The table below lists Canadian penny stocks trading under $1.00 with the highest volume from the most recent trading day.

This list updates as markets shift, providing a quick snapshot for investors.

Sort by price, volume, or market cap to find stocks that fit your strategy.

Penny stocks are companies with share prices under $1.00 and market caps under $100 million, often appealing for their potential upside.

Got some speculative cash you're willing to gamble for a potential multi-bagger profit? Or do you have a small brokerage account with risk capital that you want to multiply? The upside may sound appealing as long as you are fine with the downside of investing in the market's riskiest type of stocks.

The stock market tends to make rewards proportionate to risk. The more you risk, the higher your potential for reward. If you have an appetite for increased risk for high rewards, consider trading Canadian penny stocks. It's prudent to be aware of its risks, and you should be able to go into it with your eyes wide open after reading this article.

What is a Penny Stock?

Penny stocks are a term for trading under $5 per share. Usually, these stocks have low prices because they tend to be in the early stages of development or their business fundamentals have cratered. Many penny stocks are fraudulent or shady as there is less information on the business operations due to the less stringent reporting requirements. This leaves much room for shady operators to manipulate these stocks.

Many of these stocks are shell companies that provide some legitimate companies to reverse merge into them, like a snail taking on a new shell as a home. Penny stocks can range in price from fractions of a penny to $5. The hope for speculators is to find a penny stock that will become a significant business as more investors rush into the shares, ballooning its price. The thinking that the market overlooked or mispriced these stocks drives penny stock speculation.

How to Find Canadian Penny Stocks

Finding Canadian penny stocks to buy starts with looking at the exchanges. While some penny stocks trade on the Toronto Stock Exchange (TSX), it's mainly reserved for more extensive and more established companies with a minimum valuation of $50 million or more. Companies with much smaller market caps tend to be riskier and don't qualify to trade on a major exchange like the TSX. These penny stocks often trade on over-the-counter exchanges, accommodating riskier companies.

You can find most Canadian penny stocks on the smaller TSX Venture Exchange (TSXV) and the Canadian Securities Exchange (CSE). The TSXV and CSE stocks tend to be smaller emerging companies and start-ups without a track record. These stocks are risky due to the lack of transparency about the company and a lack of liquidity.

Liquidity refers to how quickly and efficiently a stock can be bought and sold at a fair price. Fair price refers to having a tight spread between the bid and ask price. A liquid stock will have a spread that's only a few pennies apart between the bid and ask price. For example, XYZ is liquid because the spread is only two cents between the $3.20 bid price and the $3.22 ask price. You can find individual TSX penny stocks and TSX OTC (over-the-counter) stocks in several ways.

Step 1: Use a stock screener.

The evolution of computer technology and trading software has made scanning and finding potential penny stocks more manageable than ever. Most brokerage platforms have some stock screener. You can find them online as well. When creating filters, it's essential to set the search for stocks priced at $5 and below. It also helps narrow the search to stocks on the TSXV and CSE.

Step 2: Use MarketBeat to get Ideas and use its tools for research.

MarketBeat has many tools to find the best Canadian penny stocks to buy now. You can start by familiarizing yourself with established TSX stock price targets and analyst ratings. You can search for Canadian stocks on MarketBeat and search for stocks hitting Canada's 52-week highs. Once you understand the larger market cap stocks, you can learn how to start investing in penny stocks. It's prudent to start with well-known, established stocks before diving into penny stocks. It's also important to be aware of Canada stock market holidays.

Most new traders invest in penny stocks when they should learn how blue chip stocks operate, then work their way down to the riskier stuff.

Step 3: Subscribe to newsletters for ideas after taking a free trial.

Numerous stock picking and newsletter services provide penny stock candidates to speculate in. It's a good idea to test out the services that offer a free trial period. This allows you to look at their track record and the picks' historical performance before considering a subscription.

Not all newsletters offer a free trial. The ones that do offer a free trial are more transparent, which is a rarity when it comes to penny stocks. Read the fine print and cancel the trial before the billing period begins if you wish to refrain from signing up.

Even if you sign up, be mindful of their cancellation policy, as some services may require upfront notice or other conditions to cancel a recurring payment. It's wise to only select annual prepayment plans after testing the product sufficiently for some time, as most newsletter services don't offer refunds.

