Delta Air Lines is one of the world's largest airlines, and its stock has been relatively volatile in recent months. The company has benefited from a strong recovery in air travel, and its financial results have been impressive. Next quarter's earnings estimate for DAL is $1.16, down from the previous quarter's $2.03.

DAL beat its EPS estimate 75% of the time in the past 12 months. Revenue has increased 22.83% year-over-year.

So, is Delta Air Lines a good stock to buy? The answer may be yes, with its strong financial results and bright future. But before you buy Delta Air Lines stock, there are a few things to consider. Let's review Delta Air Lines' stock comprehensively for a few minutes.

Overview of Delta Air Lines

Delta Air Lines Inc. NYSE: DAL is a major American airline headquartered in Atlanta, Georgia. It is the second largest airline in the United States by fleet size, the third largest by scheduled passenger miles flown and the largest by number of destinations served. Delta operates a global network serving over 300 destinations in 50 countries on six continents. Delta Air Lines is among the few blue-chip stocks in the aerospace division.

The company was founded in 1925 as Huff Daland Dusters, an aerial crop dusting operation. In 1929, the company began passenger service under Delta Air Service. Delta proliferated in the 1930s and 1940s, and by the end of World War II, it was one of the largest airlines in the United States.

In the 1950s and 1960s, Delta continued to grow and expand its network. The company also became a pioneer in the use of jet aircraft. In 1961, Delta was the first airline to fly the Douglas DC-8 jetliner.

In the 1970s and 1980s, Delta faced increasing competition from other airlines. The company responded by merging with several smaller airlines, including Northeast Airlines and Western Airlines. Delta also began to expand its international network.

In the 1990s, Delta continued to grow and expand. The company also began finding new technology to invest in, including developing its reservation system.

In the 2000s, Delta faced many challenges, including the September 11 terrorist attacks and the 2008 financial crisis. However, the company emerged from these challenges stronger than ever. In 2008, Delta acquired Northwest Airlines, which made it the largest airline in the United States by fleet size.

In the 2010s, Delta continued to grow and expand. The company also began to invest in new aircraft, including the Airbus A350 and the Boeing 787 Dreamliner.

Today, Delta Air Lines is one of the most successful airlines in the world. The company is known for its excellent customer service and its commitment to safety. Delta is also a leader in environmental sustainability. The company has set a goal of reducing its carbon emissions by 50% by 2050.

Are you still asking yourself, “Should I buy Delta stock?” Reviewing the latest headlines is important as we continue our journey to discover if investors should buy Delta stock. Delta Air Lines has recently reported strong financial results, surpassing analyst expectations in multiple quarters.

The company's earnings have exceeded projections, driven by factors such as the ongoing recovery in air travel, the addition of new routes and the implementation of innovative pricing strategies. Alongside its impressive financial performance, Delta has made strategic moves, including an upcoming acquisition and investments in new aircraft, setting the stage for continued growth.

Delta Air Lines has been posting strong earnings surpassing analyst estimates. The strong performance was attributed to the recovering air travel industry, expanded route offerings and effective pricing strategies. These factors combined to drive robust growth and position Delta favorably among its competitors.

Delta Air Lines continued its positive trajectory in the third quarter of 2023, reporting earnings of $2.03 per share, surpassing analyst expectations. Additionally, year-over-year revenue saw a healthy increase of around 22%. The sustained demand for air travel, ongoing route expansion and successful pricing strategies contributed to Delta's impressive performance.

The company's strong showing in consecutive quarters reflects its ability to navigate market challenges effectively.

According to Delta Air Lines' most recent earnings call, revenues in the December quarter are expected to be 10% higher than in 2022, with a 10% operating margin and over $1 per share earnings, aligning with analyst expectations. Delta is poised to benefit from sustained strong demand for air travel, ongoing route expansion and successful pricing strategies. These factors should contribute to the company's solid performance in the current quarter.

Delta Air Lines has been making strategic moves to solidify its market position further. In October 2022, the company announced a joint venture with LATAM Airlines Group, which began servicing the Brazilian market in early 2023.

Delta is also actively investing in its fleet by ordering 155 Airbus A321neo aircraft and 59 Airbus A220-300 aircraft in 2022, which will be delivered in mid-2023 and 2024. These investments highlight Delta's commitment to modernizing its fleet, enhancing operational efficiency and providing an exceptional travel experience for customers.

