Shares of DoubleVerify Holdings Inc. NYSE: DV took a 39% plunge on its Q1 2024 earnings report. DoubleVerify is a leading media effectiveness platform that leverages artificial intelligence (AI) to verify ads, provide data analytics, and detect fraud. Just as cybersecurity companies manage identity verification, DoubleVerify manages digital advertising verification. The company has 50% of the top 1,000 advertisers as clients. These advertisers work with many high-profile companies, including PepsiCo. Inc. NASDAQ: PEP, New Balance, Dolce&Gabbana, Softbank OTCMKTS: SFTBY, and Sanofi NASDAQ: SNY.

The computer and technology sector company competes with Integral Ad Science Holding Co. NASDAQ: IAS and Neilson.

Digital Media Measuring

DoubleVerify helps advertisers measure the effectiveness of their digital and social advertising and marketing spend. It offers a suite of products to verify the effectiveness and legitimacy of online ads. For example, their AI power tools can identify invalid traffic (IVT), which are clicks and impressions coming from bots, and non-human traffic (NHT), which comes from scripts with potential malware. It can spot geo-fraud ads that appear in unrelated and unintended geographic locations. Viewability fraud occurs when ads are shown off screen being unavailable for a sufficient period.

Third-Part Verification and Integration

DoubleVerify acts as a third-party verification service that independently confirms the right placement of digital ads and measures the effectiveness of advertising campaigns. Their services are scaled to meet the needs of clients worldwide. DoubleVerify can also integrate its platform with most major ad-tech platforms and exchanges. This enables their verification tools to operate seamlessly within existing workflows.

Its social integration verification tool, Scibids AI, is a growth driver with much more room to grow even with existing customers. DoubleVerify has established partnerships with leading social platforms X, Snap Inc. NYSE: SNAP, Pinterest Inc. NYSE: PINS, Alphabet Inc. NASDAQ: GOOGL, Meta Platforms Inc. NASDAQ: META and TikTok. Almost 40% of the companies' new logos were actively testing Scibids AI. Nearly 50% of its clients haven't activated social measurement, and 80% haven't activated pre-screen social activation. DoubleVerify has 82 key global retail media networks and sites that accept their measurement tags.

