Rideshare operator Lyft Inc. NASDAQ: LYFT stock has been given a second life thanks to its Q4 2023 earnings performance. The computer and technology sector company has been written off as a distant second in the rideshare industry dominated by Uber Technologies Inc. NYSE: UBER. Under the helm of new leadership spearheaded by CEO David Risher, formerly of Amazon.com Inc. NASDAQ: AMZN and Microsoft Co. NASDAQ: MSFT, Lyft appears to be back on a renewed path to profitability. There's no arguing that Lyft's business is still growing, as underscored by the 17% YoY growth in bookings despite flat revenues.

The Oligopoly Rides On

The markets have realized that despite how far ahead Uber has taken the lead, Lyft is still the (far distant) number 2 player in the industry, which is still an oligopoly. Oligopolies are still rampant in commerce. Though not quite an even oligopoly like The Boeing Co. NYSE: BA and Airbus with airliners or The Coca-Cola Co. NYSE: KO and PepsiCo Inc. NASDAQ: PEP with beverages. The Uber and Lyft oligopoly is more like Alphabet Inc. NASDAQ: GOOGL owned Google, and Microsoft Co. NASDAQ: MSFT owned Bing, which is the oligopoly in internet search.

Clawing Back on Track

On February 13, 2024, Lyft released its fourth-quarter 2023 results for December 2023. The company reported an adjusted earnings-per-share (EPS) profit of 19 cents, excluding non-recurring items, beating consensus analyst estimates of 8 cents by 11 cents. The net loss was $26.3 million compared to $588.1 million in the previous year. Net loss includes $93.3 million in stock-based compensations related to payroll tax expense. Adjusted EBITDA was $66.6 million compared to a loss of $248.3 million in the year-ago period. It beats estimates for $50 million to $55 million. Revenues were unchanged at $1.2 billion versus $1.22 billion consensus analyst estimates.

Record Riders and Gross Bookings

Active riders grew 10% YoY. Gross bookings rose 17% YoY. Riders and gross bookings reach all-time highs for the company. Rides grew 26% YoY to 191 million. Full year rides rose 10% to 709 million. Full-year total active riders rose to more than 40 million, the highest annual ridership in Lyft's history.

On-Time Pick-Up Promise

Lyft introduced its On-Time Pick-Up Promise for scheduled airport rides in major markets. This initiative promised riders that their driver will pick them up within 10 minutes of the scheduled pick-up time, or they will be given $100 in Lyft ride credits. As a result, 98% of its scheduled airport rides were on-time, reaching an all-time high.

Women+ Connect Shows Strong Growth

Lyft's Women+ Connect feature has had nearly 7 million rides to date. This feature prioritizes matching women passengers with women and non-binary drivers. Over 67% of eligible drivers opted to keep the feature on 99% of the time.

Lyft Media is Getting Noticed

Lyft's in-app video ads were launched in the fourth quarter with strong results as measured in views and clicks. The company is working closely with partners to create great experiences for riders, tapping into its lifestyle and destination-targeting capabilities. Nearly 20% of Lyft's rides have a direct connection to one of its partners. These partnerships result in collaboration deals and advertising on its app. Some of the partnerships include Delta Air Lines Inc. NYSE: DAL, Comcast Co. NASDAQ: CMCSK owned Universal Pictures, Starbucks Co. NASDAQ: SBUX, Amazon.com Inc. NASDAQ: AMZN and Apple Inc. NASDAQ: AAPL. Get AI-powered insights on MarketBeat.

Lyft Raises Forward Guidance

Lyft sees Q1 2024 gross bookings of $3.5 billion to $3.6 billion. Adjusted EBITDA is expected to be between $50 million and $55 million, with adjusted EBITDA margin between 1.4% and 1.5%. Full-year 2024 rider growth is expected in the mid-teens YoY. Gross bookings growth is forecast to be slightly higher than rides growth YoY.

Adjusted EBITDA margin expansion is expected to be around 50 bps improvement YoY. It's worth noting that the press release had a typo regarding its Adjusted EBITDA margin expansion, listed as 500 bps when it was actually 50 bps YoY. This sent shares in a frenzy up and then a pullback before resuming an uptrend.

CEO Insights

CEO Risher noted that the company expects to generate positive full cash flow in 2024 on a full-year basis for the first time in its history. The company has prioritized its focus on drivers and seen driver hours rise 47% YoY. The company also implemented a policy that drivers earn at least 70% of the rider's weekly payments after applying external fees. Lyft also experienced significantly less primetime YoY growth. Primetime is Lyft's version of Uber's surge pricing during extra busy periods. He noted that people are getting out more when commuting, traveling, and taking rides to events.

CEO Risher concluded, "The headline is that in 2024, we expect Lyft to generate positive free cash flow on a full-year basis for the first time in our company's history. It's a huge milestone for us. I am very proud of all Lyft has achieved in 2023 and the first few weeks of 2024. As I said at the beginning, this will be the year that we prove customer obsession leads to profitable growth."