During the fourth quarter, Delta made a $150 million strategic investment in Wheels Up, co-investing alongside Certares Management, Knighthead Capital and others. The move combines the airline with the travel and tourism expertise of Certares and the turnaround expertise of Knighthead to create a new premium product line for customers.

Industry comparison

Several key factors come to light when comparing Delta Air Lines' stock performance with its competitors.

First, Delta's history as the first airline to fly the Douglas DC-8 jetliner showcases its long-standing presence in the industry. This early adoption set a precedent for Delta's commitment to innovation and growth.

Delta has faced competition from other airlines through the years but has responded strategically by merging with smaller airlines like Northeast Airlines and Western Airlines. These mergers allowed Delta to expand its international network, giving it a competitive edge in attracting a global customer base.

Financially, Delta has consistently outperformed its competitors. The company's recent strong earnings and revenue growth demonstrate its ability to navigate market challenges and capitalize on opportunities.

Delta's strategic moves, such as the joint venture with LATAM Airlines Group and investments in new aircraft, have further solidified its market position. The partnership with LATAM Airlines Group has opened up the lucrative Brazilian market, providing Delta with new routes and access to a large customer base.

Delta's commitment to modernizing its fleet through investments in Airbus A321neo and A220-300 aircraft highlights its focus on operational efficiency and providing an exceptional travel experience. It aligns with its goal of reducing carbon emissions.

Delta has clearly maintained a strong position in the industry. Its history of innovation and strategic mergers has set the stage for its continued growth and success. Combined with its impressive financial performance and commitment to sustainability, Delta is a top choice.

Delta's ability to surpass analyst expectations in earnings and revenue growth speaks to the company's resilience and strategic decision-making.

Macroeconomic influences

Macroeconomic factors like fuel prices and global economic conditions all shape Delta Air Lines' stock performance.

Fuel prices, for instance, directly impact Delta's operational costs. Fluctuations in crude oil prices can affect the cost of jet fuel, one of the most significant expenses for any airline. When fuel prices rise, it puts pressure on Delta, as the company must either absorb the increased costs or pass them on to consumers through higher ticket prices. On the other hand, lower fuel prices provide the airline with cost savings you can reinvest into the business or pass on to customers through competitive pricing.

Global economic conditions also influence Delta. During periods of economic growth, consumer spending tends to rise, leading to increased travel demand. This creates a favorable environment for airlines, as more people are willing and able to fly. Conversely, during economic downturns, consumer discretionary spending may decrease, impacting the demand for air travel.

However, Delta has proven its ability to navigate and adapt to these macroeconomic influences. Route expansion and innovative pricing strategies allow Delta to mitigate the effects of fluctuating fuel prices. Expanding its routes enables the company to strategically allocate resources to routes with higher demand and lower fuel costs.

Innovative pricing strategies have also allowed the airline to remain competitive. By closely monitoring market trends and consumer behavior, Delta can adjust ticket prices and promotions to attract passengers even during economic downturns. This flexibility in pricing has helped Delta maintain a stable customer base and generate consistent revenue.

Delta Airlines' stock performance over the past year has been notable, with a year-to-date increase of around 23%. The stock's upward trajectory can be attributed to several factors.

First, the continued recovery in air travel has played a significant role in Delta's stock performance. As the aviation industry rebounds from the challenges posed by the COVID-19 pandemic, increased passenger demand has improved revenue and profitability for Delta Airlines. This recovery has been driven by factors such as easing travel restrictions, growing consumer confidence and pent-up demand for leisure and business travel.

Delta's proactive approach to expanding its route network has also contributed to its stock's success. The company has effectively captured market opportunities and expanded its customer base by adding new routes. These strategic route expansions have increased Delta's revenue streams and enhanced its competitive position in key markets.

Implementing new pricing strategies has further bolstered Delta Air Lines' financial and stock performance. By optimizing pricing structures and leveraging data analytics, Delta has been able to maximize revenue per passenger and improve overall profitability. These pricing strategies have enabled the company to adapt to changing market dynamics and optimize its offerings to cater to diverse customer segments.

Delta Air Lines' substantial investments in new aircraft have also resonated positively with investors. The order of 155 Airbus A321neo and 59 Airbus A220 aircraft demonstrates the company's commitment to fleet modernization, operational efficiency and improved customer experience. These investments should enhance Delta's competitive advantage, reduce fuel costs and position the airline for long-term success.

