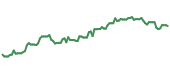

The transportation average has trended higher for the last two years and is set to reach new highs this year. The price action in early 2025 is bullish, confirming the trend with a strong signal, including crossovers in critical moving averages. While not technically a Golden Crossover, the set confirms the trend with a strong signal.

The 9-day EMA moves above the 150-day and 30-day, showing short, mid and long-term market participants in alignment with ample room for the market to move higher. There is some risk of resistance at the 16,600 level, but it is unlikely that this market will hold back without a significant change in the outlook.

The freight growth forecast for 2025 is tepid but includes modest volume and price increases sufficient to sustain a solid capital return outlook. Driven by international demand and consumer strength, growth is expected in the upper-mid single-digit range for air, trucking, and rail carriers.

The latest reading on consumer spending shows December retail sales outpacing inflation, a sign of demand growth expected to be sustained in 2025.

The long-term forecasts are also good. The freight industry bottomed in 2024 and is anticipated to grow and accelerate over the next four to five years.

Catalysts exist that may lead to better-than-expected performance for transportation stocks across the board. President Trump enacted numerous executive orders to bolster his pro-growth agenda. The orders include deregulation of industry, tax relief, and tariffs to boost domestic production and job creation. Because the labor market was already in solid shape, tailwinds are likely to form and may be seen in the data as early as Q2.

Growth and Wider Margins in 2025 for the Top 3 Transportation Stocks

The top three transportation stocks by market cap are Union Pacific NYSE: UNP, Uber NYSE: UBER, and United Parcel Service NYSE: UPS. All three are expected to grow in 2025, sustaining 2024’s pace or accelerating compared to last year. A wider margin is also in the forecast. Uber is likely to lead with a 22% bottom-line growth, but all are forecasted to grow earnings by double digits. Uber is notable for its margin improvements and increased cash flow. It began to repurchase shares in 2024 aggressively and will likely maintain a healthy pace in 2025.

Analyst trends lift these transportation stocks. All are rated a Moderate Buy, with a low-double to high-double digit upside indicated at the consensus. Critical takeaways from the data include increasing coverage, warming sentiment, and an expectation for new multi-year or all-time highs in 2025. Analysts are the coolest toward UNP but still see at least a 10% upside this year.

Uber doesn’t pay dividends, but UNP and UPS stocks do, and the yields are attractive. UPS is a high-yielding name that delivers more than 5% annually, with shares trading near mid-January levels. Its payout is reliably safe but likely to grow at a slow pace due to the higher-than-wanted payout ratio.

The company will pay about 85% of its 2024 earnings, a red flag mitigated by the growth outlook. The payout ratio will fall in 2025 and continue to fall through the decade's end. Union Pacific is also high-yielding compared to the S&P 500, paying about double the broad market. Its payout is more reliable at only 50% of earnings and will likely increase this year at a high-single-digit pace.

Delta Air Lines Is a Well-Positioned Transportation Stock

Delta Air Lines Today

DAL

Delta Air Lines

$40.81 +0.22 (+0.54%) As of 04/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $34.74

▼

$69.98 - Dividend Yield

- 1.47%

- P/E Ratio

- 7.66

- Price Target

- $61.06

Delta Air Lines NYSE: DAL is the 7th largest transportation stock by market cap and among the best-positioned to capture strength in 2025. Its business is exposed to consumer and business travel and the freight industry; all three are strong. Travel demand and revenue hit record levels in 2024, driven by industry-leading loyalty and premium services, and new highs are expected in 2025.

The company’s guidance expects strong travel demand in 2025 centered on higher-margin premium services. Among the critical takeaways from 2024 is that cash flow is improving, allowing debt reduction and resumed dividend distribution. The dividend is still below the 2019 level but on track for a robust increase in 2025 and 2026.

Before you consider Uber Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uber Technologies wasn't on the list.

While Uber Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.