Energy keeps the world moving, from oil to gas to solar to wind. Unsurprisingly, the energy sector is a vast, complex and ever-changing landscape. The sector is affected by new technologies and political developments worldwide.

As exciting as all this is, it's no surprise you're wondering how to invest in energy. When you are done reading this article, you'll have a better idea of the types of energy investments, where to find them and which may be best for your needs.

Key Takeaway

Investing in energy offers a wide array of opportunities spanning from traditional fossil fuels like oil and gas to renewable energy sources like wind, solar and hydro.

Understanding the Energy Sector

Understanding the energy sector means diving deep into the many sources of power and how they're harnessed, distributed and consumed. We'll start by looking at some of the key components of the sector, both renewable and non-renewable.

Key Components of the Energy Sector

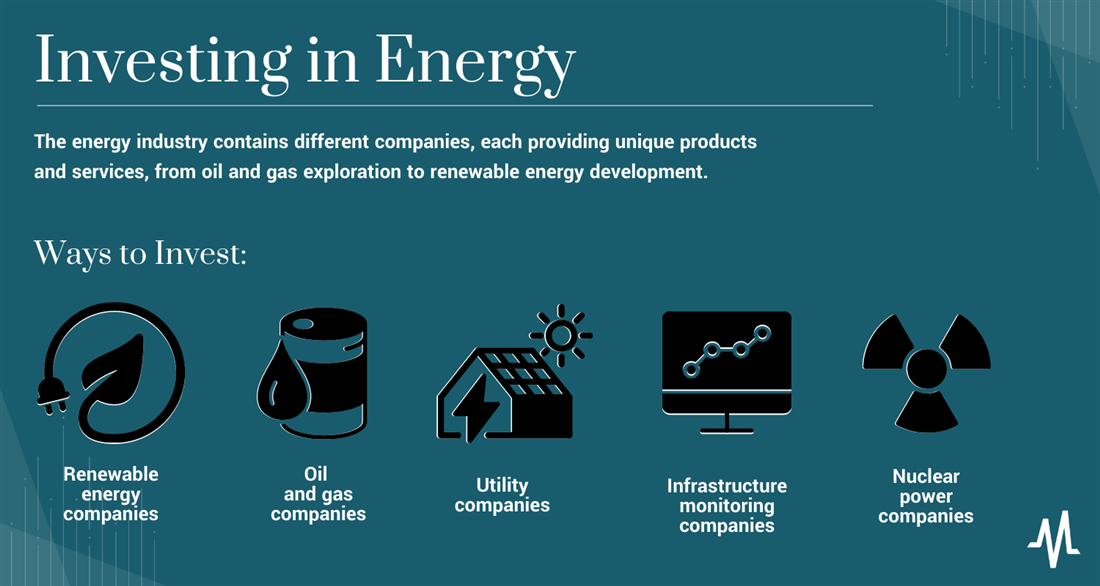

The energy industry contains different companies, each providing unique products and services, from oil and gas exploration to renewable energy development.

Renewable Energy Companies

The renewable energy industry is booming. These companies generate power through solar, wind, geothermal and hydroelectricity. Solar energy is one of the most popular renewable energy investments. Companies like SunPower Corp. NASDAQ: SPWR and First Solar Inc. NASDAQ: FSLR produce photovoltaic (PV) panels that convert sunlight into electricity. Wind energy has also grown in popularity over the last few years, with companies such as Vestas Wind Systems A/S OTCMKTS: VWSYF, Siemens Gamesa Renewable Energy SA OTCMKTS: GCTAF and Xinjiang Goldwind Science & Technology Co. Ltd. OTCMKTS: XJNGF making gains in this sector.

Geothermal energy produces power by tapping into natural heat from underground, while hydroelectricity involves using water to turn turbines to generate electricity. Many renewable energy companies are publicly traded. Figuring out how to invest in renewable energy stocks can be a great way to get involved in the green movement while diversifying your portfolio.

