Sea Limited NYSE: SEA is a Singapore-based consumer internet technology conglomerate operating in three main digital segments, which include gaming, e-commerce and financial services. The company serves the consumer cyclical sector in Southeast Asia, Taiwan, and Latin America. Sea started as an online video game publisher, Garena, with its popular mobile battle royale game, Free Fire. Garena evolved into a leading esports organizer, providing a digital entertainment platform enabling users to access its mobile and PC online games.

The company also operates Shopee, which is Southeast Asia's largest e-commerce platform with over 343 million. Its SeaMoney division offers digital banking and financial services. Together, the company achieves a network and cumulative effect by cross-selling its services to a growing base of consumers in Southeast Asia. Get AI-powered insights on MarketBeat.

One Stop Digital Shop

Sea is like Amazon.com Inc. NASDAQ: AMZN, Activision Blizzard Inc. NASDAQ: ATVI and Sofi Technologies Inc. NASDAQ: SOFI of Southeast Asia. Its scale is massive, and it owns a dominant market share in each division. SeaMoney offers financial services from mobile wallet, payment processing, insurance and lending to buy-now-pay-later (BNPL) services under its SPayLater, SeaBank, and SeaInsure financial service brands. Its value proposition lies in offering convenient, accessible and reliable digital solutions to consumers and businesses.

The Company Delivered a Solid Year-End Earnings Report

On March 4, 2024, Sea Limited reported its fourth-quarter 2023 earnings for the quarter ending December 31, 2023. The company reported a loss of 19 cents as revenues grew 5.7% YoY to $3.62 billion versus $3.57 billion consensus estimates. Total gross profit was $1.5 billion, and net loss was $111.6 million. Total adjusted EBITDA was $126.7 million. The company closed the quarter with $8.5 billion in cash and cash equivalents.

Q4 2023 Segment Performance

Shopee GAAP revenues grew 23.2% YoY to $2.6 billion. Core marketplace revenues, consisting mostly of transaction-based fees and advertising revenues, grew 40.6% YoY to $1.6 billion. Adjusted EBITDA was a loss of $225.3 million. Gross orders grew 46% YoY to 2.5 billion. Gross merchandise value (GMV) grew 28.6% YoY to $23.1 billion.

SeaMoney GAAP revenues rose 24.3% to $472.4 million. Adjusted EBITDA was $148.5 million, up 96.4% YoY. Garena GAAP revenues were $510.8 million. Bookings were $456.3 million. Adjusted EBITDA was $217.4 million. Adjusted EBITDA was 47.6% of bookings. Quarterly active users were 528.7 million. Quarterly paying users were 39.7 million. The average bookings per user was 86 cents.

The Company Achieved a Key Profitability Milestone

Sea Limited achieved its first full year of profitability since its IPO. Total GAAP revenues rose 4.9% YoY to $13.1 billion. Gross profits rose 12.5% YoY to $5.8 billion. Total net income was $163.7 million. Total Adjusted EBITDA was $1.2 billion. Get AI-powered insights on MarketBeat.

CEO Insights

Sea Limited CEO Forrest Li reiterated the milestone of hitting its first full year of profitability since its IPO in 2017. Shopee opened five new sorting centers and 385 new first and last-mile hubs across Asia. This extends its logistics network, which is now one of the most extensive and efficient in Southeast Asia. It's Free Fire was the most downloaded mobile game globally, and the positive trend continues into 2024. Free Fire has achieved more than 100 million peak daily active users, and it remains one of the largest mobile games in the world.

Li commented, "In 2023, we achieved profitability, strengthened our market leadership for our e-commerce business, grew our digital financial services business, and stabilized the performance of our digital entertainment business." He concluded, "We have emerged with a much stronger balance sheet with our cash position increasing to 8.5 billion dollars as of the end of 2023, demonstrating the discipline and prudence we have applied in our investments over the past year. Looking ahead, we expect 2024 to be another profitable year."

SEA Stock Gets an Analyst Upgrade

JP Morgan upgraded SEA to Overweight from Neutral raising its price target to $70 from $43. Analyst Ranjan Sharma thinks Sea will continue increasing commissions and reduce marketing and sales spending, noting that Shopee raised its digital mall commission by 400 bps in Malaysia. High take rates could result in volatility in its earnings due to the competitive environment. Sharma noted that high take rates, the percentage of sales Sea keeps, can increase the propensity for sellers to look for alternative cheaper platforms.

Sea Limited analyst ratings and price targets are at MarketBeat. Sea Limited's peers and competitor stocks can be found with the MarketBeat stock screener.