Step 4: Use social media with your eyes wide open.

Using social media can be tricky due to the anonymous and spam-like nature of social media sites like Twitter. You can search for news or events by adding a "$" to the stock symbol in the search line. These sites can provide timely news, opinions and rumors and post the most active penny stocks for the day. There are a ton of bots, so it can be exhausting to block them constantly. The goal is to find ideas and follow users with a credible history. Most bots are trying to sell you a newsletter, chat room, or advisory service, so be skeptical.

How to Trade Canadian Penny Stocks

Once you've found some penny stocks Canada candidates, it's time to put the work into motion. Here are the steps to take when trading penny stocks.

Step 1: Research the company thoroughly.

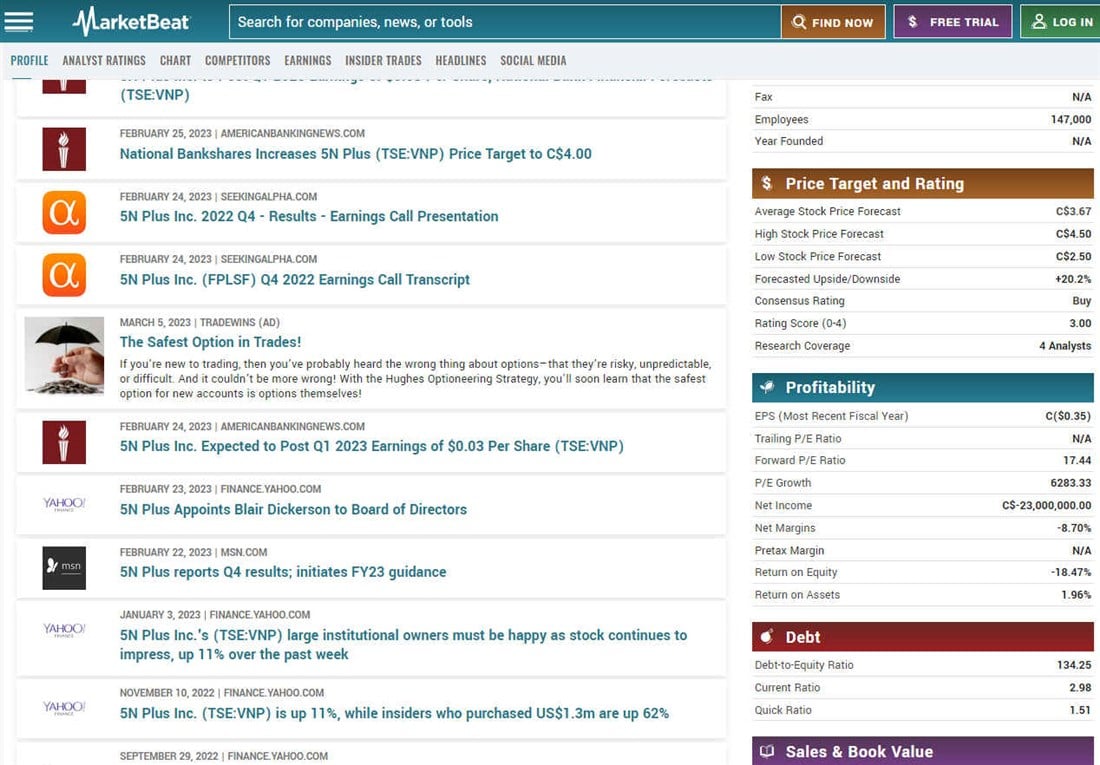

Use MarketBeat.com and research the stock with an all-in-one place source. Enter the symbol on the MarketBeat "search for companies, news or tools" tab. This should display the "stock forecast, price and news" page. Read the description of the company and learn about the industry.

Check the 52-week range to understand where the stock trades. Compare the current volume to the average volume to see if there's a high volume. It usually precedes a strong move in the underlying price. Work your way down the page. You can find some of the best information on the "news headlines" portion.

Step 2: Research the stock price action.

This step requires technical analysis to gauge support and resistance price levels and trends. Utilizing candlestick charts and various indicators like a 20-period exponential moving average (EMA) and or a 50-period MA helps to determine the trend. The time frame of the charts is also important, ranging from as short as a one-minute chart up to a weekly or monthly candlestick chart. Swing traders can look to use a daily candlestick chart to be able to swing the stocks.

