APA (NASDAQ:APA - Get Free Report) had its price target cut by investment analysts at Piper Sandler from $26.00 to $23.00 in a report issued on Tuesday,Benzinga reports. The brokerage currently has a "neutral" rating on the stock. Piper Sandler's price target indicates a potential upside of 9.26% from the company's previous close.

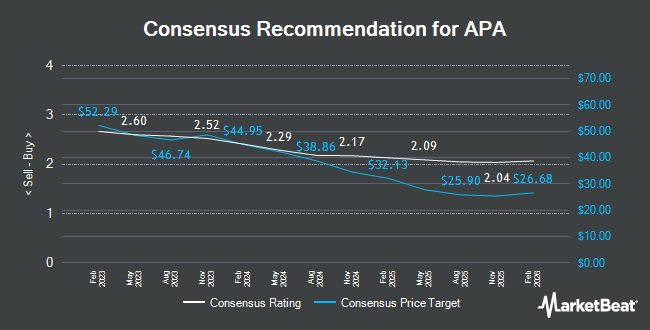

APA has been the topic of a number of other reports. Bernstein Bank reduced their price target on shares of APA from $30.00 to $28.00 in a research note on Friday, October 18th. Scotiabank lowered their price target on shares of APA from $30.00 to $27.00 and set a "sector perform" rating for the company in a report on Thursday, October 10th. Citigroup reduced their price target on shares of APA from $29.00 to $24.00 and set a "neutral" rating for the company in a report on Tuesday, November 26th. JPMorgan Chase & Co. cut their price target on APA from $29.00 to $25.00 and set a "neutral" rating for the company in a research note on Wednesday, November 13th. Finally, Evercore ISI reduced their price objective on shares of APA from $39.00 to $33.00 and set an "in-line" rating for the company in a research report on Monday, September 30th. Four investment analysts have rated the stock with a sell rating, twelve have issued a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $31.14.

View Our Latest Stock Analysis on APA

APA Stock Performance

Shares of APA stock traded down $0.89 during trading on Tuesday, reaching $21.05. The company's stock had a trading volume of 10,227,939 shares, compared to its average volume of 6,291,604. APA has a 52 week low of $20.45 and a 52 week high of $37.82. The company has a quick ratio of 1.24, a current ratio of 1.24 and a debt-to-equity ratio of 1.03. The business's 50-day moving average price is $23.41 and its 200-day moving average price is $26.51. The firm has a market cap of $7.79 billion, a PE ratio of 2.91 and a beta of 3.18.

Insider Activity at APA

In other APA news, Director Juliet S. Ellis purchased 4,391 shares of the stock in a transaction dated Thursday, December 12th. The shares were acquired at an average price of $22.78 per share, for a total transaction of $100,026.98. Following the completion of the acquisition, the director now owns 12,436 shares of the company's stock, valued at $283,292.08. This represents a 54.58 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Corporate insiders own 1.30% of the company's stock.

Hedge Funds Weigh In On APA

Large investors have recently added to or reduced their stakes in the company. Woodstock Corp increased its position in APA by 20.3% in the third quarter. Woodstock Corp now owns 308,253 shares of the company's stock worth $7,540,000 after purchasing an additional 51,993 shares during the period. Charles Schwab Investment Management Inc. raised its position in shares of APA by 4.2% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 11,991,513 shares of the company's stock valued at $293,312,000 after acquiring an additional 485,291 shares during the last quarter. HITE Hedge Asset Management LLC acquired a new position in shares of APA in the 3rd quarter valued at $7,238,000. Ellis Investment Partners LLC bought a new position in shares of APA in the 2nd quarter worth $2,499,000. Finally, Victory Capital Management Inc. grew its stake in shares of APA by 13.5% during the third quarter. Victory Capital Management Inc. now owns 1,261,324 shares of the company's stock worth $30,852,000 after purchasing an additional 149,762 shares during the period. Institutional investors and hedge funds own 83.01% of the company's stock.

APA Company Profile

(

Get Free Report)

APA Corporation, an independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids. It has oil and gas operations in the United States, Egypt, and North Sea. The company also has exploration and appraisal activities in Suriname, as well as holds interests in projects located in Uruguay and internationally.

Featured Stories

Before you consider APA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APA wasn't on the list.

While APA currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.