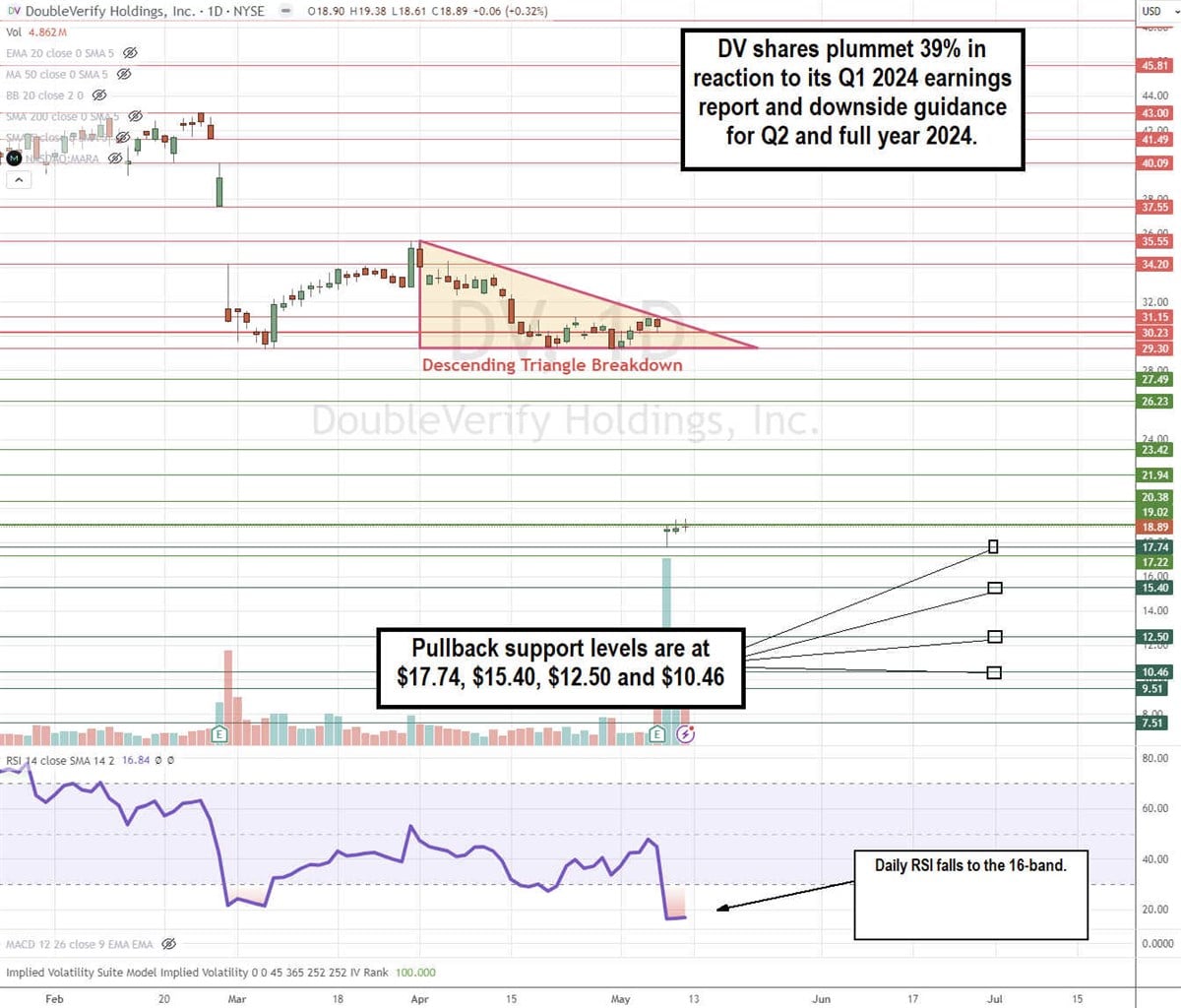

Daily Descending Triangle Breakdown Pattern

DV formed a daily descending triangle breakdown on its Q1 2024 earnings release. The descending trendline formed at $35.55 on April 1, 2024, and the flat-bottom lower trendline formed at $29.30, deflecting two attempts for a breakdown heading into earnings. The downside of Q2 and full-year guidance caused DV collapse and a gap down over 35% to the $18.89 level. The daily relative strength index (RSI) plunged to the oversold 16-band. Pullback support levels are at $17.74, $15.40, $12.50 and $10.46.

Is Growth Slowing?

DoubleVerify Today

DV

DoubleVerify

$14.59 -0.38 (-2.51%) As of 03:58 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $13.42

▼

$35.57 - P/E Ratio

- 39.44

- Price Target

- $23.00

DoubleVerify reported EPS of four cents, which missed 12 cents consensus analyst estimates by eight cents. Revenues grew 15% YoY to 140.70 million, beating $138.25 million analyst estimates. Revenue growth was driven by global growth in social and connected TV (CTV) measurement. The company had an 82% win rate across all opportunities, and 62% were greenfield wins in the quarter. The revenue drivers were Activation with 13% YoY growth, Measurement with 19% YoY growth and Supply-Side with 8% YoY growth.

Mixed Guidance

DoubleVerify issued downside Q2 2024 revenue guidance of $152 million to $156 million versus $158.32 million consensus estimates. Full-year 2024 revenues were lowered to $663 million to $675 million from the previous forecast of $688 million to $704 million versus $696 million consensus estimates. The guidance cut to 15% YoY and adjusted EBITDA around 28% margin at midpoint was primarily due to uneven ad spending amongst its largest advertisers.

Social Media Ad Spend Driving Social Media Measurement Sales by 51%

DoubleVerify CEO Mark Zagorski noted that digital video has emerged as the key catalyst for digital ad growth. Video comprised 81% of social measurement impression volumes in Q1 2024. Social media is the leading driver of the company’s impression volume.

Zagorski commented, “We grew our social measurement revenue by 51% year-over-year in the first quarter, following 48% growth in the full year 2023. Most of our social media revenue growth was driven by existing DV advertisers who increased their usage of our social measurement solutions. In addition, we increased the number of Top 100 customers leveraging our solutions across Meta, YouTube, TikTok, Pinterest, and Snap compared to last year.”

Bank of America Double Downgrade

DoubleVerify MarketRank™ Stock Analysis

- Overall MarketRank™

- 83rd Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 57.6% Upside

- Short Interest Level

- Bearish

- Dividend Strength

- Weak

- Environmental Score

- N/A

- News Sentiment

- 0.52

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 36.11%

See Full AnalysisDV received a double downgrade from Bank of America as analysts cut its ratings to Underperform from Buy with an $18 price target, down from $45. Analyst Omar Dessouky doesn't see any significant bullish catalysts justifying expectations for its high LT growth rate. He also believes that programmatic ad spending from its large clients could slide. This could lead to lower activation volumes. This contrasts with what CEO Zagorski said regarding its customers' increasing ad spend on social media. The uptick in social media spending on Snapchat and Pinterest also seems to side with the CEO.

DoubleVerify analyst ratings and price targets are at MarketBeat.

Before you consider DoubleVerify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleVerify wasn't on the list.

While DoubleVerify currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.