Silicon Motion Technology Co. NASDAQ: SIMO is a fabless semiconductor company in the computer and technology sector specializing in designing and developing NAND flash memory controllers. The controllers enable solid-state drives (SSD) to operate seamlessly, managing the communications between the NAND flash memory and the computer system. The artificial intelligence (AI) boom is driving insatiable demand for memory chips, notably non-volatile NAND flash memory by Micron Technology Inc. NASDAQ: MU used in SSDs devices by giants like Seagate Technology PLC NASDAQ: STX and Western Digital Co. NASDAQ: WDC.

AI-Driven Demand Tailwinds

The AI revolution has driven demand for high-speed storage solutions. SSDs are seeing massive demand as AI models need oceans of data to train them. Not only does AI demand data capacity, but high-speed access and transfers are a necessity. NAND memory is non-volatile, meaning it can retain data without power, unlike volatile memory like DRAM, which loses data once power is turned off. Silicon Motion derives the majority of its revenues from SSD controllers.

It also generates revenues from the mobile storage used in tablets, smartphones and mobile devices. These devices utilize data embedded in universal flash storage and USB flash drives. Silicon Motion's data center and enterprise solutions segment provides storage solutions catering to big data analysis and cloud computing demands.

Heavy Competition in the NAND Flash Market

Silicon Motion has heavy competition in the NAND flash memory market. Its top three competitors are Samsung Electronics Co. Ltd. OTCMKTS: SSNLF (which has a massive scale as a developer of its own NAND flash memory semiconductors and flash controllers), Western Digital (whose SanDisk division makes it a threat in the NAND market), and Marvell Technology Inc. NASDAQ: MRVL (which specializes in NAND storage controllers for enterprise and data centers).

Future Competition

The demand for fast data storage and access has fostered a race to usher in the next big storage technology. While HDDs are much cheaper and have much greater storage capacity, the moving parts make them vastly slower and clunkier than SSDs. Resistive RAM, or ReRAM, is a promising technology that enables faster data write times, higher endurance and lower power consumption. Micron Technology and Samsung are two pioneers that are currently in the research phase of ReRAM technology. It hasn't materialized yet, as companies are still attempting to assemble a prototype.