Delta Air Lines remains well-positioned for continued growth with a strong financial position, a robust network and a commitment to innovation. The combination of favorable market conditions, strategic initiatives and a focus on meeting evolving customer needs has propelled the company's stock performance, instilling confidence among investors in Delta's potential for future success.

Balance sheet

Delta Airlines' balance sheet provides a comprehensive overview of the company's financial position as of December 31, 2022. The balance sheet showcases the company's assets, liabilities and equity, offering insights into its financial health and resources.

Delta Air Lines reported total assets of $72.29 billion, representing the company's holdings and investment value. The most significant asset category is its aircraft, valued at $34.8 billion. It highlights the importance of the airline's fleet in its operations. Other notable assets include cash and cash equivalents ($5.5 billion), accounts receivable ($10.9 billion) and property and equipment ($11.2 billion), which encompasses various tangible assets owned by the company.

The company reported total liabilities of $65.71 billion, reflecting the company's outstanding obligations and debts. The largest liability category is accounts payable, with a value of $11.5 billion. This represents the amounts owed to suppliers and vendors. Other significant liabilities include accrued expenses ($6.7 billion), long-term debt ($20.2 billion) and deferred revenue ($10.2 billion), which represents payments received for services not yet provided.

Delta Air Lines' equity is reported at $8.2 billion, representing the portion of the company's value attributable to its shareholders. It represents the cumulative investments made by the shareholders of the business. The equity amount considers factors such as retained earnings and additional shareholder contributions.

Its balance sheet demonstrates a healthy financial position. The company's asset base is substantial, with a strong focus on aircraft as a significant asset category. This reflects the core operating assets required for its business model. The liabilities are within a manageable range, indicating that the company has a reasonable level of debt and obligations. The shareholders' equity of $8.2 billion signifies the ownership stake in the company and represents the residual value after deducting liabilities from total assets.

A robust balance sheet is crucial for an airline like Delta Air Lines, as it provides a solid foundation to support its operations, growth and financial stability. The balance sheet snapshot offers valuable insights for investors, creditors and stakeholders to assess the company's financial health and ability to meet its obligations and pursue future opportunities.

Valuation

Delta Air Lines' valuation is an essential indicator of investor sentiment and reflects the market's perception of the company's worth. We can comprehensively overview Delta Air Lines' valuation by analyzing key data points and considering market trends.

Delta Air Lines' market capitalization is $25.89 billion. You can calculate market capitalization by multiplying the company's stock price by its outstanding shares. This figure represents the total value the market assigns to the company.

We consider the earnings per share (EPS) figure to assess valuation further. Delta Air Lines reported an EPS of $2.03, an increase of about 34% over the same quarter a year before. EPS represents the company's profitability per outstanding share and is a crucial metric in determining valuation.

Calculate the price-to-earnings (P/E) ratio by dividing the market capitalization by the EPS. Delta Air Lines's most recently calculated P/E ratio stands at 7.62. The P/E ratio compares a company's stock price to earnings, providing insights into how much investors are willing to pay for each dollar.

A high P/E ratio suggests that investors have a positive outlook on the company's growth prospects, as they are willing to pay a premium for the stock. Conversely, a low P/E ratio may indicate lower investor confidence in the company's future performance. The airline industry currently has a P/E ratio of 13.77, slightly higher than Delta's P/E ratio.

Various factors influence a company's valuation, including financial performance, growth prospects and competitive position. Delta Air Lines' valuation is likely affected by these factors and broader market conditions.

Delta Air Lines' valuation appears reasonable. The company has a strong financial position and positive growth prospects, as evidenced by its market capitalization and earnings performance. Delta Air Lines is considered a growth stock because it has a history of above-average earnings and revenue growth.

SWOT analysis of Delta Air Lines

Delta Air Lines is a large and well-established airline with a strong track record compared to other airline industry stocks.

