Unity Software Inc. NYSE: U is a leading platform used by software developers to create and manage real-time 3D content. Its core product is the Unity game engine, which video game developers use to create video games and interactive and immersive entertainment. Unity's game engine is used in nearly 50% of all video games and 70% of the world’s top 1,000 mobile games.

Unity Software Today

U

Unity Software

$20.96 +0.79 (+3.92%) As of 04/23/2025 03:59 PM Eastern

- 52-Week Range

- $13.90

▼

$30.88 - Price Target

- $23.96

The computer and technology sector company received major backlash when it implemented a “runtime fee” in July 2023, which was initially triggered based on the number of times or devices a video game was installed on. The backlash and sentiment reversal led to a collapse of its stock from $47.16 to an all-time low of $13.90 on Aug. 7, 2024. Unity has made adjustments and could be on the comeback trail.

Unity Software competes with Roblox Inc. NYSE: RBLX, Adobe Inc. NASDAQ: ADBE, and Autodesk Inc. NASDAQ: ADSK.

Recovering From the Runtime Fee Debacle

The runtime fee incident caused developers to consider switching to other game engine licenses, including its top competitor, Unreal Engine. Critics felt it was a money grab that unfairly punished more popular games, a form of double-dipping that hurt smaller studios and developers. Unity's CEO, John Riccitiello, apologized publicly after the initial announcement and promptly resigned a few weeks after the botched pricing policy.

After multiple adjustments, the latest policy on runtime fees applies to games made on the Unity 6 or higher game engine. Developers using Unity Personal Edition are exempt but must upgrade upon earning $200,000 in revenue. The fee only applies to companies with at least $1 million in gross income on a trailing 12-month basis and have one million first-time installs. The fee is the lesser of 2.5% of the game's monthly revenue or a calculated fee based on the number of unique engagements during the month. Developers are supposed to report both stats voluntarily. The goal was to ensure smaller developers wouldn't take a big hit while still earning revenue from larger studios. Unity's CEO, John Riccitiello, stepped down weeks after the botched pricing policy.

Unity's Core Business Is Growing

Unity's Create Solutions segment drove 4% year-over-year (YoY) revenue growth, and core subscriptions grew 14% YoY. This is significant since this segment includes all Unity game engine revenues, subscriptions, seat licenses, and runtime fees. This may indicate that the runtime fee debacle cloud may finally be lifting. Its Unity 6 game engine is due out by the end of the year, and the new runtime fee model will be implemented. Unity 6 is a high-performance platform that's expected to provide improved workflows, improve rendering speeds, and include AI capabilities.

Unity Slashes Guidance

Unity Software Stock Forecast Today

12-Month Stock Price Forecast:$23.9614.33% UpsideModerate BuyBased on 18 Analyst Ratings | Current Price | $20.96 |

|---|

| High Forecast | $34.00 |

|---|

| Average Forecast | $23.96 |

|---|

| Low Forecast | $15.00 |

|---|

Unity Software Stock Forecast DetailsUnity Software reported second-quarter 2024 losses of 32 cents per share, missing consensus estimates for a loss of 13 cents. Revenues continued to slide 15.8% YoY to $449.3 million, beating $438.37 million consensus estimates. However, core strategic portfolio revenue rose 6% YoY to $426 million. Adjusted EBITDA grew to $113 million.

Unity expects Q3 2024 revenue for its strategic portfolio to be between $415 million and $420 million, and its adjusted EBITDA is between $75 million and $80 million. Full Year 2024 revenue is expected to be between $1.68 billion and $1.69 billion, down from previous guidance of $1.76 billion to $1.80 billion. Adjusted EBITDA was also slashed from $340 million to $350 million, down from previous guidance of $200 million to $425 million. Unity stock rallied following the news of its CFO's resignation. The company will focus on boosting its mobile gaming ad revenue.

Morgan Stanley Upgrades Unity

On Sept. 3, 2024, Morgan Stanley upgraded Unity stock to Overweight from Equal Weight, setting a $22 price target. Analyst Matthew Cost noted that the 2024 full-year guidance cut has reduced risk, while Unity's 70% market share in mobile highlights its strong competitive moat.