Investing in renewable energy is an environmentally friendly alternative to fossil fuels and an effective way to reduce your carbon footprint. You can invest directly in stocks of companies involved within the industry. Exchange traded funds (ETFs) such as iShares Global Clean Energy ETF NYSEARCA: ICLN and Invesco Solar ETF NYSEARCA: TAN can also offer you exposure.

Oil and Gas Companies

Oil and gas companies are also publicly traded. These companies explore, extract, refine and market petroleum products like gasoline, heating oil and diesel fuel. The types of oil and gas stocks are often categorized by the roles they play in the industry.

At the top of the chain are major oil and gas companies such as Exxon Mobil Corp. NYSE: XOM, Chevron Corp. NYSE: CVX, BP PLC NYSE: BP and Shell PLC NYSE: SHEL. These giant corporations are involved in all aspects of the industry, from exploration to production to refining and distribution.

Exploration and production (E&P) companies focus specifically on finding new sources of oil and gas and then extracting them from the ground or seafloor. They often lease land for drilling rights.

Oilfield services firms provide support and technical services to E&P companies like drilling, well completion and maintenance. Some examples include Halliburton Co. NYSE: HAL, Schlumberger Limited NYSE: SLB and Baker Hughes Co. NASDAQ: BKR.

Midstream companies focus on the transportation and storage of oil and gas. They build and operate pipelines, storage tanks and other infrastructure to move oil and gas from the wellhead to refineries. Midstream companies are generally less volatile than E&P firms since their revenues are tied to the volume of oil and gas produced rather than the price.

Finally, downstream companies refine and sell petroleum products to end-users such as gas stations, airlines and manufacturing. As a consumer, you might be most familiar with companies such as Phillips 66 NYSE: PSX and Valero Energy Partners NYSE: VLP. Changes in demand and prices at the pump can impact them.

Utility Companies

Utilities generate and distribute electricity and natural gas to homes and businesses. These companies often operate in regulated markets, which can provide a stable source of revenue. Examples include Duke Energy Corp. NYSE: DUK, The Southern Co. NYSE: SO and American Electric Power Company Inc. NASDAQ: AEPPZ. Utility stocks can be a way to diversify your portfolio, as they can have lower volatility than other energy stocks.

Infrastructure Monitoring Companies

Infrastructure monitoring companies ensure that energy networks and systems remain operational and secure. They monitor the system in real-time, detecting any irregularities that may indicate a malfunction or security breach. Companies such as Siemens Energy AG OTCMKTS: SMEGF and EnerNOC Inc. NASDAQ: ENOC specialize in monitoring services for renewable energy. These companies often have stable revenues as they provide critical services.

Nuclear Power Companies

The nuclear power industry relies on uranium-based fuel to generate electricity relatively cheaply and with environmental impact. But investing can be risky since the sector requires government approval and public trust, though it has the potential for high returns. Some well-known nuclear power companies include Exelon Corp. NASDAQ: EXC, NextEra Energy Partners LP NYSE: NEP and Duke Energy. Approach this industry with caution and thoroughly research the companies you're considering.

Current Trends and Future Outlook

Steady technological progress points the energy sector toward renewable energy sources like wind, solar, hydropower and geothermal. It's all fueled by growing consumer demand for clean energy and governmental support for green initiatives.

Investments in advanced energy storage technologies like lithium-ion batteries and pumped storage hydroelectricity systems are on the rise. These address the problem of the intermittent nature of renewable energy sources.

Beyond storage, advancements in energy distribution technology also promise to make a big impact. Smart grid systems, for instance, can optimize the way we transmit and distribute electricity from power plants to consumers. By linking information technology to the power infrastructure, these systems allow for real-time adjustments to changes in energy demand and can be more flexible in accommodating renewable energy sources.

Hydrogen is also emerging as a clean and sustainable energy source, especially in heavy-duty transportation and industrial processes. Companies are investing in research to create efficient and reliable methods for hydrogen production, storage and transportation.

