Dividend stocks are all-weather investments for buy-and-hold investing because they can help reduce portfolio volatility while generating income. Buying them when they are down and building a solid position is the recipe for market-beating total returns over time.

Dividend stocks can reduce portfolio volatility because the high-quality payers tend to have ample institutional interest and a loyal following of retail investors who don’t succumb to knee-jerk reactions. If the S&P 500 sells off sharply because of the FOMC, inflation, or the rise of recession fears, high-quality dividend stocks will have some insulation from the volatility and may even move higher as fear drives a flight to safety.

The stocks on the list today also have the potential to beat the S&P 500 NYSEARCA: SPY average share price performance in 2025, so now is a good time to invest regardless of the economic outlook. They have the potential for S&P 500-beating share price performance because their stock prices are in recovery mode following price corrections, and accelerating business growth is the forecast.

Abbott Laboratories Signals Multi-Year Rally Ahead

Abbott Laboratories Dividend Payments

- Dividend Yield

- 1.82%

- Annual Dividend

- $2.36

- Dividend Increase Track Record

- 54 Years

- Annualized 3-Year Dividend Growth

- 7.17%

- Dividend Payout Ratio

- 30.61%

- Next Dividend Payment

- May. 15

ABT Dividend HistoryAbbott Laboratories NYSE: ABT quality management, healthy balance sheet, profitable growth, and capital return have the stock in a long-term uptrend that is expected to continue. Not only is the dividend safe, but the combination of qualities has allowed the company to increase its distribution annually for over 50 years, making it a Dividend King. Because of earnings growth and balance sheet health, Abbott can sustain annual distribution growth for the foreseeable future.

Highlights from Q2 2024 include accelerating revenue growth for this healthcare company, beat-and-raise performance, and a forecast for another sequential acceleration. Numerous new product approvals drive the acceleration, which may be sustained for several years because of the healthy pipeline of products. That has the market for ABT stock on track to reverse after years of struggle.

The business acceleration in 2024 is good news as it marks the end of post-COVID normalization and sets the stock up for significant gains. Today, the market is moving up from a solid support base and confirming a significant uptrend line and may set a multi-year high soon. Because the price action is repeating a pattern formed from 2013 to 2015, it is possible Abbott Laboratories stock could set a new all-time high soon and then advance more than 100% over the next ten years.

Johnson & Johnson Returns to Growth, Shares Are Heading Higher

Johnson & Johnson Dividend Payments

- Dividend Yield

- 3.35%

- Annual Dividend

- $5.20

- Dividend Increase Track Record

- 64 Years

- Annualized 3-Year Dividend Growth

- 5.43%

- Dividend Payout Ratio

- 57.84%

- Next Dividend Payment

- Jun. 10

JNJ Dividend HistoryJohnson & Johnson NYSE: JNJ is driven by many of the same forces as Abbott, as it is a competing business, with organic growth in core segments normalized in the wake of COVID-19.

However, Johnson & Johnson is also on the brink of returning to top-line growth following the recent spin-off of its consumer health division, Kenvue. This move has allowed J&J to streamline its operations and focus more heavily on its pharmaceutical and medical device segments, which are expected to accelerate over the next several quarters.

It, too, is a Dividend King with over 50 years of consecutive dividend increases and the power to continue increasing for the foreseeable future. With analysts forecasting earnings growth of 7% in 2025, Johnson & Johnson is well-positioned to maintain its mid-single-digit distribution compound annual growth rate (CAGR), providing investors a reliable and growing income stream.

Additionally, the spin-off has freed up capital that can be reinvested into high-growth areas like oncology, immunology, and robotics, further bolstering the company’s top-line growth potential.

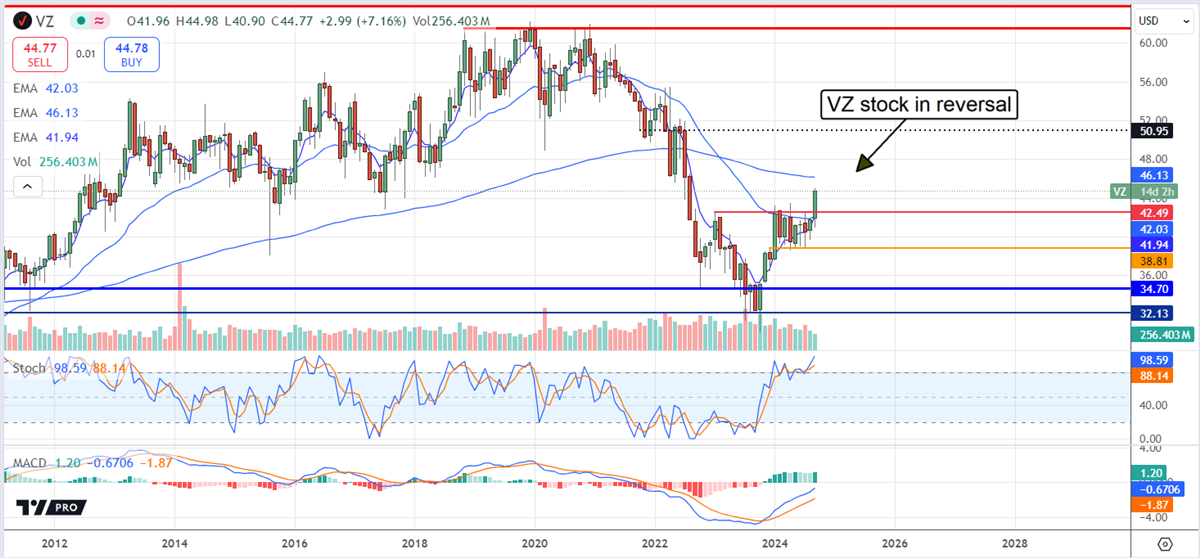

High-Yield Verizon Confirms Reversal: Double-Digit Upside and 6% Yield

Verizon Communications Dividend Payments

- Dividend Yield

- 6.35%

- Annual Dividend

- $2.71

- Dividend Increase Track Record

- 20 Years

- Annualized 3-Year Dividend Growth

- 1.93%

- Dividend Payout Ratio

- 65.46%

- Next Dividend Payment

- May. 1

VZ Dividend HistoryAfter years of sluggish growth, Verizon NYSE: VZ shares are trading near the bottom of a long-term range. However, the market is entering a technical reversal and will likely retrace to the high-end range because of an expected boom in 2024.

The boom will be driven by expanding networks and use cases for 5G as AI brings the IoT to life. The takeaway is that Verizon’s dividend payment, worth roughly 6% in yield with shares near $44.50, is safe and growing with the tailwind of earnings growth to support them.

Among the catalysts for Verizon’s share price is the expected acquisition of Frontier Communications. The all-cash deal will help Verizon scale while reducing costs by a forecasted $500 million annually.

Upon closing, the deal is expected to be accretive, bringing more than 2.2 million fiber optic subscribers and infrastructure to enhance Verizon’s Intelligent Edge, AI, and IoT capabilities.

Before you consider Verizon Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verizon Communications wasn't on the list.

While Verizon Communications currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.