NVIDIA’s NASDAQ: NVDA growth is slowing, and margins are expected to compress, but so what? The company’s business has grown nearly 800% in the last four years and continues to grow. The Growth will eventually top out, but high levels of business are expected because of the AI revolution.

NVIDIA’s first-mover advantage and dominant position in the DC market make it well-positioned to benefit from the persistent technology upgrade cycle that it began. AI technology will make giant steps over the next few years.

Globally, data centers are upgrading to NVIDIA semiconductor infrastructure to keep up with demand from and for AI. The critical details from the Q3 results show that the demand for Hopper, the current generation of AI, and Blackwell, the next generation, is “incredible.” The only thing that will hold this company back over the next two to four quarters is supply, which is ramping.

NVIDIA Produces Another Stunning Quarter

NVIDIA Stock Forecast Today

12-Month Stock Price Forecast:$165.0155.42% UpsideModerate BuyBased on 43 Analyst Ratings | Current Price | $106.17 |

|---|

| High Forecast | $220.00 |

|---|

| Average Forecast | $165.01 |

|---|

| Low Forecast | $102.50 |

|---|

NVIDIA Stock Forecast DetailsNVIDIA’s Q3 results are perhaps the best performance it has put in over the last two years of successively stronger results. The company’s growth slowed to only 95%, but this is on top of the 205% growth produced last year in Q3 and is well above the consensus. The company’s outperformance is impressive enough at 1300 basis points above MarketBeat’s reported consensus but more so because of the revision trend.

The analysts increased their revenue and earnings forecasts until the report was released, setting the bar very high. Strength is centered in the DC business, up 112% YOY and 87% of revenue, but all segments grew. The core gaming segment is up 15%, Pro Visualization 7%, and automotive 30%, showing broad-based strength within the portfolio.

The margin news is also robust. The company improved the gross margin by another 60 basis points, and operating income grew by 110%. Net income is up more than 50%, and adjusted earnings are up 103%. The critical detail in the cash flow and balance sheet is that positive cash flow is robust, fueling enviable balance sheet improvements.

The company’s cash balance is up about 50% YOY to $38 billion, leaving it in a net-cash position relative to total liability, not just its very low debt. Shareholder equity is also rising, up about 50% YOY and is expected to continue rising.

The takeaway from this data is that the company is well-positioned to do whatever it wants, including significant shareholder returns. The possibility of aggressive share repurchases, special dividends, and dividend increases grows with each quarter. Repurchases in Q3 were enough to offset dilution and reduce the share count incrementally.

Guidance is another factor in favor of rising share prices. The company says that demand for Blackwell is outstripping the pace of production, but production is ramping, so investors can expect revenue to remain steady, if not grow, in F2025. Regarding Q4 of fiscal 2024, the company expects another sequential revenue growth, with revenue up about 70% YOY, and for margin to remain strong.

Analysts Lead Market to Higher Price Points

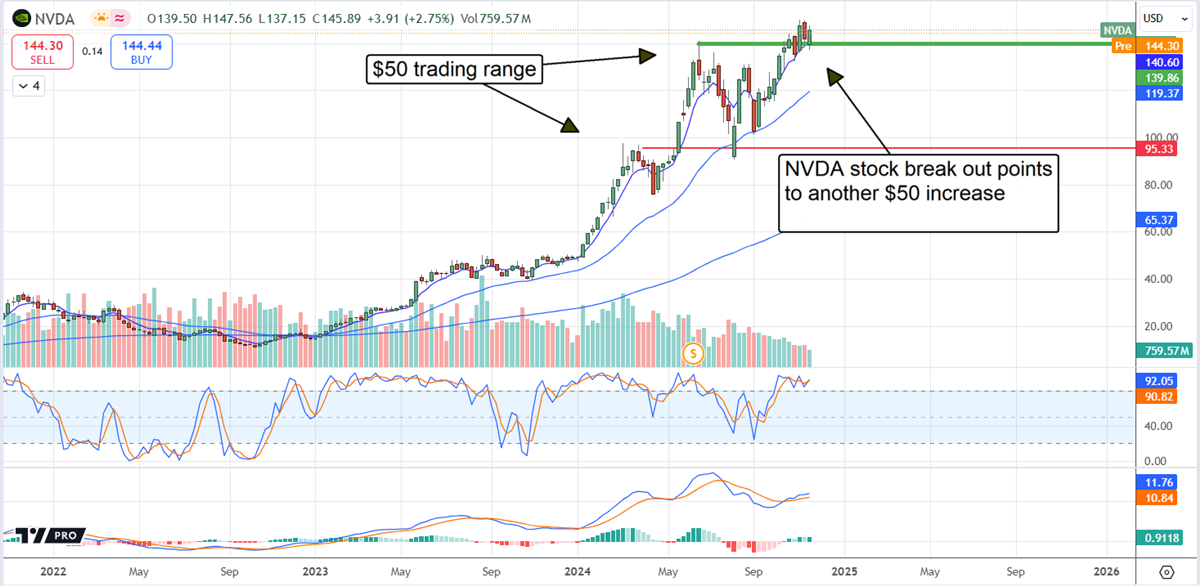

The analysts' response to the news differs from the initial market response. Analysts raised their price targets, showing a growing conviction that NVIDIA will trade at nearly $200 within the next twelve months. A move to $200 is worth nearly 40% of upside from the critical support target and will likely be viewed as a low target in hindsight. The trends that are driving analysts' sentiment are still in place, suggesting the analysts' upgrade and revision trend will continue in Q4 and fiscal 2025.

The price action in NVIDIA shares pulled back following the Q3 release but, even so, remained bullish for investors. The pullback is less than 5%, and the critical resistance target has yet to break, which was the previous all-time high. The likely scenario is that this market will retest support at the previous all-time high and confirm it, if not confirm support at a higher level, leading to new all-time highs this year. In this scenario, NVIDIA shares can hit the $200 level in the first half 2025.

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.