Petco Health and Wellness Co. Inc. NASDAQ: WOOF is a leading national pet supply and health store. The company sells pet products, from food to suppliers to toys and accessories, catering to pets, from fish, reptiles, birds, hamsters, cats, and dogs. While carrying the major well-known brands, Petco also sells many private-label products. The company also provides veterinary care, grooming, boarding, training and even pet insurance.

Petco competes in the retail/warehouse sector with online pet products supplier Chewy Inc. NYSE: CHWY and PetSmart and Petmed Express Inc. NASDAQ: PETS. Petco stock has a 23.39% short interest.

One-Stop Shop for All Things Pets

Petco Health and Wellness Today

WOOF

Petco Health and Wellness

$4.57 +0.13 (+2.93%) (As of 01:16 PM ET)

- Price Target

- $4.16

Petco operates over 1,500 brick-and-mortar stores across the United States, Mexico and Puerto Rico. California is the state with the most Petco stores, with just over 200. The company also offers online sales, a mobile app and a loyalty program. It's very similar to privately held competitor PetSmart. Most locations have a schedule of training programs. Over 100 locations also feature in-store veterinary hospitals.

Pet Insurance Plans

The company has partnered with Nationwide Insurance to offer pet insurance, including accident plans for dogs, starting at $16 per month. The insurance provides reimbursements after you upload the medical bill receipts and insurance claims. The pet insurance plans don't cover pre-existing conditions contracted, manifested or incurred before the policy's effective date, like diabetes or skin allergies. Policies have a 14-day waiting period. Exotic pet insurance is available for exotic pets.