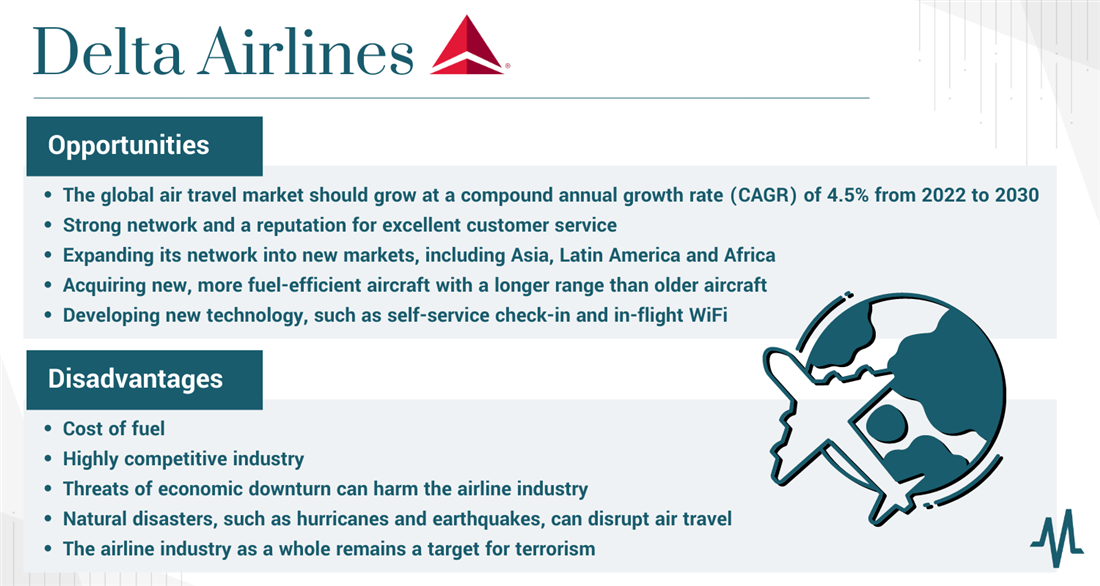

The company has several opportunities for growth, including expanding into new markets, acquiring new aircraft and developing new technology.

However, the company faces challenges, including high fuel costs, rising competition and economic downturns. Let's take a moment to review Delta's opportunities and disadvantages in detail. We provide a SWOT analysis that explores its strengths, weaknesses, opportunities and threats.

Strengths

We can't overlook the significance of the company's extensive fleet. With a diverse range of aircraft, Delta is equipped to cater to various travel needs and maintain a competitive edge in the market. The reliability and efficiency of its fleet contribute to the company's success.

Moreover, Delta boasts considerable cash reserves and accounts receivable, giving it financial stability that can allow it to weather economic downturns and invest in growth opportunities. Its brand reputation and customer loyalty are also strong thanks to its excellent customer service and industry-leading on-time performance.

Another strength is its extensive route network. The company operates many domestic and international flights, connecting major cities and popular tourist destinations, attracting a large customer base and allowing Delta to capture a huge market share.

Weakness

Despite its strengths, Delta also faces several weaknesses and challenges in its business model. One is the high fuel costs that the airline industry must cope with. Fuel expenses constitute a substantial portion of Delta's operating costs, and any fluctuations in fuel prices can eat into profit. Delta is also susceptible to market volatility, as fuel prices are subject to global events, political instability and economic factors.

Another weakness is the rising competition within the airline industry. With the emergence of low-cost carriers and increased globalization, Delta faces intense domestic and international competition. This competition puts pressure on pricing and reduces profit margins.

Opportunities

According to the FAA's Aerospace Forecast, the global air travel market should grow at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030. Several factors, including rising incomes, increasing urbanization and the growth of the middle class in developing countries, drive this growth. Delta Air Lines is well-positioned to benefit from this growth, as it has a strong network and a reputation for excellent customer service.

Delta Air Lines is expanding its network into new markets, including Asia, Latin America and Africa. This expansion will allow the company to reach new customers and grow its revenue.

Delta Air Lines is acquiring new, more fuel-efficient aircraft with a longer range than older aircraft, which will allow Delta Air Lines to reduce its costs and expand its network.

Delta Air Lines continues to develop new technology, such as self-service check-in and in-flight Wi-Fi. This technology will make travel easier for customers and improve their experience.

It has also increased its focus on customer service. The company continues investing in new employee training programs and ways to improve the customer experience.

Threats

The cost of fuel is a significant expense for airlines. Delta Air Lines is working to reduce its fuel costs by using more fuel-efficient aircraft and negotiating better fuel prices. However, the company is still vulnerable to oil price changes.

The airline industry is highly competitive. Delta Air Lines faces competition from other major airlines, such as American, United and Southwest. The company also faces competition from low-cost carriers like Spirit and Frontier.

