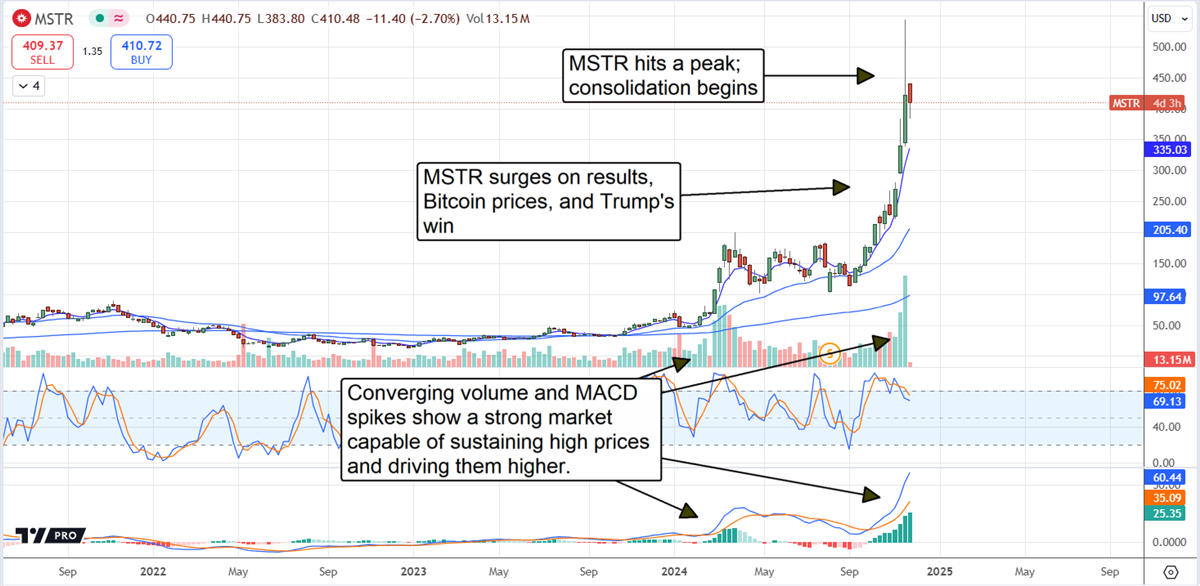

MicroStrategy NASDAQ: MSTR stock is up more than 500% since the beginning of 2024 and has the potential to grow even more. As the world's largest corporate holder of Bitcoin (CRYPTOCURRENCY: BTC) and a potential pioneer in establishing a Bitcoin reserve bank, the company is well-positioned in an industry where the underlying asset is expected to keep appreciating in value.

However, forces in play promise to bring volatility to this market, so investors should be prepared.

MicroStrategy share sales increased the share count by nearly 40% at the end of FQ3 2024, with the company not only anticipating but actively projecting further dilution. MicroStrategy execs plan to raise another $21 billion via share sales over the next three years and will compound it with an equal amount of debt. This $42 billion initiative, known as the "21/21 Plan," aims to significantly expand the company's Bitcoin holdings. The funds are intended for Bitcoin acquisitions and general corporate purposes, beyond the company's core software operations.

However, this aggressive Bitcoin acquisition strategy has introduced some financial challenges. The company's core enterprise software business, specializing in AI-powered data analytics, has faced declining revenues and increasing losses in 2024. In the third quarter of 2024, MicroStrategy reported total revenues of $116.1 million, a 10.3% decrease year-over-year, and a net loss of $340.2 million, compared to a net loss of $143.4 million in the same quarter of 2023.

MicroStrategy Builds Value With Bitcoin

Strategy Today

$350.34 +4.61 (+1.33%) As of 04:00 PM Eastern

- 52-Week Range

- $101.00

▼

$543.00 - Price Target

- $508.09

As risky as the MicroStrategy stock is, the company can build shareholder value with its Bitcoin strategy. Balance sheet highlights at the end of Q3 include a flat cash position, ample liquidity with over $46 million in cash and investments, a 75% increase in total assets, and an offsetting increase in debt and total liability. The net result is a 75% increase in shareholder equity that keeps leverage low, with long-term debt running near 1.1x equity and about 0.5x assets.

More importantly, MicroStrategy’s digital assets more than doubled to a carrying value of nearly $7 billion, providing a significant profit cushion with a market value closer to $32 billion. That’s sufficient to cover total liabilities with over $25 billion left over. These trends are expected to continue in 2025 and fuel a robust revision among analysts.

And the outlook for Bitcoin prices is in play. The price of Bitcoin has surged since Donald Trump won the presidential election and will likely continue to move higher. His crypto-friendly posture and policy moves, as well as those of other Republicans, include nominating known crypto-advocate Scott Bessent for Treasury Secretary.

Other noteworthy developments include the Republican takeover of the House of Representatives and the critical House Financial Services Committee, which is central to cryptocurrency regulation in the United States. Bitcoin struggled to cross the $100,000 level in late November but may do so soon. If so, it could rise by another $30,000 or more.

Analysts Forecast Higher Prices: Institutional Buying Picks Up

Strategy Stock Forecast Today

12-Month Stock Price Forecast:$508.0947.10% UpsideModerate BuyBased on 11 Analyst Ratings | Current Price | $345.42 |

|---|

| High Forecast | $650.00 |

|---|

| Average Forecast | $508.09 |

|---|

| Low Forecast | $220.00 |

|---|

Strategy Stock Forecast DetailsEight analysts currently unanimously rate the MSTR stock a Buy with a price target of $357. The consensus implies about a 20% downside for the market, but it is rising sharply—up 1000% in the last year and nearly double since the last earnings report was released. The revision trend leads to the high-end range, which tops at $600 for a 50% gain from $400.

The institutional activity also supports the price action for MicroStrategy stock this year. Following the Q3 earnings report, institutional purchasing ramped in Q4 at a pace of 3:1 compared to sellers, increasing the total holding to over 70% of the stock.

MicroStrategy Hits a Ceiling: Consolidation Begins

MicroStrategy surged more than 500% but hit a ceiling in November that may cap gains in 2024. The ceiling is marked by a large green candle with a large upper wick that shows resistance at the $450 level. The subsequent candle confirms resistance at that level but not a reversal in the stock price. The market for this stock is strong, as shown by the MACD oscillator and increasing volume, so consolidation is expected to lead to higher prices sometime down the road. Potential catalysts for that move include an increase in Bitcoin pricing, the presidential inauguration in January 2025, and the FQ4 earnings report due in early February.

Before you consider Strategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Strategy wasn't on the list.

While Strategy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.