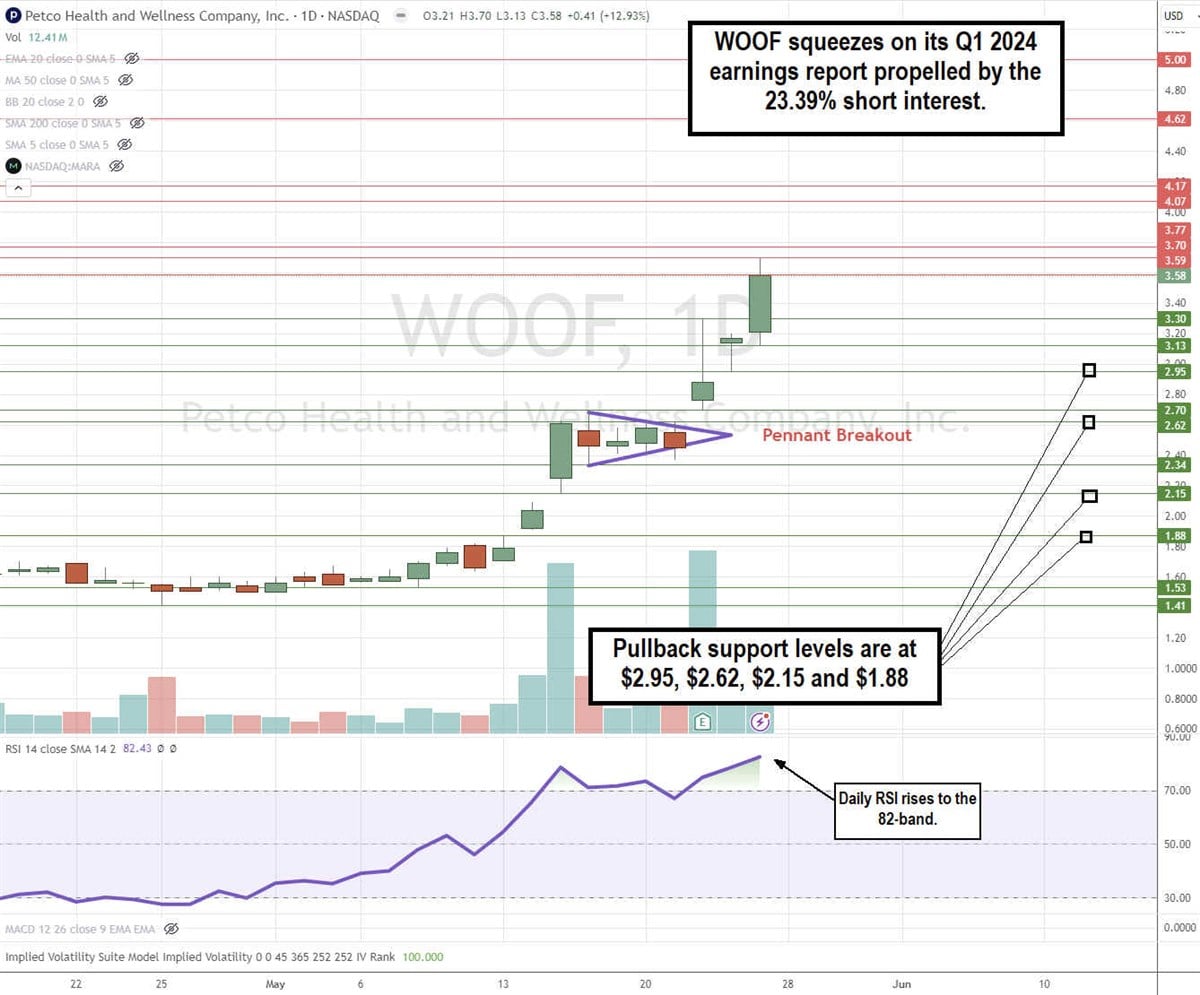

Daily Pennant Breakout

WOOF triggered a daily pennant breakout pattern. This comprised a flagpole preceding the symmetrical triangle, which makes it a pennant. The flagpole ran up from $1.53 to $2.70. The lower highs and higher lows eventually formed an apex point that WOOF broke out of to the upside, surging share on earnings to $3.70. The daily relative strength index (RSI) rose to the 82-band. Pullback support levels are at $12.14, $11.40, $10.55 and $9.98.

Could the Worst Be Over?

Petco reported Q1 2024 losses of 4 cents, which beat analyst estimates by 2 cents. GAAP net loss was $46.5 million or 17 cents per share compared to a GAAP loss of $1.9 million or 1 cents per share in the year-ago period. Adjusted net income was a loss of $11.8 million. Revenues fell 1.7% YoY to $1.53 billion, beating analyst expectations for $1.51 billion. This was an improvement from the 6.1% drop in net revenues in Q4 2023. Comparable sales declined 1.2% YoY but increased 4.1% on a 2-year basis.

In-Line Guidance

Petco gave in-line guidance for Q2 2024 of an EPS loss of 2 cents, matching consensus analyst estimates. Revenues are expected to be around $1.525 billion, beating $1.52 billion consensus estimates. Full-year 2024 net interest expense is expected to be around $145 million, and capex of 140 million.

Interim CEO Insights

Petco Interim CEO Mike Mohan noted the transformation that Petco must undergo to become profitable by reinforcing an owner's mindset. The company has rolled out a new store operating model that prioritizes and increases customer-facing time. The company is conducting an end-to-end review and rationalization of price and merchandise mix. The goal is to better align in-store and online merchandising to meet the needs of pet parents.

Inventory management requires realigning the omnichannel delivery model, better balancing capacity and cost to serve its direct-to-consumer (DTC) fulfillment centers and managing overall distribution costs. Mohan sees meaningful opportunities across its entire supply chain to grow efficiencies.

Petco is recalibrating marketing efforts to deliver more effective lower funnel marketing and engaging actively with pet parents in-store and online. The company is on track to unload $150 million in cost savings by the end of fiscal 2025.

Mohan concluded, "Our ecosystem comprised of a fully integrated services offering, one of the most comprehensive nutrition and merchandising assortments in the market, and a powerful omnichannel delivery model remains a competitive differentiator from online-only and mass players. This ecosystem powers our customer acquisition flywheel and reinforces our unique position as a retailer of choice within the pet category."

Petco Health and Wellness analyst ratings and price targets are on MarketBeat.

Before you consider Petco Health and Wellness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Petco Health and Wellness wasn't on the list.

While Petco Health and Wellness currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.