It’s been a long time coming, but stock rotation is back in the outlook. Rotation, the practice of exiting one group of stocks in favor of another, was triggered by the latest CPI report, which was better than expected.

The takeaway from the CPI report, compounded by comments from Jerome Powell, is that inflation is cooling and tracking where the FOMC can cut interest rates. Because the latest PCE data has consumer inflation at 2.6% and trending lower, that could be within the next few months. The CME FedWatch Tool shows the market pricing in 100% of a cut by September, only two meetings away, so the upcoming July FOMC meeting could catalyze the market into a quicker rotation.

Big Tech Is Out: Everything Else Is Back In

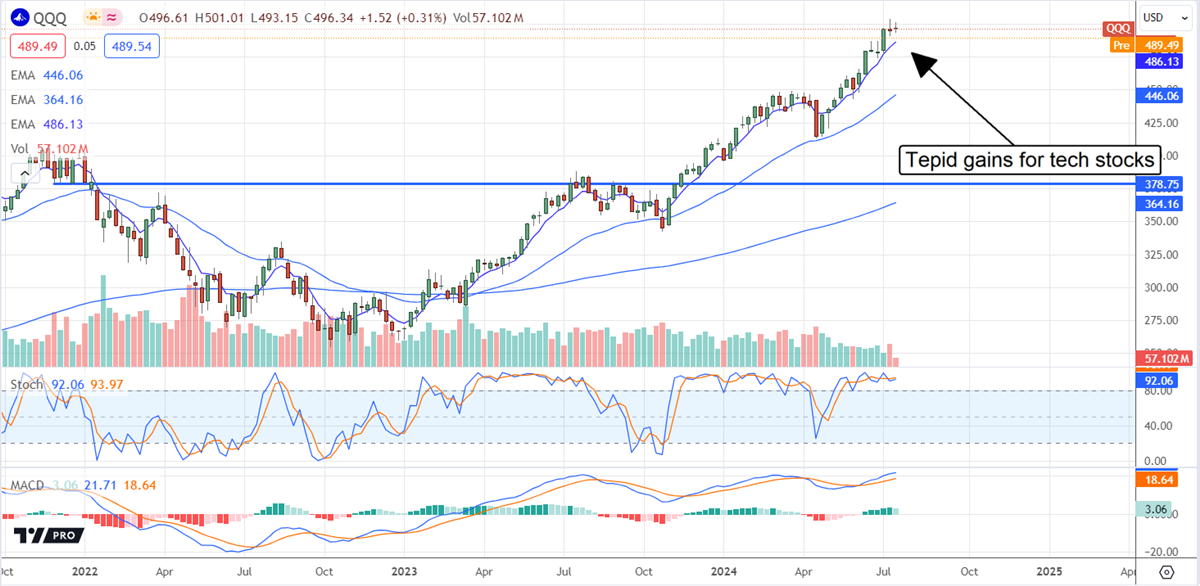

It is no secret that the market is heavily concentrated. Tepid economic conditions, interest rate headwinds, and sluggish consumer spending were offset by the rise of AI, led by Big Tech. The Magnificent 7 are the most heavily traded stocks set up for correction. The caveat for bearish traders is that a correction in Big Tech will also set up a buying opportunity for it.

With interest rates set to fall, business conditions will improve across the economy, resulting in a cyclical upswing that can drive earnings growth for years. As it is, the market expects earnings growth to accelerate this year through year-end and YoY S&P 500 NYSEARCA: SPY earnings growth to accelerate from this year to the next. That tailwind could strengthen if the FOMC follows through on the rate cut and gives a favorable outlook for additional cuts within the next 12 months.

Specific sectors that will benefit most from lower rates include consumer-oriented businesses and small businesses, which may choose to increase capital investment because of the lower cost of money.

Flight to Safety Leads Blue Chip Index to New Highs

The CPI spurred all three major indices to new all-time highs, but there is clear outperformance in the safe-haven blue-chip Dow Jones Industrial Index NYSEARCA: DIA. The Dow Jones Industrial Average has gained nearly 5%, more than doubling the S&P 500 advance since the CPI was released, both outperforming the NASDAQ Composite’s NASDAQ: QQQ tepid 0.75% advance.

While most of the Mag 7 names are moving lower, Dow components like Home Depot NYSE: HD and United Health NYSE: UNH advanced more than 10%, and consumer names like McDonald’s NYSE: MCD followed with smaller but still robust advances. The idea here is that quality counts. Home Depot, United Health, and McDonald’s are market leaders that drive value for shareholders even when growth is absent, and growth is present now and about to be invigorated by lower interest rates.

The Rally Broadens to Small and Mid-Cap Stocks

As solid as the gains in the Dow Jones Industrial and S&P 500 were, the real strength was in the Russell 2000 INDEXRUSSELL: RUT. The small-cap Russell 2000 advanced more than 10% in the last week, more than doubling the Dow Jones Industrial advance, with roughly 90% of the stocks within it making gains.

Most R2K names advanced at least 3% and many more than 10%. All sectors contributed to the gains as risk-on investing returned to the fore. Names making significant advances include but are not limited to Insmed NASDAQ: INSM, SPX Technologies NYSE: SPXC, Flour Corporation NYSE: FLR, and Hamilton Lane NASDAQ: HLNE, which advanced 13% to 14% for the week.

Coincidentally, SPX Technologies and Flour Corporation are involved in the engineering/construction industries, which are expected to be boosted by lower rates. Insmed is a biopharma with the added tailwind of recently released good news. Hamilton Lane is a private equity firm specializing in emerging growth, middle-markets, turnarounds, and venture deals; all categories are expected to benefit from lower interest rates.

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.