Investing in carbon capture, utilization and storage (CCUS) is another trend. These technologies aim to capture carbon dioxide emissions from power plants and industrial processes, store them underground or repurpose them for commercial uses, ultimately reducing the amount of carbon released into the atmosphere.

Meanwhile, traditional energy sectors have been grappling with shifting regulatory landscapes and public opinion. Oil and gas companies are investing in technologies to reduce their environmental footprint and exploring alternative energy sources. And the nuclear power industry is developing safer and more efficient reactor designs to regain public trust.

Reasons to Invest in Energy

Investing in one of the many ways we power our world is undeniably appealing. The energy sector can be a high-reward industry due to its vast potential for growth and innovation. Here are some more reasons you might seek to invest.

Diversification and Portfolio Stability

Energy investments can hedge against market volatility, reducing overall portfolio risk and safeguarding against inflation. Since energy is a basic need, demand remains relatively constant even amid economic instability. Also, oil and gas companies often have long-term contracts with customers that provide stability and predictable cash flows. They may also be eligible for various tax benefits, including depletion allowances, research and development expense deductions and intangible drilling costs.

Growth Potential of Renewable Energy

The best energy stocks have historically produced higher returns than the broader stock market, coming in at an impressive 12% annualized over the last decade compared to the S&P 500's 10% average annual return. Part of that growth is due to the surge in renewable energy. With a growing global emphasis on fighting climate change and reducing dependence on fossil fuels, renewables like solar and wind could experience significant growth in the coming years.

The energy industry, especially in its emerging areas such as renewable energies and advanced storage technologies, holds the potential for impressive returns on investments. While these ventures come with their own risks, the rewards can be substantial for savvy investors.

Rising Global Energy Demand

The increasing global demand for clean and renewable energy sources offers growth opportunities for companies in this sector. Technological advancements and supportive government policies are driving the adoption of renewable energy more and more, creating a favorable environment for these companies.

Types of Energy Investments

Energy investment options include direct investments in energy sector stocks mutual funds, or energy ETFs. By diversifying your portfolio, you can benefit from long-term growth.

Direct Investments

The most direct investment method in the energy industry is buying energy sector stocks or mutual funds from companies across the energy spectrum, from big oil companies to alternative energy startups. Let's look at some of the best energy stocks to buy now.

Oil and Gas

Oil and gas investments can greatly diversify your portfolio and allow you to take advantage of potential growth. First, you can look for the best oil stocks and invest directly in them. But these can be volatile. When oil prices go up, so do stock prices. Even the top 50 oil and gas stocks suffer in value when gas prices drop. Be aware of current market conditions, and diversify so that gains on another can offset any losses on one stock.

Investing in E&P companies can be rewarding if you're willing to take risks. These firms experience wild price swings due to their exposure to volatile global commodity markets. If you have a lower risk tolerance, look into oilfield services firms and midstream or downstream oil companies stock. Investments in utility and infrastructure monitoring companies can also help diversify your energy holdings. Nuclear power stocks also offer an opportunity if you're more risk-tolerant.

Another option is to invest in energy ETFs. Energy ETFs track an index such as the S&P Global Energy Index or Dow Jones U.S. Energy Sector Index, which measures performance across all major energy sectors. Many of these ETFs also provide dividend payments.

If you read the news daily, you know oil and gas are subject to fluctuations in the global market. Ensure you're financially prepared for any swings.

Uranium

Since the dawn of the nuclear age, uranium has been a critical component used to power nuclear reactors, providing approximately 11% of the world's electricity in 2022. The price has shown steady growth over the past few years. But investing directly in uranium stocks or funds can be challenging due to their limited availability and thin trading volume.

One way is to purchase stocks in companies that produce uranium. They typically operate mines where they extract uranium ore and refine it. Some well-known stocks in this sector include Cameco Corp. TSE: CCO and Rio Tinto Group NYSE: RIO.

