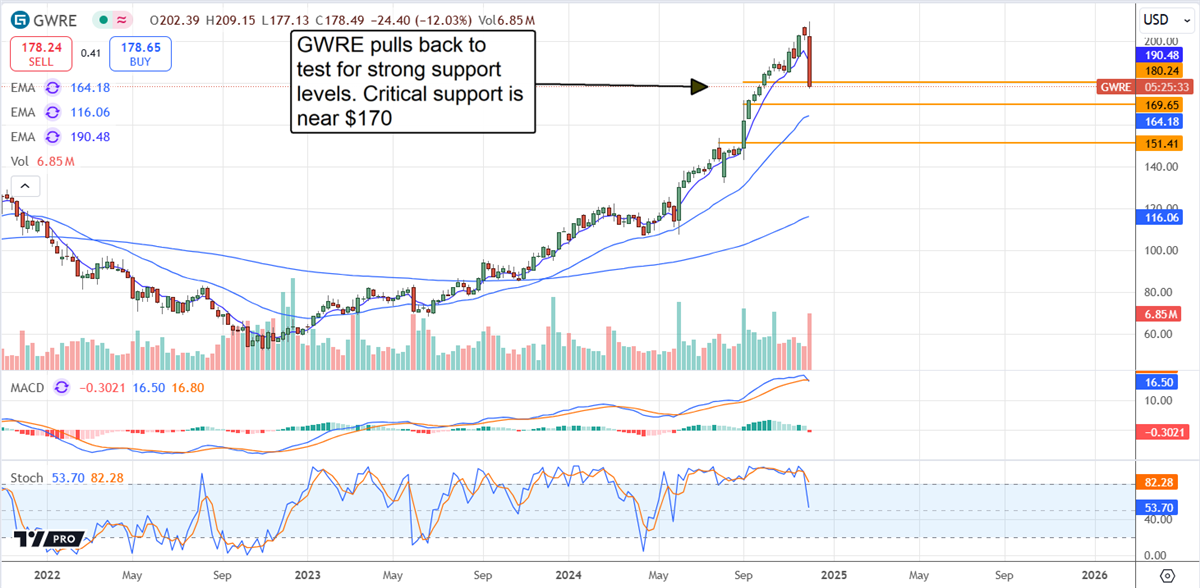

After rising 300% in 18 months, Guidewire Software NYSE: GWRE has finally produced the kind of correction into which investors can sink their teeth. The market is down more than 10% on a good report compounded by improvised guidance, a cautious stance, and other factors suggesting new all-time highs will be set.

It may take the market a little time to regain footing and build traction, but that is also good news, allowing investors and traders the time to pinpoint their entry prices and develop their positions for what will likely be a robust uptrend in 2025.

What is Guidewire Software’s business? Guidewire Software is the leading AI-powered cloud-based operating platform for P&C insurers. It offers services spanning the P&C industry spectrum and end-to-end services for some. New deals lending evidence to the claim bolstered the Q1 results and guidance for Q2, which came ahead of the consensus estimates.

The company inked nine new deals, including five tier-1 insurers, including P&C insurers with the largest market share, stable business, and healthy capital reserves. While not alone in the industry, it has a moat in an industry growing and well-suited to AI enhancement and automation.

Guidewire Software Today

GWRE

Guidewire Software

$193.88 +1.71 (+0.89%) As of 04/15/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $107.00

▼

$219.59 - P/E Ratio

- 538.54

- Price Target

- $206.08

Guidewire Software Enters Healthy Correction: Outlook Positive

Guidewire Software had a robust quarter, with revenue, margin, earnings, and guidance outpacing high expectations. The $262.9 million in net revenue is up 27% year over year and outpaced MarketBeat’s reported consensus by 350 basis points on strength in all segments driven by new deals and large clients.

Subscriptions and Support, the largest segment, grew by 33% and was offset by a slower 22% growth in Services and a 10% growth in Licenses.

Margin news includes improving gross and operating margins, with the GAAP operating loss narrowing to near $0, adjusted profitability, and an outlook for improvement as the year progresses. The net result is an adjusted EPS of $0.43, up $0.43 from last year and $0.13 ahead of forecasts, leading management to improve the guidance for FQ2 and the year.

Guidewire’s guidance is good because Q2 targets are above the consensus, and the full-year range, which brackets consensus, is likely cautious. The forecast for insurance industry process-automation growth is to double at least twice by the end of the decade.

Analysts Lift Guidewire Targets and Point to New All-Time Highs in 2025

Guidewire Software Stock Forecast Today

12-Month Stock Price Forecast:$206.086.30% UpsideModerate BuyBased on 13 Analyst Ratings | Current Price | $193.88 |

|---|

| High Forecast | $240.00 |

|---|

| Average Forecast | $206.08 |

|---|

| Low Forecast | $95.00 |

|---|

Guidewire Software Stock Forecast DetailsThe analysts' sentiment trends regarding Guidewire’s quality and price targets are robust in 2024. The coverage is rising, with 75% more analysts covering this year than last. The 14 tracked by MarketBeat peg the stock at Moderate Buy, but 78% rate it as a Buy or Better; only two rate it as a Hold and one at a Sell.

The consensus price target doesn’t offer much upside from critical support, but the trend is more important. The consensus of $190 implies about a 3% to 5% upside for the market from critical support, but the revision trends, including the few released following the Q1 report, put this stock in the high-end range near $220 to $230. That’s sufficient for a new all-time high and a gain of nearly 30% in share price.

The technical action is ugly in early December, but a bottom should quickly form. The market is down more than 10% and testing support at a level where it may be very strong. The critical level is near $170/$175, which may be reached before the year’s end. Among the hurdles for this market is its valuation.

Trading at $170, it is still 30X the 2030 EPS estimate and may be fully valuing its growth potential. However, the company’s persistent outperformance, insurance industry growth, and the outlook for insurance industry automation growth suggest the estimates are low, and a deeper value is present than current estimates suggest.

Before you consider Guidewire Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guidewire Software wasn't on the list.

While Guidewire Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.