Hewlett Packard Enterprise Today

HPE

Hewlett Packard Enterprise

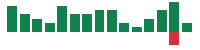

$15.13 +0.25 (+1.65%) As of 04/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $11.97

▼

$24.66 - Dividend Yield

- 3.44%

- P/E Ratio

- 7.96

- Price Target

- $20.60

Hewlett Packard Enterprise Co. NYSE: HPE is a global technology company focused on providing edge-to-cloud solutions for businesses and organizations to accelerate their digital transformation and better manage their IT infrastructure.

The company sells enterprise solutions, including servers, storage, and networking, which are also critical components of artificial intelligence (AI) deployment. Like many late bloomers in the computer and technology sector, Hewlett Packard is starting to see an acceleration in its AI business. Here are four reasons why now may be the time to get into the stock.

1) The AI Business Is Gaining Momentum with More Acceleration to Follow

Hewlett Packard reported Q3 2024 EPS of 50 cents, which beat analyst estimates by 3 cents as revenue rose 10.7% YoY to $7.71 billion, which also beat consensus estimates for $7.67 billion. This was its first double-digit revenue growth quarter since its first quarter of 2023. Taking a look under the hood, it's apparent that its AI business is revving up. Its server business saw 35% YoY growth to $4.3 billion with a 10.8% profit margin, up from 10.1% last year. AI systems business surged 40% sequentially and now accounts for 30% of its total server business.

Hewlett Packard received strong early customer response to its Private Cloud AI offering integrated with NVIDIA Co. NASDAQ: NVDA software, which it expects to supercharge enterprise AI adoption as it can reduce up to 75% of deployment time and costs. Hewlett Packard’s CEO Antonio Neri said in a CNBC interview that AI is more revolutionary than the internet itself.

2) The Enterprise Business Is Recovering From Normalization

Hewlett Packard's traditional server business is experiencing recovery as demand and revenue improve sequentially. While the pandemic surged its business during the reopening, the normalization of surplus inventory has been a slow process nearing conclusion. Networking is seeing recovery with growth in WLAN, data center networking, and switching, as well as sustained growth in services and security. While some clients remain cautious and are still only prioritizing mission-critical projects, enterprise demand is improving primarily in North America, followed by Asia Pacific, Japan, and India. Lagging geographies include Europe due to geopolitical and macroeconomic factors and the Middle East.

Overall, the server business experienced margin expansion. During its first AI Day event, the company unveiled its new data center solutions, including its fan-less direct liquid cooling systems and new AI server powered by Applied Micro Devices Inc. NASDAQ: AMD AI chip. The new fan-less design is estimated to help reduce data center cooling costs by 90%. The cooling tubes cool down every piece of hardware on the server rack, including the processors, server blades, storage devices, and network fabric. Gen AI deployment will boost productivity and operating margins as AI bots handle helpdesk tasks and provide software development assistance.

3) Valuation Is Still Relatively Cheap Compared to Peers

Hewlett Packard Enterprise MarketRank™ Stock Analysis

- Overall MarketRank™

- 97th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 36.2% Upside

- Short Interest Level

- Bearish

- Dividend Strength

- Moderate

- Environmental Score

- -1.11

- News Sentiment

- 0.66

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 9.19%

See Full AnalysisHPE stock trades at 12.48x forward earnings and offers a 2.51% annual dividend yield. Compared to Dell Technologies Inc. NYSE: DELL, with a forward PE of 18.49, and Super Micro Computer Inc. NASDAQ: SMCI forward PE of 16.77, the valuation is relatively cheap. HPE's consensus analyst price target is $21.36, with its highest price target at $26.00.

While the company closed out July 2024 with $3.1 billion in cash, it received an 80% boost since then. Hewlett Packard sold a chunk of its equity stake in H3C Technologies to Unisplendour International Technology Limited for $2.1 billion in cash, which will be reflected in its Q4 2024 earnings report.

4) The Juniper Networks Acquisition Should Close in the Next 2-3 Quarters

Hewlett Packard announced the acquisition of networking leader Juniper Networks Inc. NYSE: JNPR for $14 billion at the beginning of 2024. The deal is expected to close at the end of the calendar year 2024 or early 2025. The acquisition adds a supercharged jolt to its high-margin networking portfolio.

Networking is a critical element of AI deployment in data centers, and the acquisition will provide even stronger offerings for its data center clients. The acquisition helps materialize its full edge-to-cloud vision. It enables Hewlett Packard to gain control of a fully integrated network IP stack from the underlying hardware to software and security layers, a complete one-stop solution.

Before you consider Hewlett Packard Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hewlett Packard Enterprise wasn't on the list.

While Hewlett Packard Enterprise currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.