You can also invest in ETFs tied to uranium prices. Two popular ETFs are the Global X Uranium ETF NYSEARCA: URA and the VanEck Vectors Nuclear Energy ETF NYSEARCA: NLR. These funds track the Solactive Global Uranium Index.

Another way to invest is through purchasing physical uranium, either as ore or in refined form, and storing it yourself or through a custodian. This can be risky, as there are few buyers for uranium, and its price can be volatile. Storing uranium safely can also be complicated and expensive because it's highly radioactive.

Pipelines and Oil Refining

Pipelines provide infrastructure for transporting oil and gas, and refining converts crude oil into gasoline and diesel. Pipeline investments typically come in two forms: master limited partnerships (MLPs) or ETFs. MLPs offer a share of profits generated by the pipeline network and often have attractive dividends. Of course, always consider the companies' safety records, environmental practices and regulatory environment.

Indirect Investments

Energy Mutual Funds

Energy mutual funds invest in the stocks of companies across the energy spectrum. These offer diverse exposure to the industry, including oil and gas, renewables, utilities and other energy services. By pooling your investments with others, you can access a broader range of companies than you could on their own. Some of these funds focus on specific areas, like green energy or oil and gas, while others offer broad-based exposure.

Bonds

Energy bonds and bond funds offer a more conservative way to participate in the energy industry. These are debt securities issued by energy companies looking to raise capital for various projects, like drilling for oil or constructing wind farms. The issuer promises to pay back your initial investment along with periodic interest payments at a fixed rate. Bonds typically pose less risk than stocks because bondholders have a higher claim on company assets if the company goes bankrupt. However, the returns are typically lower.

Commodity Futures and Options

You can also gain exposure to the energy sector by investing in commodities such as crude oil, natural gas, and coal, which are traded on markets like the New York Mercantile Exchange (NYMEX). Commodities trading can be riskier than investing in stocks since prices can be affected by things like geopolitical events and weather patterns.

Derivatives

Finally, derivatives trading is another option. Derivatives are contracts that derive value from an underlying asset, such as a stock, commodity or currency. They can be traded on regulated exchanges and over-the-counter (OTC) markets. This type of trading is complex and carries more risk than other investment types as the prices can be much more impacted by changing market conditions.

Alternative Energy Investments

If you seek portfolio diversification, consider investing in startups, venture capital, green bonds and sustainable investment funds.

Startups and Venture Capital

With the global push toward renewable energy, companies focused on innovation in solar, wind or electric cars are increasing in valuation. While not all startups will succeed, the potential for a substantial return on investment is high. Venture capitalists often have a keen eye for such opportunities, but remember that this type of investing often requires a lot of capital as well as patience.

Green Bonds

Green bonds are fixed-income securities that raise capital specifically for climate-related or environmental projects. These could include renewable energy installations, energy efficiency upgrades, pollution prevention projects and sustainable water management systems. Issuers may include corporations, municipalities or even nations. The return on green bonds tends to be quite stable, making them a good choice for conservative investors concerned about climate change.

Sustainable Investment Funds

Environmental, Social and Governance (ESG) funds, are mutual funds that invest in companies and projects focused on sustainability. These funds give priority to companies that meet strict standards in these three areas. Sustainable investment funds can invest in a wide range of industries, not just energy, but many do emphasize renewable energy and sustainability-focused businesses.

How to Start Investing in Energy

Before diving into the energy market, draw up a well-researched plan of action. Understand your investment goals, risk tolerance and time horizon. If you're brand new to investing in energy, consider working with a financial advisor or broker who specializes in the sector.

Research and Due Diligence

The energy market can be a complex maze of companies, commodities and assets. The more due diligence you do, the better equipped you'll be.

Your in-depth research should include studying market trends, understanding how different sub-sectors operate and familiarizing yourself with key industry terms and metrics like barrels of oil equivalent (BOE) or British thermal units (BTUs). Pay special attention to economic factors like inflation rates, currency values and political stability in countries where energy companies operate.

