GitLab NASDAQ: GTLB shares wallowed over the summer, but those days are long behind it now that the Q2 results are in. The results show that AI-focused spending is shifting to applications development, where GitLab excels. It is the leading DevSecOps platform, providing an end-to-end solution for companies ramping up their software development programs. Its AI-powered tools improve development time, security, and outcomes; they were recently named a leader in AI assist in one of Gartner’s newest Magic Quadrants and are likely to retain that position over time.

GitLab’s Beat-and-Raise Quarter Drives Market Into a Reversal

GitLab Today

$43.04 +0.87 (+2.05%) As of 01:48 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $37.90

▼

$74.18 - Price Target

- $72.64

GitLab’s share price wallowed over the summer because the results and guidance released earlier in the year did not meet the optimistic market expectations. However, those days are behind because the Q2 results include better-than-expected revenue and earnings, compounded by above-consensus guidance that leads analysts to adjust their price targets.

The $182.6 million in revenue is driven by new clients and deepening penetration, which is expected to continue. Revenue outpaced consensus by 300 basis points, driven by a 19% increase in small clients and a 33% increase in large. Regarding penetration, the company’s net retention rate came in at 126%, down from the previous quarter but an acceleration compared to the previous year.

The margin news is the most impressive, exceeding consensus due to revenue leverage and operational quality. The gross margin was flat YoY, which is significant because it runs near 90% on a GAAP and adjusted basis. Still, the operating margin improved significantly, extending the trend that began last year. The GAAP operating margin improved by 1700 bps and adjusted by 1300 to drive positive cash flow, free cash flow, and earnings power. Adjusted earnings were positive versus the expected loss and outpaced consensus by $0.35, leading management to improve the guidance.

The guidance for Q3 is tepid but aligns with the consensus estimates; it is likely cautious. The full-year guidance is more robust, expecting $742 million in revenue at the low end of the range compared to the $737.8 consensus. Earnings of $0.46 are 30% above forecasts, and margin strength is expected to continue in calendar 2025.

Analysts Shift Gears: Raise Targets for GitLab

GitLab MarketRank™ Stock Analysis

- Overall MarketRank™

- 72nd Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 74.4% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- N/A

- News Sentiment

- 0.63

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- Decreasing

See Full AnalysisThe analysts’ response to GitLab’s earnings release was swift and bullish. The half-dozen analysts who issued reports within the first few hours increased their price targets to align with a consensus-or-better attitude. The consensus of $65 is down compared to earlier in the year but up compared to last year and likely to trend higher until the following earnings report is released.

As it is, the consensus target implies a 20% upside in addition to the 20% post-release, sufficient to set a 6-month high. Because the revision trend is pointing to an above-consensus range, this stock will likely return to its 2024 highs before the end of this year.

"The company's ability to continue to power revenue growth from seat expansions in this software buying environment is clear evidence, in our view, that the platform value proposition is resonating with customers,” said Canaccord Genuity analyst Kingsley Crane in a note to investors.

GitLab Is Set Up for a Market Reversal

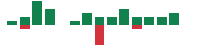

GitLab share prices surged more than 20% following the release, confirming support at recent lows. The move created a Double Bottom in the stock price and has it set up to complete a reversal soon. The critical resistance point is near $56.50 and may be reached soon. A move above $56.50 is bullish for the market and likely to attract new money, but there are still hurdles to overcome. The stock price could stall near the $60 level but will likely continue higher because of the analysts' revision trend. The bigger risks for bullish traders are the bottom of the open gap near $65 and the top of the same gap near $71.

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.