Prior to the approval of the spot bitcoin ETFs like iShares Bitcoin Trust NASDAQ: IBIT, traders would trade the Bitcoin miners and the cryptocurrency exchanges like Coinbase Global Inc. NASDAQ: COIN to benefit from the rise in Bitcoin prices. When the price of Bitcoin spiked, so did the stocks of Bitcoin miners in the business services sector.

Positive Correlation Between Bitcoin Miners and Spot Bitcoin Prices

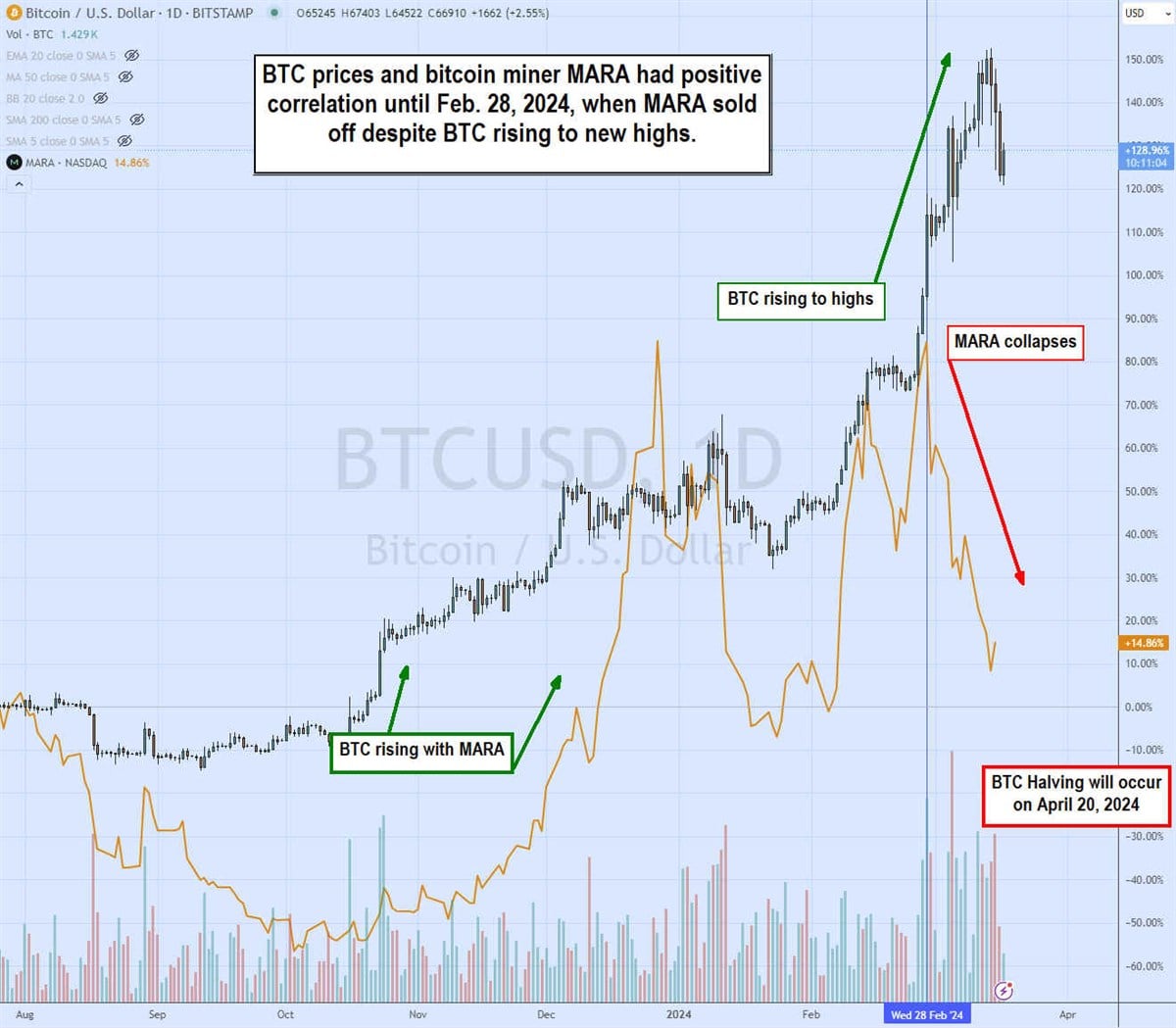

There was a positive correlation between the direction of bitcoin prices and the bitcoin miners like Marathon Digital Holdings Inc. NASDAQ: MARA, Riot Platforms Inc. NASDAQ: RIOT, Bit Digital Inc. NASDAQ: BTBT, Cipher Mining Inc. NASDAQ: CIFR and TeraWulf Inc. NASDAQ: WULF. The momentum totem pole usually starts with Coinbase, followed by Marathon Digital, Riot Platforms and on down the line.

The logic was that if spot bitcoin prices were rising, that would mean more proceeds for the bitcoin miners as the value of the bitcoins they were mining went up. This is no different than gold mining stocks rising when the spot price of gold rises.t

As the rally in bitcoin accelerated, the miners followed until something strange started to occur.

Negative Correlation Materializes

Around the end of February, as bitcoin prices were reaching yearly and all-time highs, the miners started to diverge. In fact, the higher bitcoin prices rose, the bitcoin miners may start the morning with a price gap only to sell off hard after the markets open. Numerous traders believed the positive divergence would continue only to get smoked by the divergence. They would add to their long positions in the bitcoin miners, thinking they were getting a bargain as bitcoin prices continued to rally. Sadly, as bitcoin continued to make all-time highs, the bitcoin miners continued to sell off with no sustained bounces.

To throw a wrench into the equation, COIN would often continue to rise with bitcoin prices while stocks like MARA, RIOT, BTBT and the rest of the bitcoin miners would proceed to sell off.

The Day the Correlation Died