Evaluating Risks and Returns

Energy markets are known for their volatility, as they can be heavily influenced by geopolitical events, natural disasters and changes in marketplace demand. Evaluate the potential risks associated with each type of investment. You should also consider the likely returns from your investment. Look at historical performance, but also consider future trends. The push toward renewable energy is changing the industry landscape, and companies that innovate and adapt will likely perform better in the long term.

Build Your Energy Investment Portfolio

One key strategy in managing risk is diversifying your investments. Instead of putting all your money into one energy company or one type of energy investment, consider spreading your investments across energy stocks, bonds, commodities and sustainable funds.

Once you've built your portfolio, continually monitor and review your investments. Stay updated on news and trends in the energy industry. Also, keep an eye on any changes in your personal financial situation that may require adjustments.

Challenges and Considerations for Energy Investors

Investing in energy can significantly diversify your portfolio and capitalize on the growing demand for energy worldwide. However, there are some potential risks.

Market Volatility and Price Fluctuations

Oil and natural gas prices are subject to supply and demand pressures, causing large swings and sometimes resulting in significant losses in the short term. The impact of geopolitical tensions, natural disasters and policy changes can also lead to abrupt changes in energy prices. Commodity futures and options are potentially lucrative but can be particularly susceptible.

Technological and Regulatory Risks

Advancements in technology and changes in regulation can affect investments, and not always positively. For instance, advancements in renewable energy technology may devalue fossil fuel investments as demand decreases. Similarly, changes in government support for certain types of energy can have impacts on their profitability. Regulatory changes can impact the validity and reliability of green bonds or sustainable funds.

Ethical and Environmental Considerations

Oil and gas companies carry environmental risks due to fracking or offshore drilling. Rigorous safety standards can help protect against these risks and are usually a commitment these companies make to their investors. However, accidents and unforeseen events could lead to significant damages, both environmentally and financially.

Investing responsibly in sustainable and ethical energy sources is becoming a bigger concern. Climate change and other environmental issues have cast a negative light on fossil fuel investments, leading to increased interest in renewable energy. However, this shift towards sustainable energy options comes with its own challenges and requires an investor to be well-informed about advancements in alternative technologies.

Future of Energy Investing

The future for energy stocks and other investments is constantly changing due to new technologies. Wind, solar and hydropower are catching on as clean and reliable sources of power, and advances in battery technology have made it more feasible to store energy for later use. Advances in carbon capture technology can help reduce emissions from fossil fuels and make them more efficient.

Keep the Lights on in Your Portfolio

Investing in energy can be lucrative. It can help diversify your portfolio and give you a stake in the growing global demand for energy. If you're looking for energy stocks to buy, remember that stocks, ETFs and renewable energy projects can offer possible high returns, predictable cash flows and tax benefits – but they also carry volatile prices and political risks. As the world works to reduce carbon emissions, investment in renewable energy sources will remain attractive as long-term investments.

FAQs

Below are some of the most frequently asked questions you might still have about investing in energy.

Are energy stocks a good investment?

A good energy stock can offer potentially high returns, predictable cash flows and certain tax benefits. However, they also come with volatility due to price changes and political risks. Always carefully research the company's fundamentals and diversify by sector, geography and fuel type.

What is the best way to invest in energy?

The best way to invest in energy depends on your individual investment goals. Direct investments such as stocks, ETFs and mutual funds offer more control and potential for higher returns, while renewable energy projects provide the chance to support environmentally friendly technologies.

Are energy stocks good in a recession?

Top energy stocks can be a good investment in a recession as they tend to be insulated from market downturns and often are countercyclical, which means they can often rise even in a downturn. However, practice due diligence and be mindful of their potential volatility.

Before you consider (EXA), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and (EXA) wasn't on the list.

While (EXA) currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.