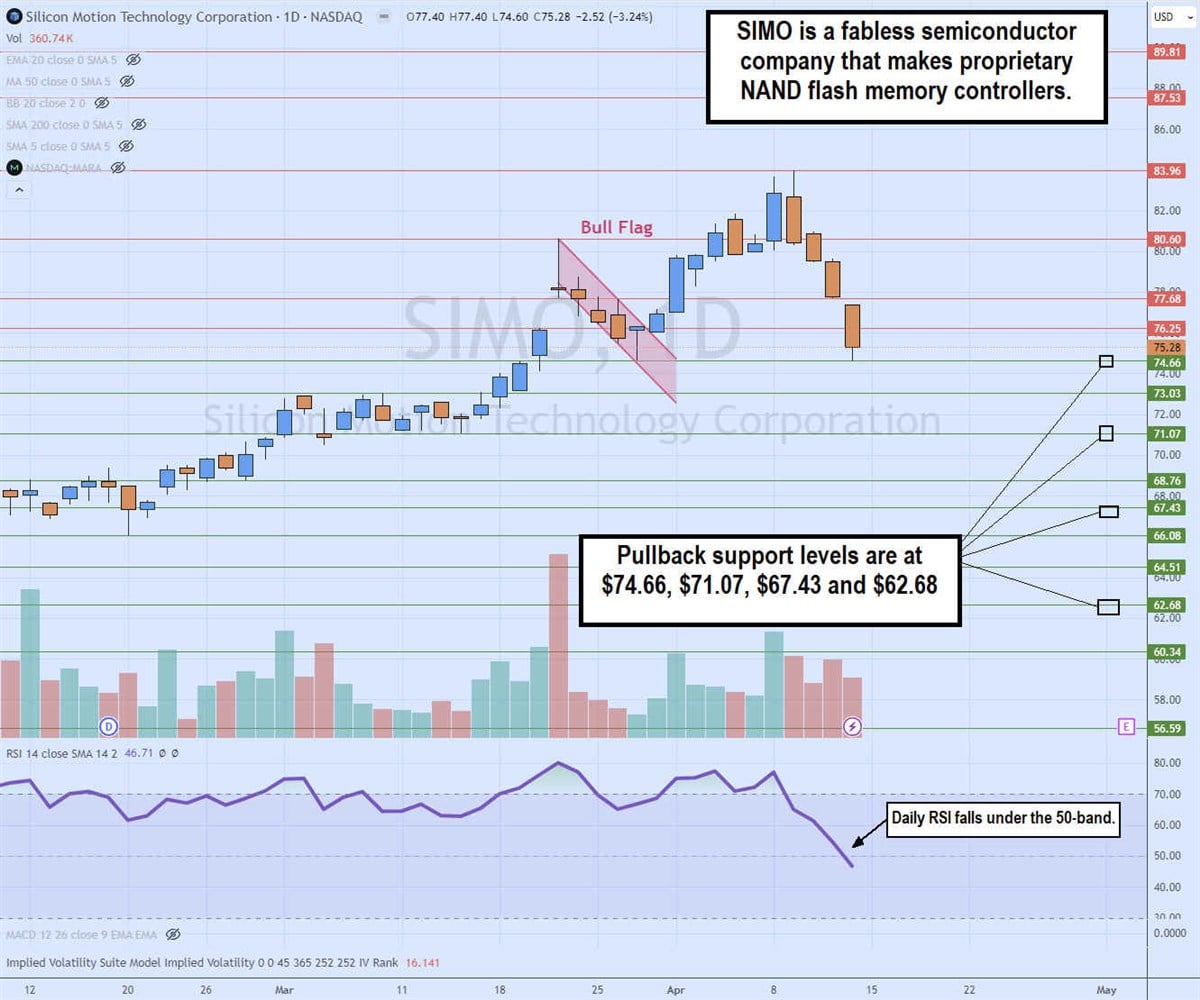

Daily Bull Flag

The SIMO daily candlestick chart illustrates a bull flag breakout pattern reeling from a pullback to support at $74.66 the bull flag low. Shares triggered a spike up to the $83.96 peak, but the pullback threatens to break through the bull flag low. The daily relative strength index (RSI) has fallen through the 50-band. Pullback support levels are at $74.66, $71.07, $67.43 and $62.68.

Solid Quarterly EPS Beat

Silicon Motion reported Q4 2023 EPS of 93 cents, beating consensus estimates by 20 cents. Revenues grew 0.8% YOY and 17% QOQ to $202.38 million, beating consensus estimates for $196.52 million. eMMC+UFS controller sales rose 25% to 30% QOQ and rose 20% to 25% YOY. SSD solution sales fell % to 10% QOQ and 45% to 50% YOY. The company announced a $2.00 per ADS annual cash dividend. Non-GAAP gross margins were 44.1%, and operating margin was 13.8%.

Full-year 2023 Non-GAAP net sales fell 32% YOY to $639.1 million, generating an 11.9% operating margin and $2.27 earnings per diluted ADS of $2.27.

Upside Guidance

Silicon Motion provided upside guidance for Q1 2024 revenues of $172 million to $182 million versus $169.19 million consensus estimates. Non-GAAP gross margins are expected to be in the high range of the original estimates of 44% to 45%. Full-year 2024 revenues were in line at $765 million to $800 million versus $767.72 million consensus estimates.

CEO Insights

Silicon Motion CEO Wallace Kou said, "Our fourth quarter results exceeded expectations as demand across the majority of our products increased sequentially, driven by holiday season demand and normalizing channel inventory."

Kou concluded, "Both eMMC+UFS and SSD controller demand grew strongly in the quarter. We are confident that our teams' ongoing commitment to deliver controller solutions that enable our customers to service a broader range of markets will continue to drive share gains for us and be the foundation for strong growth in 2024 and beyond."

Silicon Motion analyst ratings and price targets are at MarketBeat.

Before you consider Silicon Motion Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silicon Motion Technology wasn't on the list.

While Silicon Motion Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.