Step 3: Decide on entry and stop-loss price.

As you pinpoint price support and resistance levels and mark them on your chart, you should then plan your entry price or prices. Taking the time to pre-plan your trade lets you avoid impulse trading or chasing entries fueled by emotions. You can be patient and wait for a pullback to a support level to get an entry or even spread out the entries at various price levels to get a better average price on your position. It's also crucial to have a stop-loss price, which is the price where you will sell the stock for a loss to avoid a more significant loss.

Step 4: Execute and manage the trade.

Once in the trade, you must be disciplined in taking the stop-loss if the stock breaks down. The stop-loss can be based on a support breakdown, trend reversal, or percentage pullback. On that note, using profit targets to take some money off the table and pay yourself if the stock rises is also prudent. Don't get greedy and overlook taking profits. Remember that trading and investing aim to drop the risk to zero, which is only possible by going to cash. How you get there is up to the market and your discipline.

Canadian Penny Stock Trading Example

Here's an example of applying the steps for trading a Canadian penny stock 5N Plus Inc. (TSE: VNP). The description tells us that VNP is a semiconductor stock headquartered in Montreal, Canada. It's also involved in the performance materials. Going to the MarketBeat "VNP stock forecast, price and news'' page, the volume spiked nearly five times the average volume of 151,000 shares as shares closed at $3.05, rising 10.11% on the last trading day.

The "VNP stock news headlines" portion provides many research reports, articles, and analyses on VNP stock. The company appears profitable, trading at 17.44 times earnings based on the "profitability" details on the right side of the page scrolling down. Interestingly, the company has $1.28 cash per share indicated under the "sales and book value" section, which makes for a compelling valuation play. You can further research its products and services on its homepage, 5nplus.com.

Technical analysis requires interpreting the stock's price action and history, and you can do this on a candlestick chart. Try to describe the price action as follows. The daily candlestick chart on VNP shows two rectangles (purple). The first one has a trading range between a low of $1.33 to a high of $1.98. The second rectangle has a range from $2.46 to $3.22. The 20-period exponential moving average (EMA) support is $2.81 (blue).

We can use the lower range price of the second rectangle at $2.46 to buy. We can place a stop-loss at the top of the first rectangle at $1.98. This gives us a (48 cents) stop-loss or a (19.5%) stop-loss. If our goal is two times the risk ($0.48 x 2) for reward, our upside profit price target would be $3.42.

The plan is to buy at $2.46 on a pullback, sell part or all at a $3.42 profit target, or take a stop-loss if the stock falls and sell at $1.98.

Where to Trade Canadian Penny Stocks

Canadian penny stocks are on the TSX Venture Exchange (TSXV) and the Canadian Securities Exchange (CSE). You may also find larger penny stocks on the New York Stock Exchange (NYSE) and the Nasdaq exchange. Dual-listed Canadian penny stocks are also on the over-the-counter bulletin board (OTCBB) market.

Tips for Managing Penny Stock Risk

Control risk by planning with your research, preparing, and setting a firm stop-loss price. This price can be based on a maximum percentage of the loss you will take based on your entry price or a previous support price level. You can take multiple entries further to control risk for a better average entry price. Trimming down your position is the most critical way to reduce the risk until you are back in cash and zero risk.

Risk what you can afford to lose. Penny stocks are hazardous. You should be ready and willing to lose your investment if you decide to play altogether. Take the money you would invest in penny stocks and set it on fire. If you are comfortable with that, then you're ready to proceed. However, there's a saying that everyone has a game plan until they get punched in the face. Imagining you will lose your investment and losing your investment are entirely different things. Be sure you can handle it if the investment flops.

What is the best penny stock in Canada?

This is an entirely subjective question. The best-performing penny stock in Canada depends on the time frame, whether daily, monthly or yearly. You can get a list of Canadian stocks hitting 52-week highs.

Can you make money with penny stocks in Canada?

Yes, you can make money with penny stocks in Canada, but you can also lose money more often than not. The real question is, how much money are you willing to lose to make money? A common justification would be a one-to-two risk-to-reward ratio meaning you're willing to risk 50 cents to make $1.

Are there penny stocks on the TSX?

There are penny stocks on the TSX based on stocks trading at $5 or less. The majority of Canadian penny stocks are on the TSXV and CSE.