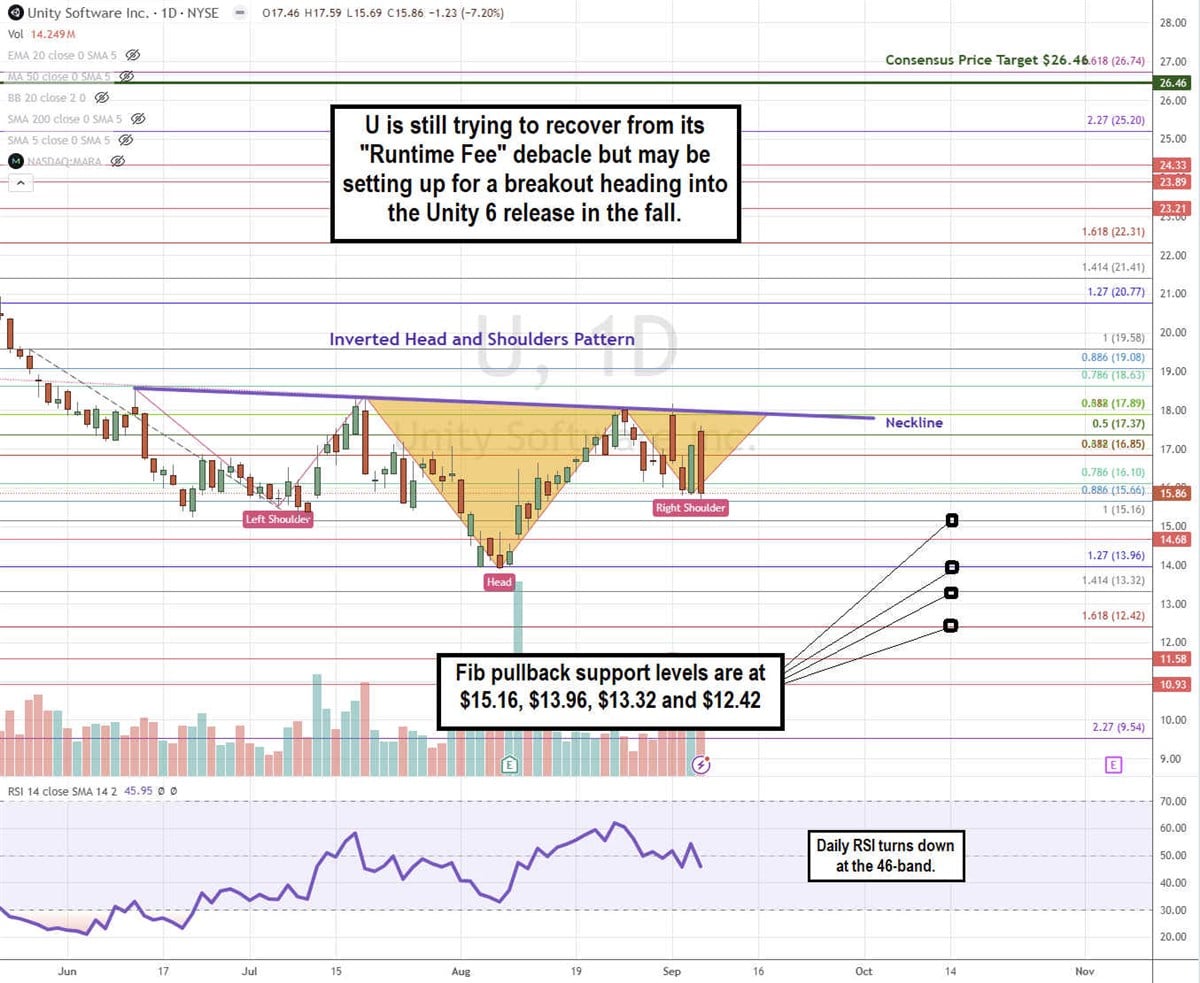

Unity Stock Is Forming a Possible Inverse Head and Shoulders Pattern

An inverse head-and-shoulders pattern is a bullish pattern comprised of three valleys. The breakout trigger is above the neckline, connecting the pullbacks from the valleys.

The left shoulder represents the first valley, followed by a retracement to the neckline. The head represents the lowest valley at $13.96, followed by a bounce to the neckline. The right shoulder is being tested at $15.66. If U can break through the neckline at $17.89, it could trigger a rally toward the Morgan Stanley $20 price target. However, if U continues to sink, the right shoulder will not form until it bounces. The daily relative strength index (RSI) has turned down again at the 46-band. Fibonacci (Fib) pullback support levels are at $15.16, $13.96, $13.32, and $12.42.

Unity’s average consensus price target is $26.46, and its highest analyst price target sits at $56.00.

Actionable Options Strategies: Bullish investors can buy on pullbacks using cash-secured puts at the fib pullback support levels to buy the dip and write covered calls to execute a wheel strategy for income.

A Poor Man’s Covered Call (PMCC) strategy is less capital intensive on this speculation, which involves buying a deep in-the-money (ITM) back-month call and selling out-of-the-money (OTM) front-month calls.

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.