An economic downturn can harm the airline industry. Delta Air Lines is considered a consumer discretionary stock versus a consumer staples stock, and each type acts differently in economic downturn situations. Being discretionary means that people with less money are less likely to travel or spend on discretionary items, which can lead to a decrease in demand for air travel and a decline in airline revenue.

Natural disasters, such as hurricanes and earthquakes, can disrupt air travel. When flights are canceled or delayed, it can inconvenience passengers and lead to a loss of revenue for airlines.

The airline industry is a target for terrorism. Security threats can lead to increased security measures, increasing airline costs. They also cause flight cancellations and delays, which can inconvenience passengers and lead to a loss of revenue for airlines.

The company must continue managing its costs and risks to maintain its success.

Dividends and shareholder value

Delta Air Lines has always been committed to providing value to its customers and shareholders and has implemented strategies to maximize dividends and shareholder value.

Since 2013, the company has returned more than $12 billion to shareholders, reducing its outstanding shares by approximately 20% and increasing its dividend for five consecutive years.

The company recognizes the importance of rewarding its shareholders for their investment and trust. By regularly distributing dividends, Delta ensures that its shareholders receive a portion of the company's profits directly. The decision to pay dividends is not taken lightly at Delta. The company carefully evaluates its financial performance, cash flow, and future growth prospects before determining the dividend amount. This ensures that dividends are sustainable and align with the company's long-term goals.

Dividend history

Over the years, Delta has consistently paid dividends to its shareholders, showcasing its stability and financial strength.

Delta Air Lines declared a quarterly dividend on September 28. Stockholders of record on October 12 were to be paid a dividend of 10 cents per share on November 2. DAL pays an annual dividend of 40 cents per share and currently has a dividend yield of 0.99%. The dividend payout ratio is 7.58%. This payout ratio is healthy and sustainable, below 75%. Based on earnings estimates, DAL will have a dividend payout ratio of 5.99% next year. This indicates that the company can sustain or increase its dividend.

Over time, we can see a pattern of reliable payouts. Even during challenging times for the airline industry, such as economic downturns or fuel price fluctuations, Delta has managed to maintain its dividend payments.

Share buyback programs

Delta Air Lines has also implemented various share buyback programs. These involve repurchasing the company's shares from the open market, reducing the number of outstanding shares and increasing the ownership stake of shareholders.

By repurchasing its own shares, Delta demonstrates confidence in its future prospects and rewards its loyal investors.

Delta Air Lines has implemented several successful share buyback programs in the past. One was initiated in 2015. At that time, the company announced a $5 billion repurchase program. The program spanned over several years, with Delta regularly repurchasing shares from the open market.

This program's success was evident in its positive impact on shareholder value. As Delta reduced the number of outstanding shares, existing shareholders' ownership stake increased, leading to more confidence in the company. This, in turn, attracted new investors.

Buoyed by the success, Delta decided to implement another program in 2018. This time, they announced a $2 billion repurchase program, signaling their continued commitment to enhancing shareholder value. In 2018, Delta returned $2.5 billion to shareholders through dividends and share repurchases and increased its dividend by 15%.

Outlook for Delta Air Lines

Based on the current stock metrics and Delta Air Lines's future projections, the company should maintain a positive trajectory and perform well. The company's strong financial position, robust network and commitment to innovation contribute to its promising outlook.

Delta's strategic initiatives further contribute to its positive future outlook. The company is actively expanding into new markets, including Asia, Latin America and Africa, allowing it to tap into previously untapped customer bases and drive revenue growth. Moreover, Delta Air Lines is acquiring new aircraft with longer ranges and reduced operating costs compared to older aircraft models. This fleet modernization enables Delta to enhance operational efficiency, expand its reach and capture new market opportunities.

Delta Air Lines invests in developing cutting-edge technologies in line with its commitment to innovation. Initiatives like self-service check-in and in-flight Wi-Fi aim to improve customers' overall travel experience, making their journeys more convenient and enjoyable. By staying at the forefront of technological advancements, Delta aims to strengthen customer loyalty and satisfaction, further driving its growth.

The company emphasizes customer service, recognizing its significance in the highly competitive airline industry. The company is investing in new employee training programs and implementing measures to enhance the customer experience. By prioritizing exceptional service, Delta aims to differentiate itself from competitors and foster long-term customer loyalty.

