revenue growth of 12% is expected versus 9% to 12% YoY.

Ally Financial CEO Remains Upbeat

Michael Rhodes had his first conference call as the new CEO of Ally Financial for Q2 2024. He pointed out that Ally has been in the auto finance business for over 100 years and has grown to be the nation’s largest auto finance bank. Ally provides auto financing to nearly 4 million customers.

Ally Financial MarketRank™ Stock Analysis

- Overall MarketRank™

- 100th Percentile

- Analyst Rating

- Hold

- Upside/Downside

- 29.8% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Moderate

- Environmental Score

- -0.81

- News Sentiment

- 0.57

- Insider Trading

- Acquiring Shares

- Proj. Earnings Growth

- 53.22%

See Full AnalysisRhodes extolled the virtues of integrity, innovation, customer obsession, and relentless focus on execution ingrained in the company culture. Its insurance products complement its auto finance business. It’s produced over $1 billion in annual written premiums, including $1.3 billion in 2023. The company has over 600 experienced underwriters. The company has made significant investments to modernize its technology platform, continuously investing in data and analytics.

Rhodes commented on the synergies between products, “Ally Invest and Ally Home are key components to the overall depositor value proposition. Customers are primarily sourced from existing Ally depositors, and we've built a solid foundation focused on strengthening the customer experience. An Ally credit card provides an opportunity to add a floating rate product with attractive returns to the balance sheet.”

Ally Financial analyst ratings and price targets are at MarketBeat. The 19 analyst ratings comprised nine Buys, eight Holds, and two Sells.

Before you consider Ally Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ally Financial wasn't on the list.

While Ally Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.