The divergence was so apparent that it can be pinpointed to an exact date when the correlation essentially died: February 28, 2024. As bitcoin and COIN prices jumped, the bitcoin miners fell. It has continued through March 2024. Traders attributed the divergence to possible earnings reports, rumors, or big short sellers, but there's a logical explanation for the sell-off. It has to do with an event that occurs every 4 years called a halving.

Only 21 Million Bitcoins Ever Exist

Bitcoin has a finite supply as it will only ever produce 21 million period. Once the 21 millionth bitcoin is mined, there will be no more. This limit goes against fiat currencies, which can continue to print money, eventually driving up inflation and causing purchasing power to collapse. Bitcoin avoids this by ensuring that only 21 million bitcoins will ever exist. There are only around 1.35 million bitcoins left to be mined.

What is a Bitcoin Halving?

To further keep inflation in check, the infamous creator of bitcoin, Satoshi Nakamoto, implemented what's known as the halving. Every 4 years, or 210,000 blocks, bitcoin will cut its payout rewards to miners by half. Originally, the first payout was 50 bitcoins. That was halved to 25 bitcoins on November 28, 2012. That was halved to 12.5 bitcoins on July 9, 2016. That was halved to 6.25 bitcoins on May 11, 2020. On April 17, 2024, that will be halved to 3.125 bitcoin on April 20, 2024.

Why Does This Matter for Miners?

If you're a gold mining company and were told that even though spot gold prices are at $3,000 an ounce, on April 20, 2024, you would only be getting paid 50% of that amount moving forward, how upset would you be? It's the same for bitcoin miners. They will be making 50% less than they are now, taking a 50% haircut. For this reason, the market started pricing in the reality of fewer proceeds being generated by the bitcoin miners starting on February 28, 2024.

Historically, bitcoin miners have sold off after the halving event as investors realized revenues were being cut in half. Eventually, the miners resumed positive correlation months after the halving. This may be the case again, but only time will tell.

Before you consider MARA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MARA wasn't on the list.

While MARA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.