The company's future outlook appears positive, considering Delta's strong financial position, robust network, commitment to innovation and anticipated global air travel market growth.

Strategic initiatives

Delta has set its sights on several key areas to solidify its position as a leading player in the airline industry.

The company invests heavily in acquiring new aircraft with advanced technologies, recognizing the importance of having a modern and efficient fleet.

The investments in modernizing its fleet with the Airbus A321neo and A220-300 aircraft enhance operational efficiency and offer passengers a more comfortable and technologically advanced travel experience.

Delta also focuses on expanding its route network to capture new market opportunities. The company has identified Asia, Latin America and Africa as key regions for growth. Delta aims to tap into previously untapped customer bases by adding new destinations in these markets and increasing its revenue streams. This expansion strategy includes additional landing slots at major international airports to increase flight frequency and provide customers with more options.

Technology and innovation

The company also recognizes that in today's digital age, customers expect seamless and personalized experiences in their

advanced mobile apps, Delta is investing in cutting-edge technologies to streamline processes, reduce wait times, and give travelers greater control over their travel plans.

One strategic initiative is the development of biometric technology. By utilizing facial recognition and other biometric identifiers, Delta aims to eliminate the need for physical boarding passes and identity verification documents. This will expedite the check-in process and enhance security measures at airports.

Environmental, social and governance (ESG) factors

Another area of focus for Delta is sustainability. As the airlines face scrutiny in this area, Delta recognizes the importance of investing in sustainable practices and reducing its environmental impact.

The company has committed to reducing its carbon emissions and has implemented various initiatives to achieve this goal. These include investing in more fuel-efficient aircraft, adopting sustainable aviation fuels, reducing waste and promoting recycling.

Analyst predictions and recommendations

Overall, analysts' opinions regarding the company's future performance are largely positive, with many recommending buying or holding the stock.

Twelve Wall Street research analysts have issued "buy," "hold" and "sell" ratings for Delta Air Lines in the last 12 months. There are currently 11 buy ratings and one strong buy rating for the stock. That means the consensus among analysts is that investors should "buy" DAL shares.

One key factor contributing to Delta's optimistic outlook is its strong financial position. The company's robust revenue growth and cost management strategies have resulted in healthy profitability. Delta's commitment to enhancing shareholder value through share repurchases and dividend increases has garnered positive attention from analysts.

Is Delta Air Lines stock a buy?

The answer to the question, "Is Delta a good stock to buy?" depends on your investment strategy. Delta Air Lines is a large, well-established airline with a strong track record. The company has several opportunities for growth, including expanding into new markets, acquiring new aircraft and developing new technology.

However, the company faces challenges, including high fuel costs, rising competition and economic downturns.

Delta Air Lines is a well-positioned blue-chip company with a bright future. The company has a solid financial position, a robust network and a commitment to innovation.

Whether or not Delta Air Lines is a "buy" depends on your investment goals and risk tolerance. Delta Air Lines may be a good option if you want a stock with a strong financial position and a bright future. However, if you are concerned about the risks of the airline industry, then consider other investments. There are many other excellent consumer discretionary stocks on the market. You can compare Delta against other blue-chip stocks to see how Delta's metrics stack up.

FAQs

This FAQ section addresses some commonly asked questions about Delta's operations and future outlook. Whether you're a potential investor, a frequent flier or simply curious about the company, this section aims to provide you with valuable information and insights.

Is Delta stock a good buy right now?

So, is DAL a buy now? Whether this blue-chip stock is a good investment depends on your investment goals and risk tolerance. If you are looking for a stock with a solid financial position and a bright future, Delta may work for your portfolio. However, if you are concerned about the risks of the airline industry, then consider other investments.

Will Delta Airlines' stock go up?

It is impossible to say whether or not Delta Airlines' stock will increase. The stock market is volatile and can be affected by various factors, both internal and external to the company. However, the DAL stock forecast shows that it is a well-established company with a strong track record, so the stock could go up.

Is Delta stock undervalued?

Whether or not Delta stock is undervalued is a matter of opinion. Some investors may believe the stock is undervalued, while others may think it is fairly valued. Ultimately, answering the question "Is Delta stock a buy?" is up to each investor to decide whether or not they believe the stock is at the correct valuation to purchase.

Before you consider Delta Air Lines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Delta Air Lines wasn't on the list.

While Delta Air Lines currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.