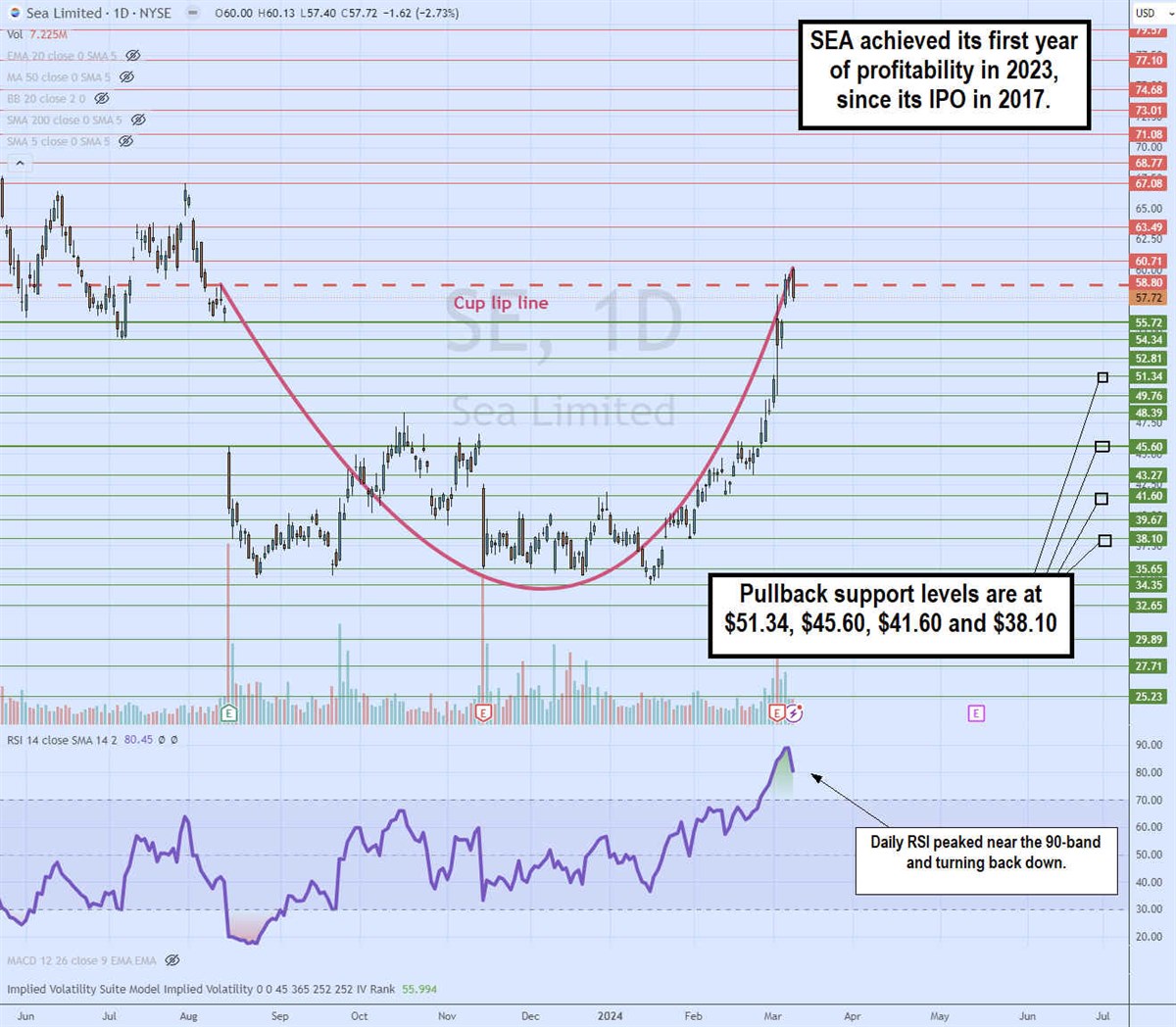

Daily Cup Pattern

The daily candlestick chart on SE illustrates a cup pattern. The cup lip line formed at $58.80 on August 11, 2023, before shares cascaded down to the $34.35 swing low on January 17, 2024. SE staged a rally back up through the $45.60 gap fill level and propelled higher through the $55.72 gap fill level on its Q4 2023 earnings release as it retested the cup lip line. The daily relative strength index (RSI) surged to the 90-band before peaking and turning back down towards the 70-band. Pullback support levels are at $51.34, $45.60, $41.60 and $38.10.

Before you consider SEA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEA wasn't on the list.

While SEA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.