Lyft analyst ratings and price targets can be found on MarketBeat. The MarketBeat stock screener can help you find Lyft's peers and competitor stocks.

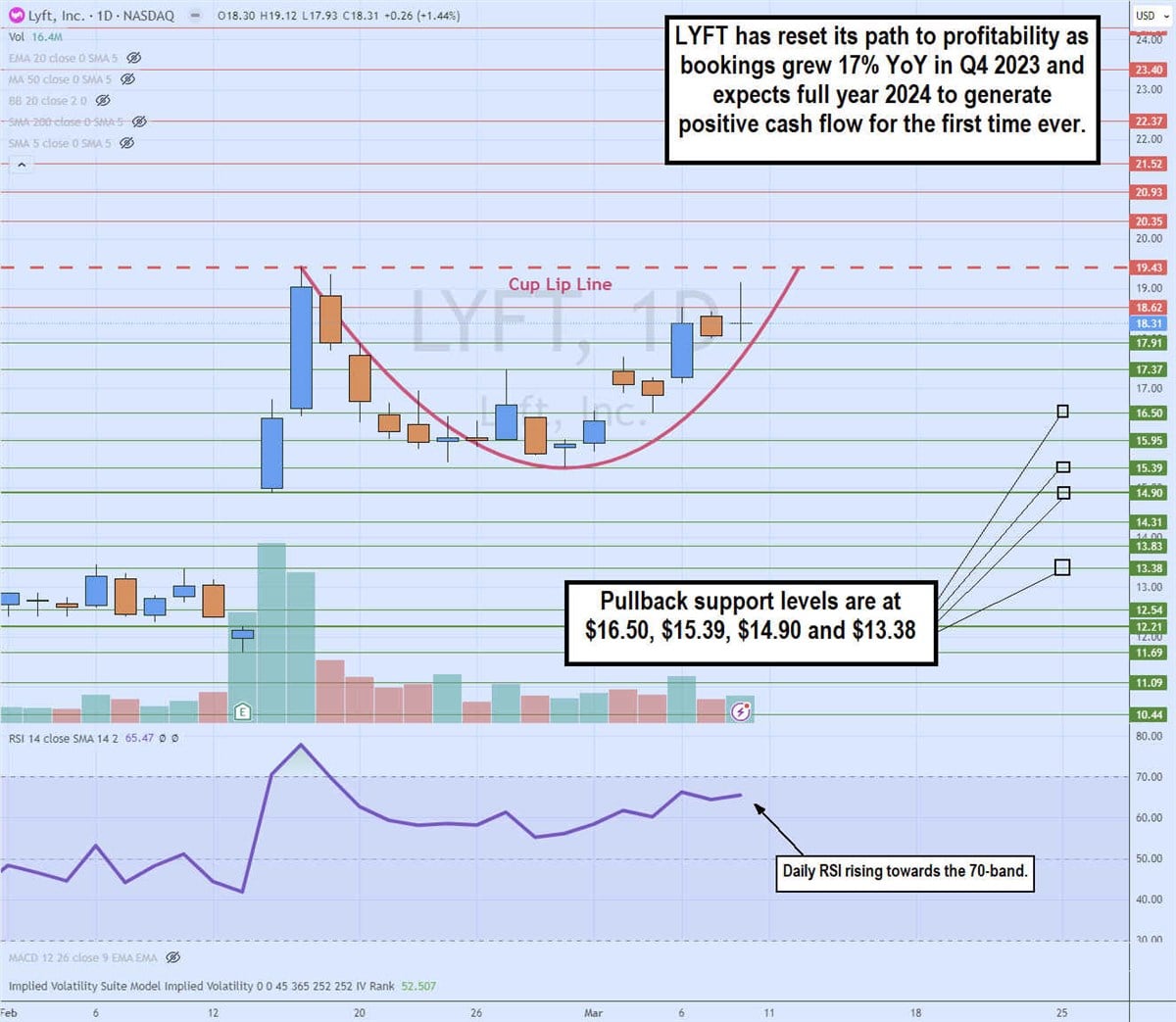

Daily Cup Pattern

The daily candlestick chart on LYFT illustrates a cup pattern. The cup lip line formed at the $19.43 peak that formed on February 15, 2024, following its gap at $14.90 and short squeeze the next day to 52-week highs. Shares got a healthy pullback to the $15.39 level, forming a rounding bottom and holding above the gap fill level at $14.90, setting the stage for a rally back towards the cup lip line to complete the cup pattern. The daily relative strength index (RSI) has been climbing steadily back up towards the 70-band. Pullback support levels are at $16.50, $15.39, $14.90 and $13.38.

Before you consider Lyft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lyft wasn't on the list.

While Lyft currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.